-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

- 1099 Forms

- W-9 Forms

- Other Tax Forms

- Real Estate

- Legal

- Medical

- Bill of Sale

- Contracts

- Education

- All templates

HIPAA Compliance Patient Consent Form

HIPAA Compliance Patient Consent Form

Legal Aid Queensland Application

Legal Aid Queensland Application

Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment

Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment

Florida Last Will and Testament Form

Florida Last Will and Testament Form

Recertification for Calfresh Benefits (CF 37)

Recertification for Calfresh Benefits (CF 37)

Pennsylvania Last Will and Testament Form

Pennsylvania Last Will and Testament Form

AU Mod(JY), Parent(s), Guardian(s) details

AU Mod(JY), Parent(s), Guardian(s) details

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

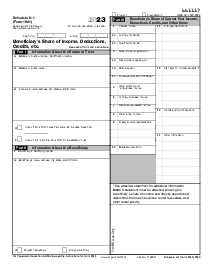

Schedule I Form 1120-F (2023)

Get your Schedule I Form 1120-F in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What is Form 1120-F Schedule I?

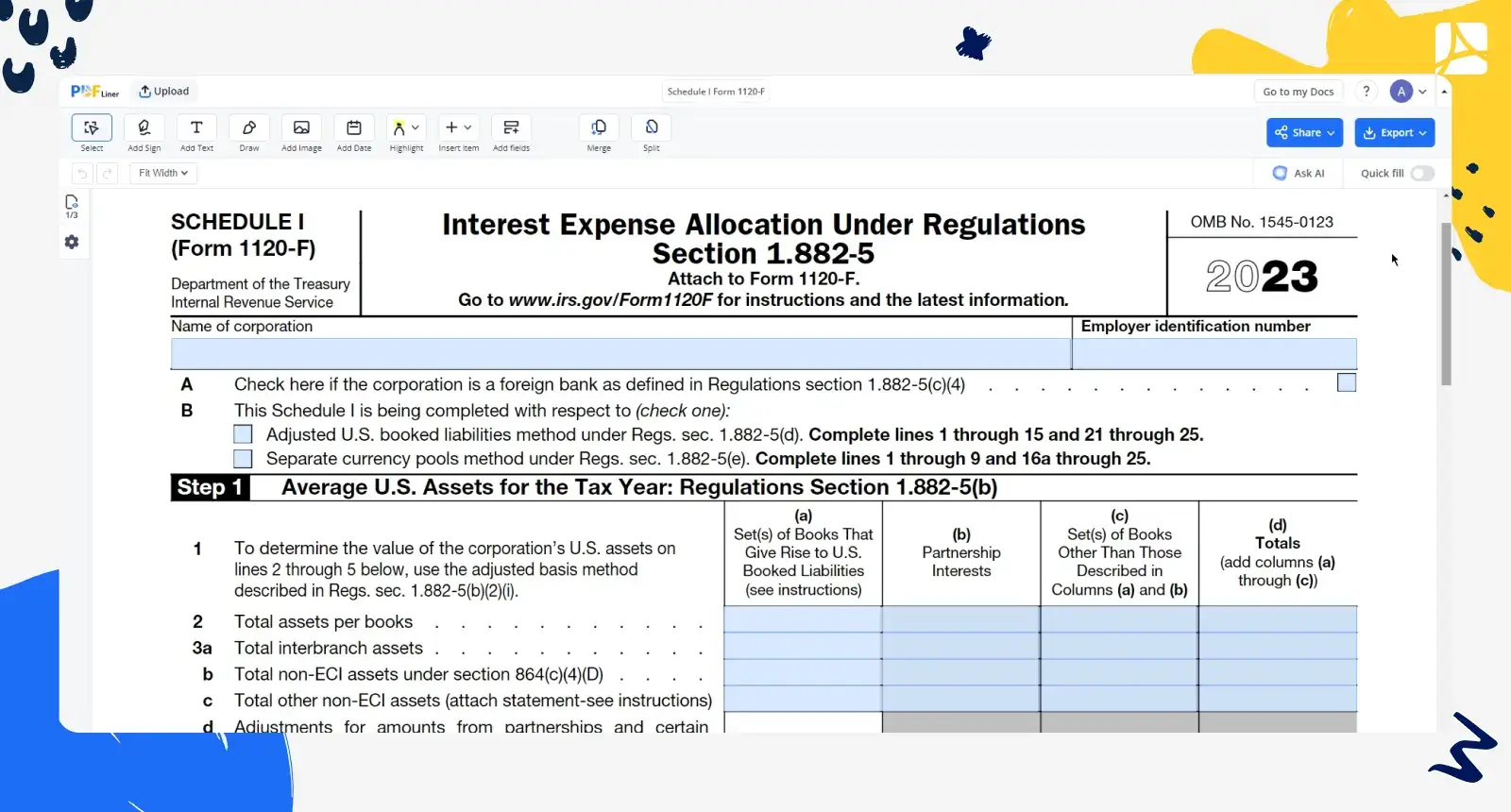

Form 1120-F Schedule I is an essential document for foreign corporations engaged in business within the United States, specifically those that need to allocate interest expense to effectively connected income (ECI). Required under section 882(c) and the corresponding regulations, it helps these entities comply with U.S. tax obligations by calculating interest expense deductions allocable to ECI. This process ensures accurate tax liability assessments, aligning with the operational and financial structures of foreign corporations operating in the U.S.

How to Fill Out

Completing Schedule I of Form 1120-F involves a meticulous approach, adhering to step-by-step instructions that accurately reflect the corporation's financial activities within the U.S. Here's a detailed breakdown:

- Determine the Filing Method: Decide whether the corporation's situation suits the "Adjusted U.S. booked liabilities method" under Regulations section 1.882-5(d) or the "Separate currency pools method" under Regulations section 1.882-5(e).

- Calculate Average U.S. Assets for the Tax Year: Using the adjusted basis method, fill in the required details regarding the corporation's total assets, interbranch assets, non-ECI assets, and any pertinent adjustments as instructed in Step 1 of the form.

- Determine U.S.-Connected Liabilities: Under Step 2, select between the actual and fixed ratio methods to calculate the average worldwide liabilities and assets, applying the chosen ratio to the U.S. asset values derived from Step 1.

- Calculate Interest Expense: For Step 3, report the total average amount of U.S. booked liabilities and the associated interest paid or accrued during the tax year. Further calculations involving excess interest and scaling ratio might be required depending on the corporation's liability standing.

- Summarize Interest Expense Allocation: After detailed calculations, summarize the interest expense allocable to ECI, including any deductions or disallowances under various sections of the Internal Revenue Code.

By following these steps, entities accurately complete the schedule, ensuring compliance with U.S. tax regulations.

Submission Deadlines and Filing Location

Submission deadlines for Form 1120-F, including Schedule I, align with the entity's tax year. Generally, it must be filed by the 15th day of the 4th month following the end of the corporation's tax year. Extensions are available, but requests must be submitted by the original due date.

As for where to submit, the IRS provides specific addresses and centers depending on the entity's location and whether a payment is included. It's advisable to consult the latest IRS instructions or a tax professional to ensure the form is sent to the correct address.

Navigating the complexities of IRS Form 1120-F Schedule I demands meticulous attention to detail and a thorough understanding of the regulations governing foreign corporations' taxation in the U.S. By adhering to the step-by-step instructions provided in the Schedule I Form 1120 F Instructions, foreign entities can accurately report their interest expense allocations, maintaining compliance and optimizing their tax positions within the United States.

Form Versions

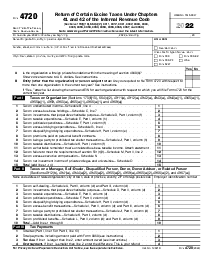

2022

Fillable Schedule I Form 1120-F (2022) year

Fillable online Schedule I Form 1120-F