-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Lease Agreements Templates

-

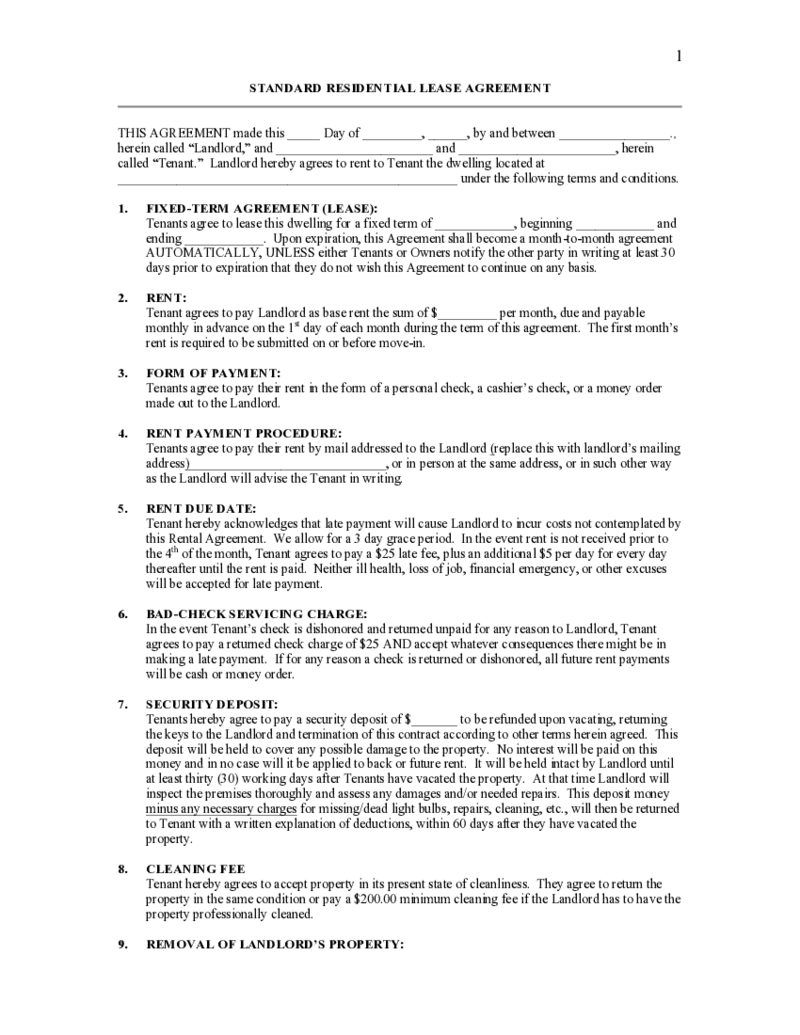

Standard Residential Lease Agreement

What is the Residential Lease Agreement?

The fillable Residential Lease Agreement is a form used by landlords to rent property based on the fact that someone will live there.

Standard Residential Lease Agreement

What is the Residential Lease Agreement?

The fillable Residential Lease Agreement is a form used by landlords to rent property based on the fact that someone will live there.

-

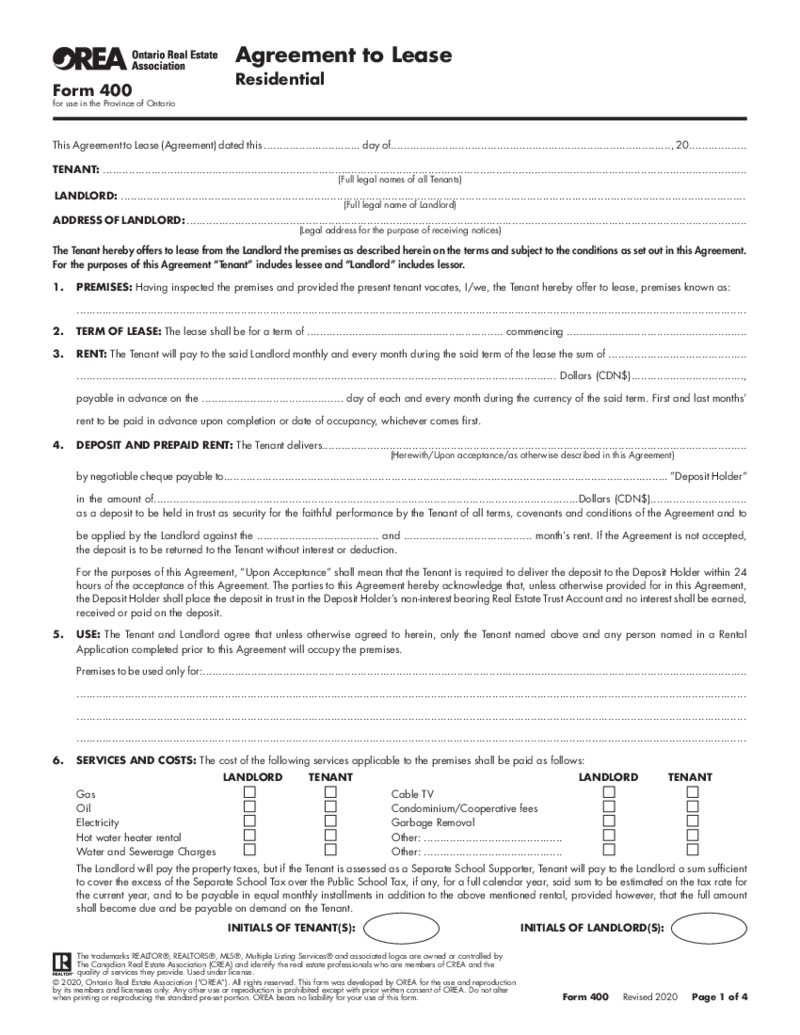

OREA Form 400 Agreement to Lease Residential

What Is Fillable OREA Form 400?

An OREA Form 400 fillable PDF is an official document based on which a landlord and tenant agree on the lease of premises, fix a rent and advance payment, and deal on additional services. It is three pages long and requires

OREA Form 400 Agreement to Lease Residential

What Is Fillable OREA Form 400?

An OREA Form 400 fillable PDF is an official document based on which a landlord and tenant agree on the lease of premises, fix a rent and advance payment, and deal on additional services. It is three pages long and requires

-

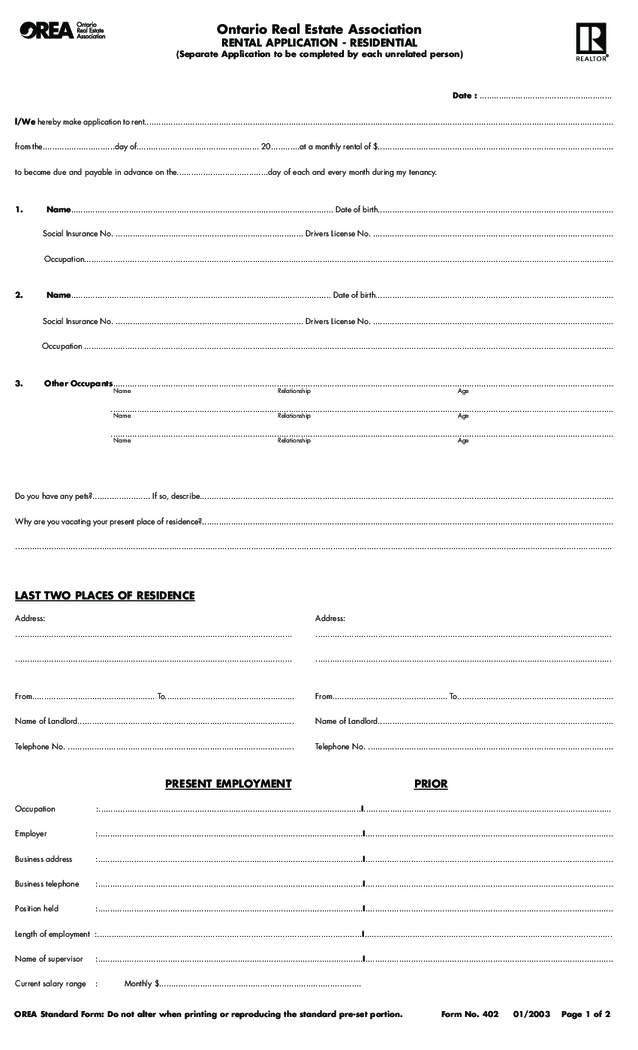

Form 402, Mutual Release - Agreement to Lease - Residential

What Is Form-402?

Also known as Rental Application Residential, it’s a form used by an individual in the province of Ontario who’s planning to rent a house or apartment. It formalizes the potential tenant’s intention to rent a livi

Form 402, Mutual Release - Agreement to Lease - Residential

What Is Form-402?

Also known as Rental Application Residential, it’s a form used by an individual in the province of Ontario who’s planning to rent a house or apartment. It formalizes the potential tenant’s intention to rent a livi

-

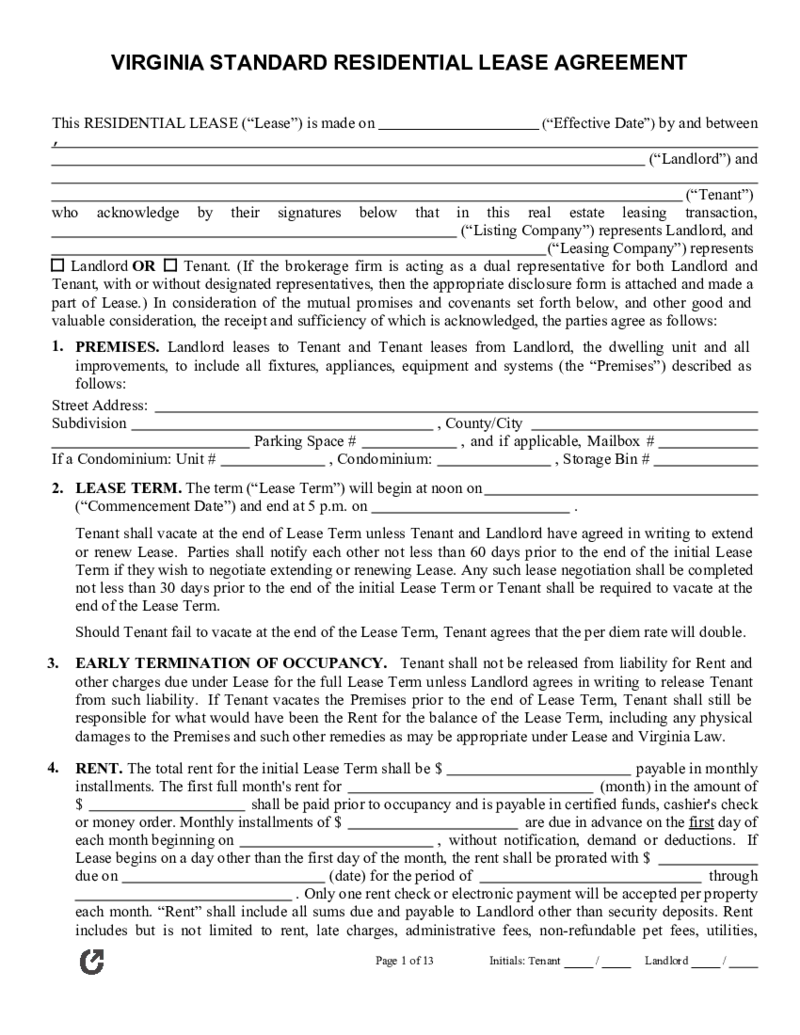

Virginia Standard Residential Lease Agreement

What Is a Virginia Standard Residential Lease Agreement

A Virginia Standard Residential Lease Agreement is a legally binding document designed to outline the terms and conditions of rental between a landlord and tenant for residential property in Virginia

Virginia Standard Residential Lease Agreement

What Is a Virginia Standard Residential Lease Agreement

A Virginia Standard Residential Lease Agreement is a legally binding document designed to outline the terms and conditions of rental between a landlord and tenant for residential property in Virginia

-

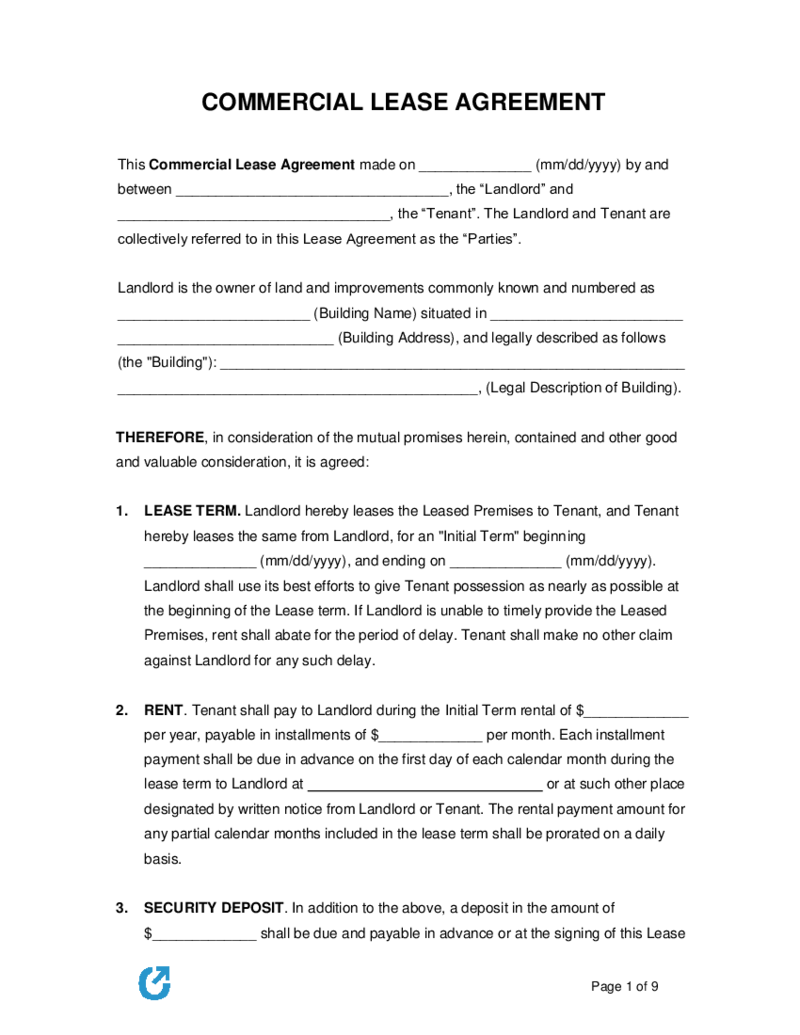

Commercial Lease Agreement

How to Redact and Fill Out Commercial Lease Agreement Online?

To redact and fill out a pdf commercial lease agreement online, you should follow these steps:

Obtain a copy of the commercial lease agreements template: You can either downlo

Commercial Lease Agreement

How to Redact and Fill Out Commercial Lease Agreement Online?

To redact and fill out a pdf commercial lease agreement online, you should follow these steps:

Obtain a copy of the commercial lease agreements template: You can either downlo

-

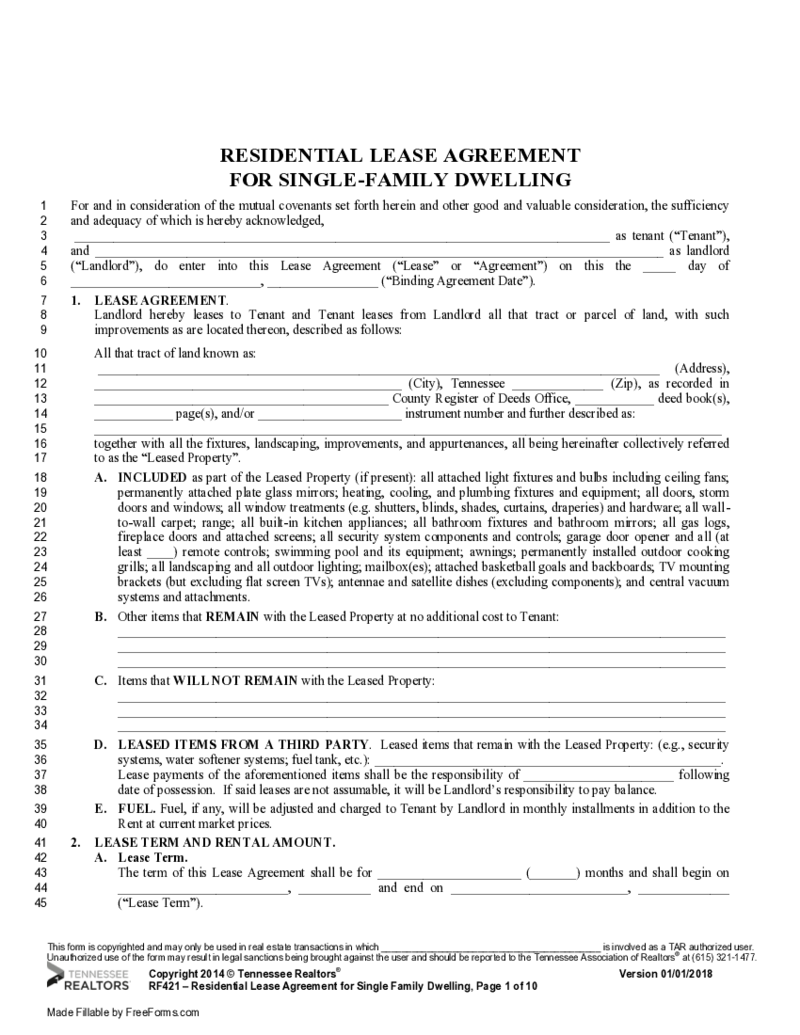

Residential Lease Agreement for Single-Family Dwelling

Comprehensive Guide to the Residential Lease Agreement for Single Family Dwelling

A residential lease agreement for a single family dwelling is a legally binding document between the property owner and a tenant. When renting out a single-family dwelling,

Residential Lease Agreement for Single-Family Dwelling

Comprehensive Guide to the Residential Lease Agreement for Single Family Dwelling

A residential lease agreement for a single family dwelling is a legally binding document between the property owner and a tenant. When renting out a single-family dwelling,

-

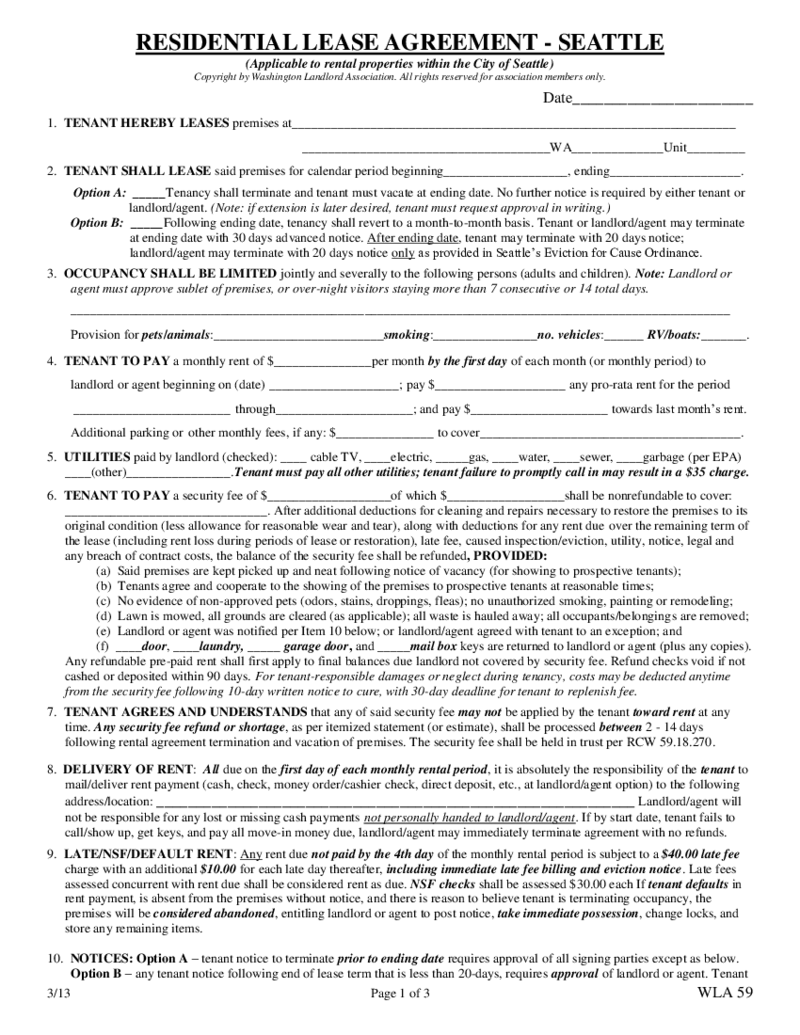

Seattle Residential Lease Agreement

What Is Seattle Residential Lease Agreement

In the vibrant city of Seattle, the residential lease agreement is a legally binding contract between a landlord and a tenant designed specifically for renting out residential properties. This detailed document

Seattle Residential Lease Agreement

What Is Seattle Residential Lease Agreement

In the vibrant city of Seattle, the residential lease agreement is a legally binding contract between a landlord and a tenant designed specifically for renting out residential properties. This detailed document

-

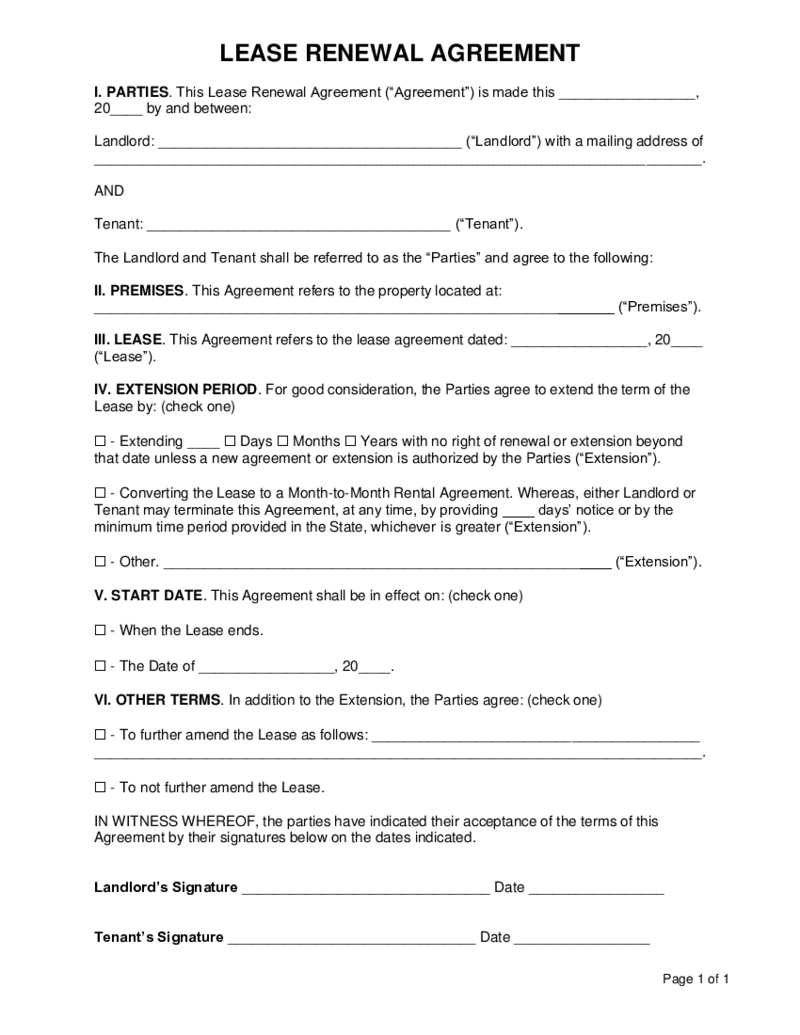

Rent Lease Renewal Agreement

What Is a Renewal of Lease Agreement?

A Renewal Lease Agreement Form is a document used to extend or renew an existing lease contract between a landlord and a tenant. It’s typically used when both parties wish to continue the rental arrangement beyo

Rent Lease Renewal Agreement

What Is a Renewal of Lease Agreement?

A Renewal Lease Agreement Form is a document used to extend or renew an existing lease contract between a landlord and a tenant. It’s typically used when both parties wish to continue the rental arrangement beyo

-

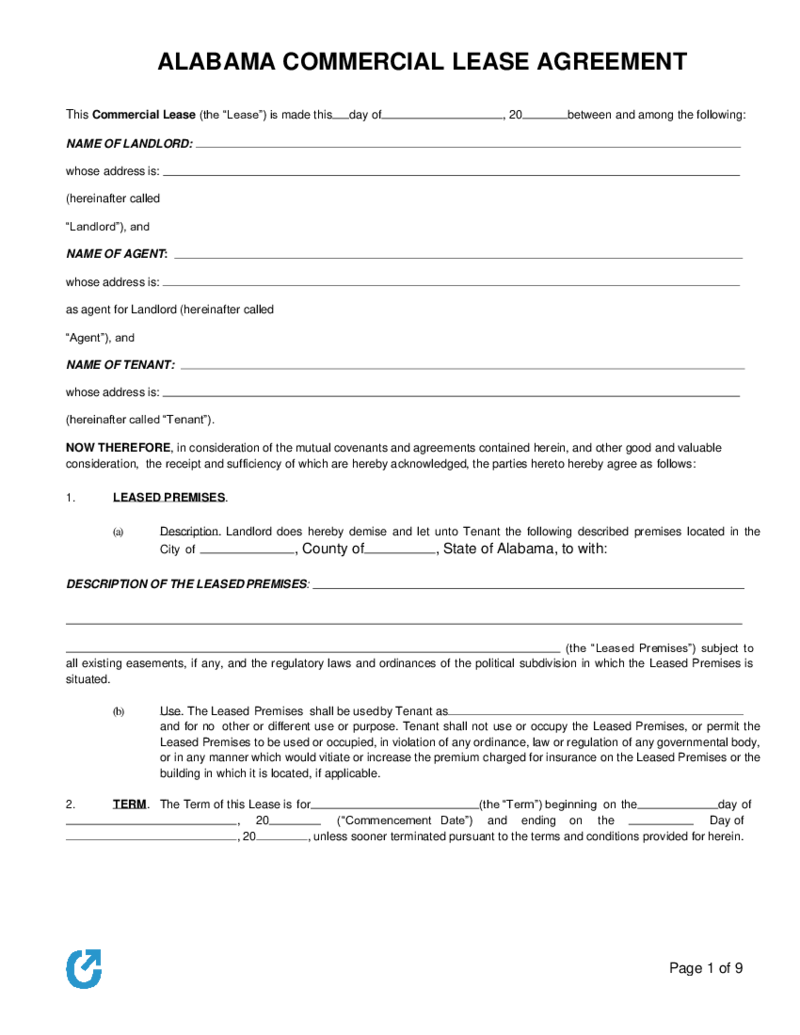

Alabama Commercial Lease Agreement

What Is a Commercial Lease Agreement Alabama

A Commercial Lease Agreement in Alabama legally binds a landlord and a business tenant. This agreement outlines the terms and conditions under which the tenant can rent commercial property from the landlord. Th

Alabama Commercial Lease Agreement

What Is a Commercial Lease Agreement Alabama

A Commercial Lease Agreement in Alabama legally binds a landlord and a business tenant. This agreement outlines the terms and conditions under which the tenant can rent commercial property from the landlord. Th

-

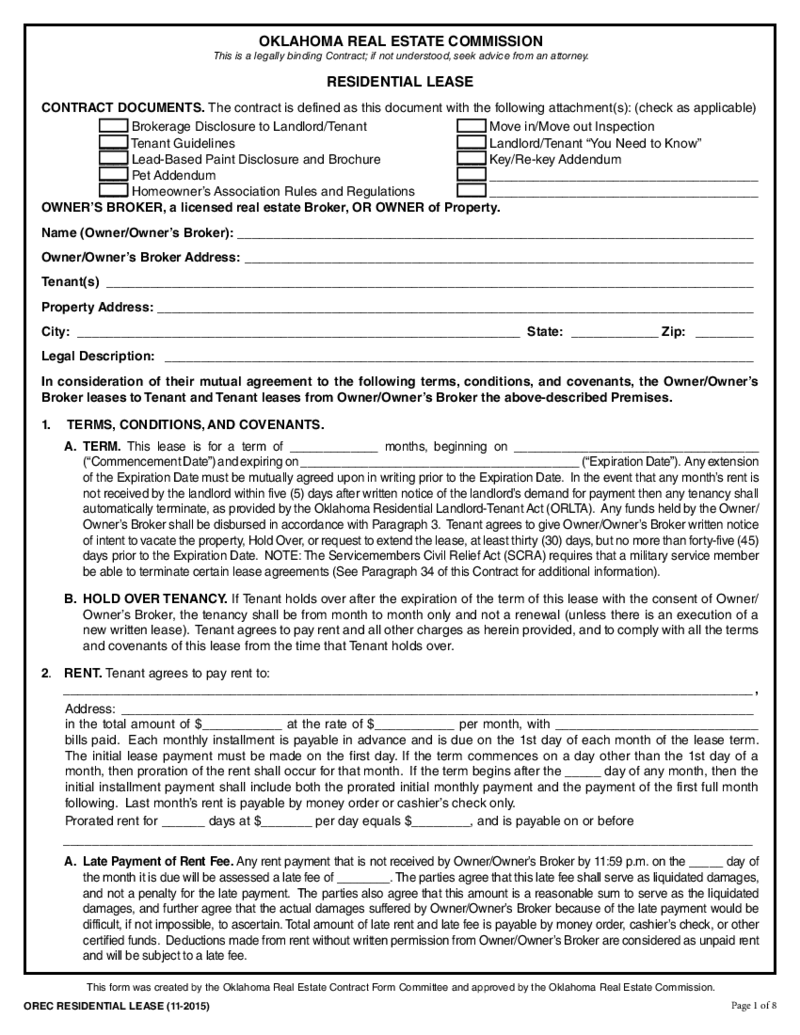

Oklahoma Rental Lease Agreement

What is the Fillable Oklahoma Rental Lease Agreement?

Fillable Oklahoma Rental Lease Agreement is a document that will help the landlord to lease the premises for a specific sum of dollars. The document is legal in Oklahoma State.

What I need t

Oklahoma Rental Lease Agreement

What is the Fillable Oklahoma Rental Lease Agreement?

Fillable Oklahoma Rental Lease Agreement is a document that will help the landlord to lease the premises for a specific sum of dollars. The document is legal in Oklahoma State.

What I need t

-

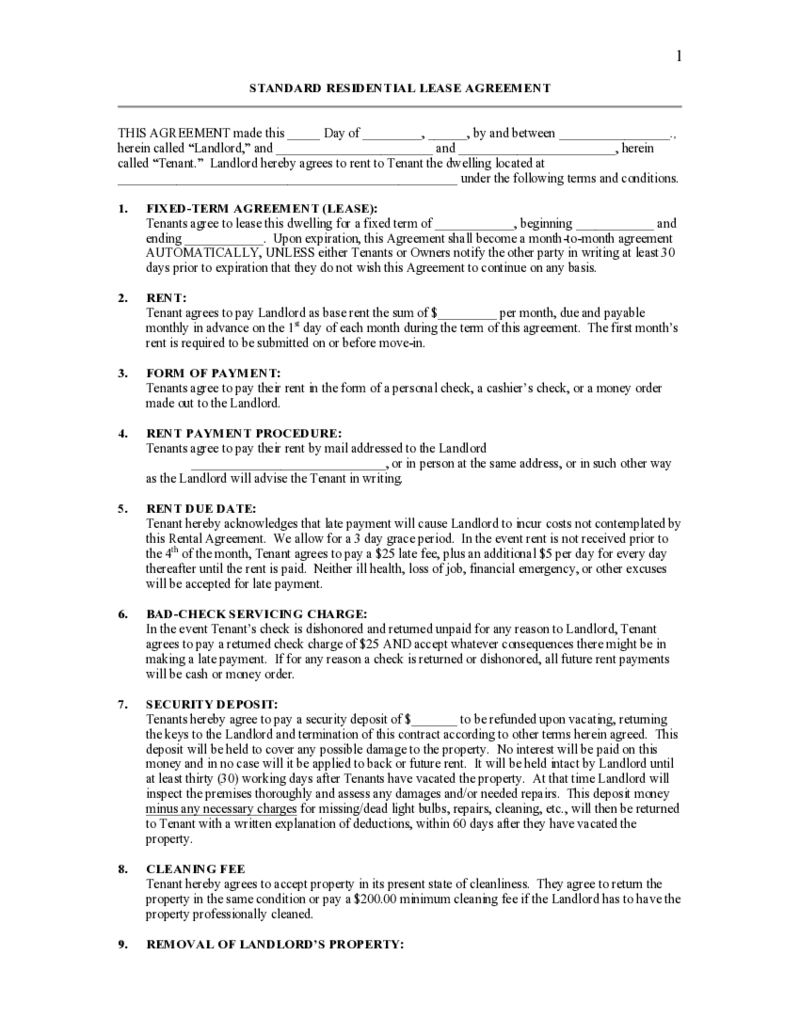

Residential Lease Agreement

What is the Residential Lease Agreement Form?

Residential Lease Agreement Form is a legal contract form that establishes a legal agreement between a landlord and his or her tenant. Residential Lease Agreement Form covers the size of the monthly rent payme

Residential Lease Agreement

What is the Residential Lease Agreement Form?

Residential Lease Agreement Form is a legal contract form that establishes a legal agreement between a landlord and his or her tenant. Residential Lease Agreement Form covers the size of the monthly rent payme

-

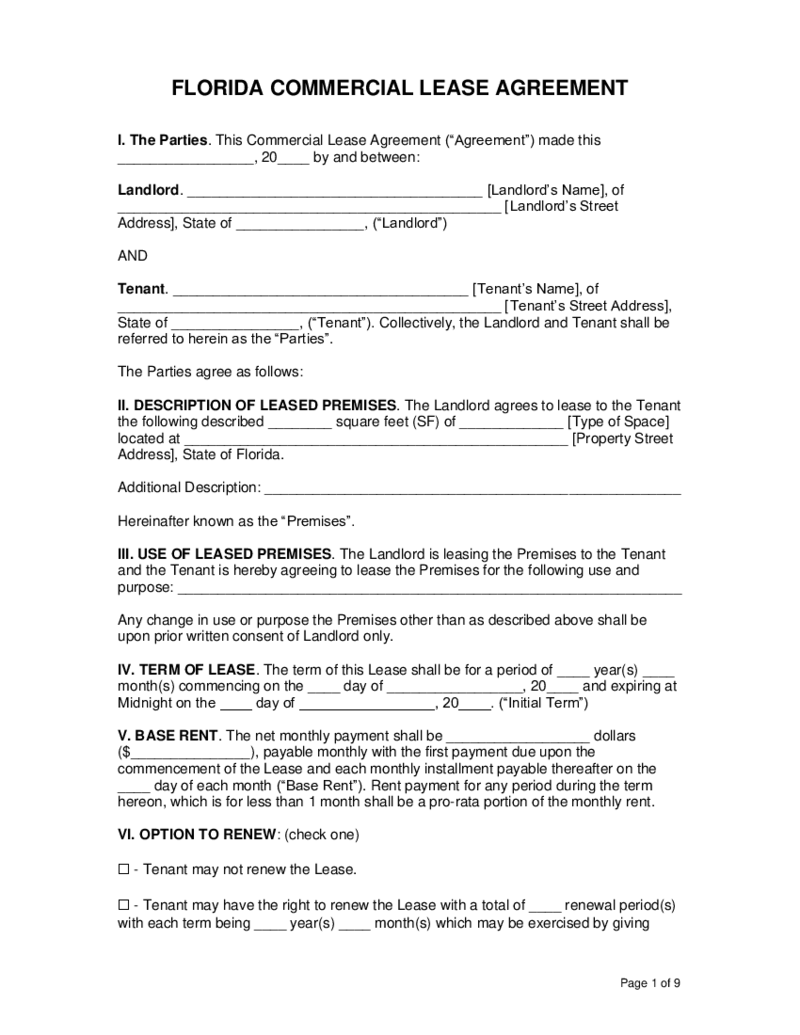

Florida Commercial Lease Agreement

Exploring the Florida Commercial Lease Agreement: Comprehensive Guide

Entering into a commercial lease can often be a strategic move for numerous business owners. Whether you're leasing property for retail, office space, or a general commercial ventur

Florida Commercial Lease Agreement

Exploring the Florida Commercial Lease Agreement: Comprehensive Guide

Entering into a commercial lease can often be a strategic move for numerous business owners. Whether you're leasing property for retail, office space, or a general commercial ventur

Search by State

- Alabama

- Arizona

- Arkansas

- California

- Delaware

- Florida

- Idaho

- Illinois

- Indiana

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Mississippi

- Missouri

- Nebraska

- New Jersey

- New Mexico

- New York

- North Carolina

- Ohio

- Oklahoma

- Oregon

- South Carolina

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

What are the Lease Agreement Templates For?

Lease agreement templates can be very useful for landlords and tenants who are looking to create a legally binding contract. These templates can be found online and can be customized to fit the specific needs of the landlord and tenant. The templates can also be used to create a standard lease agreement that can be used for multiple properties.

When creating a lease agreement, it is important to make sure that all of the terms and conditions are clearly stated. The agreement should also be signed by both parties in order to make it legally binding. If there are any questions about the agreement, it is always best to consult with an attorney before signing.

What is a lease agreement?

Lease agreements for rental property are legally binding contracts between a landlord and tenant that outlines the terms of the rental arrangement. The lease and rental agreements should include the names of the landlord and tenant, the address of the property, the length of the lease, the amount of rent, and the date the rent is due. The agreement may also include other terms and conditions, such as the landlord's right to enter the property and the tenant's responsibility for damages.

There are 5 main types of lease agreements:

- Commercial leases;

- Residential leases;

- Industrial leases;

- Lease-to-own agreements;

- Sub leases.

Why Use the Printable Lease Agreements?

Using a lease agreement template can save time and money by providing a pre-drafted agreement that can be easily customized. The template can also help ensure that all of the necessary terms and conditions are included in the agreement.

What Should be Included in a Lease Agreement?

A lease agreement should include the names of the landlord and tenant, the address of the property, the length of the lease, the amount of rent, and the date the rent is due. The agreement should also state the landlord's right to enter the property and the tenant's responsibility for damages.

How Do I Create a Lease Agreement?

To create a lease agreement, start by finding a template online. Once you have found a template that you like, customize it to fit the specific needs of your landlord and tenant. Be sure to include all of the necessary information, such as the names of the landlord and tenant, the address of the property, the length of the lease, the amount of rent, and the date the rent is due. Once you have customized the agreement, both parties should sign it to make it legally binding.

Leasing Process For Landlords: Step-by-step Guide

Step 1: Show your property

Let potential tenants know that your rental property is available by posting an online listing. Include photos and a description of the unit, as well as your contact information. Once they contact, you invite them to your property and show it to them in person if needed.

Step 2: Screen your applicants

Once you have interested renters, it’s important to screen them thoroughly. This includes running a credit check and criminal background check. You may also want to verify their employment and rental history.

Step 3: Find a proper lease agreement template

Once you've negotiated all the terms and conditions, find a couple tenants lease agreements templates and choose one that fits your needs the most. For example, different states may have different requirements to these documents. So make sure that everything is according to your state or country laws.

Step 4: Sign a lease agreement

Now, it’s time to sign a lease agreement. This document should include all the details of the rental, such as the price, length of the lease, and any rules or regulations.

Both you and the tenant should sign and date the lease agreement, so once you filled in and signed your part share the document with your future tenant and ask them to e-sign the agreement. This will save you plenty of time.

Step 5: Collect Security Deposit, Rent and Get Occupancy

The last step in becoming a landlord is to collect rent from your tenants. You will also need to collect a security deposit, which will be used to cover any damages that your tenants may cause. Finally, you will need to obtain an occupancy permit from your local municipality. This permit will allow you to legally rent out your property.

Step 6: The Lease Ending Process

When the lease is up, you’ll need to go through the process of renewing it or finding a new tenant:

- If you’re renewing the lease, you’ll just need to have the tenant sign a new agreement.

- If you’re finding a new tenant, you’ll need to go through the steps of advertising, screening, and signing a new lease agreement.

Leasing Process For Tenants: Step-by-step Guide

Step 1: Find the property

The first step in the leasing process is finding a property that you are interested in. This can be done by searching online, contacting a real estate agent, or looking for signs in the area.

Step 2: Contact landlord

Once you have found a property, the next step is to contact the landlord or property manager to set up a showing. This is an opportunity for you to see the property in person and ask any questions you may have.

Step 3: Negotiate

After you have seen the property and decided that you would like to lease it, the next step is to negotiate the terms of the lease with the landlord. This includes things like the length of the lease, the price, and any other special conditions.

Step 4: Sign the residential lease rental agreements

Once you have agreed on the terms of the lease, the next step is to sign the lease agreement. This is a legally binding document that outlines the rights and responsibilities of both the landlord and the tenant.

Step 5: Move in

The final step in the leasing process is to move into the property and start paying rent.

Lease Agreement Laws by State

The laws that apply to your lease agreement will vary based on the state in which you live.

While the law may require landlords to comply with specific standards, some laws may grant landlords additional rights as well.

For example, in Ohio, a landlord may terminate a lease agreement if the tenant violates the lease agreement. The law also requires landlords to give 30 days' notice of any changes to the lease agreement, such as a rent increase.

Some states may also require landlords to provide a written notice for any changes in the lease agreement that could affect the tenant's rights. In Illinois, landlords must provide a written notice at least 30 days before charging a late fee.

You can find more information about your state's lease agreement laws on your state's website.

In most states, the rules are similar:

- The standard lease term is one year.

- Landlords can collect a security deposit from tenants.

- Landlords must provide tenants with a copy of the lease agreement at or before move-in.

- The proper procedures must be followed when it comes to disposing of abandoned property.