-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Bank Reconciliation Statement Template

Get your Bank Reconciliation Statement Template in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

Understanding the Bank Reconciliation Statement

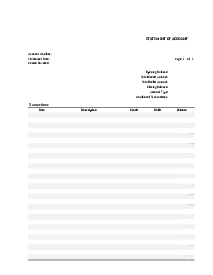

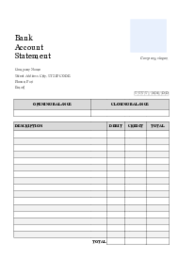

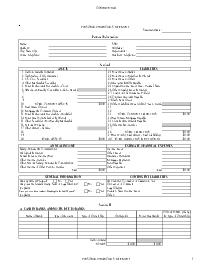

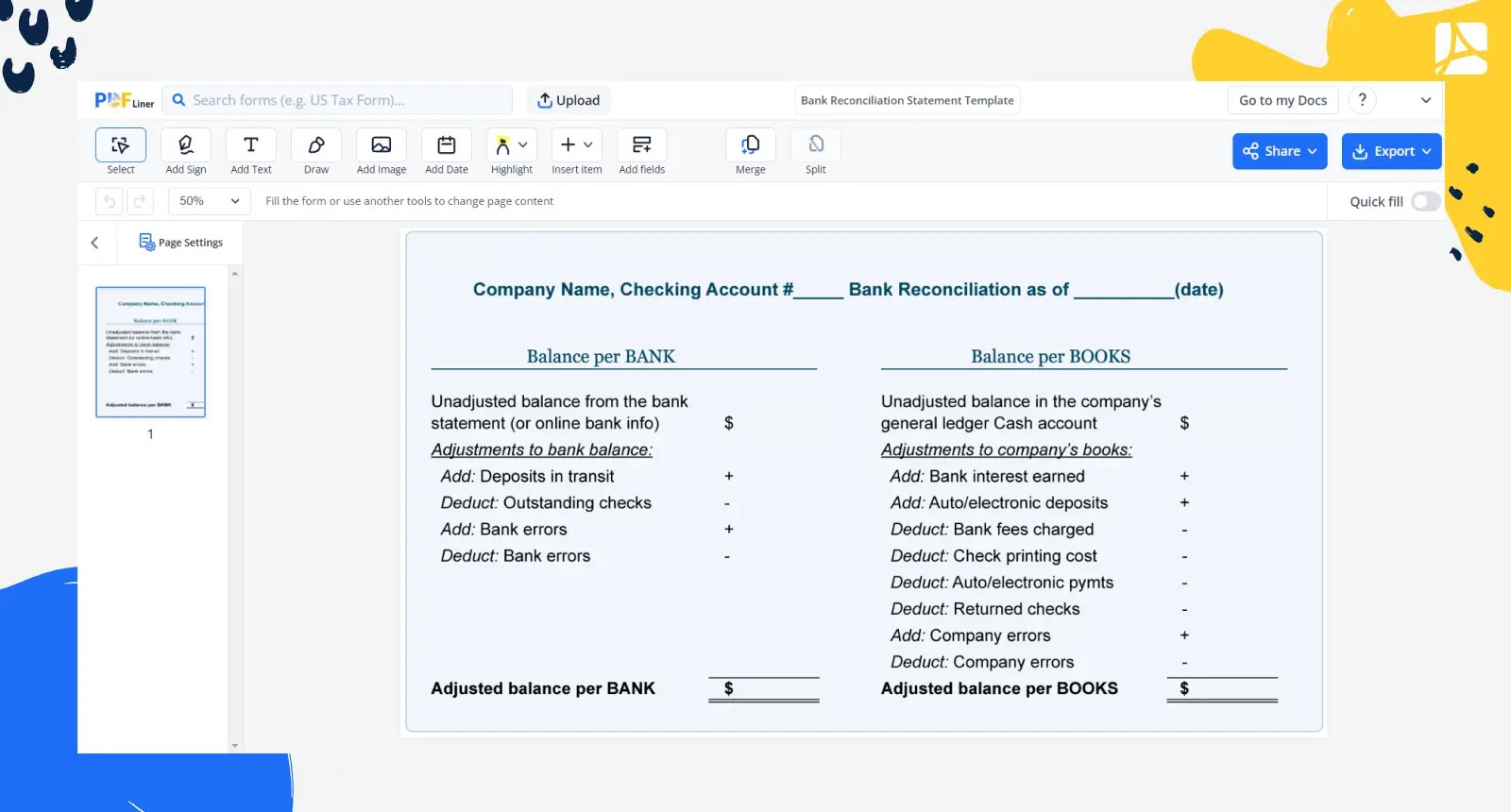

A bank reconciliation statement is a crucial tool in the financial management toolkit of any individual or business. Essentially, it is a document that aligns your bank records with your personal or business bookkeeping records. The bank reconciliation statement template you choose needs to be clear and concise. The template bank reconciliation statement generally consists of columns for dates, descriptions, deposits, withdrawals, and balance amounts.

Importance of bank statement reconciliation

This statement reconciliation is not just about keeping records neat and tidy; it is an integral part of financial health for both individuals and businesses. Regularly reconciling your statement can help identify fraudulent or erroneous transactions early and make it easier to rectify them. It could also highlight any bank errors that may have occurred, such as duplicate charges or lost transactions, thereby avoiding financial losses.

How to Fill Out Template of Bank Reconciliation Statement

Filling out a template for bank reconciliation statement involves some simple, straightforward steps:

- Fill in your Company Information: Look for the field labeled "Company Name" at the top of the form. Enter your company's legal name. Proceed to the section labeled "Checking Account #". Here, input the correct checking account number that relates to this reconciliation.

- Fill in the Date: Locate and fill in the date field tagged "Bank Reconciliation as of." Ensure that the date is correct, as it is vital for record-keeping purposes.

- Record the Balance per Bank: Navigate to the subsection labeled "Balance per Bank". Input the exact amount you have in your bank at the beginning of the reconciliation period.

- Adjust the Bank Balance: Just below or next to the Balance per Bank field, you'll find "Adjusted Balance per Bank". Here, you will incorporate any necessary adjustments such as deposits in transit, outstanding checks, or bank errors. This revised number represents the accurate amount of your bank balance.

- Record the Balance per Books: Continue down to the "Balance per Books" section. Input the amount that your financial reports or accounting system reflects at the start of the period being reconciled.

- Adjust the Balance per Books: Following that, locate the "Adjusted Balance per Books" field. Include any required changes, such as bank service charges, interest earned, or bookkeeping mistakes. This updated figure reflects the true sum in your books.

- Matching the Figures: Upon completing the two sections, cross-check that your Adjusted Balance per Bank equals your Adjusted Balance per Books. If not, there might be errors or discrepancies that need investigation.

Bank statement reconciliation template: It's simpler than it looks

Remember, one of the key reasons you would need a bank statement reconciliation template is that it simplifies the process. It offers an organized structure, so you can clearly present and compare information. A template provides room for meticulous attention to detail, ensuring accuracy in the reconciliation process. Error-free bank reconciliation means an accurate picture of your financial health, helping in informed decision-making.

Fillable online Bank Reconciliation Statement Template