-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

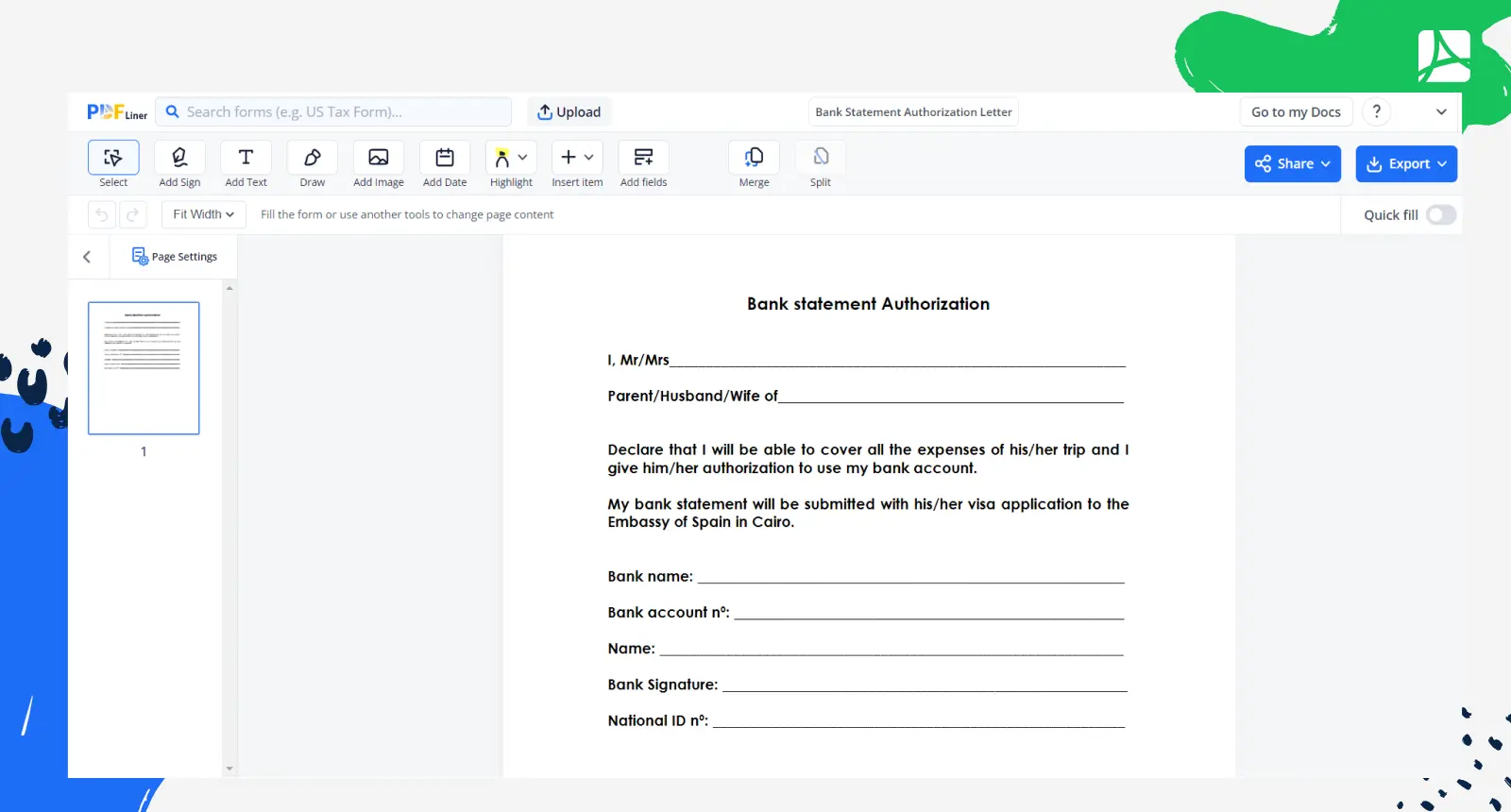

Bank Statement Authorization Letter

Get your Bank Statement Authorization Letter in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

Understanding a Letter of Authorization for Bank Statement

A letter of authorization for a bank statement is a document you create and sign to give someone else, often a trusted individual, the power to access or verify your bank details on your behalf. It's mostly used when you're unable to execute the task yourself due to various reasons such as scheduling conflicts, health issues, or distance.

Tips for creating a sample authorization letter for bank statement

While structured templates offer a great starting point, your letter requires personalization to accurately detail your situation. Know that specific language and explicit details help avoid unauthorized tasks outside your specified assignment.

- Keep the language formal and professional

- Make your authorization clear and concise

- Specify the validity duration of this authorization

Filling Out a Bank Statement Authorization Letter

Armed with the understanding of an authorization letter, completing this bank form is a simple process:

- Start with the first section. Here, you'll need to input your full legal name as it appears in your legal and bank documents. Ensure you spell your name accurately to avoid any mishaps with your bank.

- Proceed to the next section. Like your name, you need to include the full legal name of the person who holds the account. If you are the account holder, you can replicate the name utilized in the first section.

- Fill in the 'Bank Name.' This will be the name of the financial institution where the account is held. Be sure to write out the full bank's name and not just an abbreviation.

- In the 'Bank Account Number' section, include the complete account number without leaving out any digits. If you're unsure of the exact number, refer to your bank statement or bank documents for this information.

- The 'Name' section may seem a bit redundant but it's for the individual who will be processing or for the department to which the letter is intended. This could be a bank employee’s name, the name of the loan officer, or the name of the bank’s department.

- The 'Bank Signature' section requires the signature of the bank official authorizing the letter. If you are filling out the form on behalf of the bank, you should sign here.

- Lastly, fill in the 'National ID Number' section. This may either refer to your social security number (if in the USA), or another form of identification number provided by your country's government. The ID number serves as another layer of proof for your identity.

Remember to review all the filled sections for any errors or omissions before saving or printing the filled form. Errors might lead to processing delays or document rejection. Always ensure that all supplied information is correct and up to date.

When to use an authorization letter for bank statement

A bank statement authorization letter comes into play under various circumstances. Let's delve into some instances when this document becomes unavoidable.

- For Personal Use: There might be instances where you are unable to carry out your banking tasks due to health issues, extensive travel, or being located abroad. During such times, an authorization letter for bank statement can prove beneficial, allowing a trusted third party to manage your financial affairs.

- For Business Necessities: Often, in the corporate world, the top executives might not have the luxury of time to devote to financial matters. In such scenarios, a trusted entity like an accountant or financial advisor is authorized through a bank statement authorization letter to handle banking procedures.

- During Legal Procedures: Legal processes often demand a detailed audit of financial transactions. If an attorney is representing your case, you may need to provide them with a 'letter of authorization for bank statement' enabling them to collect, review, and use your financial information efficiently.

- When Applying for Visa: When you apply for a visa, you may be required to provide proof of your financial stability. If you're unable to do this personally, you can delegate this task to a representative by providing them an authorization letter bank statement.

- Rental or Lease Agreements: When leasing or renting a property, the owner may require proof of your financial stability. A bank statement authorization letter can allow your broker or attorney to provide these details on your behalf.

Fillable online Bank Statement Authorization Letter