-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Financial Services Templates

-

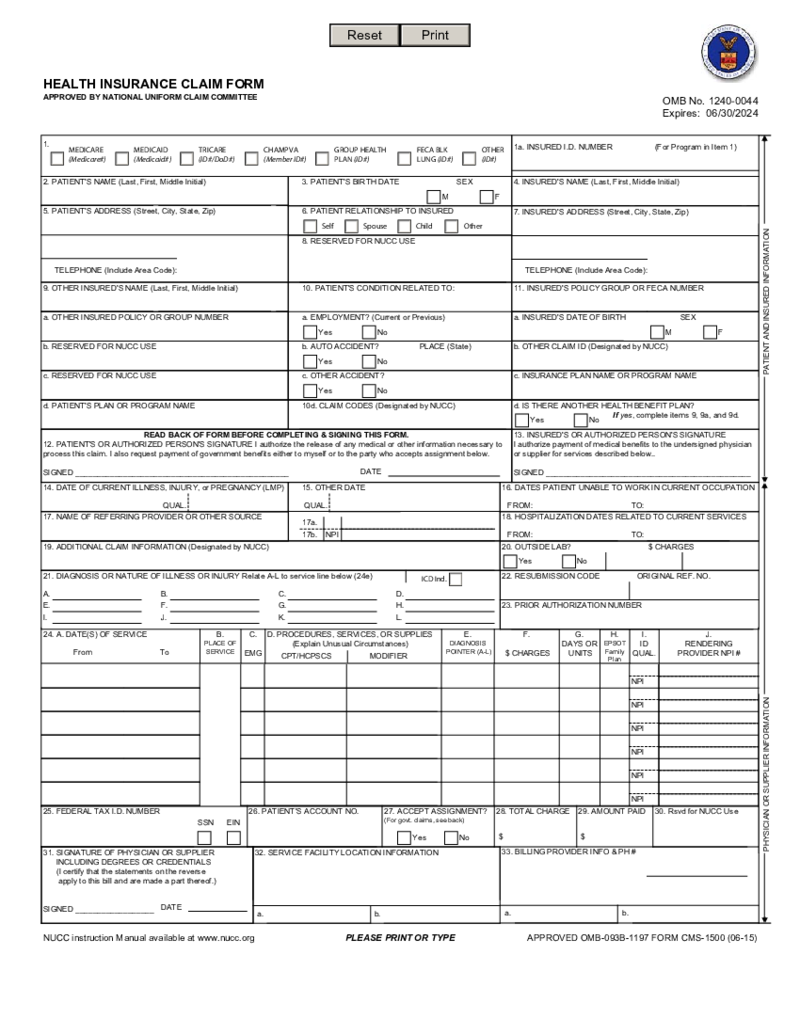

CMS 1500 Health Insurance Claim Form

What is CMS 1500 Claim?

CMS 1500 is a Claim form for Health Insurance. It was originally used to claim billing by either suppliers or a physician. The form is developed by CMS or Centers for Medicare and Medicaid. After some time, insurance carriers began

CMS 1500 Health Insurance Claim Form

What is CMS 1500 Claim?

CMS 1500 is a Claim form for Health Insurance. It was originally used to claim billing by either suppliers or a physician. The form is developed by CMS or Centers for Medicare and Medicaid. After some time, insurance carriers began

-

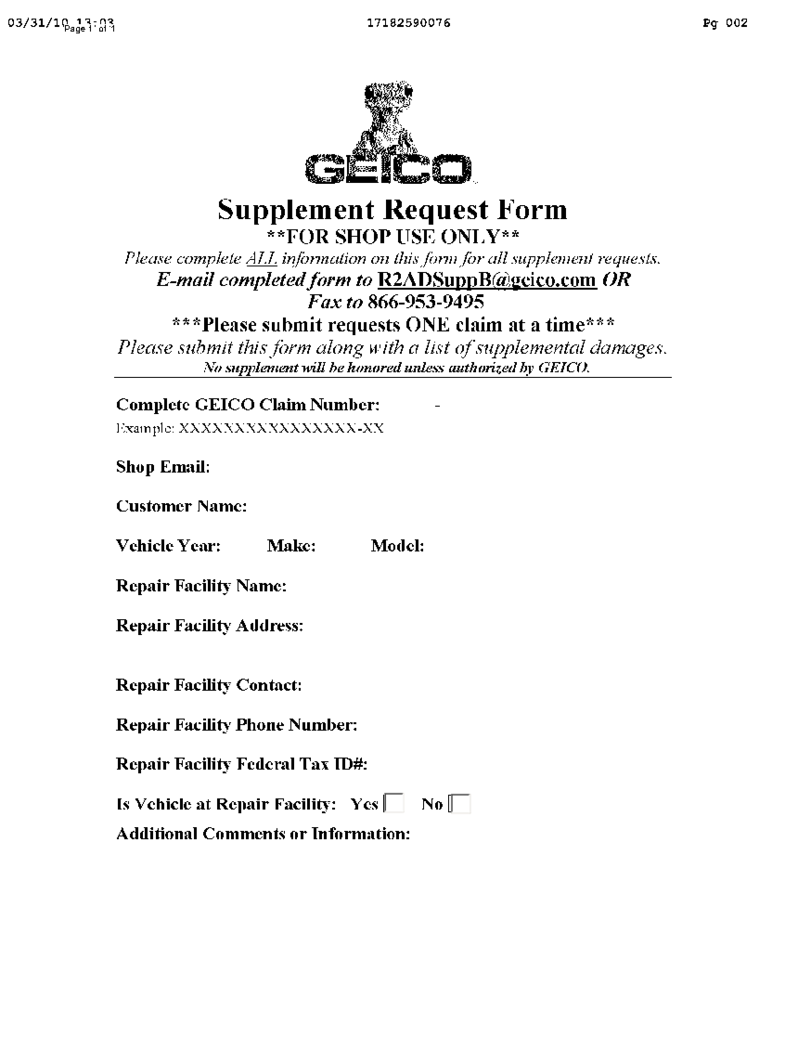

Geico Supplement Request

What is the Geico Supplement Request Form?

The Geico supplement request form is a specific form provided by Geico, one of the largest auto insurance companies in the United States. Geico policyholders use this form to request additional repairs or compens

Geico Supplement Request

What is the Geico Supplement Request Form?

The Geico supplement request form is a specific form provided by Geico, one of the largest auto insurance companies in the United States. Geico policyholders use this form to request additional repairs or compens

-

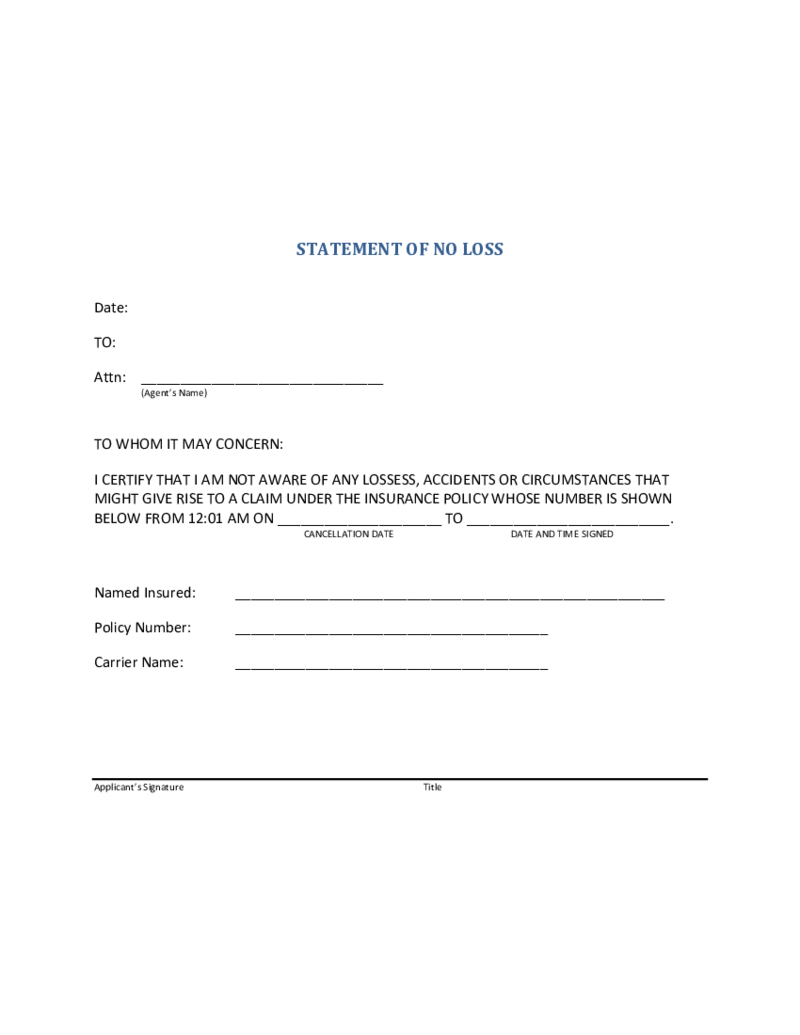

Statement of No Loss

What is a Statement of No Loss?

A Statement of No Loss Form is a simple one-page letter that ensures that you haven’t faced any losses that can result in claims. This signed document is used in the insurance field, and you need to provide it t

Statement of No Loss

What is a Statement of No Loss?

A Statement of No Loss Form is a simple one-page letter that ensures that you haven’t faced any losses that can result in claims. This signed document is used in the insurance field, and you need to provide it t

-

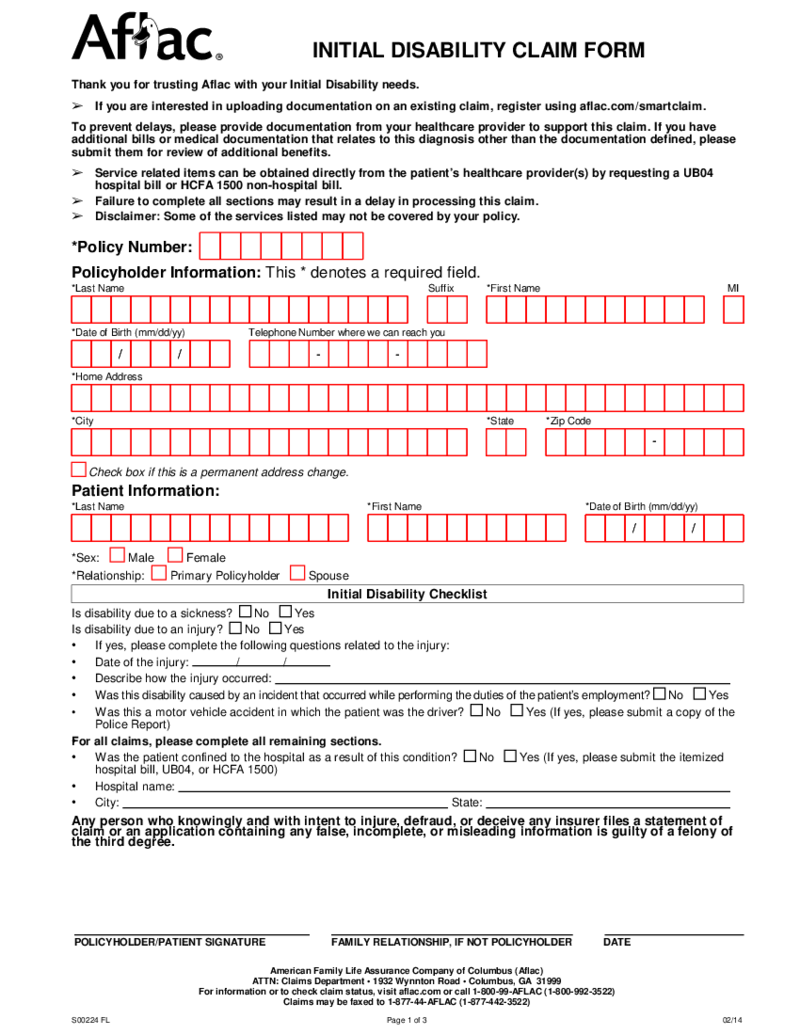

Aflac Initial Disability Claim Form

What Is an Aflac Initial Disability Claim Form?

It is a simple three-page form that AFLAC policyholders can fill out to request the benefits they are entitled to from the company. Typically, the form is provided by AFLAC itself in response to a request fr

Aflac Initial Disability Claim Form

What Is an Aflac Initial Disability Claim Form?

It is a simple three-page form that AFLAC policyholders can fill out to request the benefits they are entitled to from the company. Typically, the form is provided by AFLAC itself in response to a request fr

-

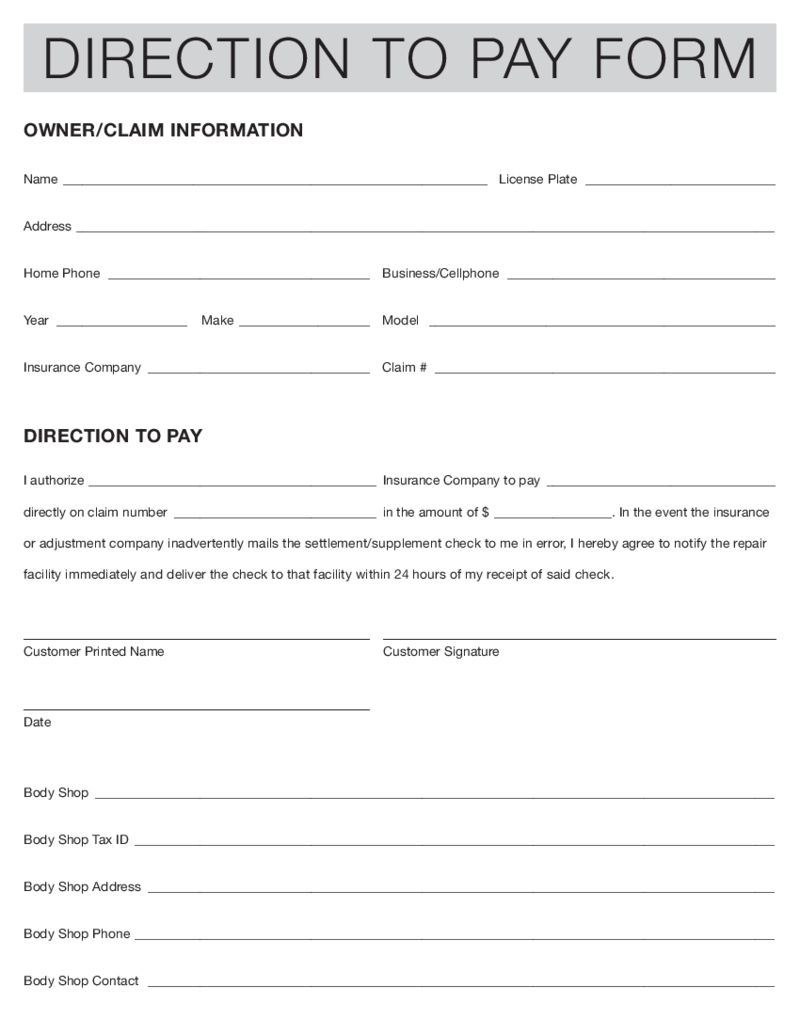

Direction to Pay Form

What Is a Direction to Pay Form Template?

A Direction to Pay Form is a document utilized to instruct a financial institution or entity to make payments on behalf of the account holder. The template of this doc typically includes the account holder's d

Direction to Pay Form

What Is a Direction to Pay Form Template?

A Direction to Pay Form is a document utilized to instruct a financial institution or entity to make payments on behalf of the account holder. The template of this doc typically includes the account holder's d

-

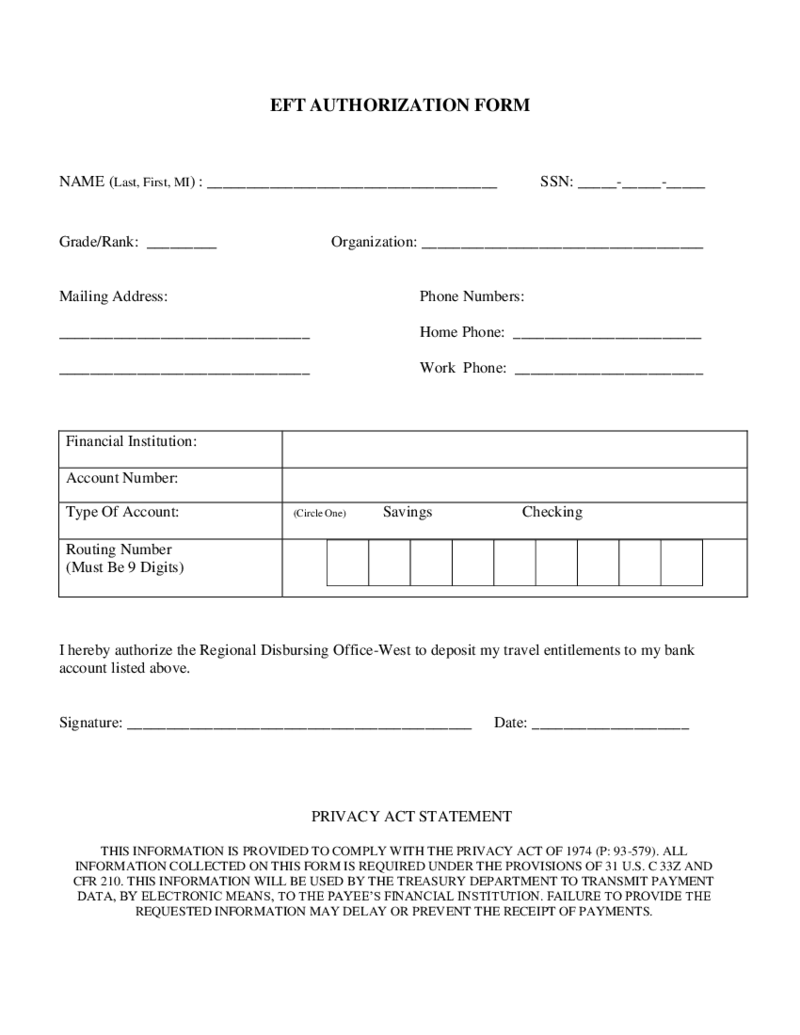

EFT Authorization Form

What is an EFT Authorization Form?

The EFT Authorization Form is used for establishing the Electronic Funds Transfer Form (EFT) instructions on your Fidelity account. This form contains only one page and doesn’t need any additional documents to

EFT Authorization Form

What is an EFT Authorization Form?

The EFT Authorization Form is used for establishing the Electronic Funds Transfer Form (EFT) instructions on your Fidelity account. This form contains only one page and doesn’t need any additional documents to

-

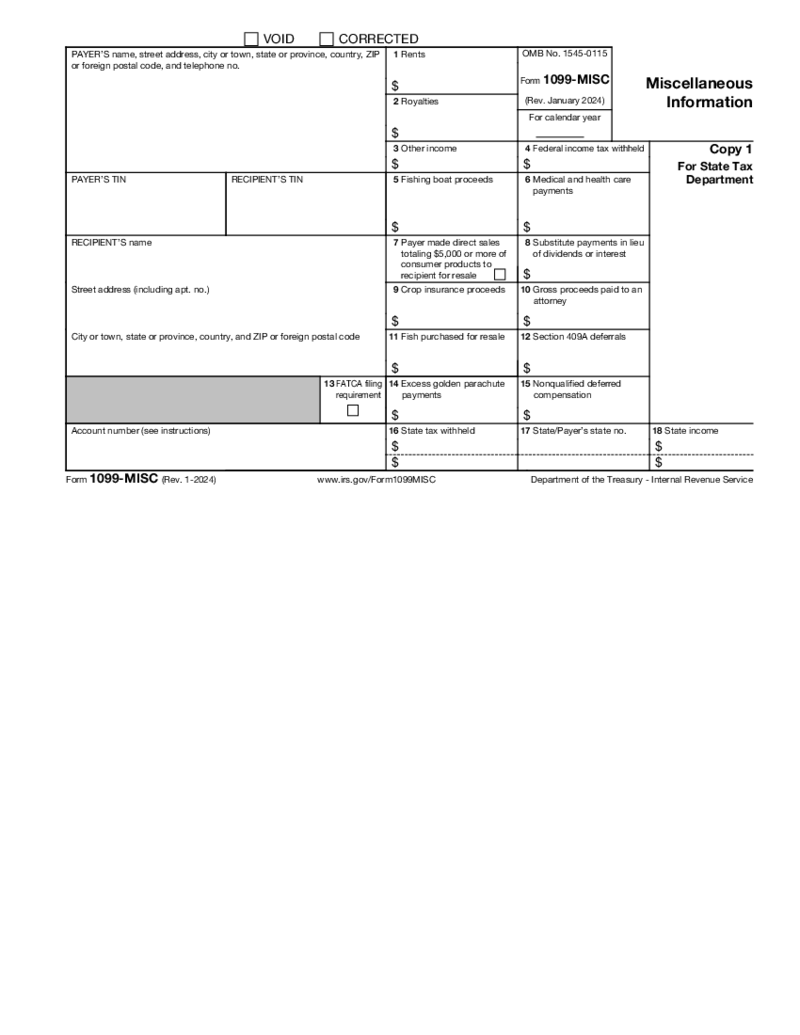

Form 1099-MISC (2024)

What Is the 1099-MISC Form?

All 1099 form series provide the IRS with all the necessary information about the taxpayer. Specifically, the 1099-MISC form is used to provide information about miscellaneous income.

Before 2020 the document wa

Form 1099-MISC (2024)

What Is the 1099-MISC Form?

All 1099 form series provide the IRS with all the necessary information about the taxpayer. Specifically, the 1099-MISC form is used to provide information about miscellaneous income.

Before 2020 the document wa

-

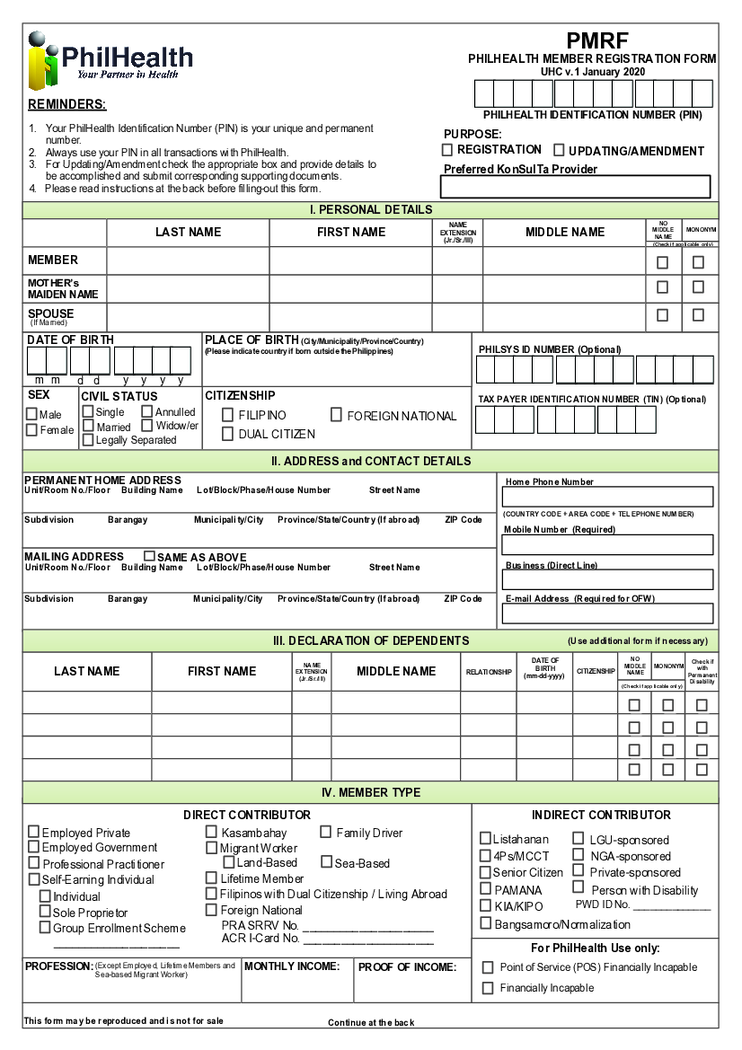

PMRF Form

What is a PMRF Form

The PMRF Form of PhilHealth is a two-page application that Filipino citizens can use to become a member of the local insurance program. You need to obtain a PhilHealth Identification Number before filling it out. You do not need other

PMRF Form

What is a PMRF Form

The PMRF Form of PhilHealth is a two-page application that Filipino citizens can use to become a member of the local insurance program. You need to obtain a PhilHealth Identification Number before filling it out. You do not need other

-

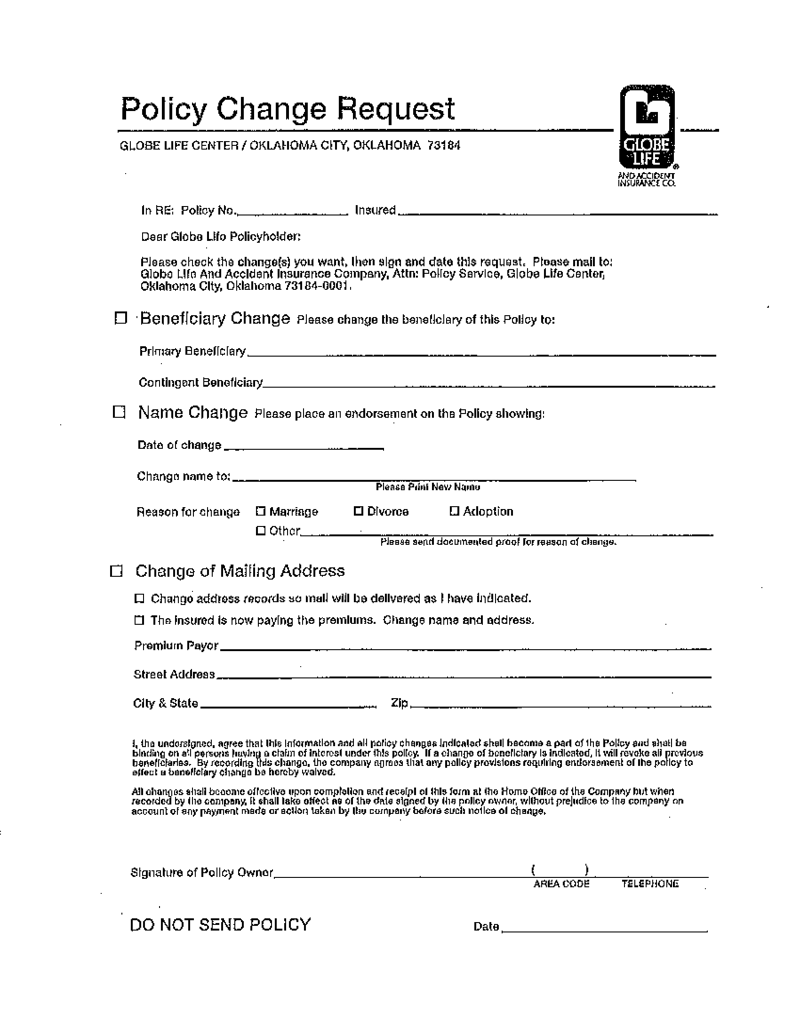

Globe Life Beneficiary Change Form

What is the Globe Life Beneficiary Change Form?

The globe life beneficiary change form is a document that allows policyholders to modify the beneficiaries listed on their life insurance policy. This form is typically required when individuals want to add,

Globe Life Beneficiary Change Form

What is the Globe Life Beneficiary Change Form?

The globe life beneficiary change form is a document that allows policyholders to modify the beneficiaries listed on their life insurance policy. This form is typically required when individuals want to add,

-

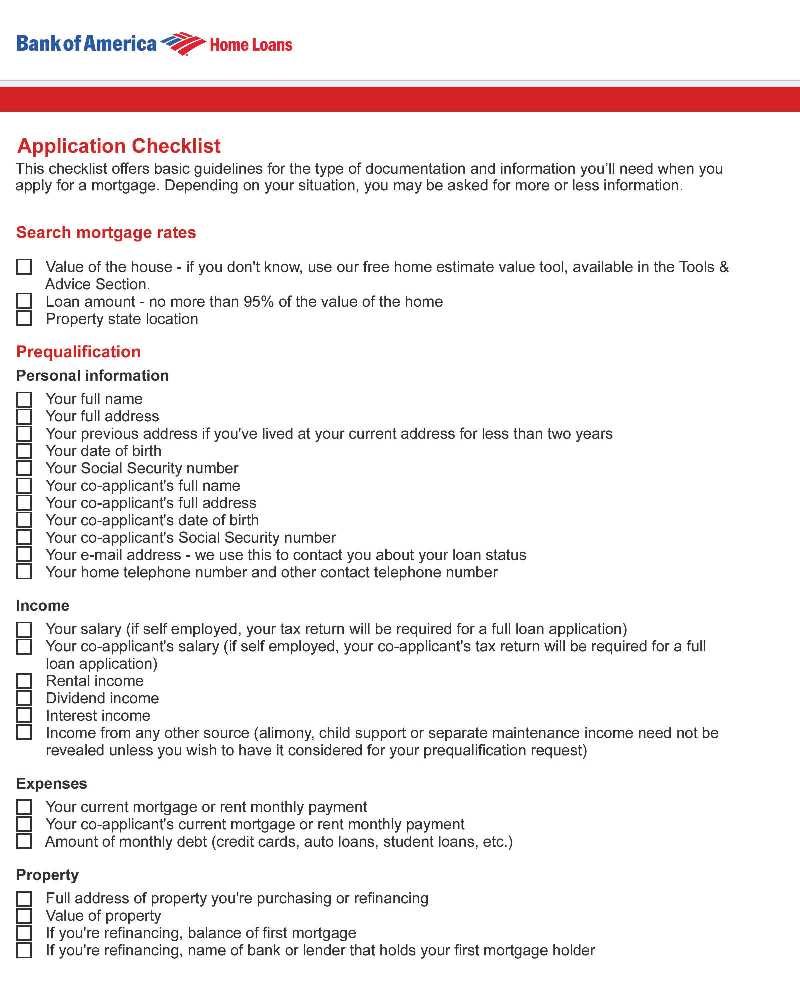

Bank Of America Letterhead

Understanding of Bank of America Form

When applying for a mortgage, a critical document to procure is the Bank of America letterhead form. This document provides significant data that are crucial to your application process. It is a form that presents evi

Bank Of America Letterhead

Understanding of Bank of America Form

When applying for a mortgage, a critical document to procure is the Bank of America letterhead form. This document provides significant data that are crucial to your application process. It is a form that presents evi

-

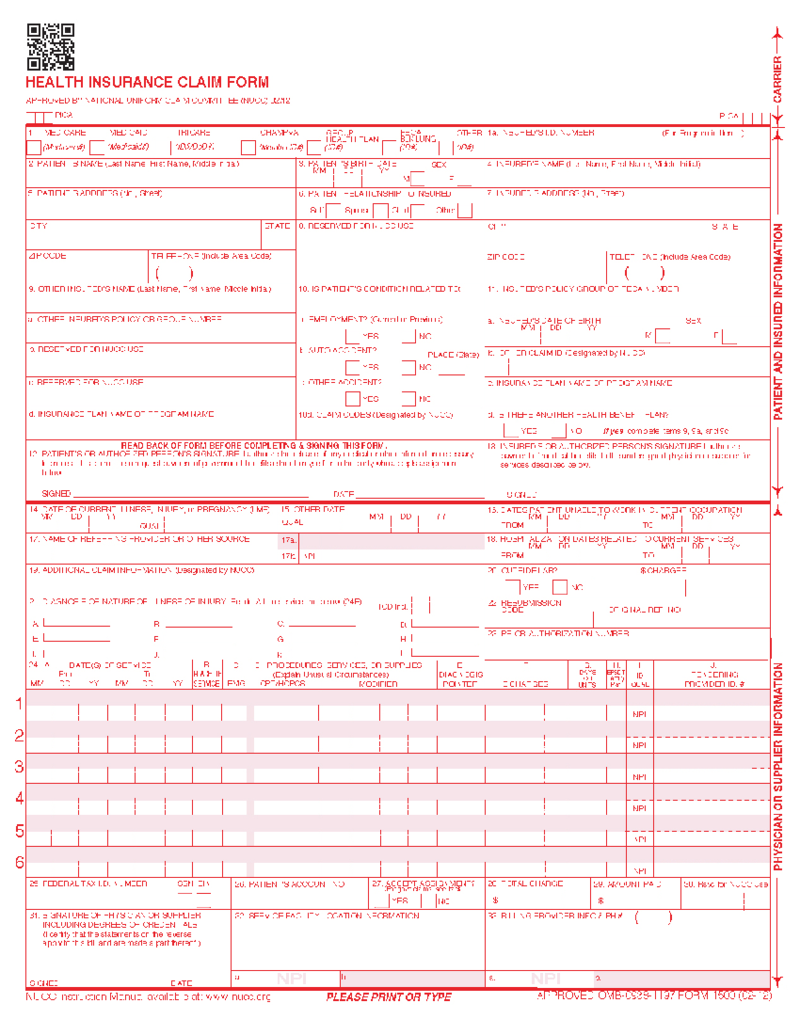

Form CMS-1500 (02-12)

What is a CMS 1500 Claim Form (2012)

The CMS-1500 Claim Form is a detailed health insurance blank used by various non-institutional providers to bill Medicare, Medicaid, Tricare, and other government carriers. Copies of other papers, such as test results

Form CMS-1500 (02-12)

What is a CMS 1500 Claim Form (2012)

The CMS-1500 Claim Form is a detailed health insurance blank used by various non-institutional providers to bill Medicare, Medicaid, Tricare, and other government carriers. Copies of other papers, such as test results

-

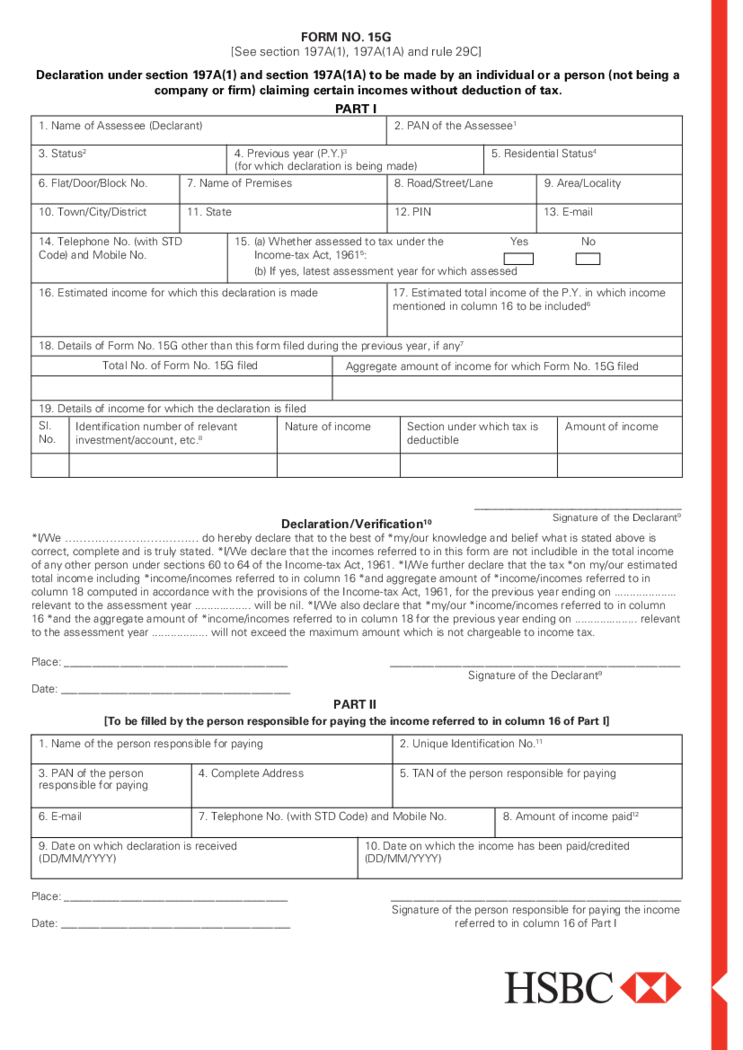

HSBC Form 15G

Understanding the Form No 15G

The HSBC Form No 15G is a critical document that Indian citizens holding bank deposits have to fill to prevent tax deducted from interest earned on their savings. The form may be intimidating for the first time; however, with

HSBC Form 15G

Understanding the Form No 15G

The HSBC Form No 15G is a critical document that Indian citizens holding bank deposits have to fill to prevent tax deducted from interest earned on their savings. The form may be intimidating for the first time; however, with

What Are Financial Services Templates Used For?

Financial service templates are a document for financial service providers to use to outline terms and conditions of service. This document is essential to both provider and client because it defines the expectations of both parties and helps protect both parties in the event of a dispute. Financial services templates come in several financial services, including investment, banking, insurance, and more.

What Are Financial Services Templates?

Financial services templates (FSTs) are a type of form used in the financial services industry. Rather, an FST helps provide information about a financial product or service and assists customers in making decisions about buying or using the product or service.

Banks, credit unions, and other financial institutions often use FST. Insurance companies, investment companies, and other businesses that offer financial products and services also use this document quite often.

FSTs should be clear, concise and should not contain misleading or deceptive information. Also, FST should be easy to understand so that customers can make informed decisions about using a financial product or service.

Types of Financial Services Templates

Nowadays, a variety of different types of financial services templates exist. Certain ones are designed for specific types of businesses, while others are more general. Here's a list of some of today's mostly used types of financial services templates.

- Business Plan Templates

So, let's begin with these templates, they are ideal for businesses starting out. You can design a professional business plan to impress potential investors.

- Financial Statement Templates

The next templates on our list are financial. This type of template will help you create accurate financial statements. This is important if you want a loan or line of credit.

- Business Budget Templates

Such templates are definitely going to help you keep track of your finances. Also, they will help you establish a budget and keep track of your expenses.

- Spire Bank Form Templates

If you're looking for a way to make your financial services more efficient and streamlined, Spire bank form templates can be the solution. Once you use these layouts, you'll simplify the process of creating and managing financial documents for yourself by giving you a wide variety of options to choose from.

- Direction to Pay

A payment form is a type of document used to give someone permission to access your money. This type of form is often used when authorizing someone to act on your behalf in financial matters such as paying bills or transferring money.

- PNC Bank Direct Deposit Form

A PNC Bank direct deposit form is a document that authorizes a financial institution to deposit money into a customer's account. The form is usually used to create payroll or retirement payments.

- Bank Account Statement

A bank statement is a document that contains a summary of all transactions that have been made on a person's or company's bank account over a certain period of time. This document keeps track of expenses, receipts, and account balances.

What Should Include in Financial Services Templates?

Financial services templates are an essential part of the financial services industry. Rather, a financial services template provides a standardized way for financial service providers to communicate with their customers. Below is a list of information that should be included in financial services templates:

- Financial services provider name

- Template purpose

- Template creation date

- Client name

- Client's address

- Client's phone number

- Customer's email address

- Contact person's name of the financial services provider

- Contact person's phone number

- Contact person's email address

How to Create Financial Services Templates: Step by Step

Creating a financial services template form is easy. Simply follow the steps below:

- First, choose a financial services form template that meets your needs. Many different types of financial services website templates are available on the PDFliner website.

- Download the financial services form template.

- Fill out the financial services form template. Be sure to include all required information.

- Save the financial services form template.

- Send the financial services form template to your clients.

Are Financial Services Templates Legally Binding?

Financial services templates are legally binding agreements between you and the financial services provider. This agreement outlines the terms and conditions under which you will receive financial services. By signing this agreement, you agree to be bound by its terms and conditions.