-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

- 1099 Forms

- W-9 Forms

- Other Tax Forms

- Real Estate

- Legal

- Medical

- Bill of Sale

- Contracts

- Education

- All templates

HIPAA Compliance Patient Consent Form

HIPAA Compliance Patient Consent Form

Legal Aid Queensland Application

Legal Aid Queensland Application

Pennsylvania Last Will and Testament Form

Pennsylvania Last Will and Testament Form

Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment

Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment

AU Mod(JY), Parent(s), Guardian(s) details

AU Mod(JY), Parent(s), Guardian(s) details

Recertification for Calfresh Benefits (CF 37)

Recertification for Calfresh Benefits (CF 37)

Wisconsin Last Will and Testament Form

Wisconsin Last Will and Testament Form

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Form 1041-N

Get your Form 1041-N in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is Form 1041-N For?

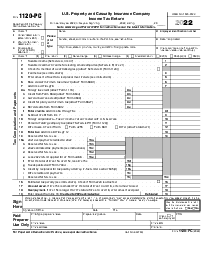

Form 1041-N, also known as the U.S. Income Tax Return for Electing Alaska Native Settlement Trusts, is designated for a very specific purpose. It is utilized by electing Alaska Native Settlement Trusts to report the income, deductions, gains, losses, etc., of both the trust and its beneficiaries. The form's primary function is to facilitate tax reporting for these trusts, ensuring that they benefit from certain tax advantages offered under the Alaska Native Claims Settlement Act (ANCSA).

Eligibility for filing form 1041-N

Not every trust can file Form 1041 N. To be eligible, the trust must have elected to be treated as an electing small business trust (ESBT) under section 646 of the Internal Revenue Code. Additionally, these are trusts established for the benefit of Alaska Natives, granting them unique tax considerations to manage their settlement income effectively.

How to Fill Out the Form 1041 N

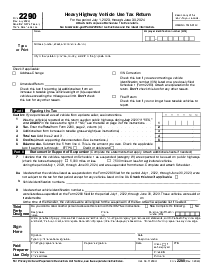

Filling out tax forms can often be perceived as an overwhelming task. However, with understanding and careful attention, completing Form 1041-N can be managed efficiently. Here is a step-by-step guide to assist you through the process:

- Begin with the top portion by entering the trust's name and the employer identification number. Include the trustee's full name and title.

- Provide the address details—number, street, room or suite number, city, town, state, and ZIP code.

- If the trust is affiliated with an Alaska Native Corporation, specify its name.

- Indicate whether the form was filed in the previous year by selecting 'Yes' or 'No'.

- Mark the appropriate checkboxes that apply to the current submission: 'Amended return', 'Final return', 'Change in fiduciary’s name', or 'Change in fiduciary’s address'.

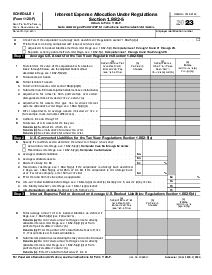

- Move to the section on financial calculations, where you'll record the trust's income items, such as interest, dividends, and other income types.

- Proceed to deduct allowable expenses, such as fiduciary fees, attorney fees, and other deductions, to adjust the trust's taxable income.

- Then, calculate the tax liability, input any payments previously made or credits, and determine if there's a balance due or an overpayment.

- In the part that requests additional details, supply any other pertinent information that's not covered in the previous sections but is relevant to the trust's tax situation. This may include miscellaneous data or explanations if necessary.

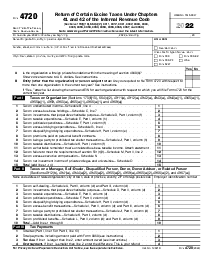

- Towards the end, capture the trustee's signature along with the current date to validate the form. This confirms the accuracy of the data provided within the document.

- If a tax professional prepared the form on behalf of the trustee, they must provide their information in the designated area for 'Paid Preparer Use Only', which includes their name, firm’s name, address, and identification numbers.

- Finally, for trusts that need to disclose asset sales or exchanges, fill out Schedule D by listing the details of such transactions to calculate capital gains or losses.

- And if the trust made any distributions to beneficiaries, complete Schedule K by detailing the distributions along with the beneficiary information and their respective share of the income.

Seeking assistance with form 1041-N

Due to the specificity of Form 1041-N, seeking professional assistance might be advisable when preparing to file. Tax professionals who are well-versed in trust tax law and the stipulations of the ANCSA can provide invaluable guidance. Their expertise can ensure that Form 1041-N is completed accurately, maximizing the trust's tax benefits.

Related to 1041-N Documents

Form Versions

2019

Form 1041-N (2019)

Fillable online Form 1041-N