-

Templates

Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesInsuranceInsurance templates make it easier for agents to manage policies and claims.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Missouri State Tax Forms - page 2

-

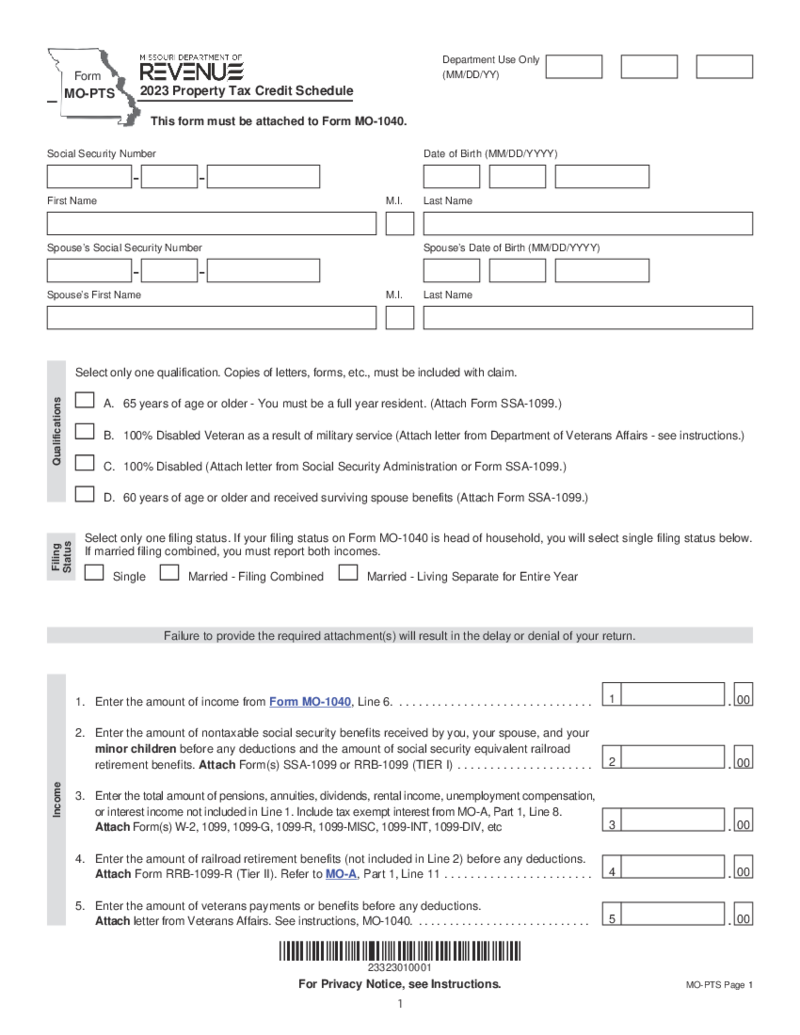

Form MO-PTS

Understanding the Missouri Property Tax Credit Form (MO-PTS)

The Missouri Property Tax Credit Claim Form, also known as Form MO-PTS, is a crucial document for Missouri residents who are 65 or older, disabled, 100% disabled veterans as a result of military

Form MO-PTS

Understanding the Missouri Property Tax Credit Form (MO-PTS)

The Missouri Property Tax Credit Claim Form, also known as Form MO-PTS, is a crucial document for Missouri residents who are 65 or older, disabled, 100% disabled veterans as a result of military

-

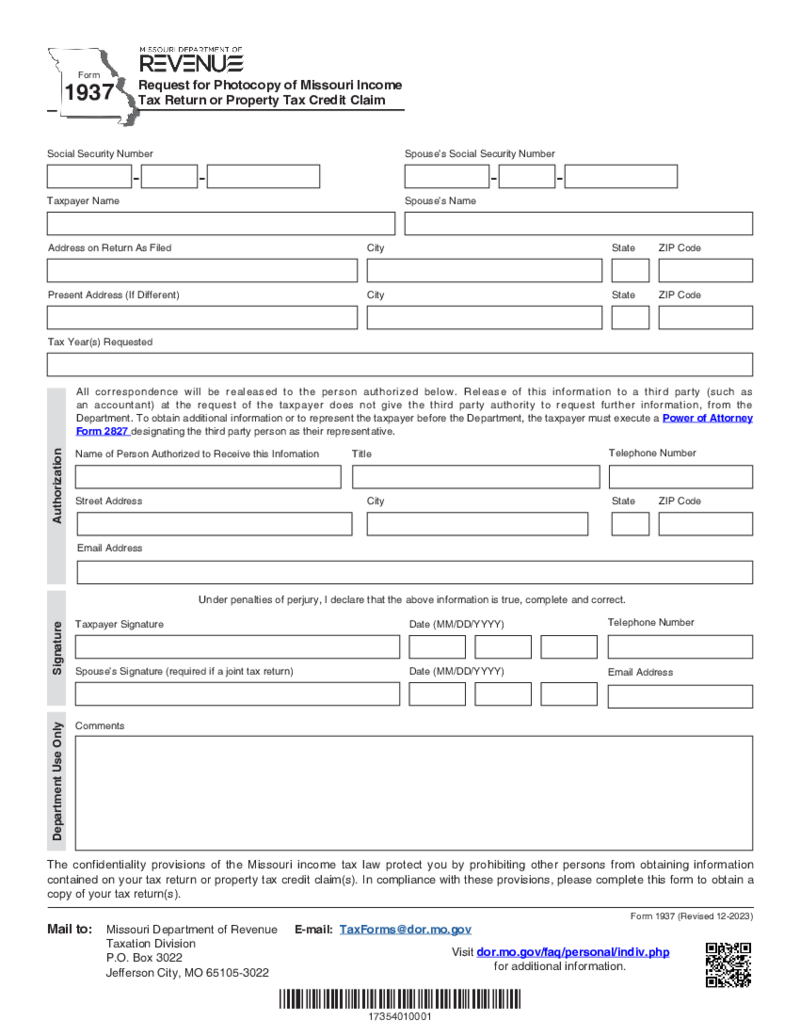

Form 1937 - Request for Photocopy of Missouri Income Tax Return

What Is Form 1937?

If you've ever needed to review or use your past state tax filings, Form 1937 is the key. This document, officially known as the Request for Photocopy of Missouri Income Tax Return, serves as an official application to obtain copies

Form 1937 - Request for Photocopy of Missouri Income Tax Return

What Is Form 1937?

If you've ever needed to review or use your past state tax filings, Form 1937 is the key. This document, officially known as the Request for Photocopy of Missouri Income Tax Return, serves as an official application to obtain copies

-

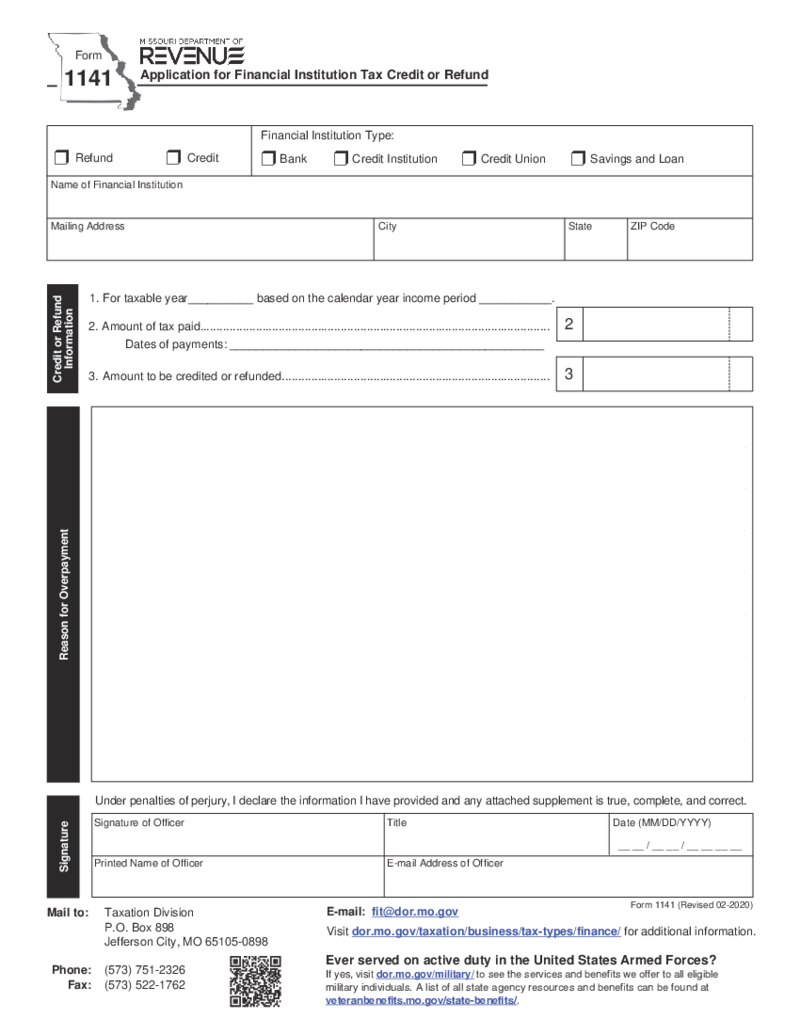

Form 1141 - Tax Credit or Refund

What Is Form 1141

Form 1141 is a document used by financial institutions to apply for a tax credit or refund from the state tax authorities. Typically, this form would be utilized by banks, credit unions, and other financial entities subj

Form 1141 - Tax Credit or Refund

What Is Form 1141

Form 1141 is a document used by financial institutions to apply for a tax credit or refund from the state tax authorities. Typically, this form would be utilized by banks, credit unions, and other financial entities subj

-

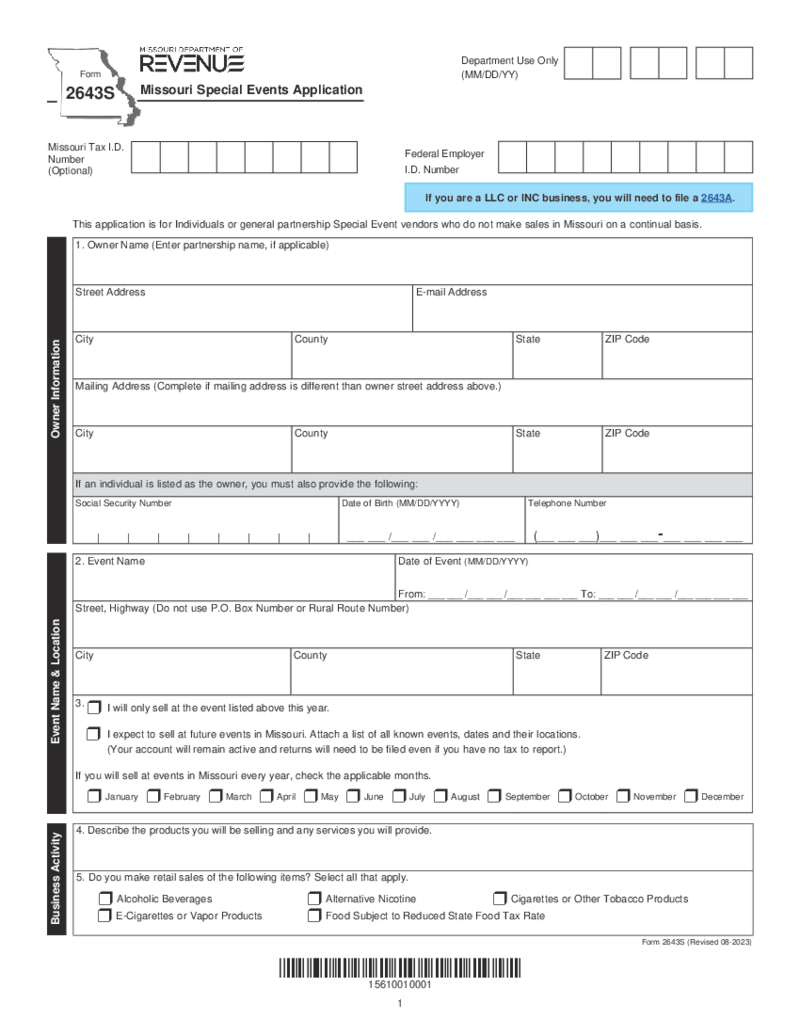

Missouri Special Events Application

What Is Missouri State Form 2643S?

The 2643S form Missouri is designed to permit vendors at temporary events such as craft fairs, festival

Missouri Special Events Application

What Is Missouri State Form 2643S?

The 2643S form Missouri is designed to permit vendors at temporary events such as craft fairs, festival

-

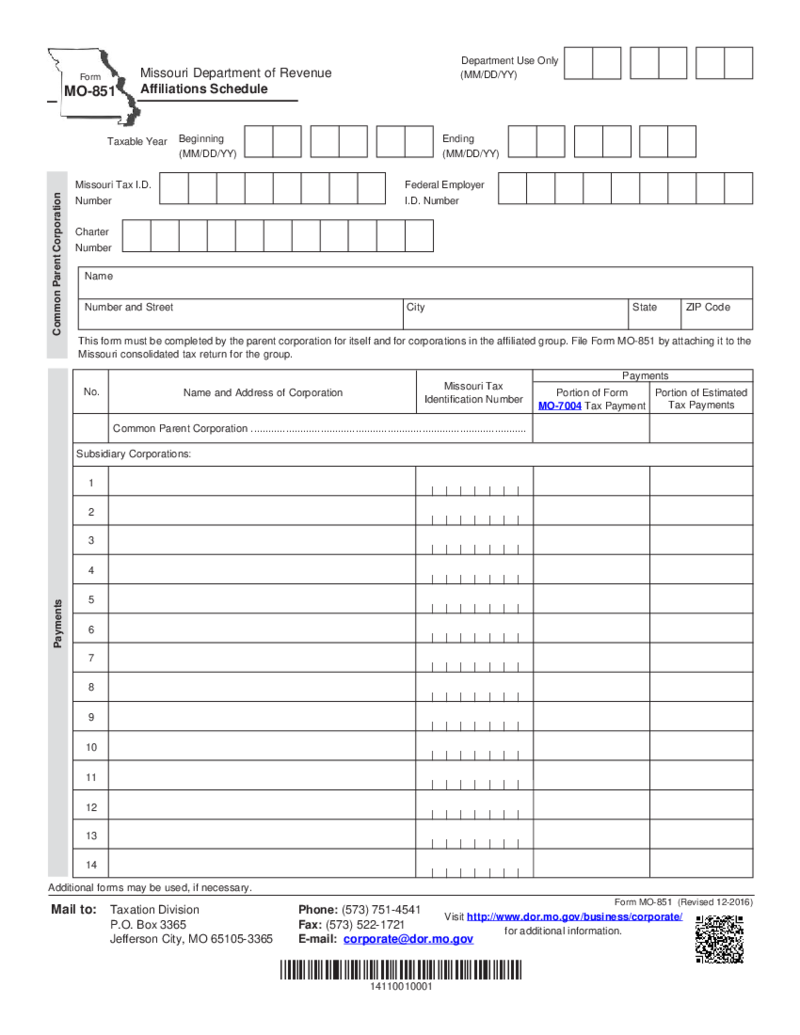

Form MO-851 - Affiliations Schedule

Complete Guide to Understanding and Filing Form MO-851

The MO Form 851 is a crucial document for corporations operating within an af

Form MO-851 - Affiliations Schedule

Complete Guide to Understanding and Filing Form MO-851

The MO Form 851 is a crucial document for corporations operating within an af

-

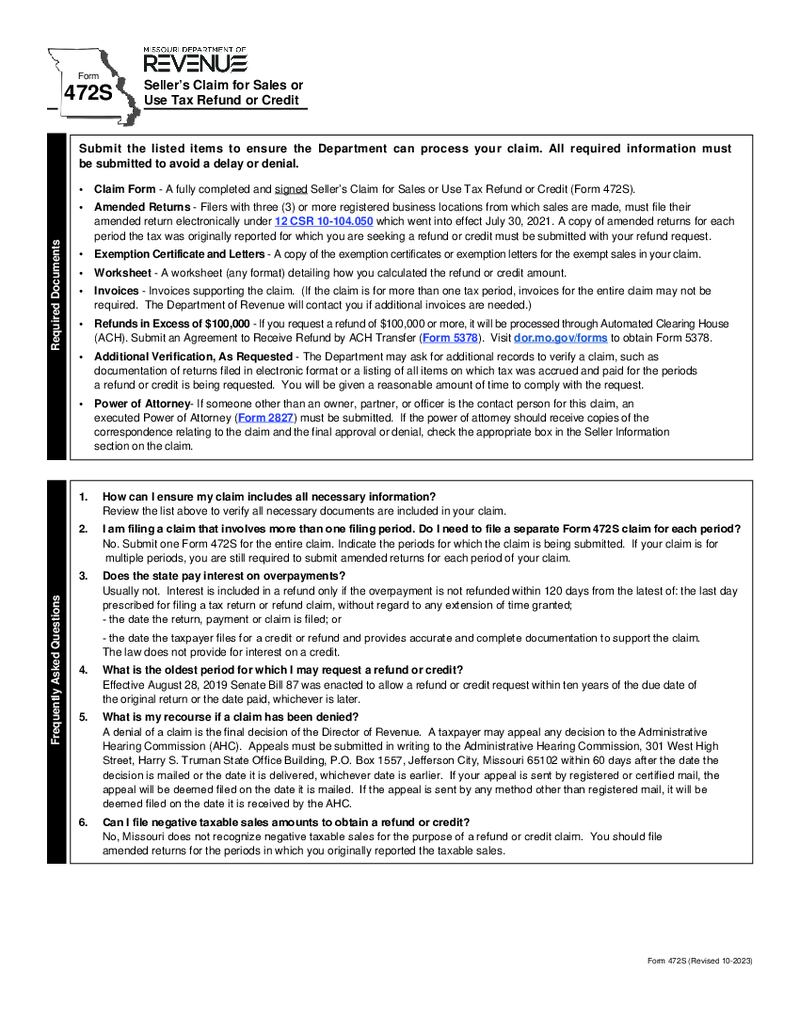

Missouri Form 472S - Sellers Claim for Sales or Use Tax Refund

Understanding Missouri Form 472S - The Essential Guide for Sellers

Missouri Form 472S, officially known as the Seller's Claim for Sales or Use Tax Refund, is a vital document for businesses and individuals seeking to claim a refund or credit for sales

Missouri Form 472S - Sellers Claim for Sales or Use Tax Refund

Understanding Missouri Form 472S - The Essential Guide for Sellers

Missouri Form 472S, officially known as the Seller's Claim for Sales or Use Tax Refund, is a vital document for businesses and individuals seeking to claim a refund or credit for sales

-

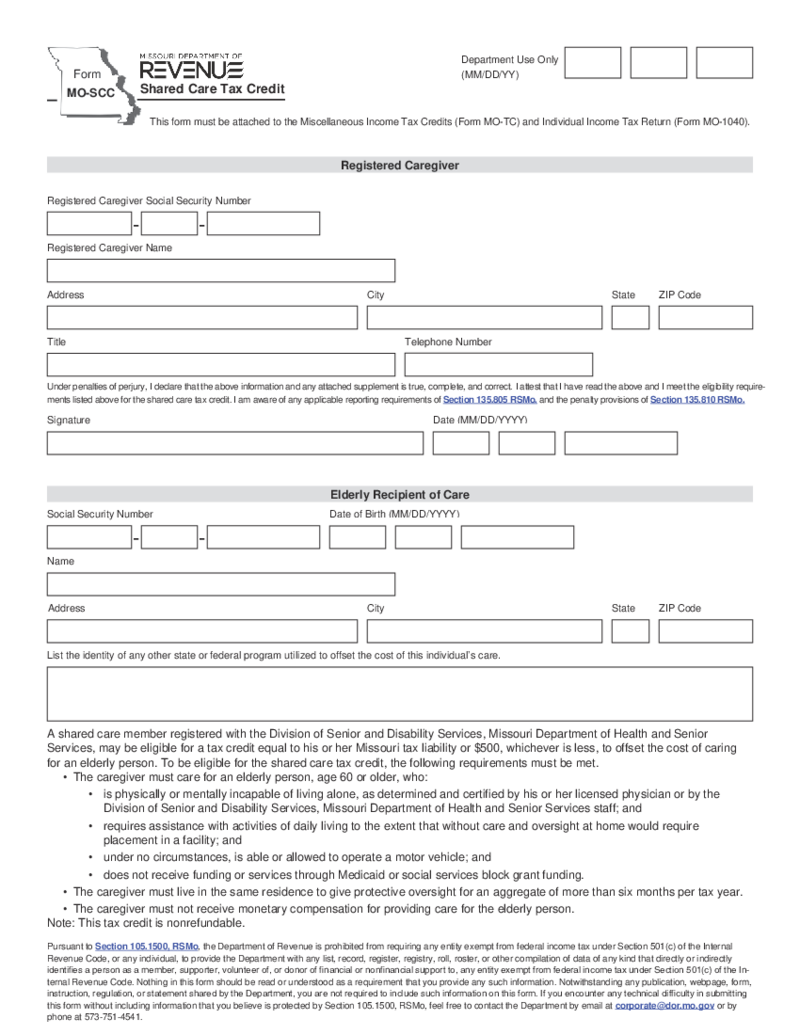

Form MO-SCC - Shared Care Tax Credit

Overview: Form MO-SCC

In Missouri, the Shared Care Tax Credit, also known as Form MO-SCC, is a financial incentive provided to eligible taxpayers. It supports those who care about older family members in their own homes instead of placing them in long-ter

Form MO-SCC - Shared Care Tax Credit

Overview: Form MO-SCC

In Missouri, the Shared Care Tax Credit, also known as Form MO-SCC, is a financial incentive provided to eligible taxpayers. It supports those who care about older family members in their own homes instead of placing them in long-ter

-

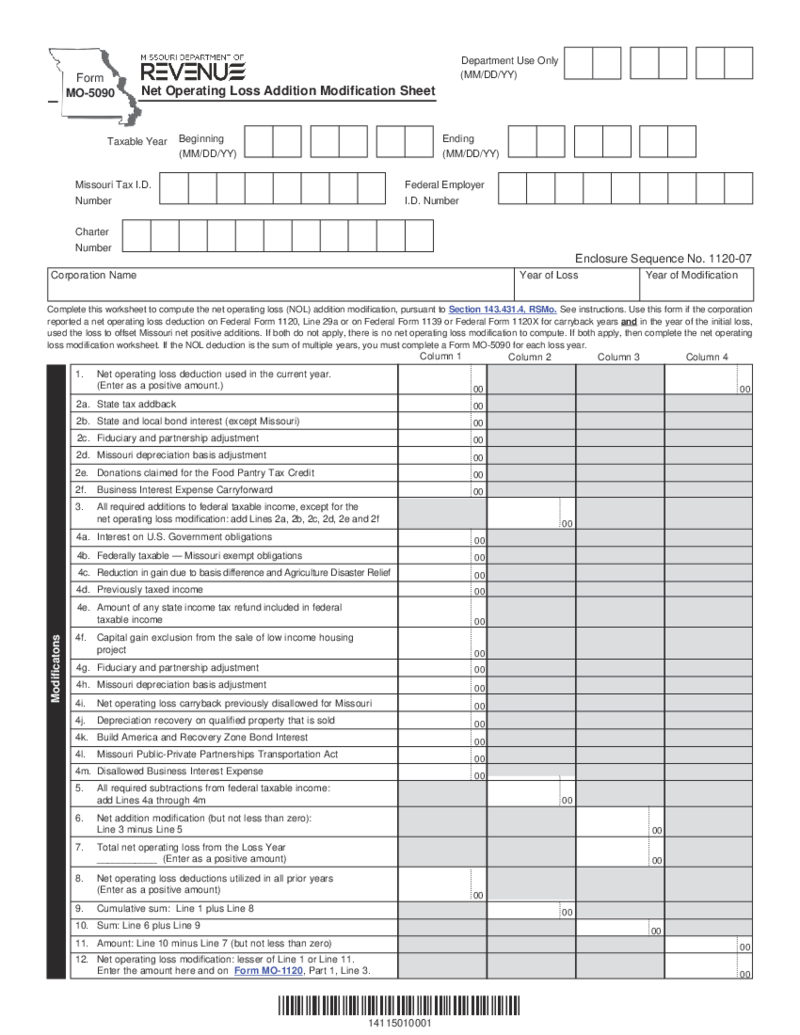

Form MO-5090 - Net Operating Loss Addition Modification Worksheet

What Is Form MO 5090?

For Missouri taxpayers, especially those seeking to adjust their taxes due to various credits, deductions, or discrepancies in their original filings, Form MO-5090 is an important document. This Missouri document helps as a means to

Form MO-5090 - Net Operating Loss Addition Modification Worksheet

What Is Form MO 5090?

For Missouri taxpayers, especially those seeking to adjust their taxes due to various credits, deductions, or discrepancies in their original filings, Form MO-5090 is an important document. This Missouri document helps as a means to

-

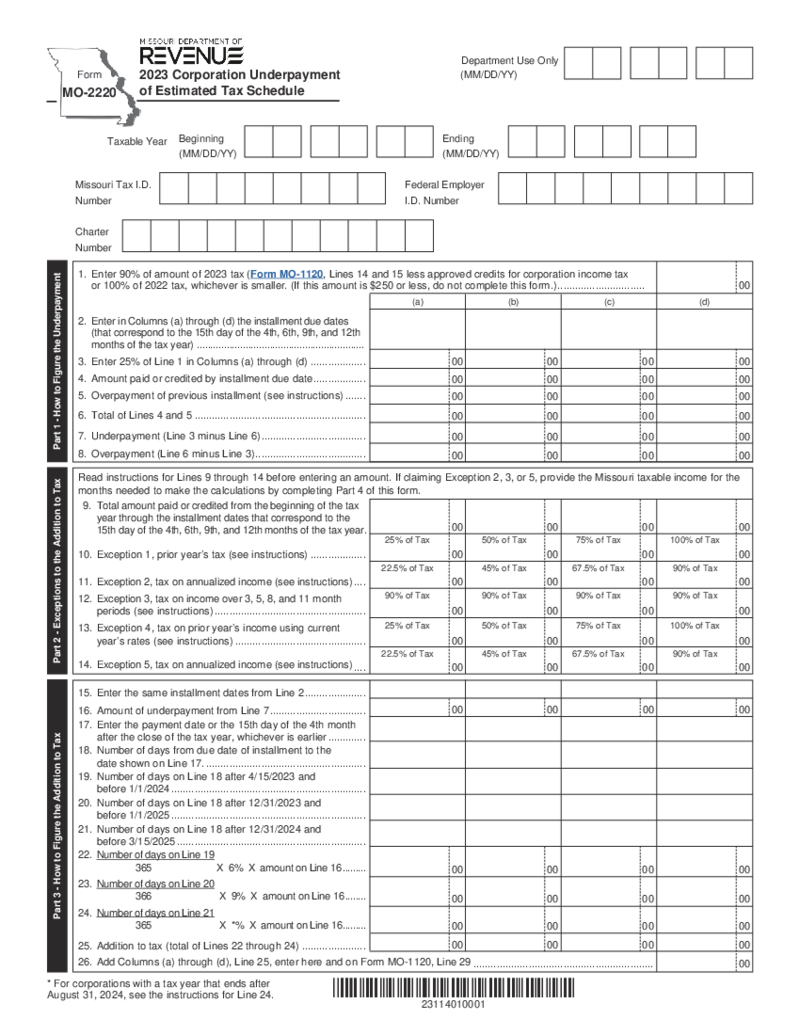

Form MO-2220 - Corporation Underpayment of Estimated Tax Schedule

What Is 2220 Form?

Form MO-2220 is utilized by corporations in Missouri when they need to compute the penalty for underpaying estimated taxes throughout the tax year. Estimated taxes are payments made in advance on income that isn't subject to withhol

Form MO-2220 - Corporation Underpayment of Estimated Tax Schedule

What Is 2220 Form?

Form MO-2220 is utilized by corporations in Missouri when they need to compute the penalty for underpaying estimated taxes throughout the tax year. Estimated taxes are payments made in advance on income that isn't subject to withhol

-

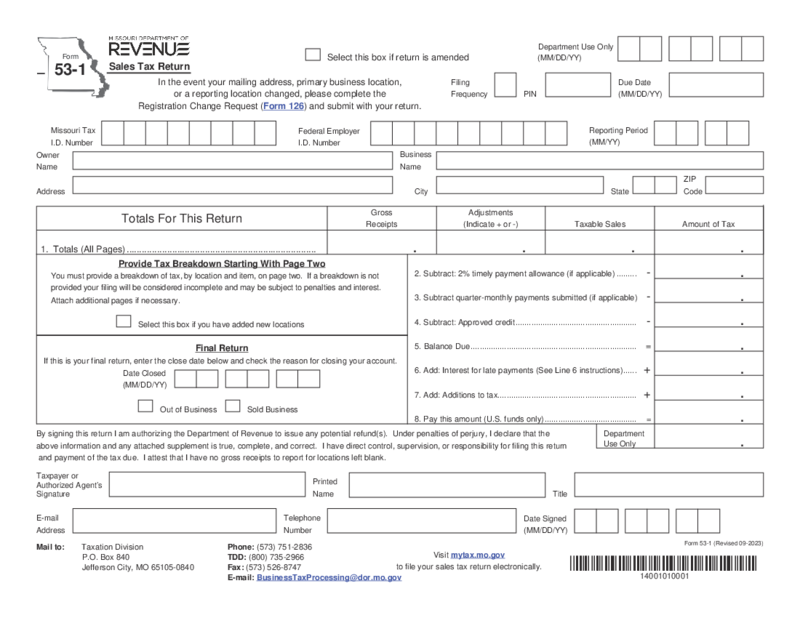

Form 53-1 - Sales Tax Return and Instructions

Information on Missouri's State Sales And Use Tax

Every business retailing tangible personal property or certain taxable services must pay sales tax in Missouri. As such, entities must collect, report, and remit this tax to the Missou

Form 53-1 - Sales Tax Return and Instructions

Information on Missouri's State Sales And Use Tax

Every business retailing tangible personal property or certain taxable services must pay sales tax in Missouri. As such, entities must collect, report, and remit this tax to the Missou

-

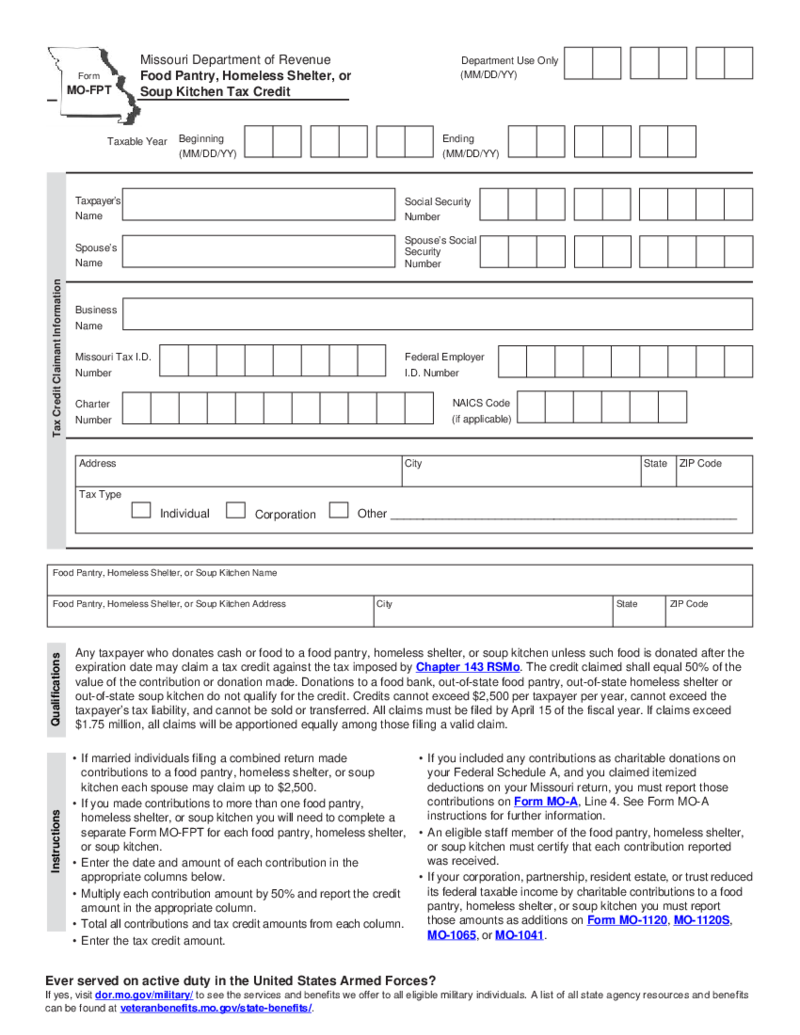

Food Pantry Tax Credit

What is the Missouri Food Pantry Tax Credit

The Missouri Food Pantry Tax Credit is a state income tax credit that offers incentives for taxpayers who make monetary or food donations to qualifying hunger relief organizations in their local communities. Don

Food Pantry Tax Credit

What is the Missouri Food Pantry Tax Credit

The Missouri Food Pantry Tax Credit is a state income tax credit that offers incentives for taxpayers who make monetary or food donations to qualifying hunger relief organizations in their local communities. Don

-

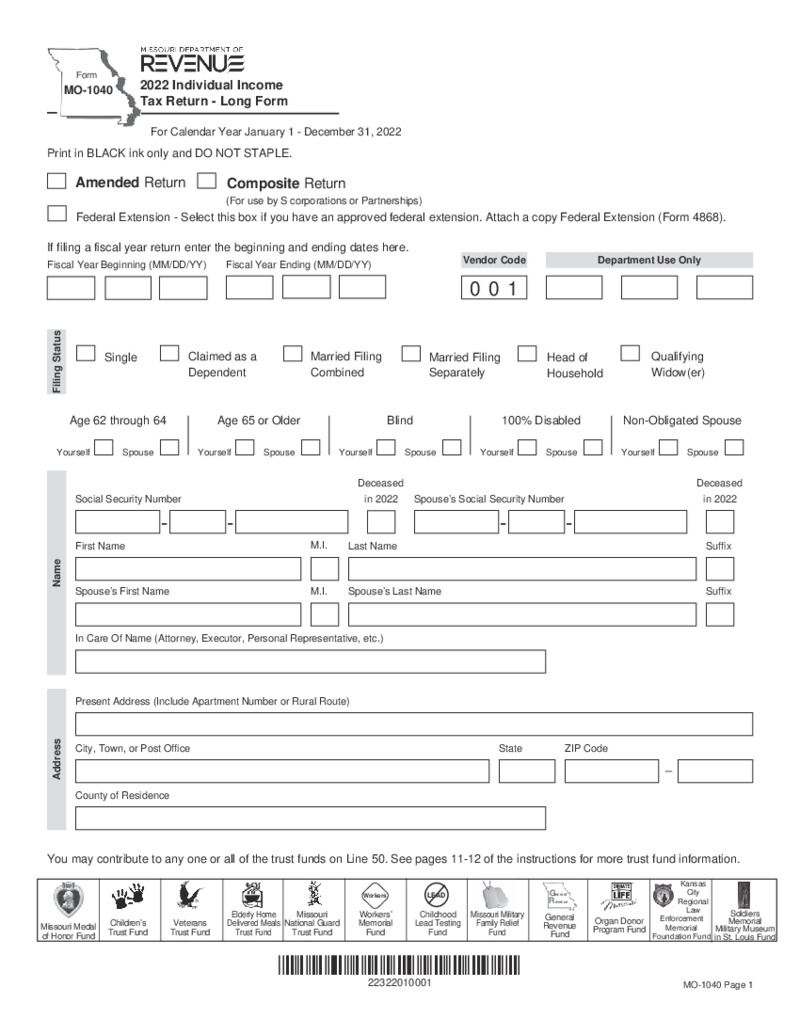

Form MO-1040 - Individual Income Tax Return

What Is MO 1040 Form

The MO 1040 form is the primary personal income tax form for residents of the state of Missouri. Similar to the federal 1040 form, this state-specific form is used to report income, calculate tax liability, and claim credits or deduct

Form MO-1040 - Individual Income Tax Return

What Is MO 1040 Form

The MO 1040 form is the primary personal income tax form for residents of the state of Missouri. Similar to the federal 1040 form, this state-specific form is used to report income, calculate tax liability, and claim credits or deduct

FAQ:

-

Where to send Missouri state tax forms?

Missouri officials usually provide a specific address for the form within it. You will find the electronic address of their website of the PO Box based on the form and its purpose. Forms that must be sent to employers or other third parties require your personal knowledge of address.

-

Can I email my Missouri state tax return?

It depends on the form you pick. If you are not sure and you can’t find the information about it in the form, it is better to contact the Department's representatives via the official website. They will answer your question as soon as possible.