-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

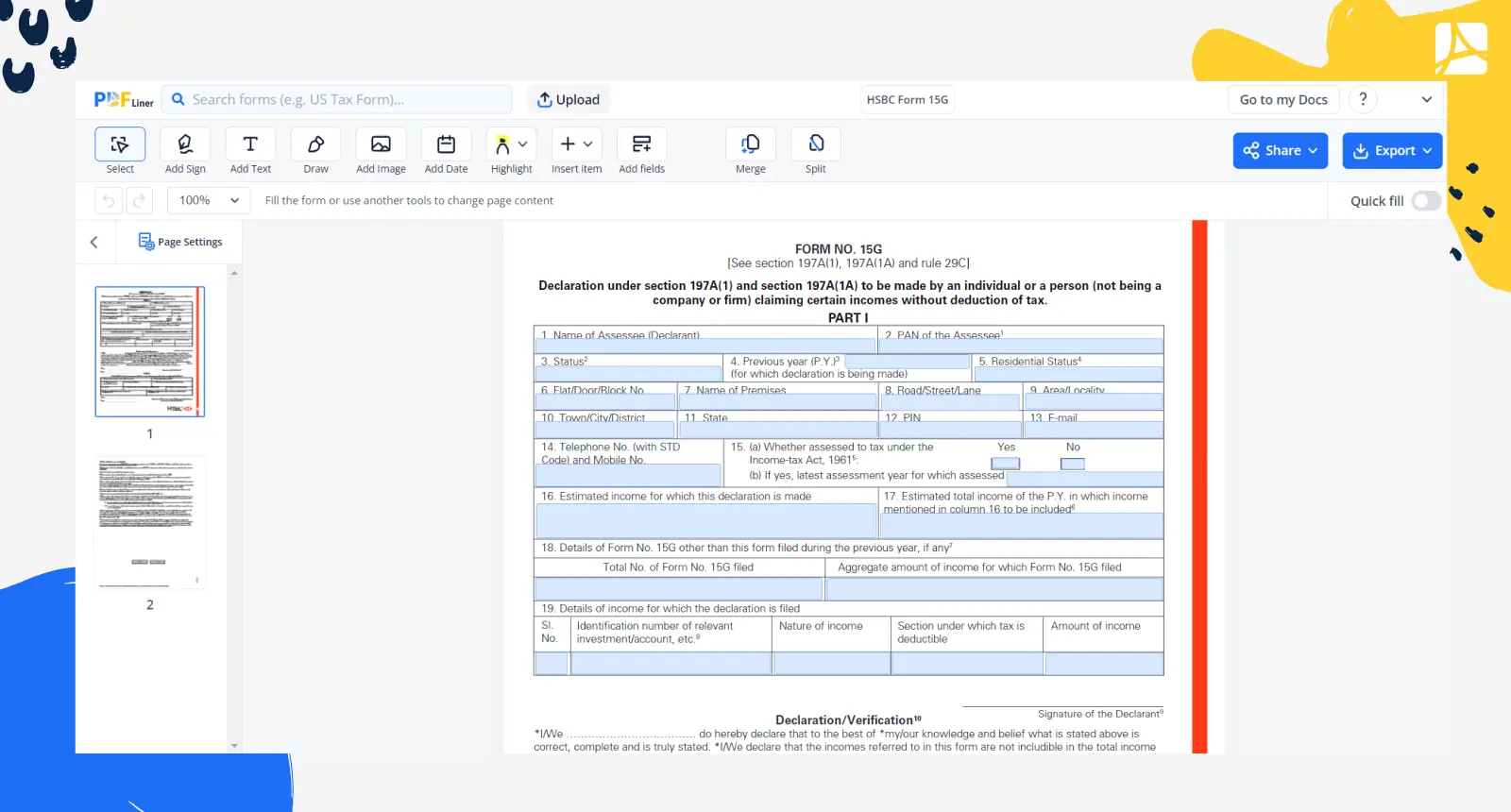

Fillable HSBC Form 15G

Get your HSBC Form 15G in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

Understanding the Form No 15G

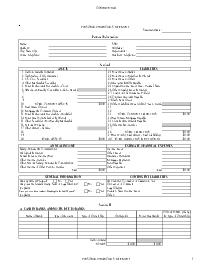

The HSBC Form No 15G is a critical document that Indian citizens holding bank deposits have to fill to prevent tax deducted from interest earned on their savings. The form may be intimidating for the first time; however, with a proper understanding and guidance, it becomes pretty straightforward.

Importance of form No 15G PDF

Filing the HSBC form No 15G is of paramount importance to keep your financial matters in order, mainly for those individuals whose taxable income is less than the tax-free limit as provided by the Income Tax Act, 1961 in India. This form aims to ensure that banks do not deduct TDS on interest earned on bank deposits if the total interest income is less than the minimum taxable amount.

How to Fill Up Form No 15G

Learning how to fill out this form doesn’t have to be complicated. Gather the necessary details required on the form beforehand to make the process smoother:

- Begin by filling out your personal details in the section titled "Name of Assessee (Declarant)", type in your full name.

- Provide your Permanent Account Number (PAN) in the section labeled "PAN of the Assessee".

- Select your status from the dropdown menu in the section titled "Status". This may be individual or company, based on your situation.

- Enter the previous fiscal year in the "Previous Year (P.Y.) (for which declaration is being made)" section. This should be the year for which your income is being declared.

- Choose your "Residential Status" from the options provided. You are either "Residential" or "Non-Residential" based on your current living situation.

- Make sure to fill out your current address details in sections named: "Flat/Door/Block No.", "Name of Premises", "Road/Street/Lane", "Area/Locality", "Town/City/District", "State", and "PIN".

- Now provide your email address, followed by your telephone number (with STD code) and mobile number in the specified sections.

- Next, you have to fill the section: "Whether assessed to tax under the Income-tax Act, 1961". Check the appropriate box and if yes, type in the latest assessment year.

- In the "Estimated income for which this declaration is made" box, provide an estimate of your income for which the declaration is being made.

- The next section focuses on any other Form No.15G you have submitted during the past year. If you have filed any, state the total number and aggregate amount of income for which the form was filed.

- Enter the details of the income declaration, such as the identification number of the relevant investment/account, the nature of income, the section under which tax is deductible, and the amount of income.

- Finally, sign the document digitally in the box labeled "Signature of the Declarant".

- Now you may save, print, send via email, or download form no 15G. On the PDFLiner website, form no 15G downloads for free.

Remember to check all information for accuracy before submitting your HSBC 15G form. It is important to provide correct and truthful information in this document.

Who needs to fill out this form

A pivotal aspect pertains to whether you're the right candidate for the task. So who exactly should fill out this form? Essentially, form no 15G is designed for Indian residents under the age of 60, and HUFs (Hindu Undivided Families) who have their total income level falling below the taxable bracket.

Notably, this form is not applicable to companies, firms, or non-residential Indians. By comprehending the qualifying criteria, you only need to worry about the form filling if it directly applies to you. This not only saves time but also ensures you're meeting the legal requirements for your specific situation.

Fillable online HSBC Form 15G