-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Georgia Forms

-

Personal and Financial Information - Georgia

What is Personal and Financial Information?

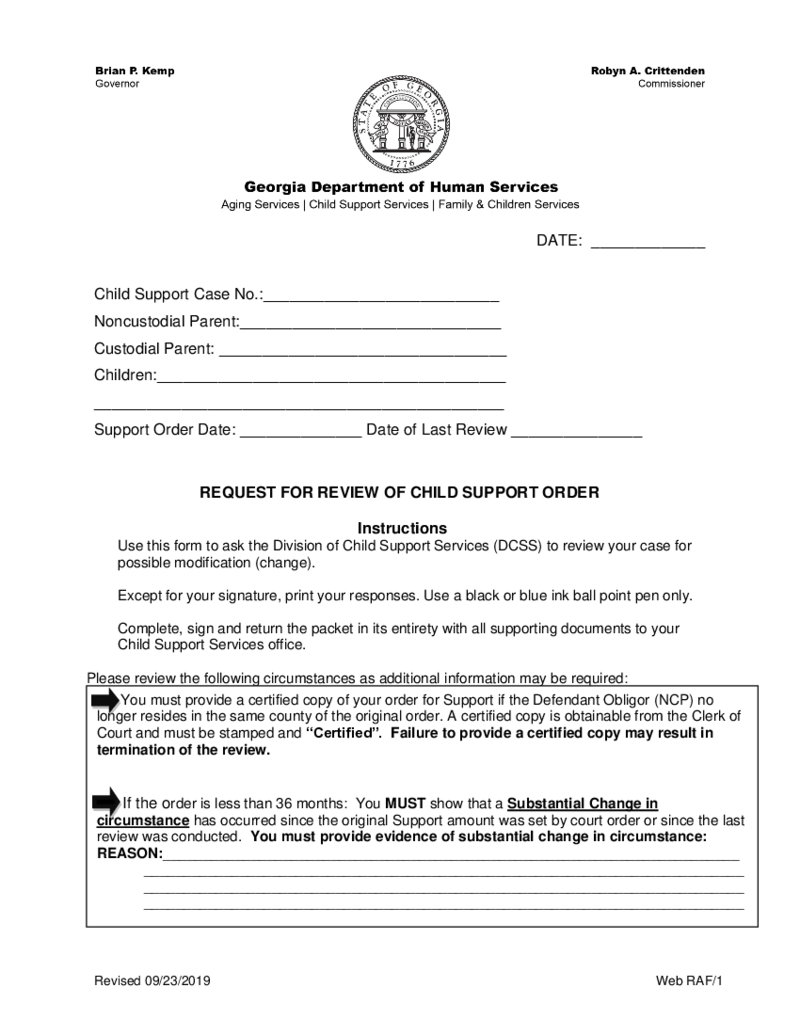

The Personal and Financial Information form is an important modification of child support order you have to fill if you make the request for the review of the child support order. The document was created by the

Personal and Financial Information - Georgia

What is Personal and Financial Information?

The Personal and Financial Information form is an important modification of child support order you have to fill if you make the request for the review of the child support order. The document was created by the

-

DMA 6, Physicians Recommendation Concerning Nursing Facility Care

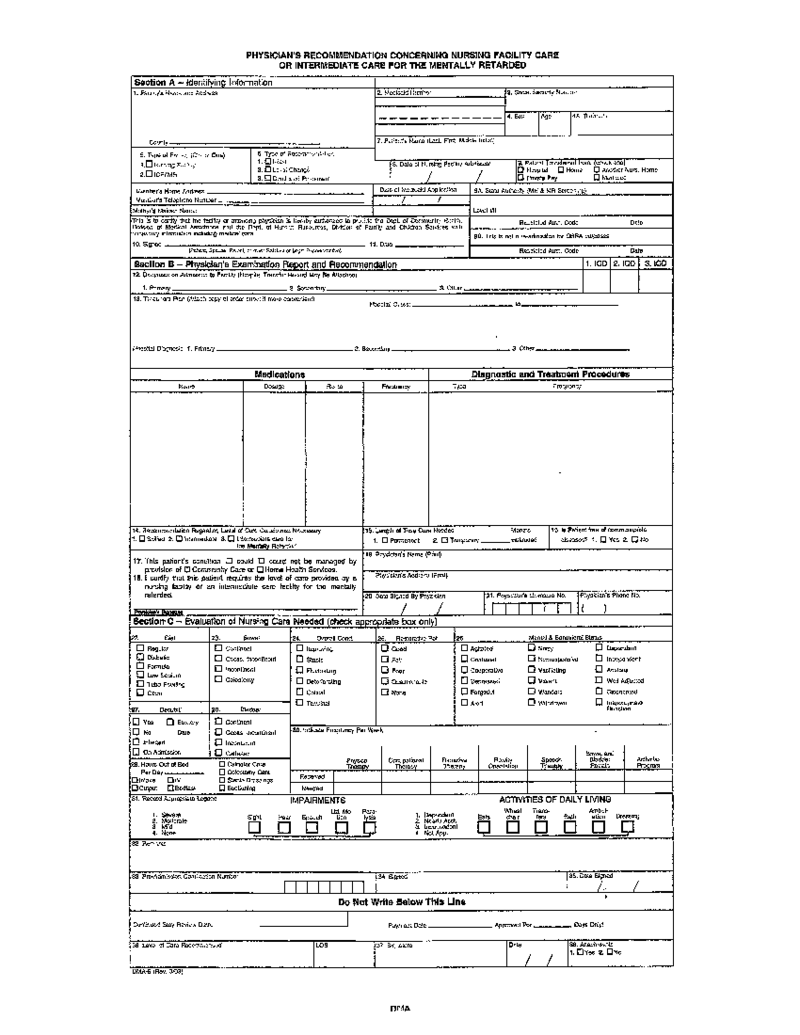

What Is DMA 6 Form?

Also known as Physicians Recommendation Concerning Nursing Facility Care, it’s a document that provides a physician’s confirmation of a person’s need for nursing facility care. The form is a must-complete when it come

DMA 6, Physicians Recommendation Concerning Nursing Facility Care

What Is DMA 6 Form?

Also known as Physicians Recommendation Concerning Nursing Facility Care, it’s a document that provides a physician’s confirmation of a person’s need for nursing facility care. The form is a must-complete when it come

-

Taxpayer Return Request Form (RET-001)

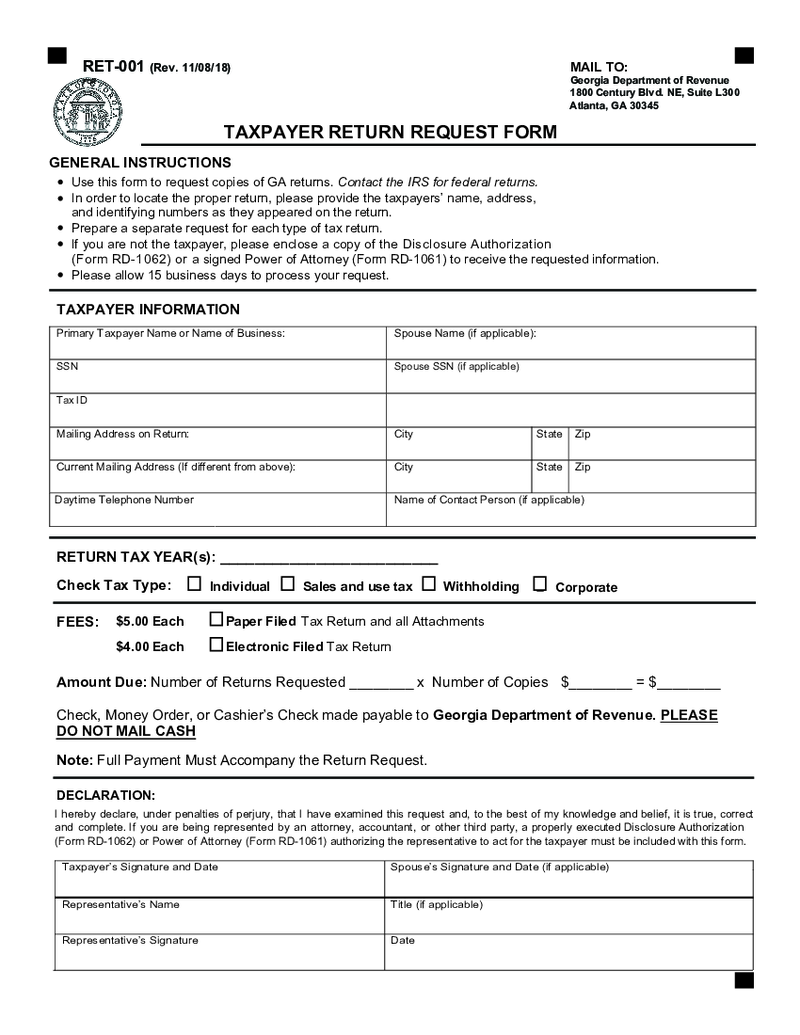

What is the RET-001 Taxpayer Return Request Form

The RET-001 Taxpayer Return Request Form is a crucial document for taxpayers. Its primary purpose is to request a return of taxes paid, whether due to an overpayment or a reassessment. This form is typicall

Taxpayer Return Request Form (RET-001)

What is the RET-001 Taxpayer Return Request Form

The RET-001 Taxpayer Return Request Form is a crucial document for taxpayers. Its primary purpose is to request a return of taxes paid, whether due to an overpayment or a reassessment. This form is typicall

-

Form T-224, Georgia Department of Revenue

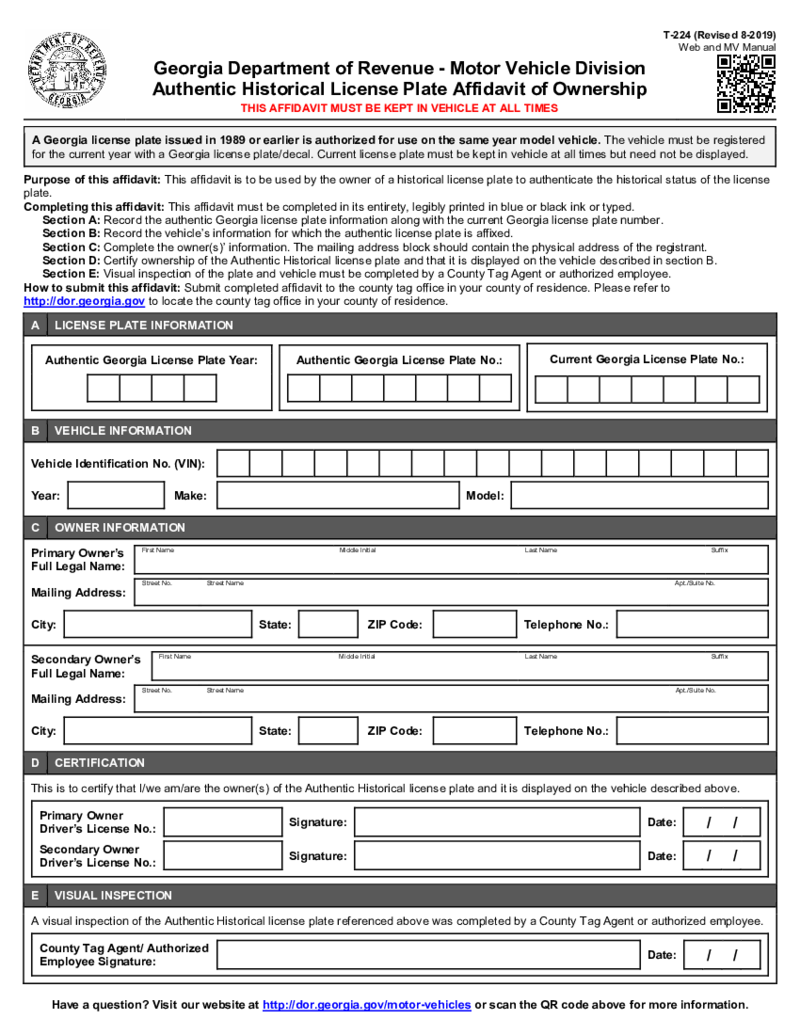

In this article, we will guide you through the processes involved in understanding and filling out the Georgia Department of Revenue Form T-224 and the Geico Supplement Form. We will also show you how to download these forms from PDFliner.

What is Georgia

Form T-224, Georgia Department of Revenue

In this article, we will guide you through the processes involved in understanding and filling out the Georgia Department of Revenue Form T-224 and the Geico Supplement Form. We will also show you how to download these forms from PDFliner.

What is Georgia

-

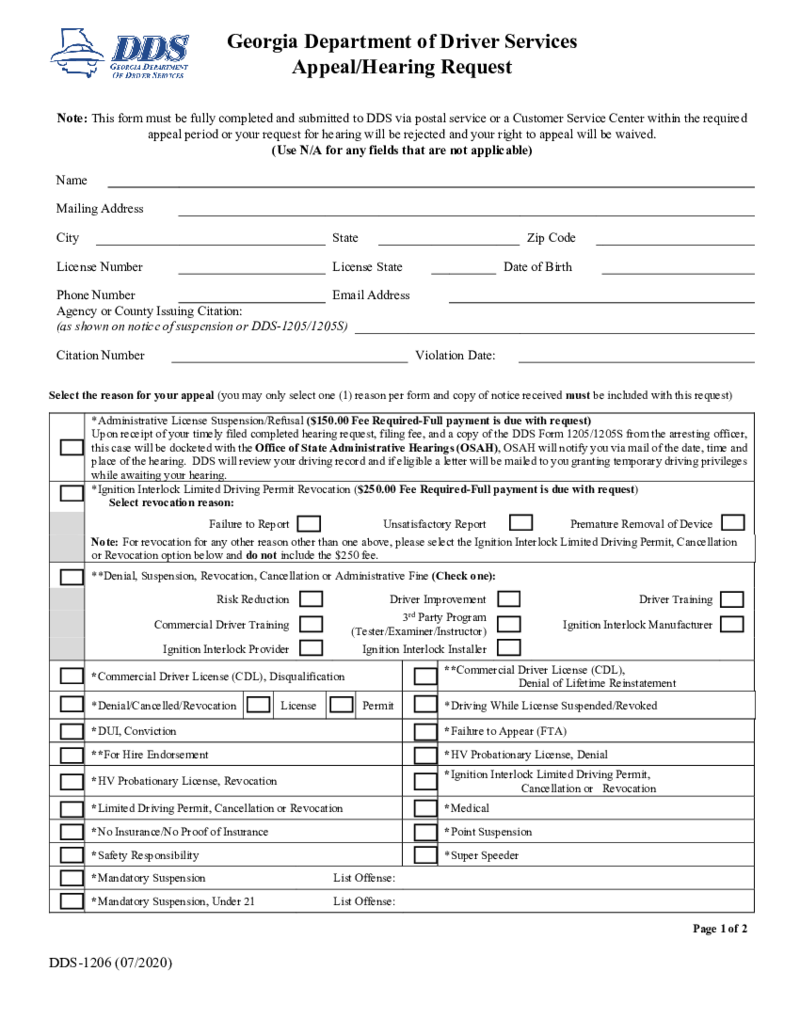

DDS-1206 Georgia Department of Driver Services Appeal and Hearing Request

What Is DDS 1206?

If you’ve been caught for a DUI in Georgia, the arresting officer can file for your license suspension. Under these circumstances, they will give you the DDS 1205 paper, which is a temporary license for over a month. As an ar

DDS-1206 Georgia Department of Driver Services Appeal and Hearing Request

What Is DDS 1206?

If you’ve been caught for a DUI in Georgia, the arresting officer can file for your license suspension. Under these circumstances, they will give you the DDS 1205 paper, which is a temporary license for over a month. As an ar

-

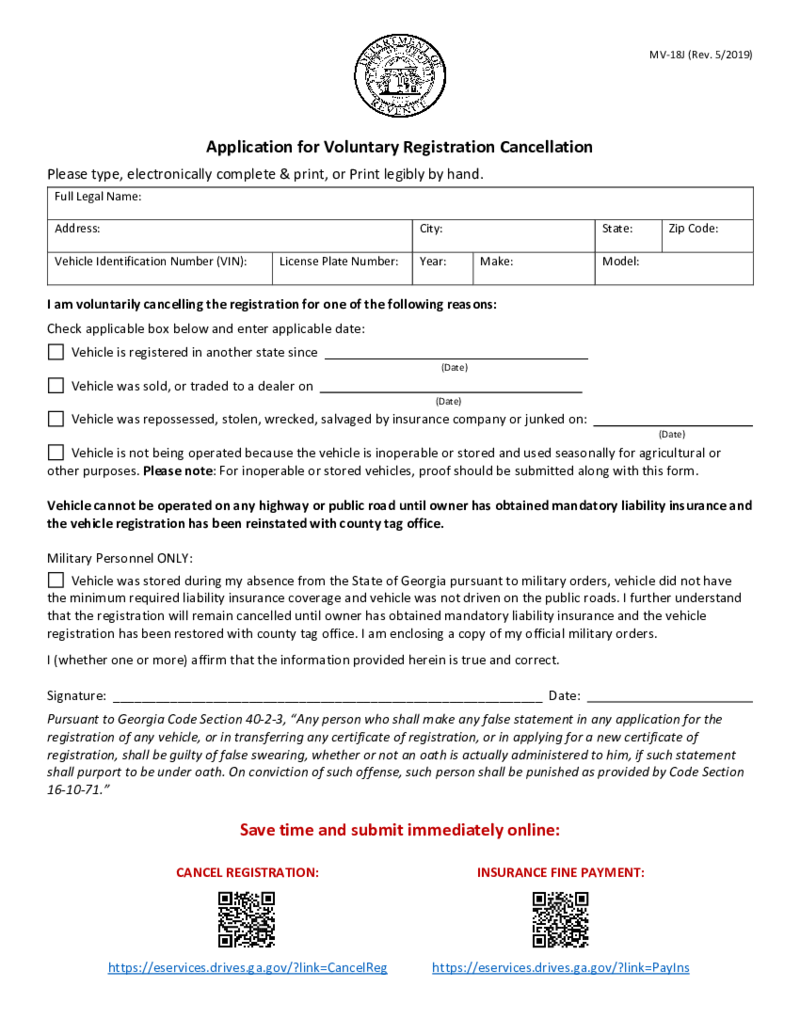

Application for Voluntary Registration Cancellation, MV-18J

What is Application for Voluntary Registration Cancellation?

The MV-18J form is the local document created by the Department of the Revenue State of Georgia. It is known mainly as the Application for Voluntary Registration Cancellation. You can fill out t

Application for Voluntary Registration Cancellation, MV-18J

What is Application for Voluntary Registration Cancellation?

The MV-18J form is the local document created by the Department of the Revenue State of Georgia. It is known mainly as the Application for Voluntary Registration Cancellation. You can fill out t

-

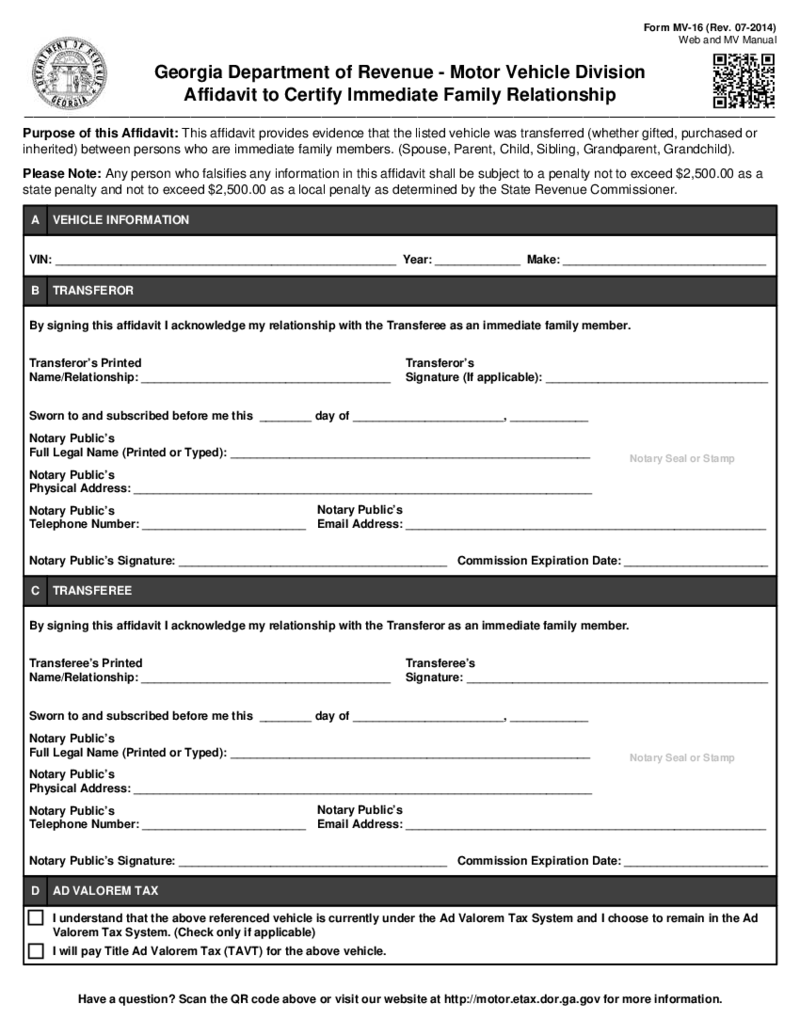

Form MV-16, Affidavit Certify Immediate Family Relationship

What Is Form GA MV-16?

The purpose of the Affidavit of Immediate Family Relationship is to prove that the vehicle was given to you by a family member and is not part of a business transaction. This is important because vehicles transferred between family

Form MV-16, Affidavit Certify Immediate Family Relationship

What Is Form GA MV-16?

The purpose of the Affidavit of Immediate Family Relationship is to prove that the vehicle was given to you by a family member and is not part of a business transaction. This is important because vehicles transferred between family

-

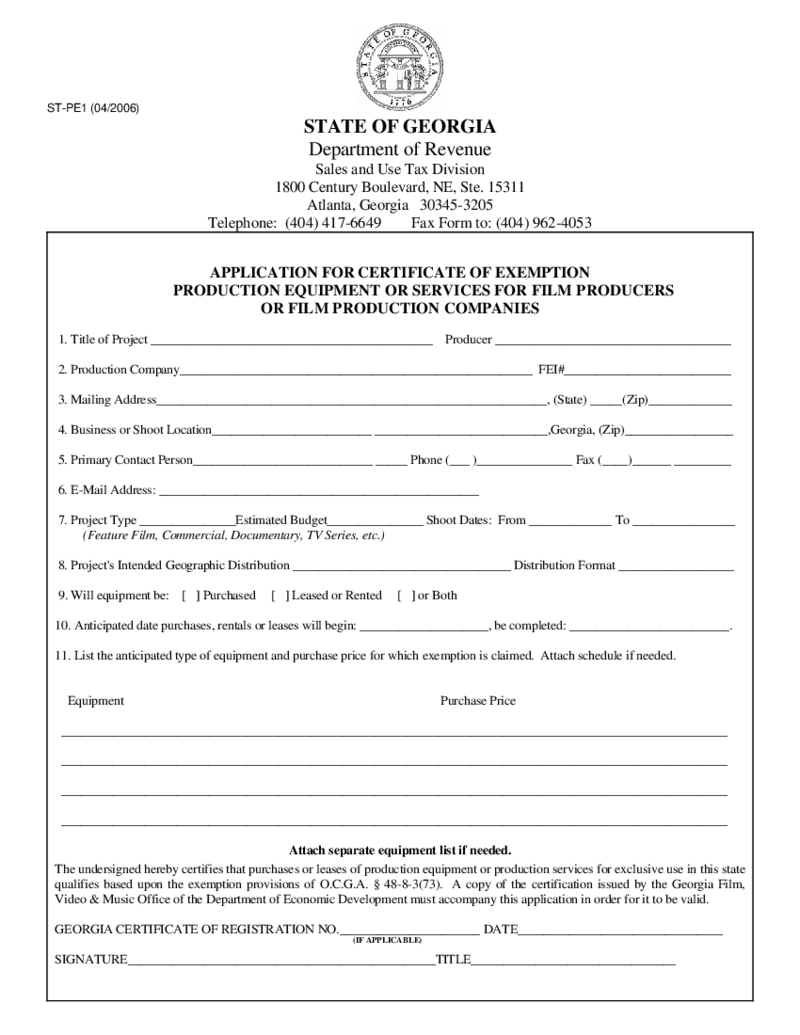

Form ST-PE1 - Georgia Department of Revenue

Completing the Form ST-PE1 from the Georgia Department of Revenue

Form ST-PE1 is issued by the Georgia Department of Revenue and is an essential document for those seeking to purchase motor fuel exempt from sales tax. In this guide,

Form ST-PE1 - Georgia Department of Revenue

Completing the Form ST-PE1 from the Georgia Department of Revenue

Form ST-PE1 is issued by the Georgia Department of Revenue and is an essential document for those seeking to purchase motor fuel exempt from sales tax. In this guide,

-

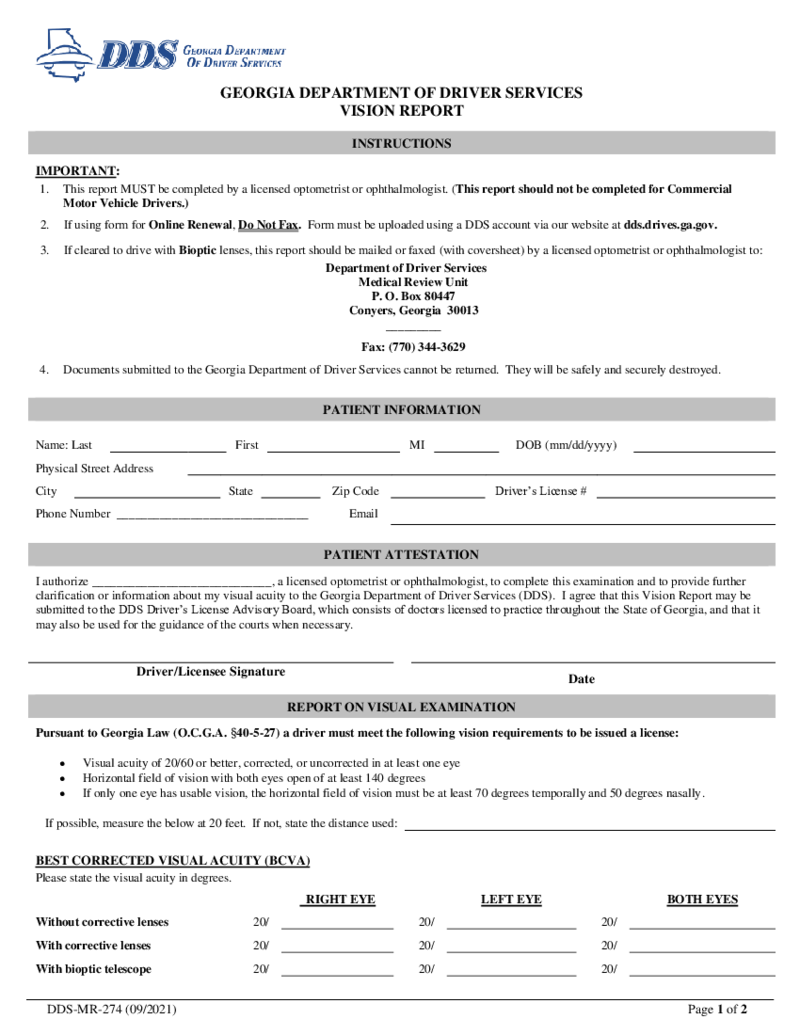

Form DDS-MR-274, Georgia Department of Driver Services Vision Report

Welcome Georgia drivers and aspiring drivers!

This piece is tailored to guide you through the intricacies of the Georgia Department of Driver Services (DDS) Vision Report Form, also known as the DDS-MR-274 Form.

Form DDS-MR-274, Georgia Department of Driver Services Vision Report

Welcome Georgia drivers and aspiring drivers!

This piece is tailored to guide you through the intricacies of the Georgia Department of Driver Services (DDS) Vision Report Form, also known as the DDS-MR-274 Form.

-

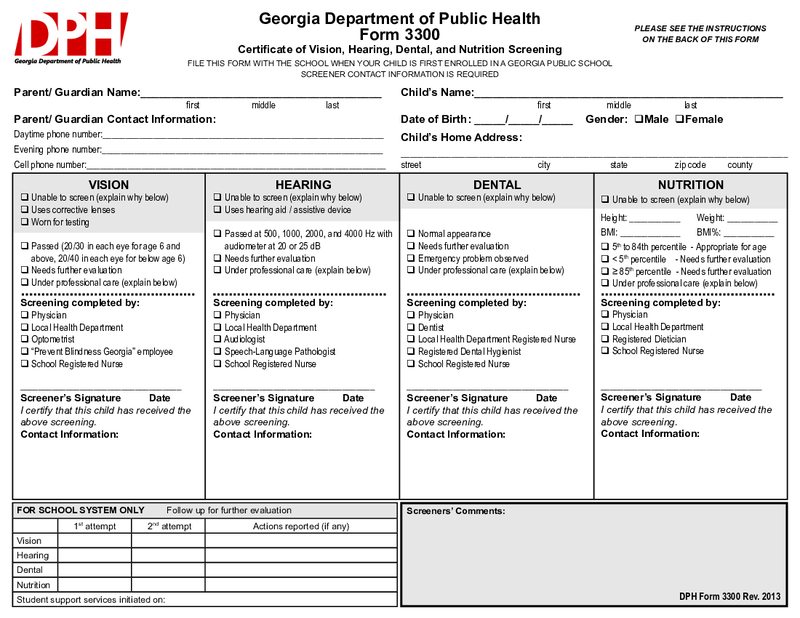

Form 3300, Georgia Department of Public Health

Understanding 3300 Georgia Form

Georgia health department form 3300 is a vital document that plays a crucial role in ensuring the well-being of students across the state. It serves as proof that a child has undergone essential health screenings, ensuring

Form 3300, Georgia Department of Public Health

Understanding 3300 Georgia Form

Georgia health department form 3300 is a vital document that plays a crucial role in ensuring the well-being of students across the state. It serves as proof that a child has undergone essential health screenings, ensuring

-

Affidavit of Sellers Gain (IT-AFF2) - Georgia

The IT-AFF2 form, officially known as the affidavit of seller's gain and residence in Georgia, plays a vital role in the sale of property in the Peach State. This document, used predominantly by sellers, carries significant legal weight and directly affects the f

Affidavit of Sellers Gain (IT-AFF2) - Georgia

The IT-AFF2 form, officially known as the affidavit of seller's gain and residence in Georgia, plays a vital role in the sale of property in the Peach State. This document, used predominantly by sellers, carries significant legal weight and directly affects the f

-

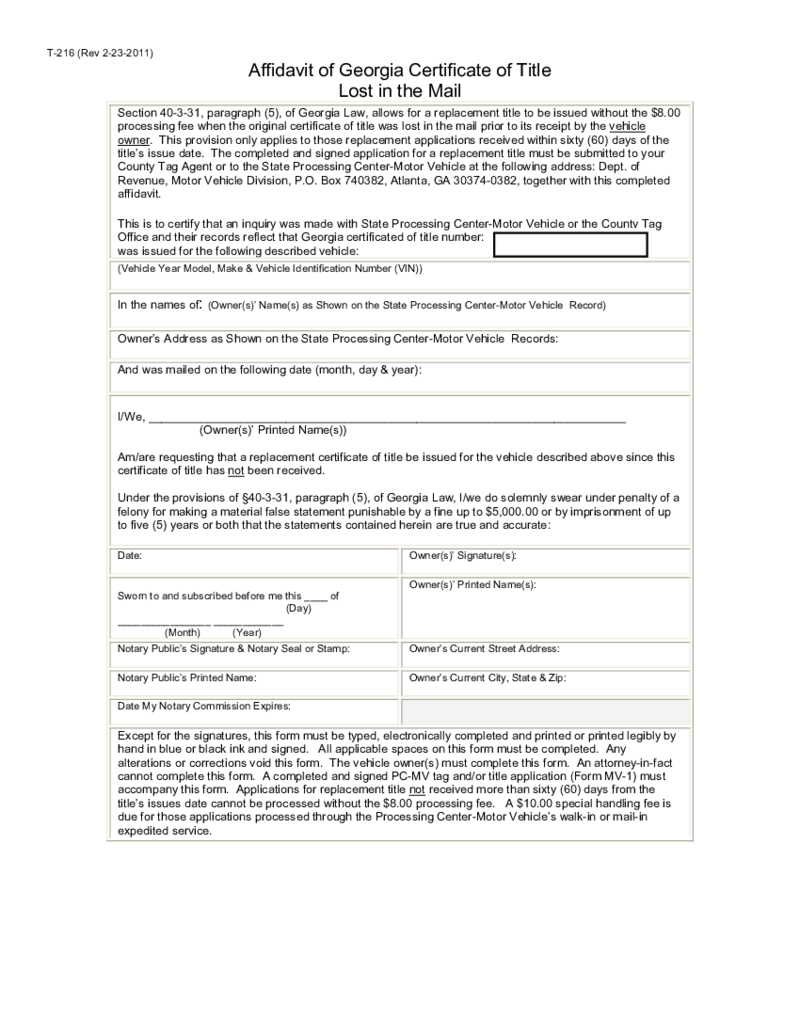

T-216, Affidavit of Georgia Certificate of Title Lost in the Mail

What Is Affidavit Of Georgia Certificate Of Title Lost In The Mail

The Affidavit Of Georgia Certificate Of Title Lost In The Mail is a legal document used when the certificate of title for a vehicle is misplaced or lost during mailing. This affidavit serv

T-216, Affidavit of Georgia Certificate of Title Lost in the Mail

What Is Affidavit Of Georgia Certificate Of Title Lost In The Mail

The Affidavit Of Georgia Certificate Of Title Lost In The Mail is a legal document used when the certificate of title for a vehicle is misplaced or lost during mailing. This affidavit serv

What Are Georgia Templates Used For?

You can use the Georgia Templates form to create standard legal documents such as wills, trusts, contracts, and leases. You can easily find the form online and it can be downloaded for free at PDFliner. The form is easy to use and is designed to save time and money.

What Are Georgia Templates?

Georgia form is a set of fillable PDFs you can use to create various legal documents for use in the state of Georgia. The forms are available for free and you may use them just like any other person who needs to create a legal document for use in the state of Georgia.

Georgia templates include a wide range of legal documents, including forms for will template for Georgia, trusts, powers of attorney, and more. The layouts are designed for use by attorneys but can be used by non-lawyers as well. The forms are easy to use, and you can also simply fill them out online or download and print them.

Georgia Template Types

There are many different types of templates available for use in the state of Georgia:

- Georgia Prenuptial Agreement

A prenuptial agreement, also known as a prenuptial agreement or prenup, is a contract made between two people who are about to get married. The agreement usually specifies how property and debts will be divided if the couple divorces. It may also include provisions for spousal support and other matters.

- Georgia Living Will (Advance Directive) Form

Advance directives are legal documents that allow you to specify your wishes about medical treatment if you are unable to communicate them yourself. A will, also known as an advance directive, is a document that allows you to express your wishes about life-sustaining medical treatment.

- Georgia Last Will Form

A Georgia last will and testament is a legal document created by an individual, also known as a testator, to express his or her wishes regarding the distribution of property and personal effects upon death. This document can be used to appoint an executor to administer the estate, appoint guardians for minor children, and indicate preferences for funerals and burial.

- Georgia Quitclaim Deed Form

The Georgia quitclaim deed is a legal document used to transfer ownership of real property from one person to another. This type of deed is usually used when there is no monetary exchange between the parties or when the parties are related to each other. The person transferring the property is known as the grantor and the person receiving the property is known as the transferee.

- Georgia Durable Power of Attorney Form

A Georgia durable power of attorney is a legal document that gives another person, known as an agent or trustee, the authority to make financial and legal decisions on your behalf. This document remains valid even if you become incapacitated, unless you revoke it, or unless it expires by its own terms.

- Georgia Vehicle Bill of Sale Form

The Georgia Vehicle Bill of Sale form is used to document the sale of a vehicle in the state of Georgia. This form is required by the state to transfer ownership of the vehicle from the seller to the buyer.

- Georgia Bill of Sale Forms

The state of Georgia offers several different forms of bill of sale, depending on the type of item being sold. The most common type of bill of sale is a general bill of sale, which can be used for any type of personal property. If you are selling a vehicle, you need to use the Georgia Motor Vehicle Bill of Sale form. If you are selling boats, you must use the Georgia Boat Bill of Sale form.

What Should Include in Georgia Templates?

Here are a few key points of information that you should include on all Georgia tax forms. Examples include the name and contact information of the company or individual filing the form and the name and contact information of the person or entity to whom the form is being filed. Other important information you should be sure to include on the form includes a description of the purpose of the form and any instructions on how to fill it out.

How to Create Georgia Templates: Step by Step

If you need to create Georgia legal form, you may be wondering where to start. PDFliner website offers you a wide variety of legal forms available to use in a variety of circumstances. Whether you need a will, a lease agreement, or a power of attorney, you can find the right template on PDFliner.

Creating a legal document may seem like a daunting task to you, but PDFliner site makes it easy. Just choose the template you want and then follow the instructions on the site. Here are the steps to follow to create your own Georgia template form:

- Visit the PDFliner website

- Click the "Create Document" button

- Select the type of document you want from the drop-down menu

- Enter the required information in the form fields

- Click the "Save" button

- Save the document to your computer

- Print the document and sign it