-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

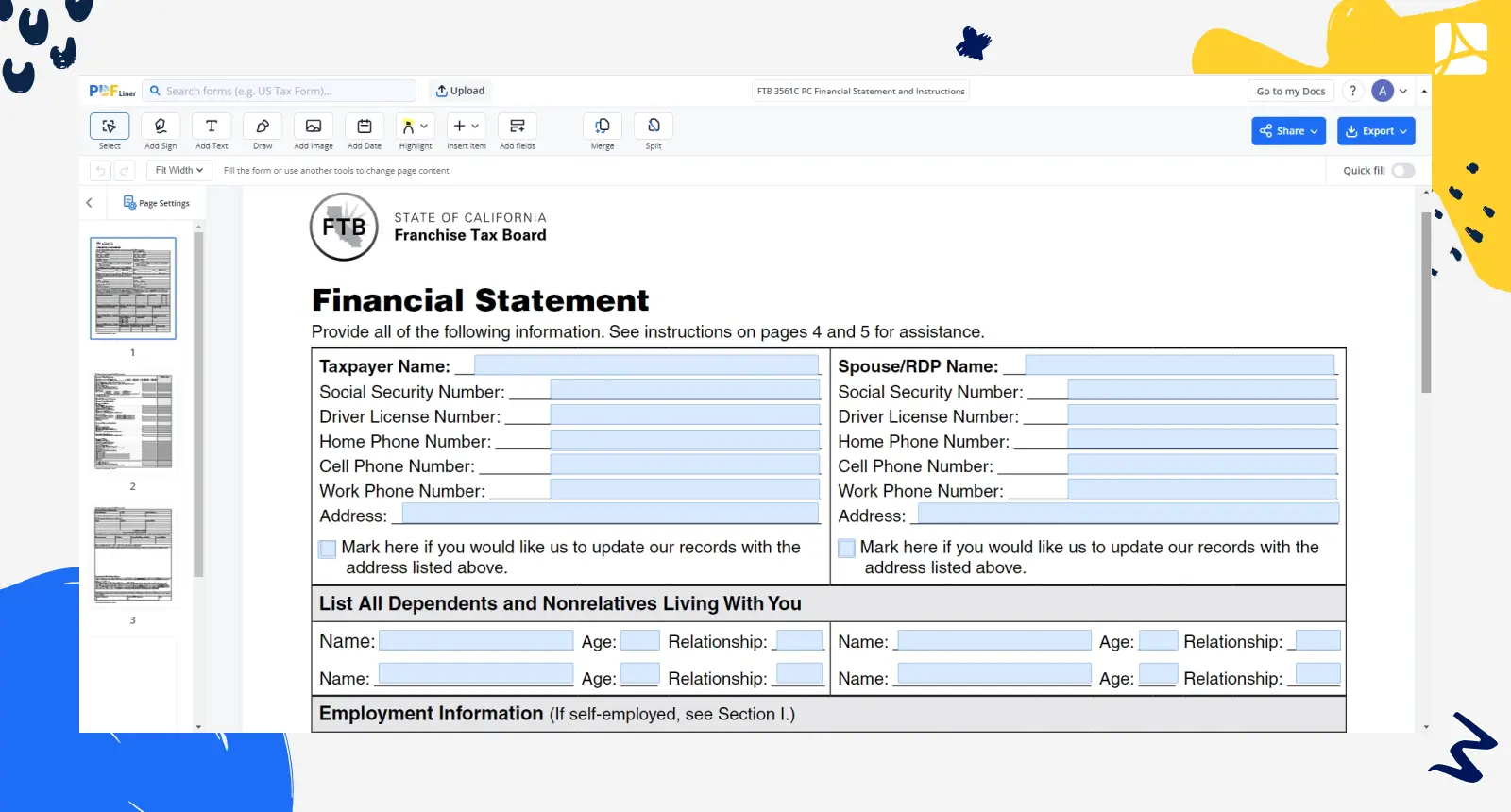

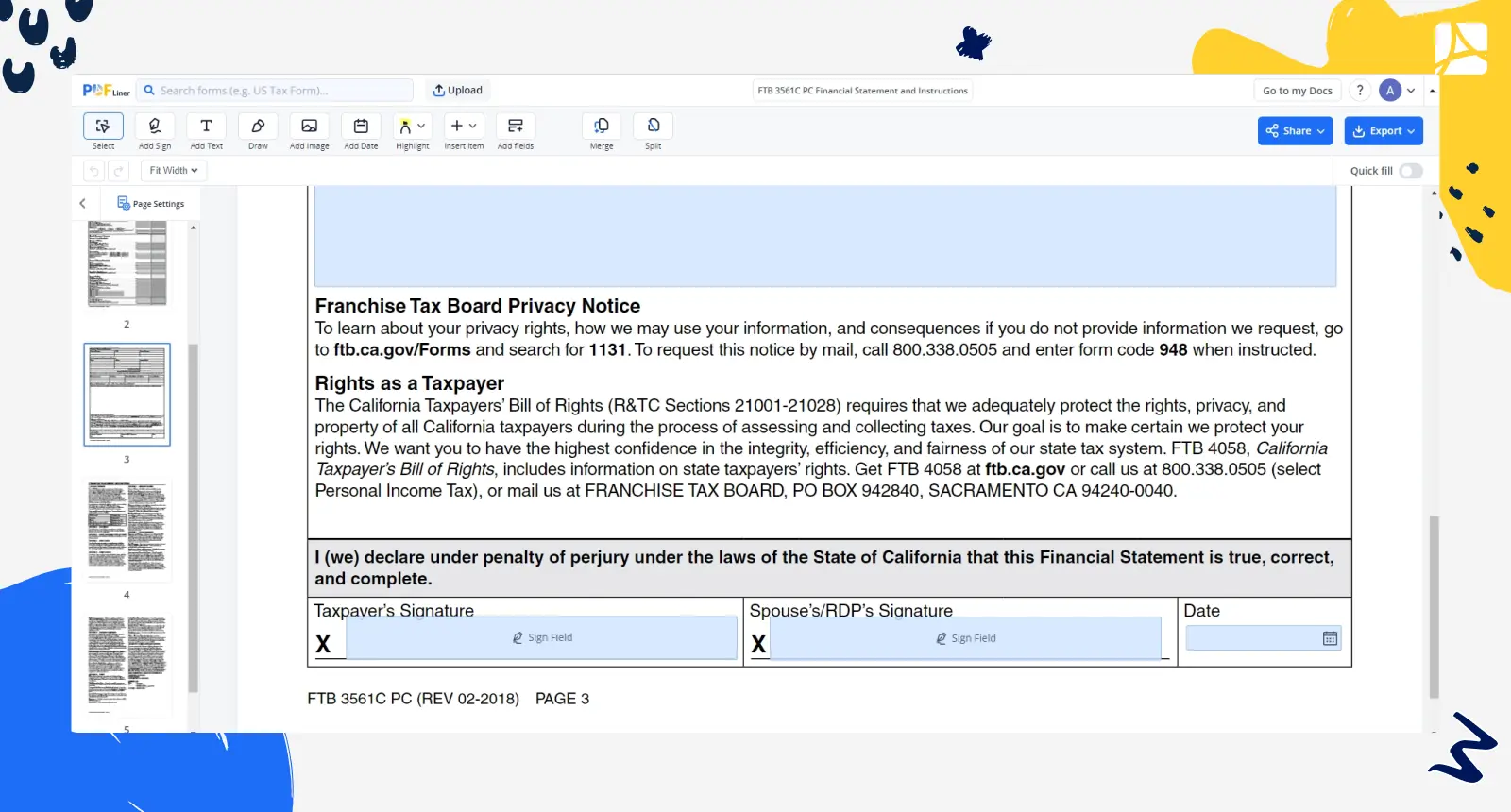

FTB 3561C PC Financial Statement

Get your FTB 3561C PC Financial Statement and Instructions in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is FTB 3561C

Also known as Financial Statement FTB 3561C, this document is pivotal in California's taxation landscape. It is utilized by businesses to meticulously outline their financial transactions, income sources, and authorized deductions. The State of California's Financial Tax Board (FTB) employs this form to ensure accurate evaluation of taxable income, contributing to transparency and tax code adherence.

Who Should Use FTB Form 3561C

The document is essential for various entities engaged in financial activities within the Golden State. It is specifically designed for:

- corporations operating in California;

- limited liability companies (LLCs);

- partnerships and joint ventures;

- S Corporations;

- trusts and estates.

The form serves as a vital communication channel between businesses and the FTB, underpinning effective tax administration.

How to Fill Out California FTB 3651C

The form requires attention to detail and deep knowledge of state tax guidelines. Follow these 16 steps to accurately complete the form:

- Open the form in the PDFLiner digital editor.

- Provide your name, contact details, and tax identification number.

- Indicate the tax year you're reporting for.

- Check the appropriate box to specify if your entity is a corporation, LLC, partnership, S corporation, trust, or estate.

- Describe the main business your entity is engaged in.

- Select the applicable filing status (initial return, amended return, final return, etc.).

- Specify ownership percentages or shares for each owner or shareholder.

- Carefully list all income sources, including sales, interest, dividends, and other revenue.

- Detail deductible business expenses such as operating costs, salaries, and rent.

- Report allowable deductions like business interest, charitable contributions, and depreciation.

- Indicate any tax credits your entity qualifies for.

- Calculate taxable income based on the provided figures.

- If applicable, include the payment amount and method.

- Sign and date the declaration verifying the accuracy of the info provided.

- If someone else is preparing the form, include their details.

- Attach any required schedules or supporting documents.

Ensure accuracy and review before submission to the State of California's Financial Tax Board (FTB) to facilitate precise tax assessment and compliance. In case the form makes you feel slightly confused, feel free to turn to the professional assistance of a reliable tax expert.

Where to File FTB 3561 C

Submit your completed doc to the State of California's Financial Tax Board through the specialized online portal or by mailing it to the address provided on the official FTB website. Remember to ensure accurate information and compliance with state tax regulations before filing.

Fillable online FTB 3561C PC Financial Statement and Instructions