-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

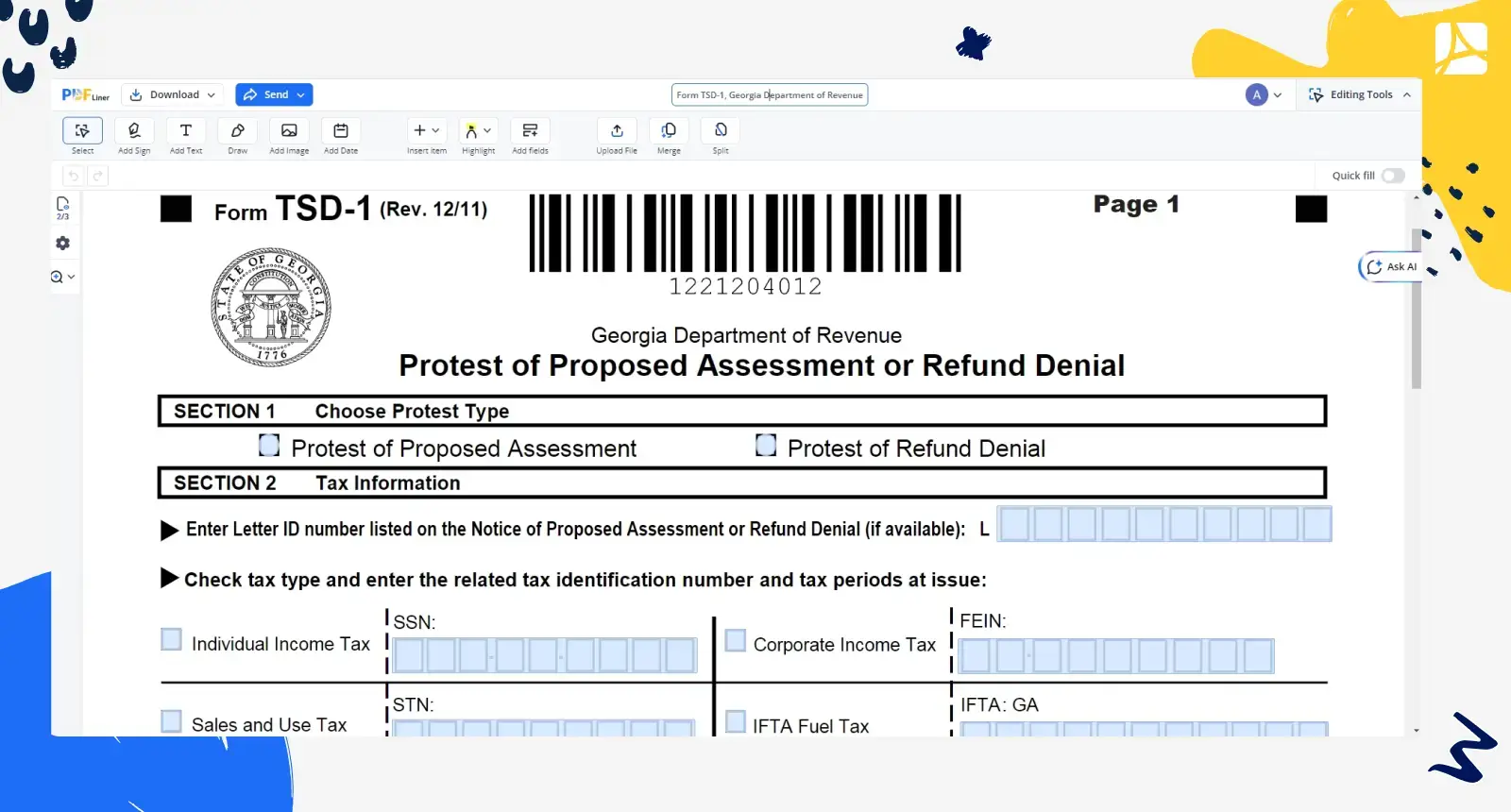

Form TSD-1, Georgia Department of Revenue

Get your Form TSD-1, Georgia Department of Revenue in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

Form TSD-1: Filing a Georgia Department of Revenue Protest

When tax season comes knocking, there are numerous forms and procedures to keep track of, especially if you find yourself in a situation where you disagree with a proposed assessment or a refund denial issued by the Georgia Department of Revenue. One essential document that taxpayers in Georgia should be aware of is Form TSD-1. This form is a critical tool for filing a protest with the Department.

What is Form TSD-1

Form TSD-1 is used by taxpayers in the state of Georgia to formally protest a Notice of Proposed Assessment or a Notice of Refund Denial. This form serves as your official documentation to contest the amount due stated by the Georgia Department of Revenue or to dispute a refusal of a refund request. It’s crucial because it provides taxpayers with a structured way to present their case, ensuring that the Department can timely and fairly resolve the dispute.

Why Do You Need Form TSD-1

The need for Form TSD-1 arises when you believe there are discrepancies or errors in the tax assessments or refund decisions made by the Georgia Department of Revenue. These discrepancies could be due to clerical errors, misunderstood tax positions, or new evidence supporting your claim.

Using this form allows you to:

- Formally present your dispute: Ensure that your grievance is taken seriously and reviewed systematically.

- Provide supporting documentation: Attach necessary documents that substantiate your claims.

- Request a conference: If needed, you can ask for a meeting with the Department to discuss your case in detail.

- Prevent unjust payments: Avoid paying incorrect amounts that have been assessed unfairly.

How to Fill Out Georgia Form TSD-1

Filling out Form TSD-1 accurately is crucial for the successful processing of your protest. Here’s a step-by-step guide:

Section 1: Select Protest Type

- Check the appropriate box to specify if you are protesting a Proposed Assessment or a Refund Denial.

Section 2: Letter ID

- Enter the Letter ID listed on the Notice of Proposed Assessment or Refund Denial.

- Choose the appropriate tax type and enter the related tax identification number.

- Indicate if you are being assessed as a responsible person for sales or income tax withholding or as a successor to a prior business.

- Enter the tax periods mentioned in the notice.

Section 3: Taxpayer Contact Information

- Provide your full name, social security number, and, if applicable, your spouse’s name and social security number.

- If the assessment pertains to a business, enter the business name and employer identification number.

- Complete the address fields ensuring there are no errors.

- Provide a daytime telephone number for any follow-up.

Section 4: Representative Information

- If you are represented by an attorney, accountant, or another third party, complete this section with the representative’s information.

Section 5: Conference Request

- Indicate whether you would like to request a conference with the Department by checking the appropriate box.

Section 6: Reason for Protesting Proposed Assessment

- Provide a detailed explanation outlining why the Department should grant your protest.

- Make sure you back up your claims with logical reasoning and any relevant documentation.

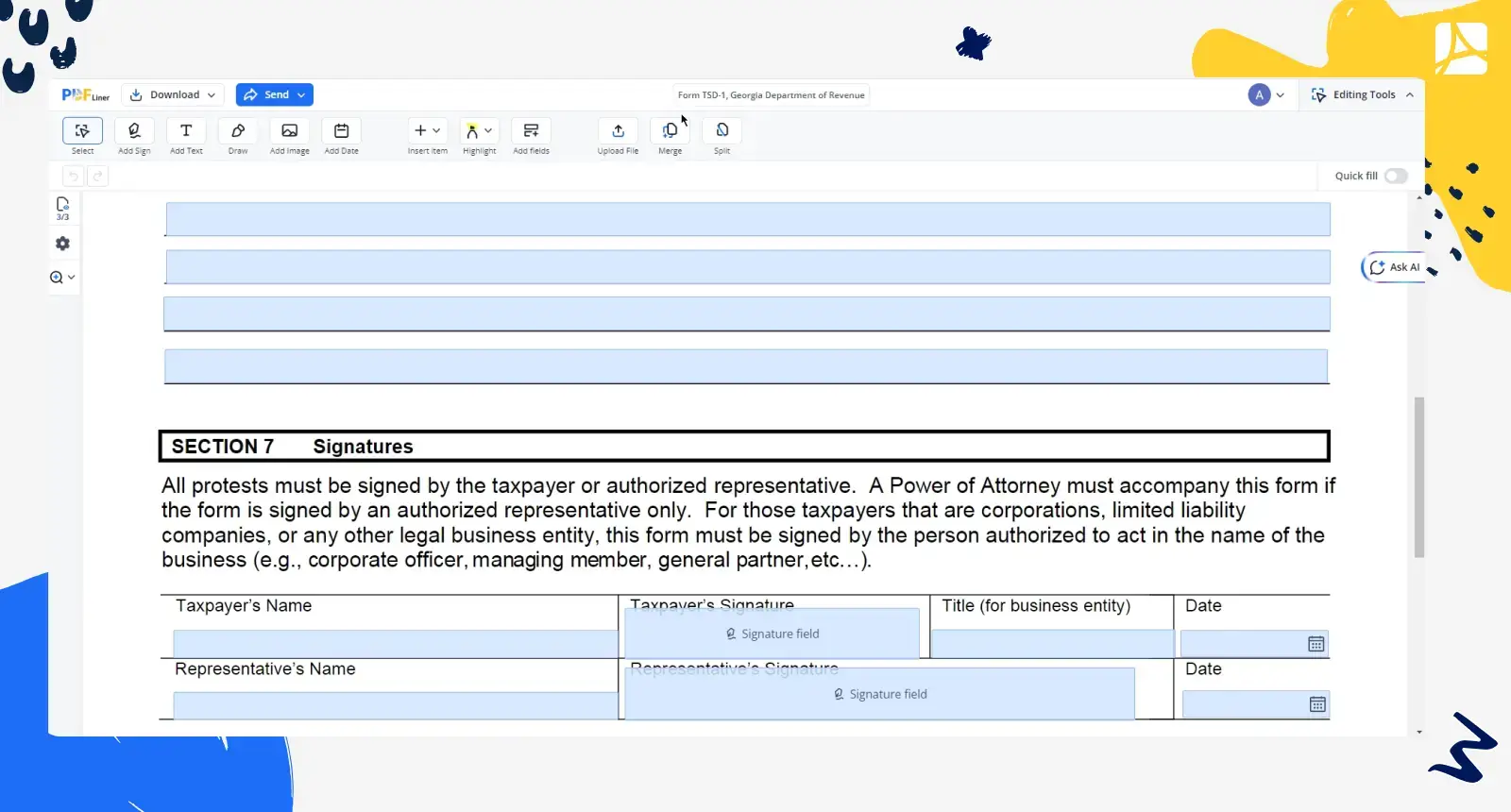

Section 7: Signatures

- Ensure that the taxpayer or their representative signs the form. Unsigned forms could lead to delays or rejections.

Tips for a Successful Submission

- Submit electronically: The Georgia Department of Revenue recommends submitting Form TSD-1 electronically via the Georgia Tax Center (https://gtc.dor.ga.gov) for quicker processing.

- Attach all necessary documents: Failure to include supporting documents can weaken your case. Attach copies of the Proposed Assessment or Refund Denial and any substantial evidence that supports your protest.

- Avoid common mistakes: Ensure that all information, especially identification numbers and periods, is entered correctly.

- Explain clearly and concisely: Your reasons for protesting should be clearly articulated and easy to understand.

- Follow up: After submission, keep track of your protest status and respond promptly to any requests for additional information.

Conclusion

Filing Form TSD-1 may seem like a daunting task, but with the right information and guidance, it can be a straightforward process. This form is crucial for taxpayers in Georgia seeking to dispute a tax assessment or refund denial legitimately. By following our step-by-step guide on how to fill out the form and adhering to our tips for a successful submission, you can ensure that your protest is well-documented, clear, and comprehensible, giving you the best chance for a favorable resolution.

Fillable online Form TSD-1, Georgia Department of Revenue