-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

- 1099 Forms

- W-9 Forms

- Other Tax Forms

- Real Estate

- Legal

- Medical

- Bill of Sale

- Contracts

- Education

- All templates

HIPAA Compliance Patient Consent Form

HIPAA Compliance Patient Consent Form

Legal Aid Queensland Application

Legal Aid Queensland Application

Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment

Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment

Florida Last Will and Testament Form

Florida Last Will and Testament Form

Recertification for Calfresh Benefits (CF 37)

Recertification for Calfresh Benefits (CF 37)

Pennsylvania Last Will and Testament Form

Pennsylvania Last Will and Testament Form

AU Mod(JY), Parent(s), Guardian(s) details

AU Mod(JY), Parent(s), Guardian(s) details

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

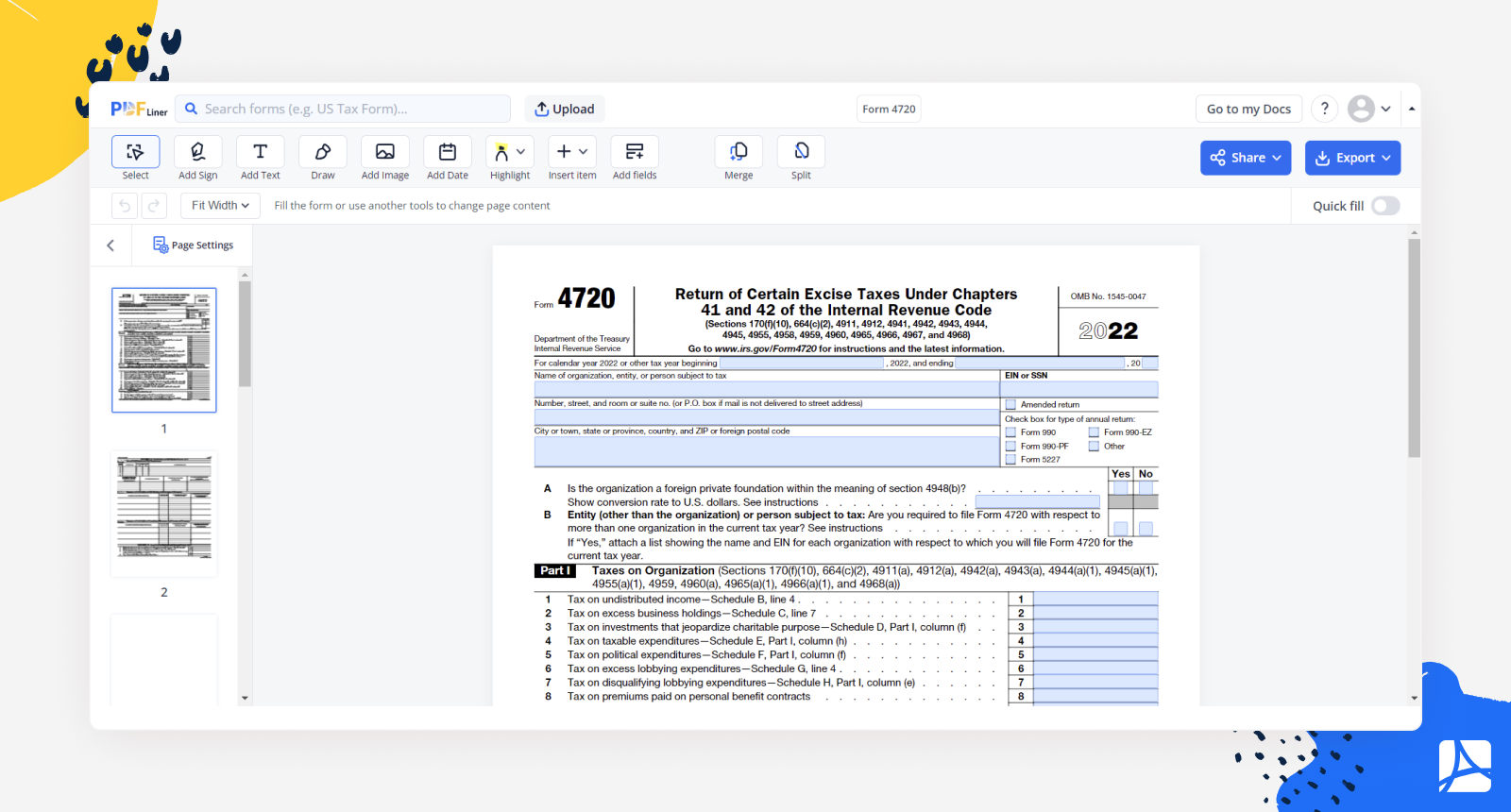

Form 4720

Get your Form 4720 in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is a Form 4720

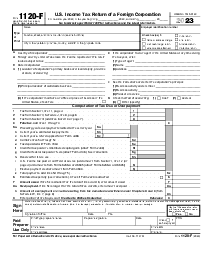

Form 4720, also known as the 'Return of Certain Excise Taxes under Chapters 41 and 42 of the Internal Revenue Code', is a document filed by the Internal Revenue Service (IRS). This form primarily reports and calculates excise taxes connected to charitable organizations, non-profit entities, and certain other foundations.

In simpler terms, the IRS uses Form 4720 to determine the excise taxes due from organizations and individuals involved in excess benefit transactions or self-dealing, among others. If these excise taxes are not paid promptly, penalties can accrue, making understanding and completing Form 4720 a high priority for those to whom it applies.

Form 4720 Instructions

Now that we've outlined what a Form 4720 is let's delve into some essential Form 4720 instructions. Completing and submitting this form must follow the specific guidance the IRS provides.

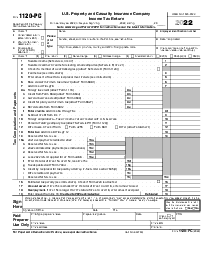

Identification:

The first part of the form requires basic identifying information about the taxpayer.

Calculation of Taxes:

The next part involves calculating the excise taxes that the organization or individual owes. This is determined by the type of violation, with different sections for each violation.

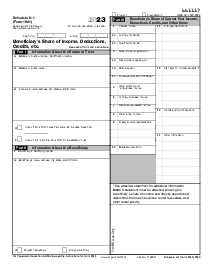

Schedules:

Depending on the circumstances, different schedules of Form 4720 might need to be completed. Each schedule pertains to a specific violation, such as self-dealing, failure to distribute income, or excess business holdings.

Payment and Signature:

Once all the necessary schedules have been completed, taxpayers calculate their total tax liability. The form is then signed, dated, and mailed to the IRS, along with the appropriate payment.

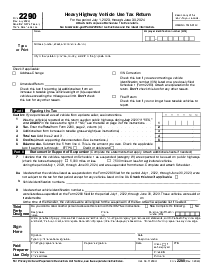

Mine Rescue Team Training Credit:

Interestingly, the IRS Form 4720 also comes into play when we discuss the Mine Rescue Team Training Credit. This tax credit is available to mine operators to offset the costs of training mine rescue team members.

To claim this credit, taxpayers fill out Form 8923 (Mine Rescue Team Training Credit) and attach it to their income tax return. However, if the taxpayer is a trust, estate, or non-profit organization liable for certain excise taxes on credit, they must report and pay those taxes using Form 4720.

Fillable online Form 4720