-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

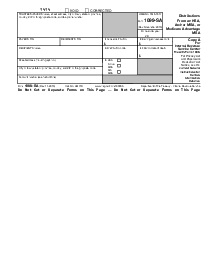

Form 1099-SB

Get your Form 1099-SB in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is SB 1099 Form

The SB 1099 form is an important tax document issued by insurers under Section 6050Y of the Internal Revenue Code. It primarily deals with sellers' investments in life insurance contracts. This form reports the seller's investment in a life insurance contract sold or transferred during the tax year. Form 1099-SB is critical for ensuring that the IRS has accurate information regarding the investment portion of a life insurance contract that has been sold.

When to Use SB 1099 Form

Form 1099-SB should be used in several specific situations:

- When a life insurance contract is sold or transferred, the seller must report the investment to the IRS.

- A reportable policy sale includes transactions where a life insurance contract or any interest in such a contract is acquired directly or indirectly, including through a partnership or other pass-through entity.

- When the acquirer is responsible for paying premiums or has agreed with another person to pay the premiums.

How To Fill Out SB 1099 Form

Filling out form 1099-SB requires careful attention to detail. Here is a step-by-step guide to help you accurately complete the form:

- At the top of form 1099-SB, enter the policy issuer's name, address, and telephone number.

- Below, enter the issuer’s information and provide the policy seller's name, address, and taxpayer identification number (TIN).

- If applicable, include an account or policy number to help identify the contract.

- Enter the OMB number and the payer's TIN

- Input the date the policy was sold.

- State the total investment the seller makes in the contract up to the time of sale.

- Provide the original issue date of the insurance policy.

- Ensure all submitted information is accurate and legible before proceeding.

When to File the SB 1099 Form

The deadline for filing the SB 1099 form with the IRS and furnishing a copy to the seller typically falls on February 28th if filing on paper or March 31st if filing electronically for transactions during the previous tax year. Filing the form 1099-SB on time is crucial to avoid penalties and ensure compliance with IRS regulations.

Fillable online Form 1099-SB