-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

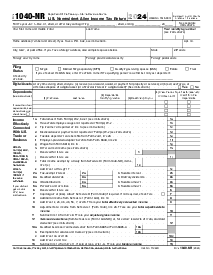

Fillable Form 1040-PR (2021)

Get your Form 1040-PR (2021) in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is a 1040 Pr 2021 Form

The 1040-PR form, specific to the year 2021, serves as the primary tax return document for residents of Puerto Rico who earn income over the threshold that necessitates filing. Unlike the standard 1040 form used in other parts of the United States, the 1040-PR form is tailored to accommodate Puerto Rican residents' unique tax requirements and benefits. This document is vital for accurately reporting income, calculating owed taxes, and claiming credits specific to the Puerto Rican taxation environment.

When to Use 1040 Pr 2021 Form

The 1040-PR 2021 form is applicable in several situations, making it critical for taxpayers to understand when its use is required. Individuals should opt for this form under the following circumstances:

- The taxpayer must be a resident of Puerto Rico throughout the tax year.

- Indicative of self-employment activities within Puerto Rico, such as business operations, freelance work, or other income-generating endeavors that do not classify as traditional employment.

- Eligibility to claim specific tax credits exclusive to Puerto Rico, necessitating a document that properly accounts for these benefits.

- If the taxpayer also files a federal income tax return, the 1040-PR form is used in conjunction to manage local tax responsibilities effectively.

How To Fill Out Form 1040 Pr 2021

Filling out the Form 1040-PR for the year 2021 can be a straightforward process if approached in a methodical manner. Below is a step-by-step guide to ensure accuracy and completeness:

Personal Information:

Begin by entering your name, Social Security Number (SSN), and address in the designated spaces.

Income Reporting:

Accurately report income from self-employment and any other sources as specified within the form. This includes business revenue, services rendered, and other relevant income types.

Deductions:

Deduct allowable business expenses to arrive at your net profit or loss from self-employment. Such deductions may include the cost of goods sold, home office expenses, and relevant business expenses.

Tax Calculation:

Utilize the tax tables provided within the form's instructions to calculate your owed taxes based on your net self-employment income.

Credits:

Claim any applicable credits for which you are eligible, reducing your total tax liability. This involves a careful review of the guidelines to ensure eligibility.

Sign and Date:

Finalize the form by signing and dating it, affirming the accuracy and completeness of the information provided.

When to File Form 1040 Pr 2021

The deadline for filing Form 1040-PR for the tax year 2021 is typically the 15th day of the fourth month following the end of your tax year, which, for most taxpayers, aligns with April 15, 2022. It is crucial to adhere to this deadline to avoid penalties and interest for late filing. However, if this date falls on a weekend or public holiday, the deadline will be the next business day.

For those requiring an extension, requesting it before the original due date is imperative to ensure you receive additional time to file your taxes without facing late filing consequences.

By adhering to these guidelines, taxpayers in Puerto Rico can navigate the complexities of tax filing, ensuring compliance and maximizing their available benefits.

Fillable online Form 1040-PR (2021)