-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

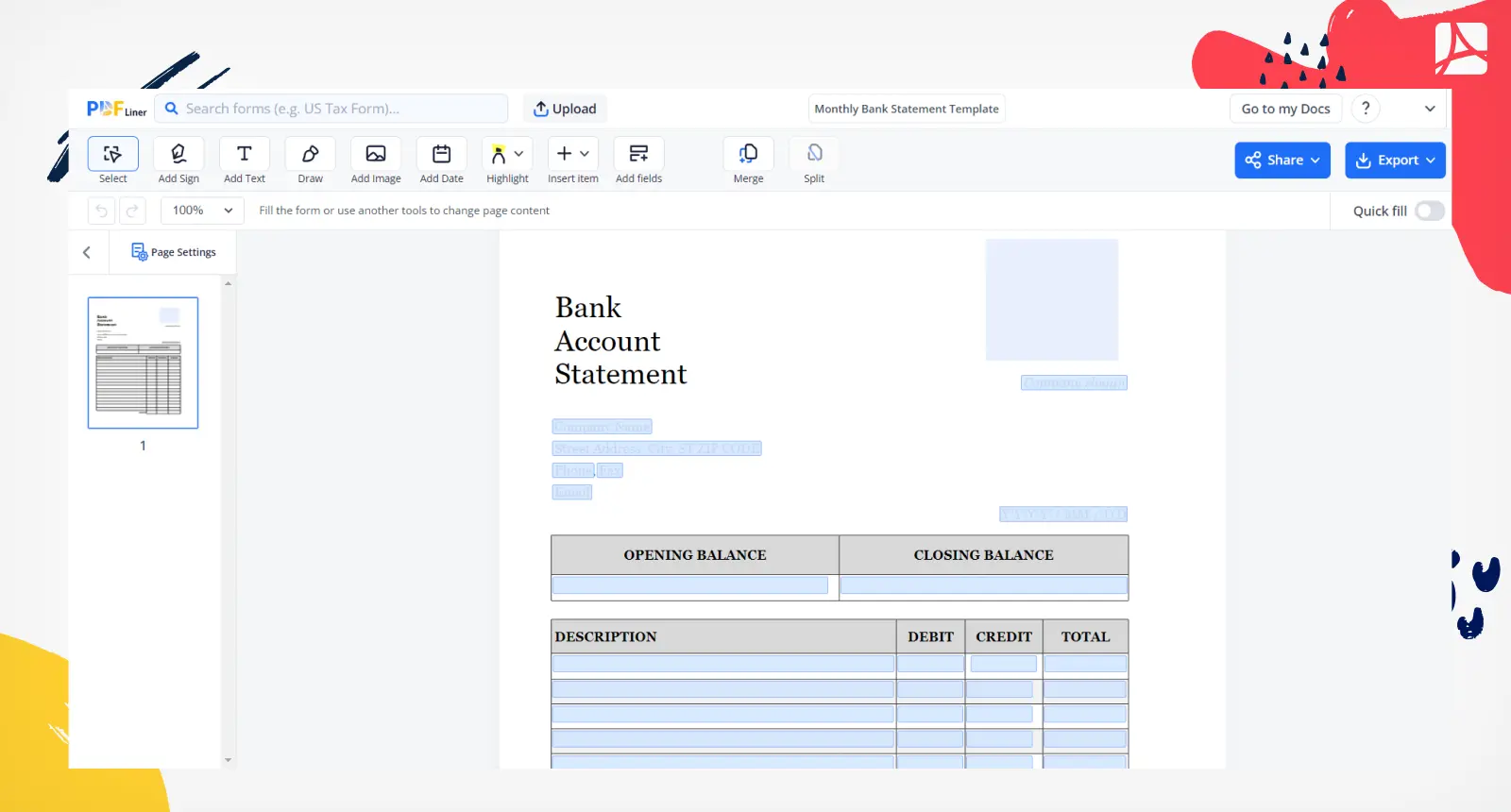

Monthly Bank Statement Template

Get your Monthly Bank Statement Template in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is a Bank Monthly Statement?

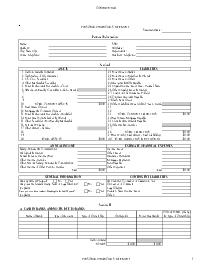

A monthly bank statement is an essential document issued by your bank that outlines your financial activities within a specified period, typically a month. It serves as a comprehensive summary of your account transactions.

Whether you receive your statement from Bank of America, US Bank, or any other institution, understanding the sections and items in this document helps maintain control of your personal finance. It is important to fill it out accurately, so using a monthly bank statement sample as a guide can be very helpful.

What a Bank of America monthly statement contains

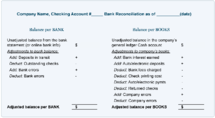

The US Bank monthly statement is not fundamentally different from the Bank of America's version. The components remain largely the same. One unique feature is that it may contain information about interest earned and an annual percentage yield earned, depending on the type of account you have. This adds an extra dimension of data you may need to consider. Yet again, it is critical to keep your records as accurate and organized as possible, particularly regarding transactions, fees, and balances.

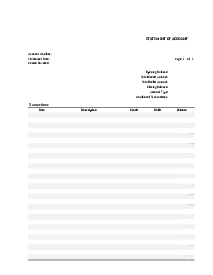

How to Fill Out US Bank Monthly Statement

You don't need to fear filling out your form if you follow the correct procedures:

- Get started by filling out your company information. Start with writing your company slogan on the appropriate line.

- Type in your company's name in the correct field.

- After this, you would need to fill out your company's street address.

- Proceed with filling out the form with your city, state, and zip code.

- Next, key in your company's phone number in the designated field.

- Now, move on to the field, asking for your company's fax number, and provide the correct details.

- Share your company's official email address by entering it in the required field.

- You will move on to the date field, where you should enter the year (yyyy), month (mm), and day (dd), respectively.

- Enter the opening balance of your company's bank account in the specific field meant for the opening balance.

- Fill out your closing balance in the corresponding field.

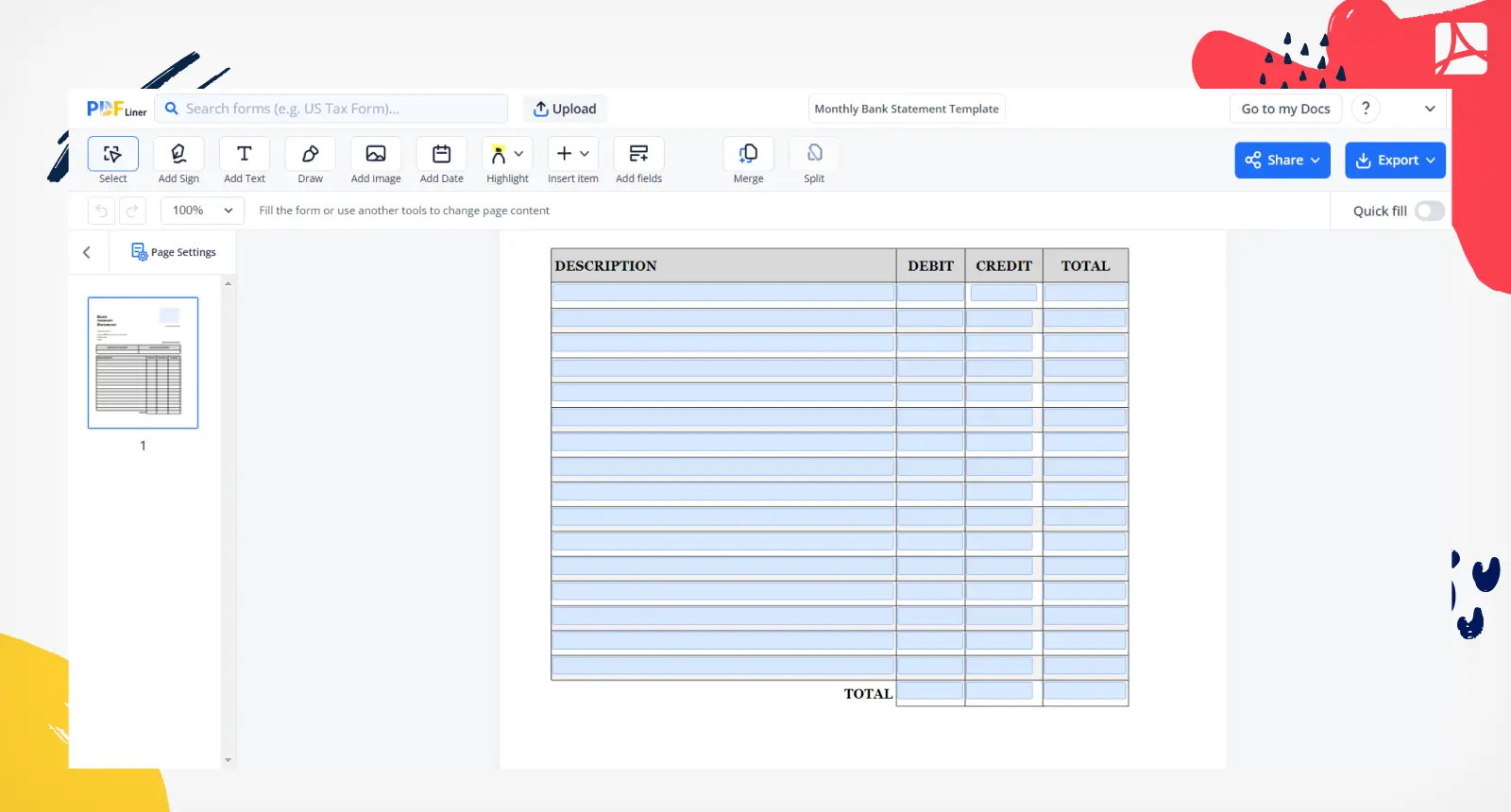

- Now, you need to start recording your transactions. In the description column, precisely describe each transaction made. This could be anything from “coffee for the office” to “payment for software subscription”.

- If the amount falls under the debit category, meaning money has been taken out of your account, enter it in the 'Debit' column.

- If the amount falls under the credit category, implying money has been deposited into your account, list it under the ‘Credit’ column.

- Finally, calculate and write down the total balance after each transaction in the 'Total' column. The total balance will be the sum of the credit and debit amount.

Importance of reviewing your monthly bank statement

After you've filled out the monthly bank statement, go through it thoroughly to ensure there are no errors or discrepancies. A single oversight can significantly alter your financial records and lead to inaccuracies down the line. Check every entry and balance to ensure that they match your records. If there are any inconsistencies or you're unsure of anything, do not hesitate to contact your bank.

Fillable online Monthly Bank Statement Template