-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

- 1099 Forms

- W-9 Forms

- Other Tax Forms

- Real Estate

- Legal

- Medical

- Bill of Sale

- Contracts

- Education

- All templates

HIPAA Compliance Patient Consent Form

HIPAA Compliance Patient Consent Form

Legal Aid Queensland Application

Legal Aid Queensland Application

Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment

Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment

Florida Last Will and Testament Form

Florida Last Will and Testament Form

Recertification for Calfresh Benefits (CF 37)

Recertification for Calfresh Benefits (CF 37)

Pennsylvania Last Will and Testament Form

Pennsylvania Last Will and Testament Form

AU Mod(JY), Parent(s), Guardian(s) details

AU Mod(JY), Parent(s), Guardian(s) details

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

T1 Income Tax and Benefit Return Forms

-

T1 BC Income Tax and Benefit Return

What is a T1 Form BC?

A T1 form is a tax return for individuals who are residents of British Columbia. This form is used to report income from all sources, including employment, business, investments, and other sources. The T1 form must be filed by April

T1 BC Income Tax and Benefit Return

What is a T1 Form BC?

A T1 form is a tax return for individuals who are residents of British Columbia. This form is used to report income from all sources, including employment, business, investments, and other sources. The T1 form must be filed by April

-

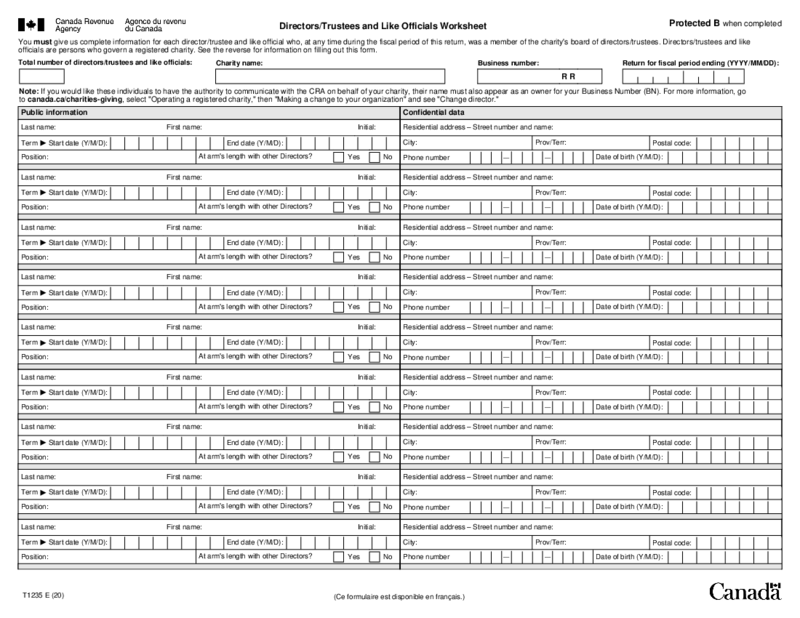

T1235 Directors Trustees and Like Officials Worksheet

What Is the T1235 Form?

It’s a document utilized by Canadian charitable organizations, public foundations, or private foundations for the purpose of their directors’ identification. Canada Revenue Agency is where this file should be subm

T1235 Directors Trustees and Like Officials Worksheet

What Is the T1235 Form?

It’s a document utilized by Canadian charitable organizations, public foundations, or private foundations for the purpose of their directors’ identification. Canada Revenue Agency is where this file should be subm

-

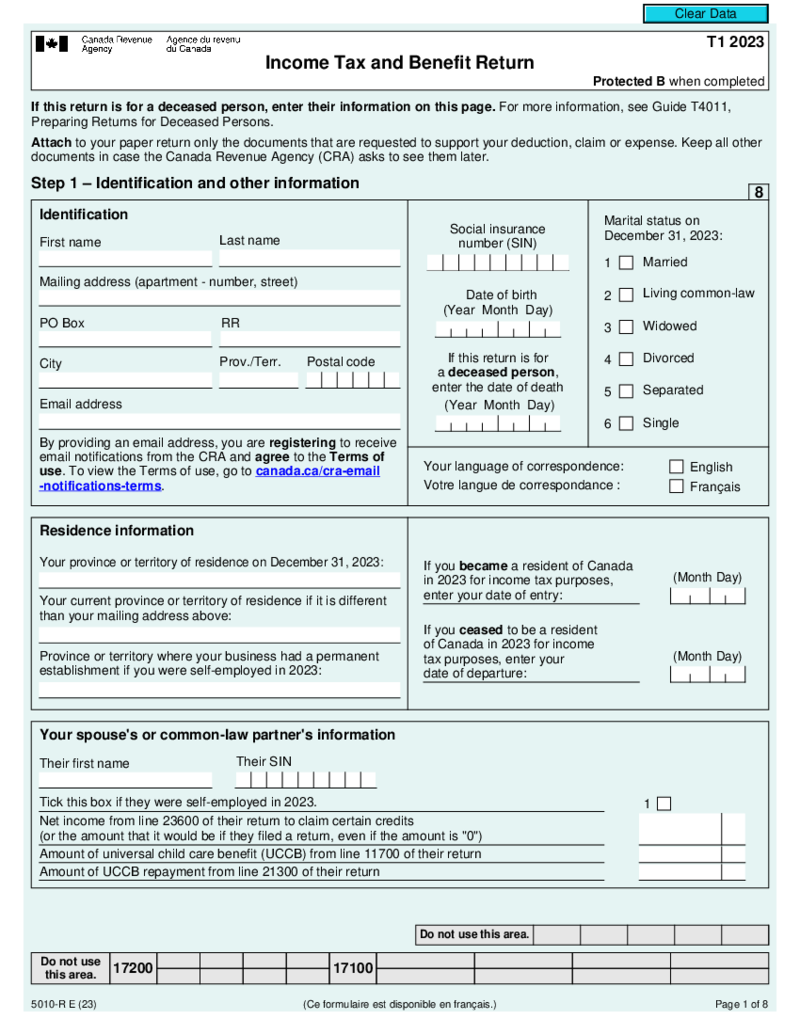

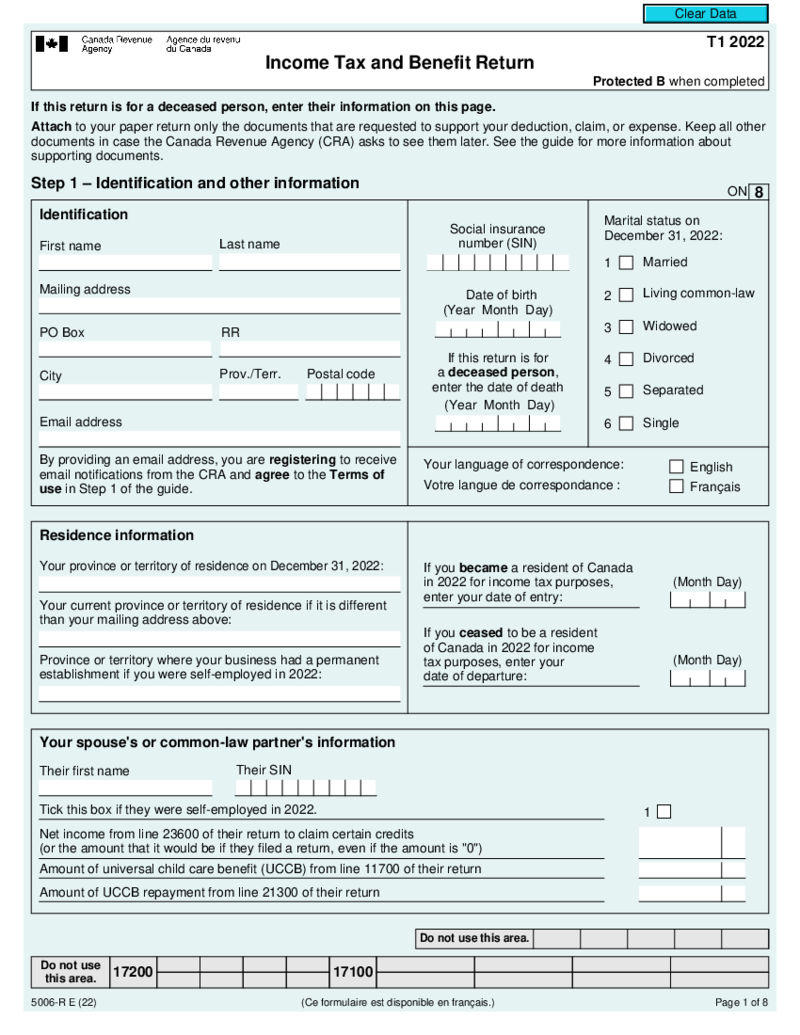

T1 General Income Tax and Benefit Return

What is a T1 General Income Tax Form?

A T1 General income tax form is a document that is used to file an individual’s income tax return in Canada. The Canadian income tax forms T1 general is the most common form used by individuals and is

T1 General Income Tax and Benefit Return

What is a T1 General Income Tax Form?

A T1 General income tax form is a document that is used to file an individual’s income tax return in Canada. The Canadian income tax forms T1 general is the most common form used by individuals and is

-

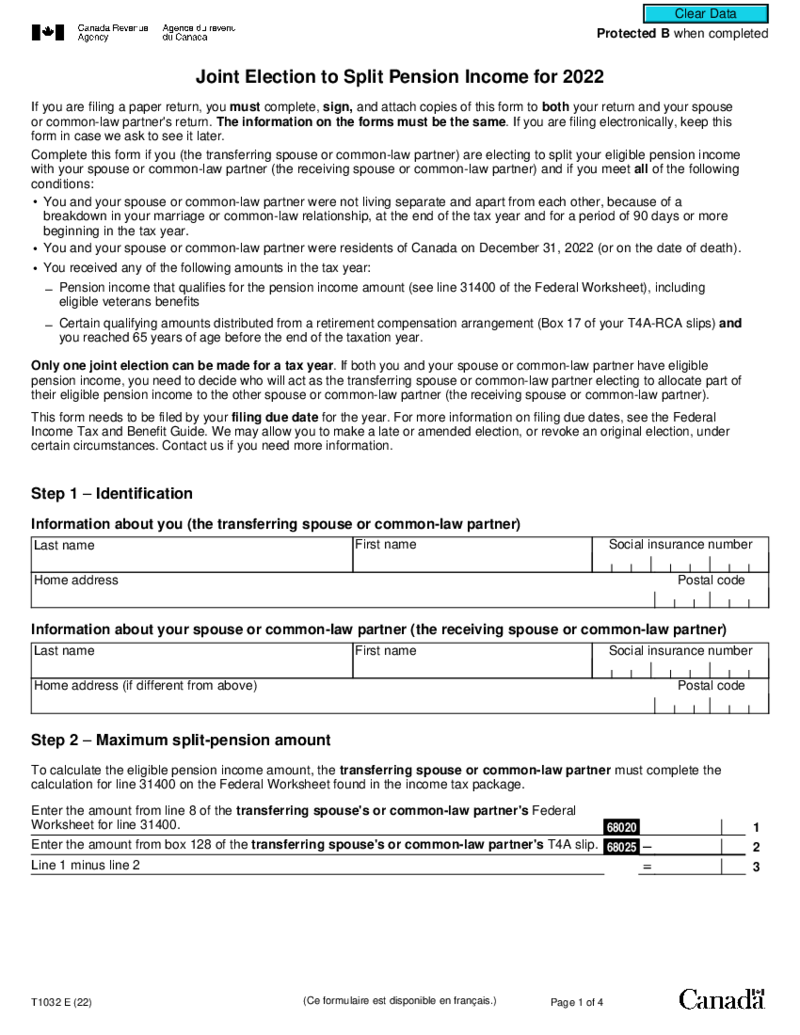

Form T1032 (2022)

What is Form T1032?

CRA form T1032 is also widely known as the Joint Election to Split Pension Income for 2022. It was created and released by the Canada Revenue Agency. The template helps pensioners to split their pension with their partner or spouse. Th

Form T1032 (2022)

What is Form T1032?

CRA form T1032 is also widely known as the Joint Election to Split Pension Income for 2022. It was created and released by the Canada Revenue Agency. The template helps pensioners to split their pension with their partner or spouse. Th

-

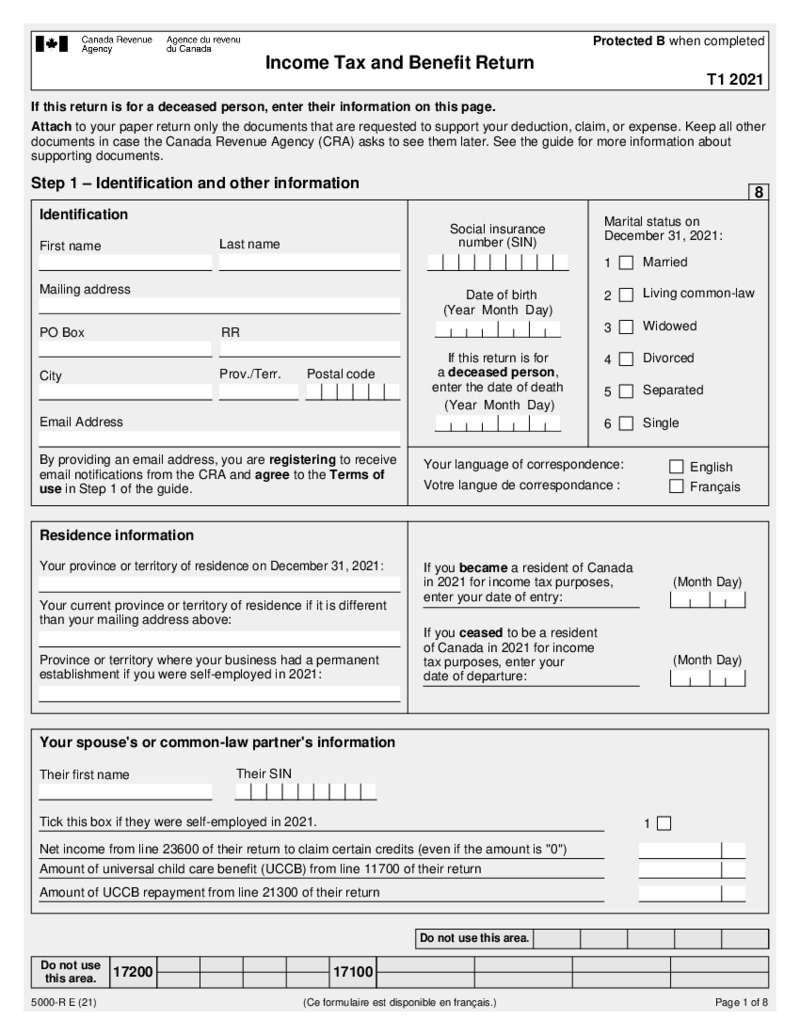

T1 General Income Tax and Benefit Return (2021)

T1 General Income Tax and Benefit Return (2021)

✓ Easily fill out and sign forms

✓ Download blank or editable online

T1 General Income Tax and Benefit Return (2021)

T1 General Income Tax and Benefit Return (2021)

✓ Easily fill out and sign forms

✓ Download blank or editable online

-

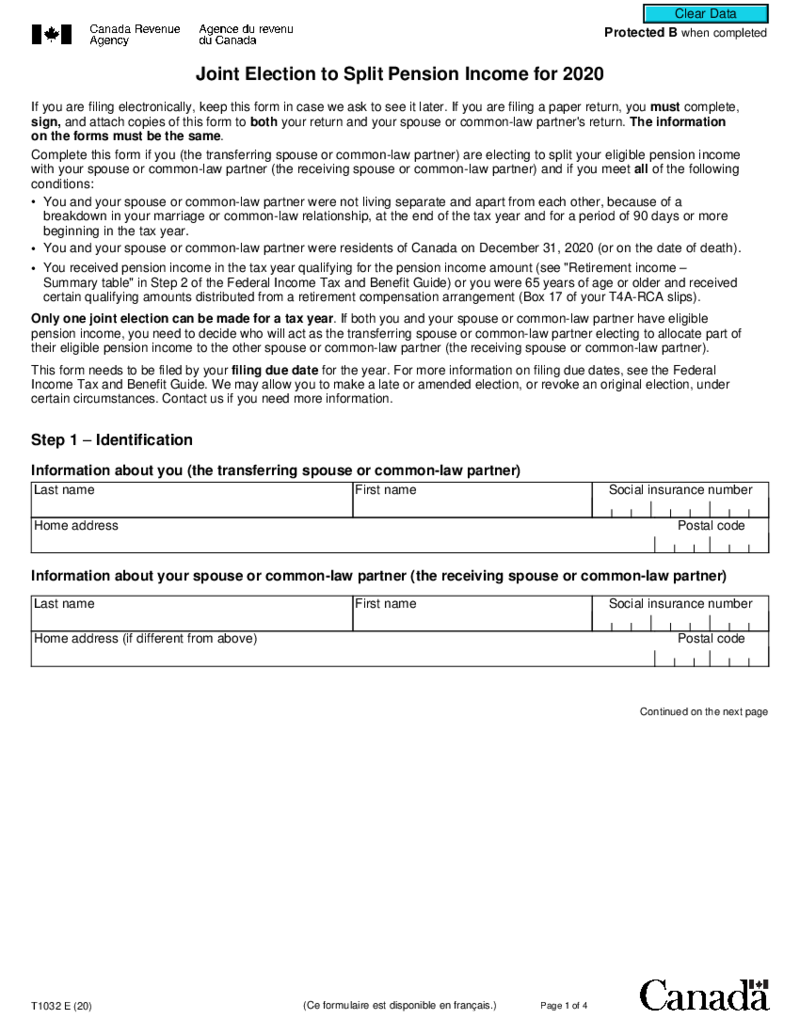

T1032 Joint Election to Split Pension Income for 2020

What is form T1032 Split Income for 2020?

Form t1032 joint election to split pension income is used to report pension income that has been split between you and your spouse or common-law partner. Under the Income Tax Act, there are restrictions on who can

T1032 Joint Election to Split Pension Income for 2020

What is form T1032 Split Income for 2020?

Form t1032 joint election to split pension income is used to report pension income that has been split between you and your spouse or common-law partner. Under the Income Tax Act, there are restrictions on who can

-

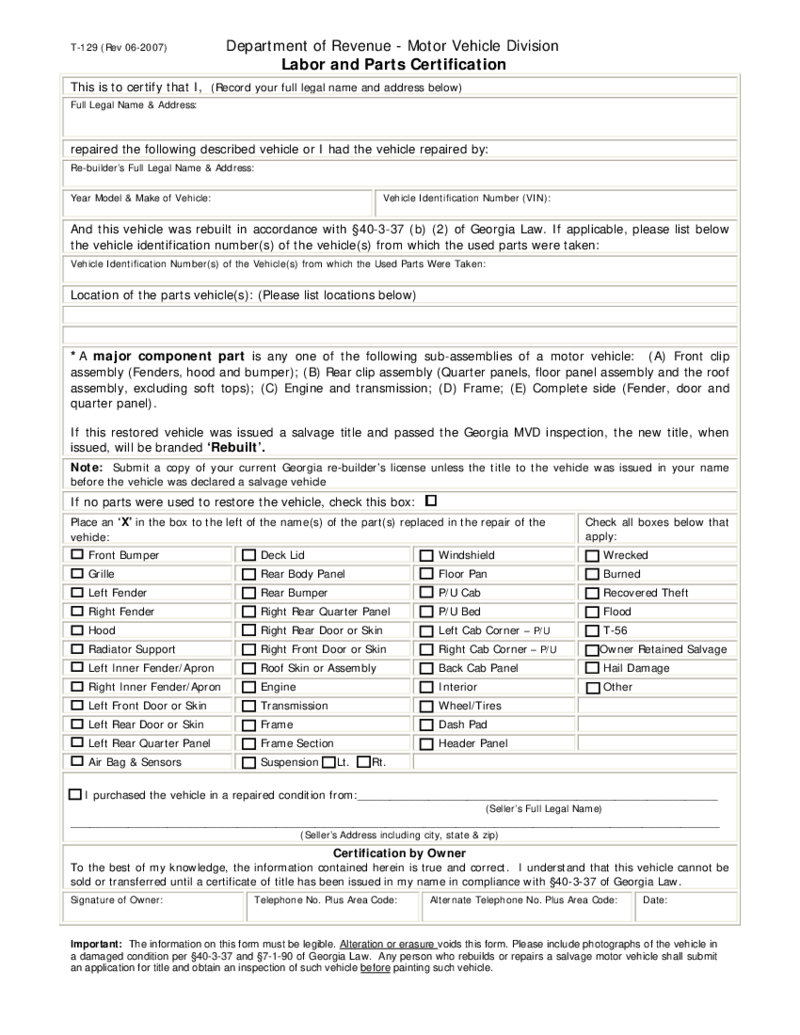

T-129, Georgia Department of Revenue

T-129, Georgia Department of Revenue

✓ Easily fill out and sign forms

✓ Download blank or editable online

T-129, Georgia Department of Revenue

T-129, Georgia Department of Revenue

✓ Easily fill out and sign forms

✓ Download blank or editable online

-

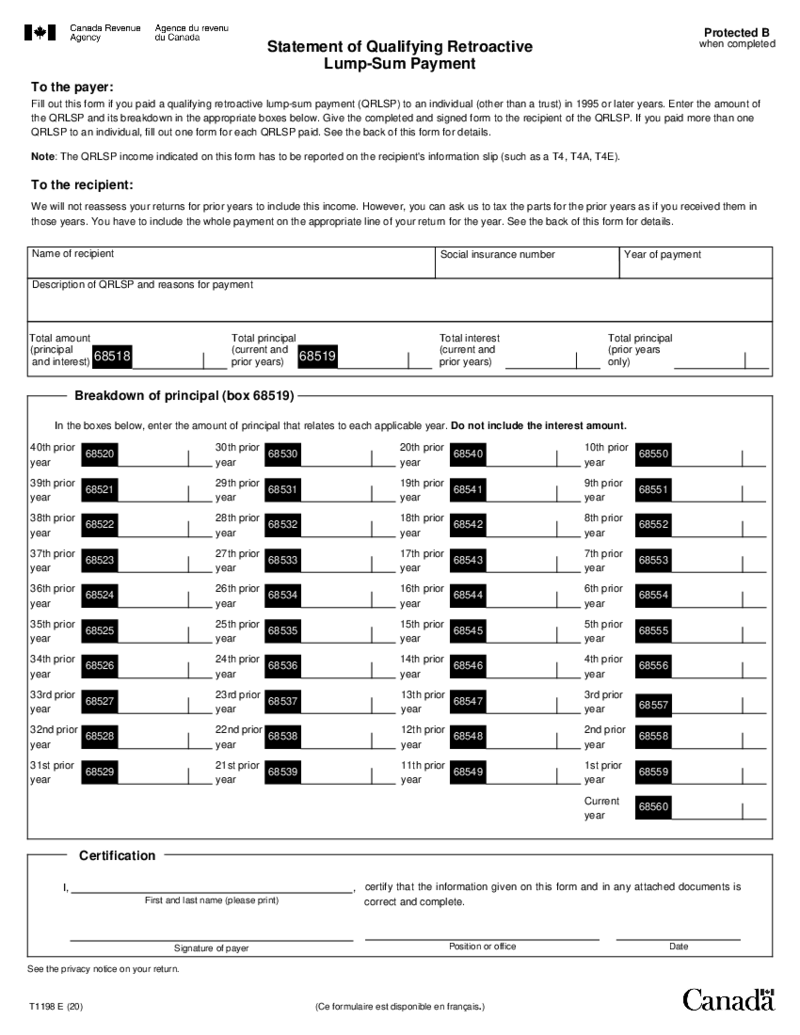

T1198 Statement of Qualifying Retroactive Lump-Sum Payment

What Is Form T1198?

The Form T1198 Statement of Qualifying Retroactive Lump-Sum Payment is a statement you can use to report certain types of lump-sum income.

What Is the T1198 Form Used For?

You can usually use the T 1198 form to re

T1198 Statement of Qualifying Retroactive Lump-Sum Payment

What Is Form T1198?

The Form T1198 Statement of Qualifying Retroactive Lump-Sum Payment is a statement you can use to report certain types of lump-sum income.

What Is the T1198 Form Used For?

You can usually use the T 1198 form to re

-

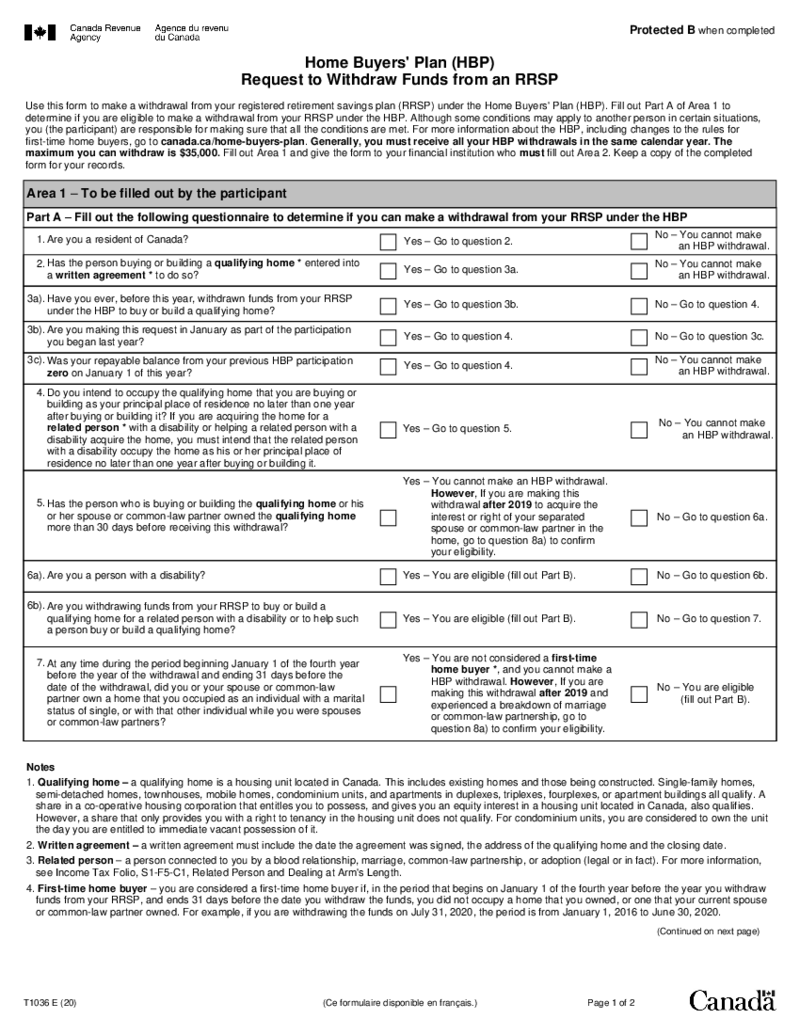

T1036 Home Buyers Plan (HBP) Request to Withdraw Funds from an RRSP

Understanding the Home Buyers' Plan (HBP): Is it Right for You

Considering the Home Buyers' Plan (HBP) as a potential option for utilizing funds from your Registered Retirement Savings Plan (RRSP) can be a significant financial decision, especiall

T1036 Home Buyers Plan (HBP) Request to Withdraw Funds from an RRSP

Understanding the Home Buyers' Plan (HBP): Is it Right for You

Considering the Home Buyers' Plan (HBP) as a potential option for utilizing funds from your Registered Retirement Savings Plan (RRSP) can be a significant financial decision, especiall

-

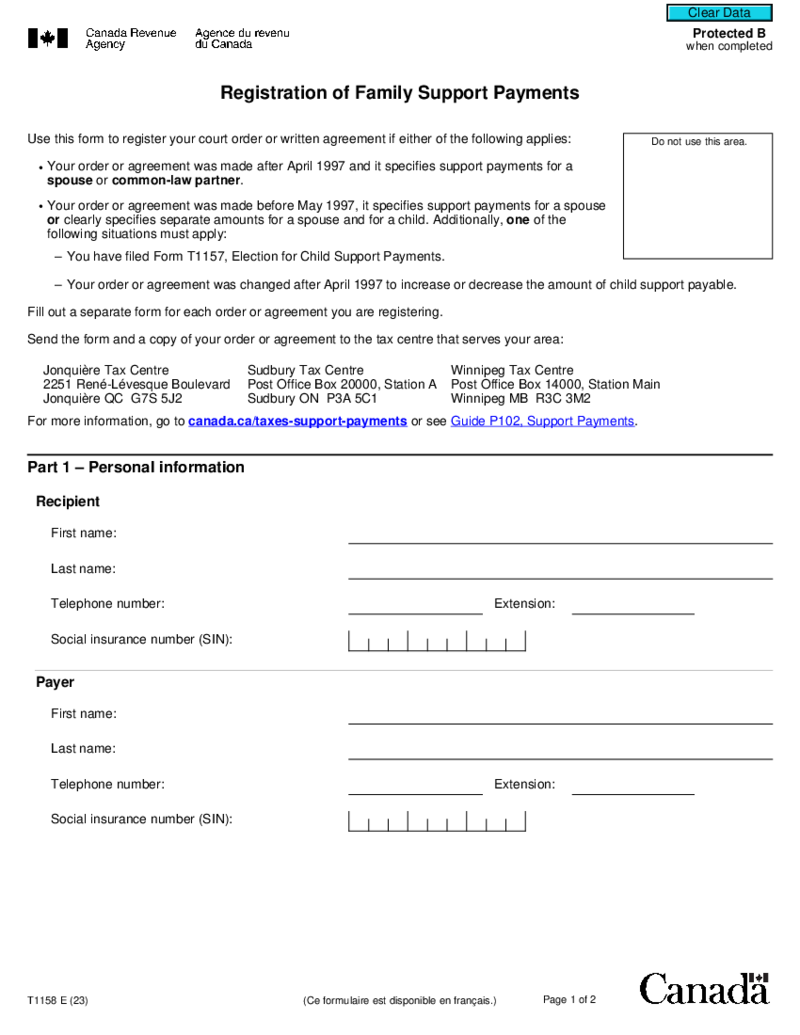

T1158 Registration of Family Support Payments

Understanding CRA Form T1158

The CRA Form T1158, or the registration of family support payments Canada, is a critical document for individuals who are required to make payments or those who receive them. Administered by the Canada Revenue Agency (CRA), th

T1158 Registration of Family Support Payments

Understanding CRA Form T1158

The CRA Form T1158, or the registration of family support payments Canada, is a critical document for individuals who are required to make payments or those who receive them. Administered by the Canada Revenue Agency (CRA), th

-

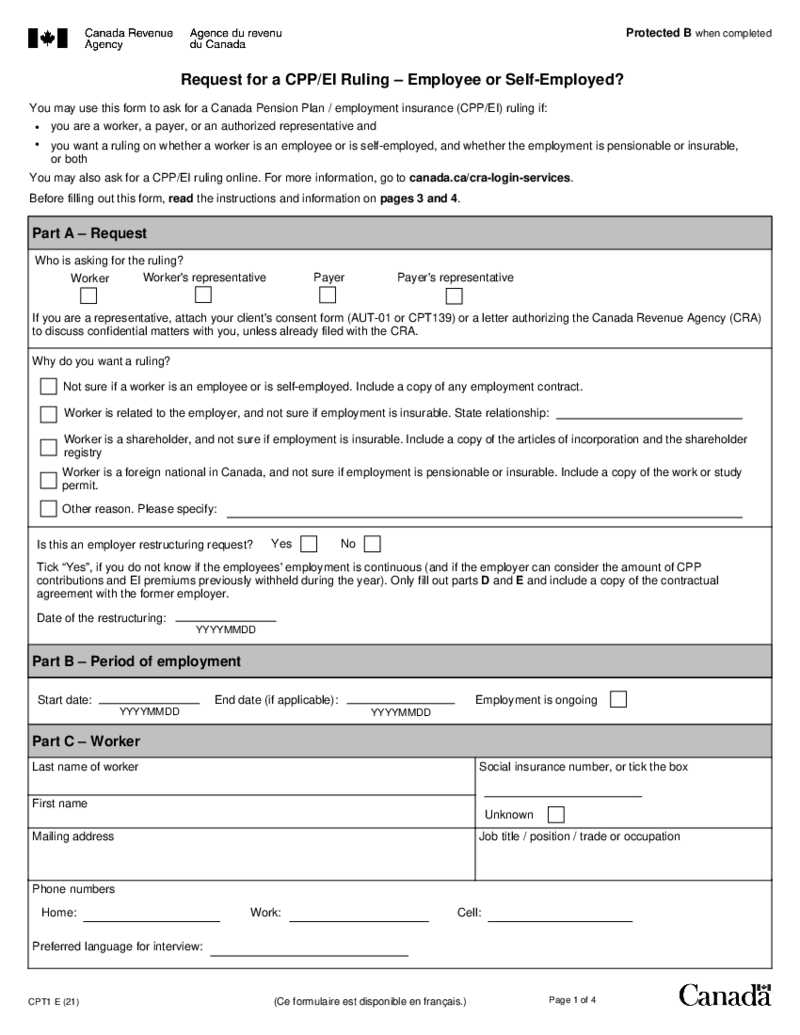

Form CPT1

What Is Form CPT1

Form CPT1, or the CPT1 Form Canada, is a critical document used for various tax-related purposes in Canada. It is primarily employed to report and reconcile certain tax payments and transactions. This form is essential for ensuring compl

Form CPT1

What Is Form CPT1

Form CPT1, or the CPT1 Form Canada, is a critical document used for various tax-related purposes in Canada. It is primarily employed to report and reconcile certain tax payments and transactions. This form is essential for ensuring compl