-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

- 1099 Forms

- W-9 Forms

- Other Tax Forms

- Real Estate

- Legal

- Medical

- Bill of Sale

- Contracts

- Education

- All templates

HIPAA Compliance Patient Consent Form

HIPAA Compliance Patient Consent Form

Legal Aid Queensland Application

Legal Aid Queensland Application

Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment

Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment

Florida Last Will and Testament Form

Florida Last Will and Testament Form

Pennsylvania Last Will and Testament Form

Pennsylvania Last Will and Testament Form

Recertification for Calfresh Benefits (CF 37)

Recertification for Calfresh Benefits (CF 37)

Form Arkansas No-Fault Divorce (Minor Children)

Form Arkansas No-Fault Divorce (Minor Children)

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Arizona State Forms

-

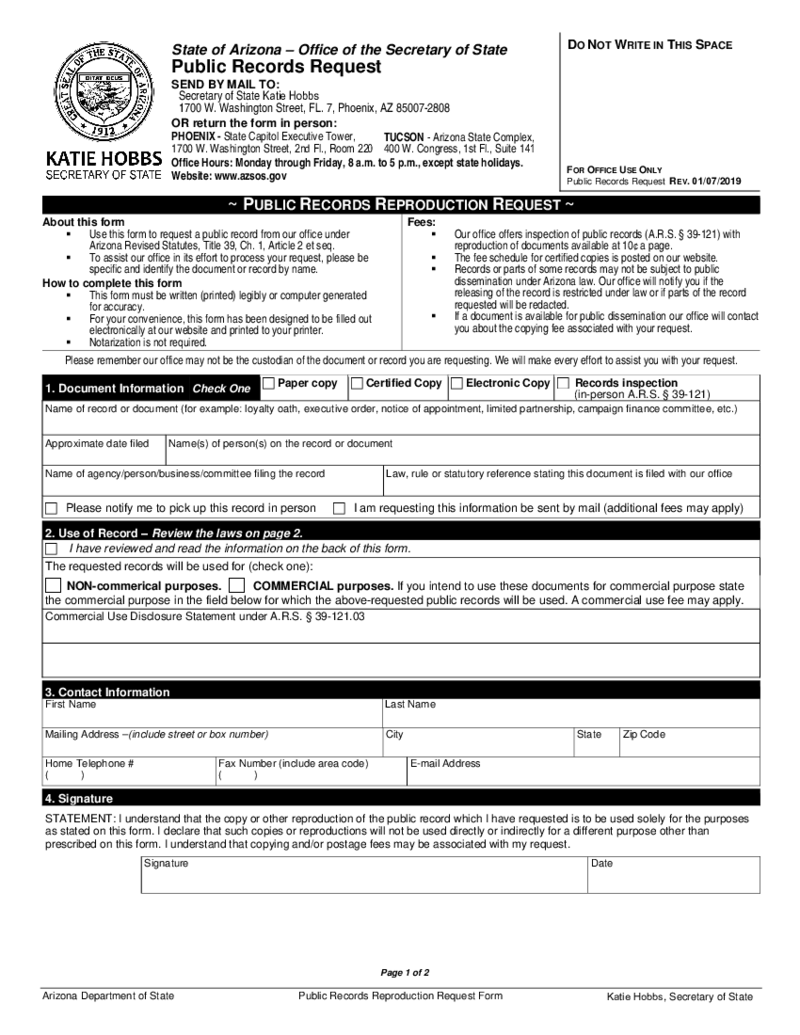

Public Records Reproduction Request

What is Public Records Reproduction Request?

The public records request Arizona is the form that allows the person to ask for the papers available for public use. The form was created by the Arizona Office of the Secretary of State and is active under the

Public Records Reproduction Request

What is Public Records Reproduction Request?

The public records request Arizona is the form that allows the person to ask for the papers available for public use. The form was created by the Arizona Office of the Secretary of State and is active under the

-

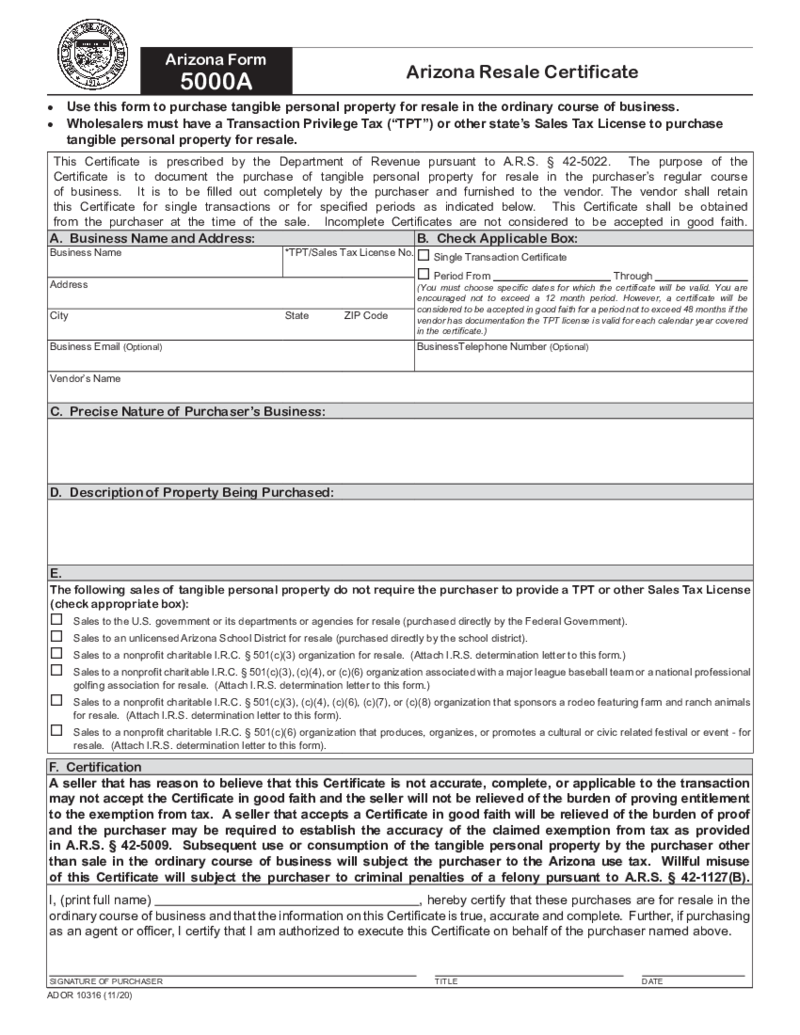

Form 5000A - Arizona Resale Certificate

What is Form 5000A?

Form 5000A Arizona is also known as Arizona Resale Certificate. Those people who are trying to buy tangible property for later resale have to complete this document. It has to be for personal matters only and in the usual business cour

Form 5000A - Arizona Resale Certificate

What is Form 5000A?

Form 5000A Arizona is also known as Arizona Resale Certificate. Those people who are trying to buy tangible property for later resale have to complete this document. It has to be for personal matters only and in the usual business cour

-

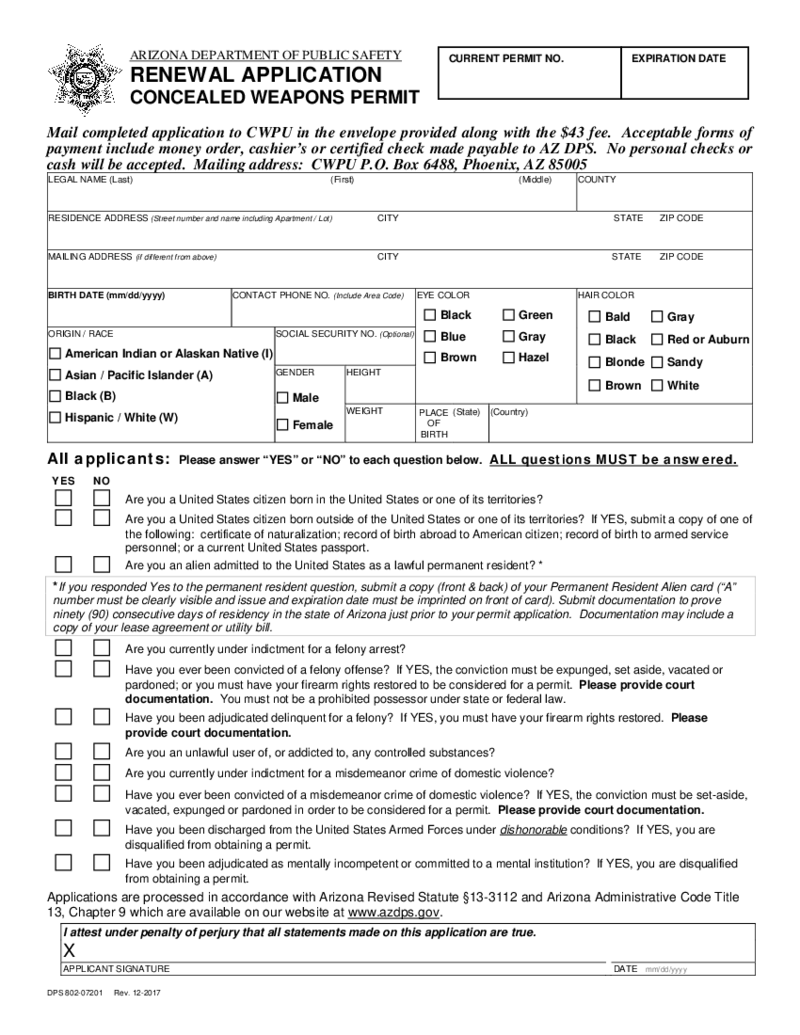

AZ DPS 802-07201

What Is an AZ DPS 802-07201 Renewal Application Form?

The DPS 802-07202-form, also known as a "Record Review" form, is a document that allows individuals to request a copy of their Arizona criminal history record. Arizona department of public sa

AZ DPS 802-07201

What Is an AZ DPS 802-07201 Renewal Application Form?

The DPS 802-07202-form, also known as a "Record Review" form, is a document that allows individuals to request a copy of their Arizona criminal history record. Arizona department of public sa

-

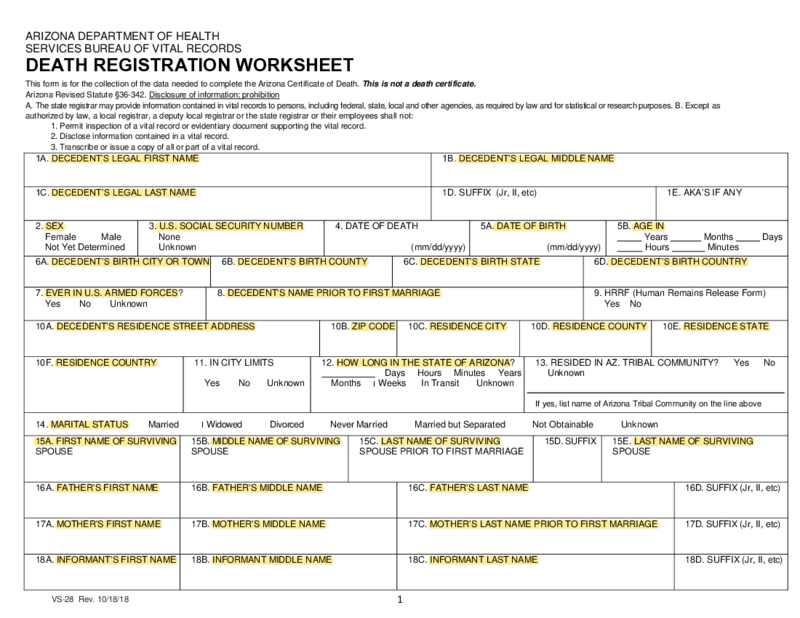

Arizona Death Registration Worksheet

What Is the Arizona Death Registration Worksheet?

The Arizona Death Registration Worksheet is an essential piece of paperwork that medical professionals, administrators, and funeral directors must use to kickstart the formal death registration process. Th

Arizona Death Registration Worksheet

What Is the Arizona Death Registration Worksheet?

The Arizona Death Registration Worksheet is an essential piece of paperwork that medical professionals, administrators, and funeral directors must use to kickstart the formal death registration process. Th

-

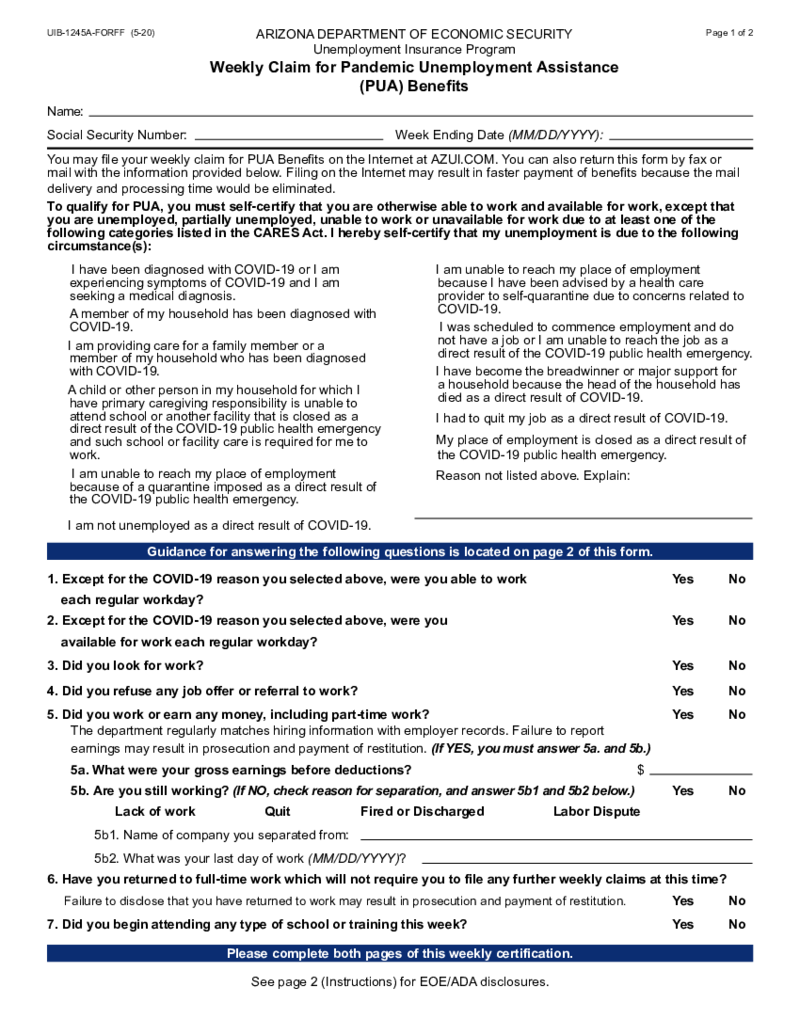

Arizona Unemployment Weekly Claim Form (2020)

Arizona Unemployment Weekly Claim Form (2020)

✓ Easily fill out and sign forms

✓ Download blank or editable online

Current Version:

Arizona Unemployment Weekly Claim Form (2020)

Arizona Unemployment Weekly Claim Form (2020)

✓ Easily fill out and sign forms

✓ Download blank or editable online

Current Version:

-

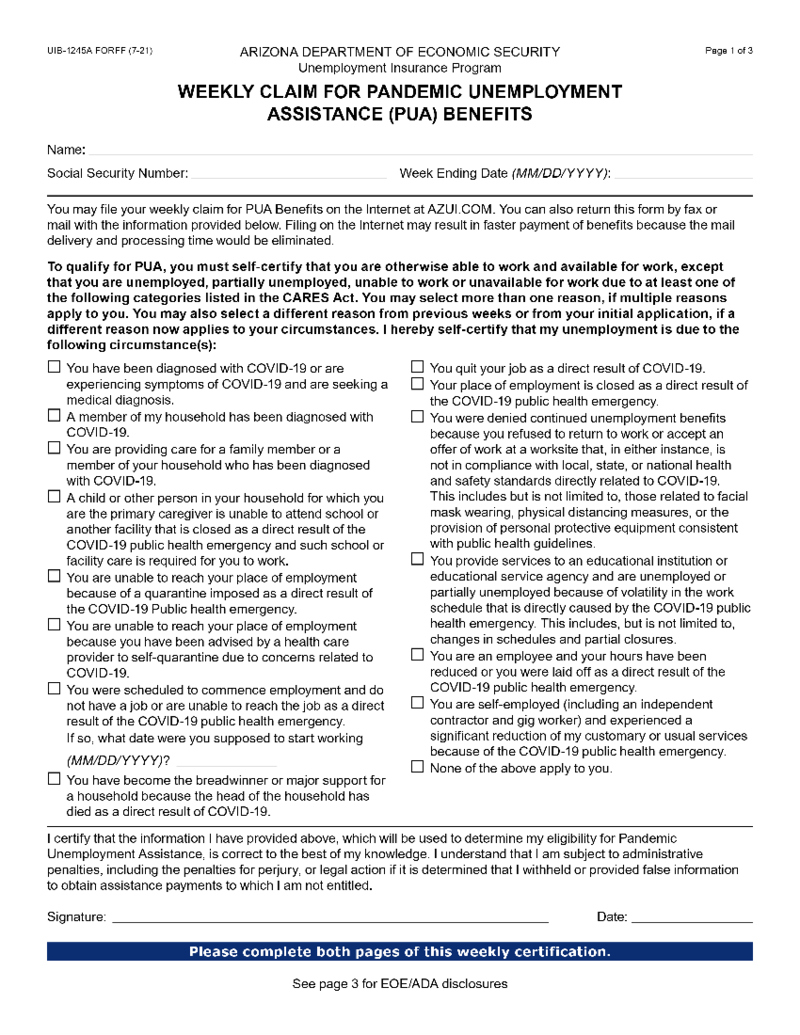

UIB 1245A Weekly Claim for Pandemic Unemployment Assistance

What is a UIB 1245A Weekly Claim form?

Fillable UIB 1245A Weekly Claim for Pandemic Unemployment Assistance form is on-demand during this lockdown period. It was created as a part of the Unemployment Insurance Program. Download UIB 1245A Weekly Claim for

UIB 1245A Weekly Claim for Pandemic Unemployment Assistance

What is a UIB 1245A Weekly Claim form?

Fillable UIB 1245A Weekly Claim for Pandemic Unemployment Assistance form is on-demand during this lockdown period. It was created as a part of the Unemployment Insurance Program. Download UIB 1245A Weekly Claim for

-

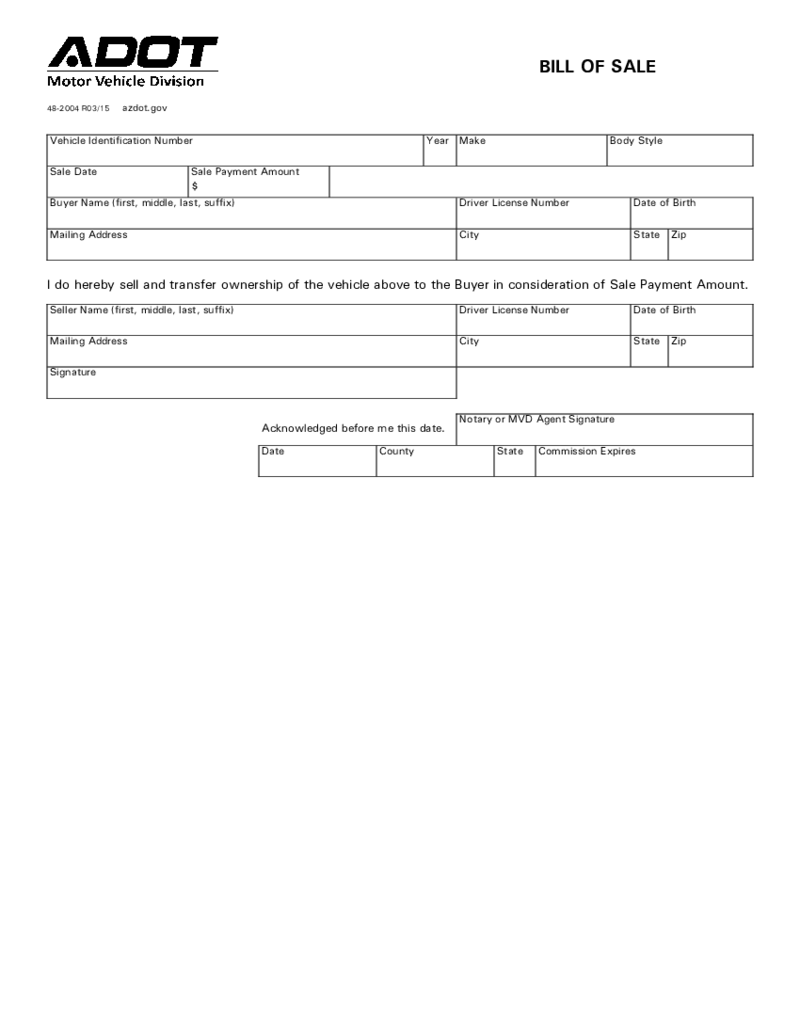

Arizona Motor Vehicle Bill of Sale

What is the Arizona Motor Vehicle Bill of Sale?

Do you need to buy or sell a car in the state of Arizona? You've probably heard what is an Arizona Motor Vehicle Bill of Sale. This is a document that proves the sale and ownership of the vehicle by the

Arizona Motor Vehicle Bill of Sale

What is the Arizona Motor Vehicle Bill of Sale?

Do you need to buy or sell a car in the state of Arizona? You've probably heard what is an Arizona Motor Vehicle Bill of Sale. This is a document that proves the sale and ownership of the vehicle by the

-

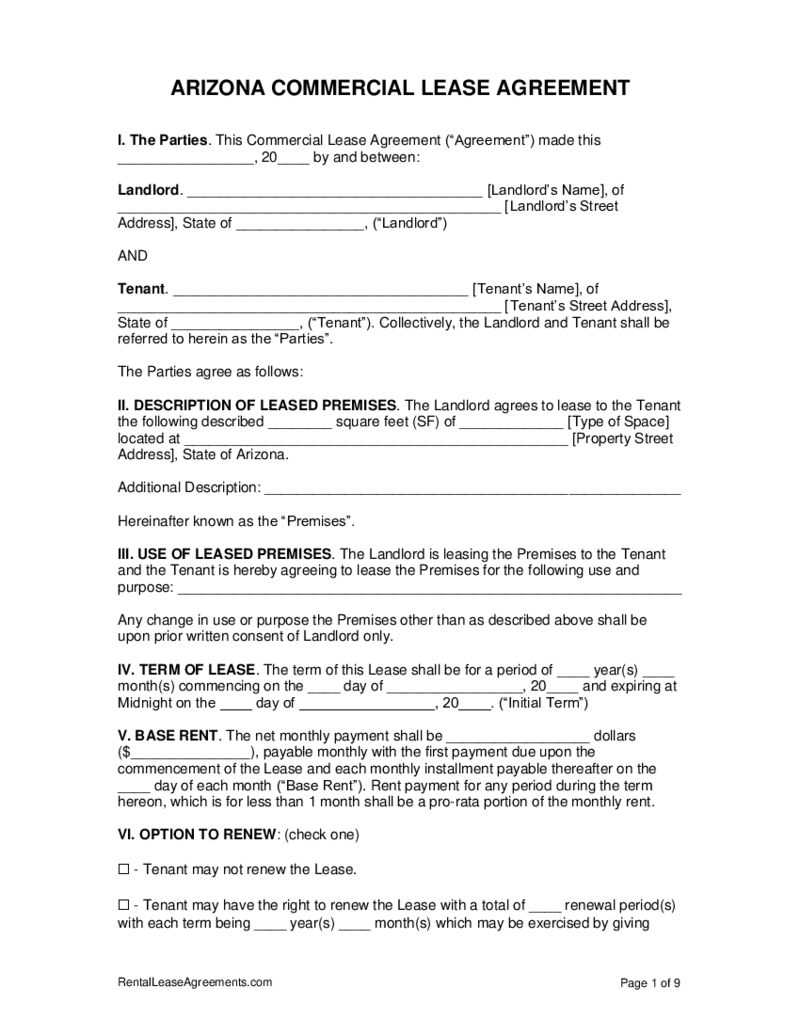

Arizona Commercial Lease Agreement

What Is A Commercial Lease Agreement Arizona

A Commercial Lease Agreement in Arizona is a legally binding document between a landlord and a business tenant for commercial property rental. Unlike residential leases, this type caters to commercial entities

Arizona Commercial Lease Agreement

What Is A Commercial Lease Agreement Arizona

A Commercial Lease Agreement in Arizona is a legally binding document between a landlord and a business tenant for commercial property rental. Unlike residential leases, this type caters to commercial entities

-

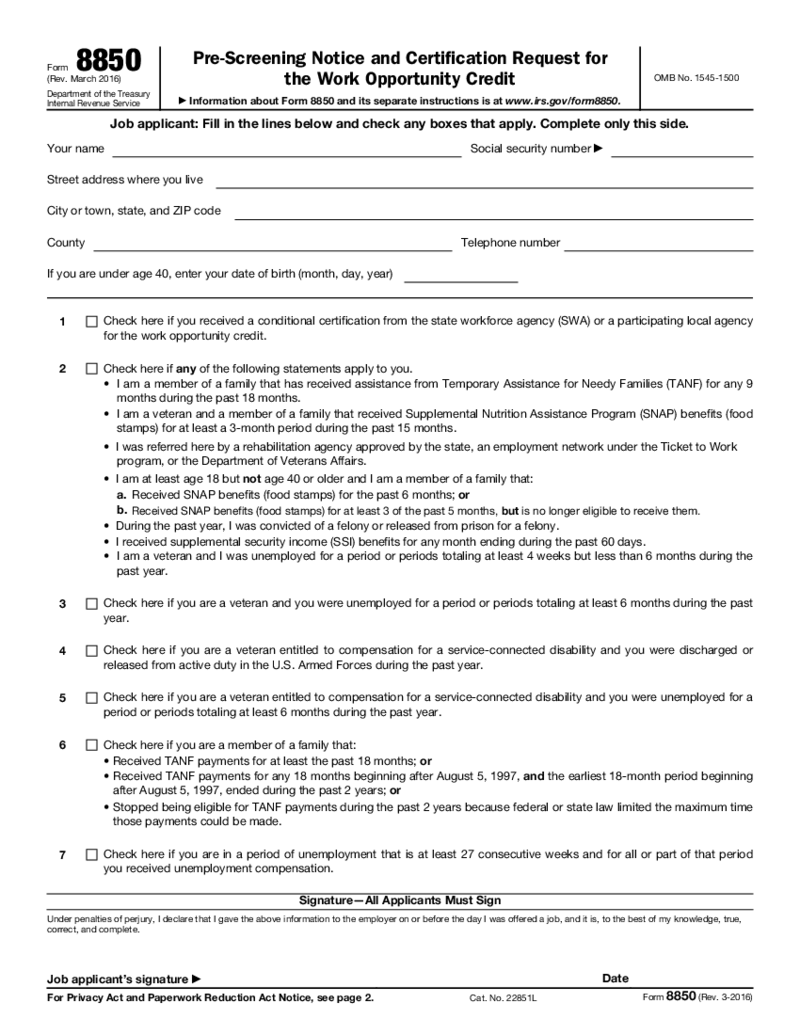

Form 8850 Pre-Screening Notice and Certification Request

What Is IRS 8850 Form

Also known as the Pre-Screening Notice and Certification Request for the Work Opportunity Credit, it’s a document utilized by employers to determine an individual's eligibility for the Work Opportunity Tax Credit (WOTC) pro

Form 8850 Pre-Screening Notice and Certification Request

What Is IRS 8850 Form

Also known as the Pre-Screening Notice and Certification Request for the Work Opportunity Credit, it’s a document utilized by employers to determine an individual's eligibility for the Work Opportunity Tax Credit (WOTC) pro