-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Canada LTB N4 - Ontario

Get your Canada LTB N4 - Ontario in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

Comprehensive Guide to Navigating the Ontario LTB N4

Handling a landlord and tenant issue can be a tedious process especially when you don't have the right tools to aid you. Thanks to the PDFliner website, you can now navigate this terrain more comfortably with the Canada LTB N4 – Ontario form. This guide will give you a comprehensive understanding of this form, its purpose, and how to utilize it.

Understanding the N4 LTB Form

Firstly, for those who might be unfamiliar, the Ontario LTB N4 Form is a legal document issued by the Landlord and Tenant Board in Ontario, Canada. It's primarily used by landlords to issue a notice to a tenant who is behind on their rent payments.

The key objective of this form is to provide an official means through which landlords can communicate rental arrears to a tenant, giving them a specific period to pay up. If the tenant fails to comply within the stated time, the landlord may then use this form as part of the evidence to evict the tenant legally.

Benefits of the LTB Ontario N4

The LTB Ontario N4 form serves multiple functions. Foremost, it regulates the process of eviction – making sure it is done fairly and legally. By standardizing the notice given to tenants who have fallen behind on rent, this form helps avoid any disputes that may arise due to misunderstandings, miscommunication, or landlord-tenant disagreements. It also provides a clear record of the landlord’s attempt to regain owed rent giving them an upper hand in court if it becomes necessary.

How to Fill Out LTB Form N4

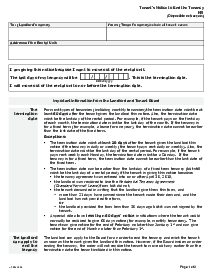

Here's a detailed step-by-step guide on how to fill out the Canada N4 LTB template on the PDFLiner, focusing specifically on the requirements and fields of this form:

- Confirm that the day after the rent due date has passed before issuing this notice, as you cannot serve the notice on the same day the rent is due.

- Enter the tenant’s name in the "To: (Tenant's name)" field at the top of the form. If there are multiple tenants, include all names as each tenant needs to receive a copy of this notice.

- Fill in the landlord's name in the "From: (Landlord's name)" field.

- Specify the complete address of the rental unit, including unit number and postal code, in the "Address of the Rental Unit" section.

- Calculate the total rent owing by the tenant and fill in the table on the second page. This table should include the rent period, rent charged, rent paid, and the rent owing for each period. Ensure all calculations are correct and the total matches the amount you claim is due.

- In the section provided on the first page, specify the calculated total rent owing in the designated box and again in the narrative section that explains the amount owed by the tenant.

- Determine the appropriate termination date based on the rental payment frequency:

- If the rent is paid monthly or yearly, the termination date must be at least 14 days after the notice date.

- For daily or weekly payments, set the termination date at least 7 days after the notice date.

- Ensure that the termination date is correctly calculated, not including the date of notice issuance, and potentially adding days if the notice is sent by mail or courier.

- Specify the termination date in the notice under the section that reads, "pay this amount by dd/mm/yyyy."

- Sign and date the notice at the bottom of the second page. If a representative of the landlord is filling out the form, include their name, LSUC number, company name (if applicable), and contact information.

- Review the entire form to ensure all information is accurate and that only rent-related amounts are claimed. Non-rent charges should not be included in the calculations or requests on this form.

- Before serving the notice, detach the checklist from the beginning of the form as it is for your use and should not be given to the tenant.

Fillable online Canada LTB N4 - Ontario