-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Bank Statement Templates

-

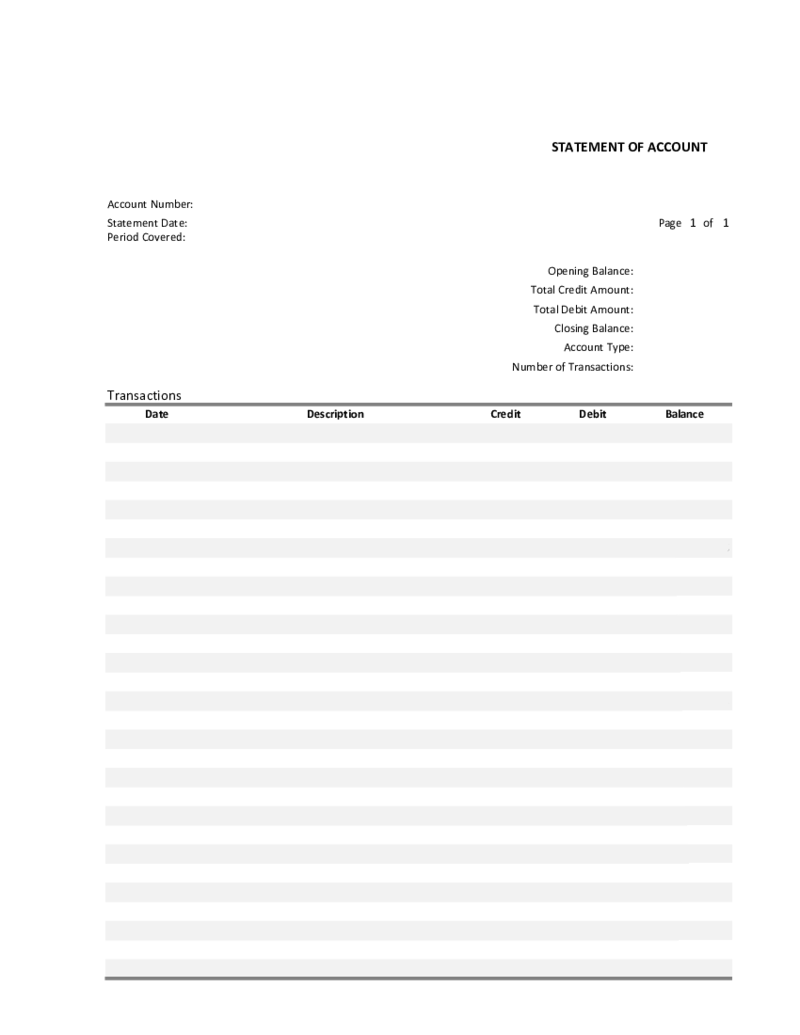

Bank Statement

What Is a Bank Statement Form?

A Bank Statement template is usually required by an account owner from the bank. This document contains a detailed description of the credit, debit, and total balance situation. The main Bank Statement creator is the bank it

Bank Statement

What Is a Bank Statement Form?

A Bank Statement template is usually required by an account owner from the bank. This document contains a detailed description of the credit, debit, and total balance situation. The main Bank Statement creator is the bank it

-

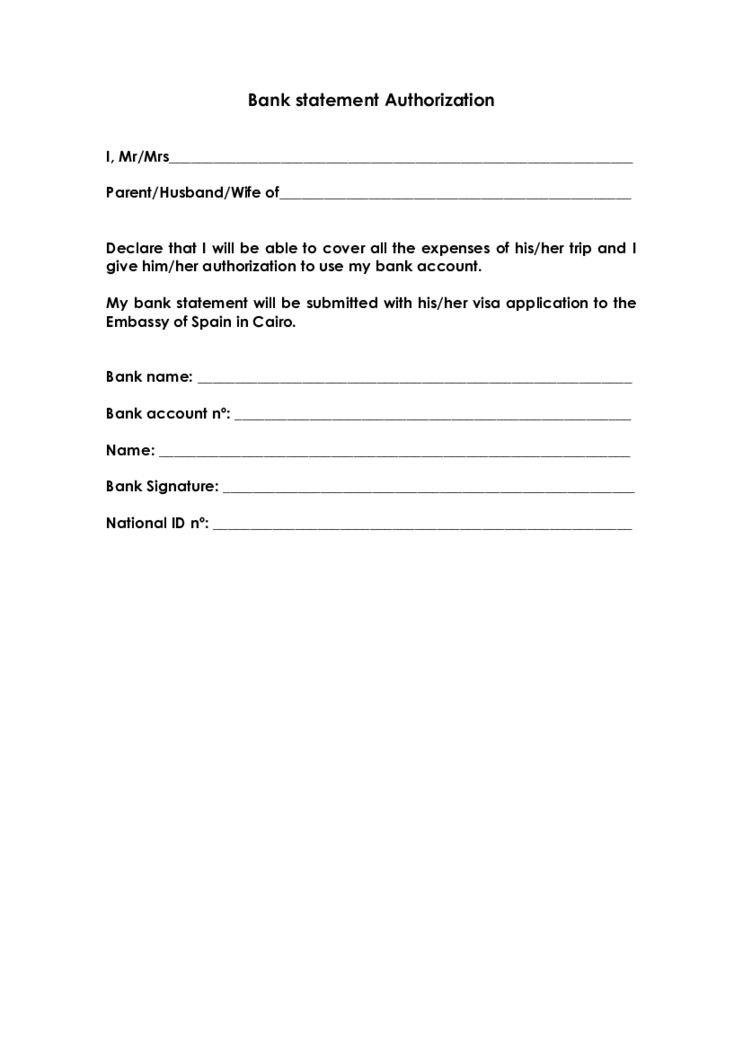

Bank Statement Authorization Letter

Understanding a Letter of Authorization for Bank Statement

A letter of authorization for a bank statement is a document you create and sign to give someone else, often a trusted individual, the power to access or verify your bank details on your behalf. I

Bank Statement Authorization Letter

Understanding a Letter of Authorization for Bank Statement

A letter of authorization for a bank statement is a document you create and sign to give someone else, often a trusted individual, the power to access or verify your bank details on your behalf. I

-

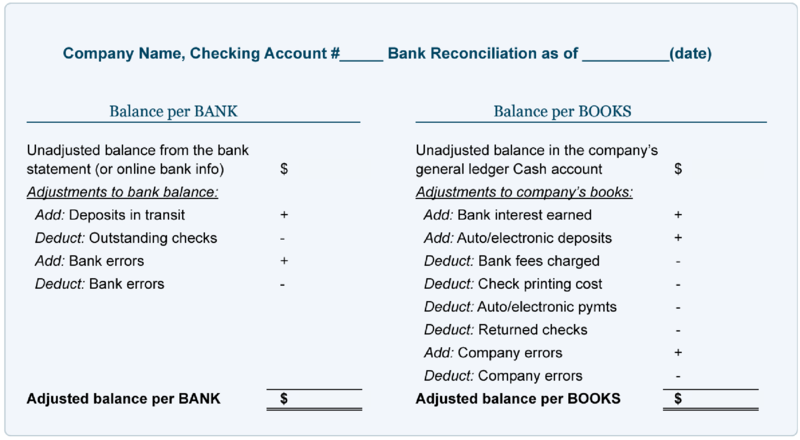

Bank Reconciliation Statement Template

Understanding the Bank Reconciliation Statement

A bank reconciliation statement is a crucial tool in the financial management toolkit of any individual or business. Essentially, it is a document that aligns your bank records with your personal or business

Bank Reconciliation Statement Template

Understanding the Bank Reconciliation Statement

A bank reconciliation statement is a crucial tool in the financial management toolkit of any individual or business. Essentially, it is a document that aligns your bank records with your personal or business

-

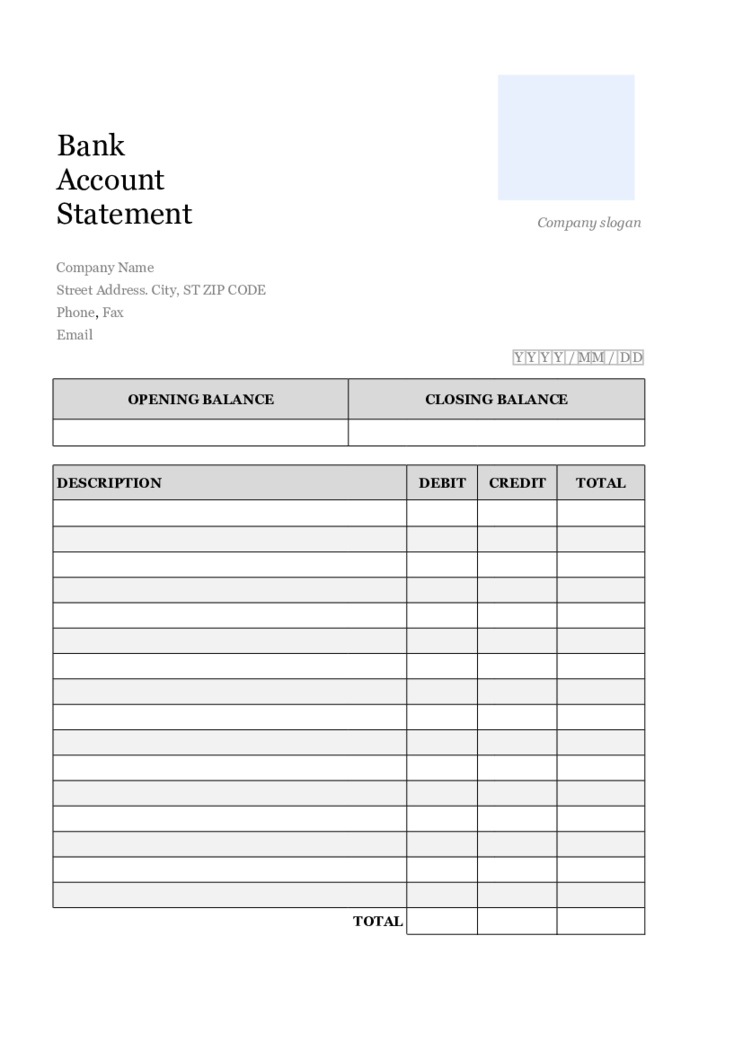

Monthly Bank Statement Template

What Is a Bank Monthly Statement?

A monthly bank statement is an essential document issued by your bank that outlines your financial activities within a specified period, typically a month. It serves as a comprehensive summary of your account transactions

Monthly Bank Statement Template

What Is a Bank Monthly Statement?

A monthly bank statement is an essential document issued by your bank that outlines your financial activities within a specified period, typically a month. It serves as a comprehensive summary of your account transactions

-

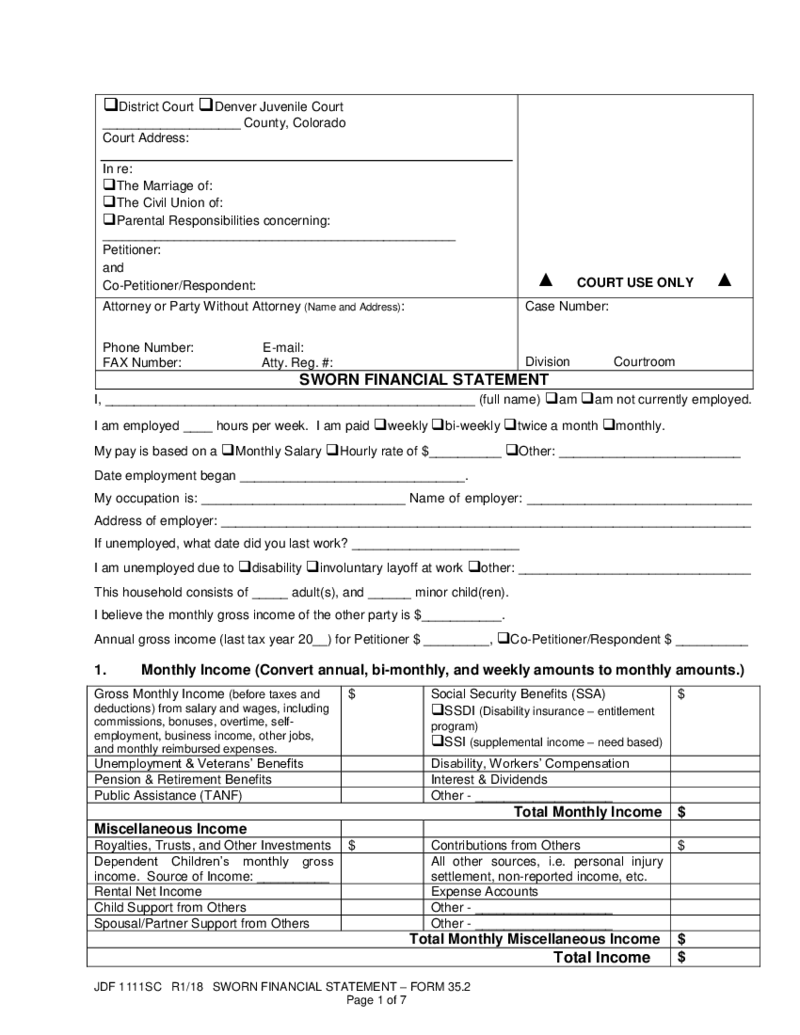

JDF 1111, Sworn Financial Statement

What Is JDF 1111 Sworn Financial Statement

It’s a principal legal document utilized in the judicial process. It is a comprehensive declaration of an individual's or entity's financial status, detailing income, expenses, assets, and liabiliti

JDF 1111, Sworn Financial Statement

What Is JDF 1111 Sworn Financial Statement

It’s a principal legal document utilized in the judicial process. It is a comprehensive declaration of an individual's or entity's financial status, detailing income, expenses, assets, and liabiliti

-

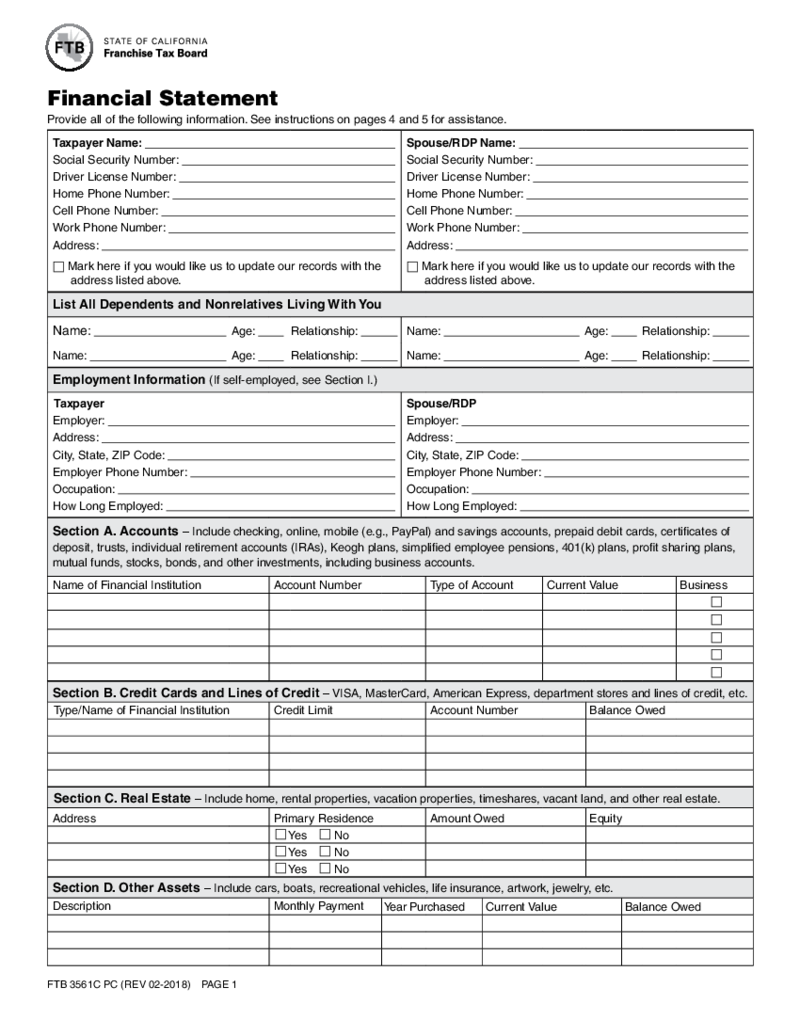

FTB 3561C PC Financial Statement and Instructions

What Is FTB 3561C

Also known as Financial Statement FTB 3561C, this document is pivotal in California's taxation landscape. It is utilized by businesses to meticulously outline their financial transactions, income sources, and authorized deductions. T

FTB 3561C PC Financial Statement and Instructions

What Is FTB 3561C

Also known as Financial Statement FTB 3561C, this document is pivotal in California's taxation landscape. It is utilized by businesses to meticulously outline their financial transactions, income sources, and authorized deductions. T

-

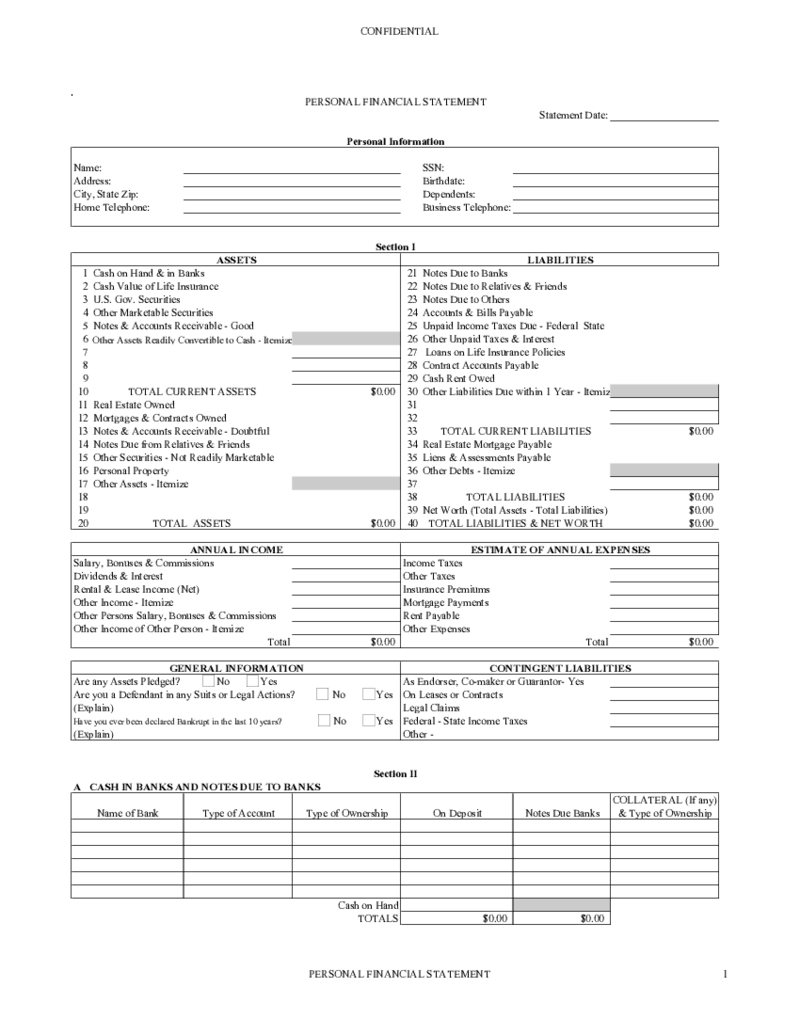

Personal Financial Statement Template

What is the Personal Financial Statement 1 Form?

Personal Financial Statement 1 Form is a federal form of the US Government that allows revealing the current financial situation of an individual in the required period. You are not required to accompany Pe

Personal Financial Statement Template

What is the Personal Financial Statement 1 Form?

Personal Financial Statement 1 Form is a federal form of the US Government that allows revealing the current financial situation of an individual in the required period. You are not required to accompany Pe

-

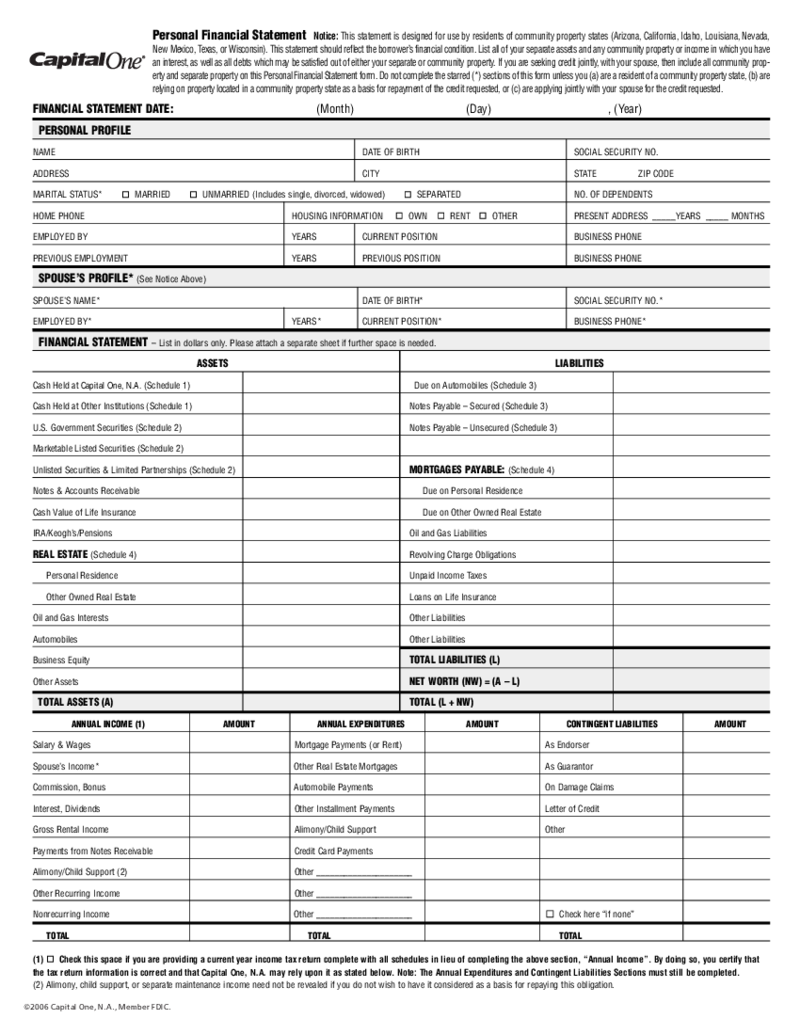

Capital One Financial Statement

What is the Capital One Financial Disclosure Worksheet?

Capital One is an American-based bank holding company that specializes in auto loans, credit cards, and savings accounts. The Financial Disclosure worksheet is submitted by the borrower.

Capital One Financial Statement

What is the Capital One Financial Disclosure Worksheet?

Capital One is an American-based bank holding company that specializes in auto loans, credit cards, and savings accounts. The Financial Disclosure worksheet is submitted by the borrower.

What Is a Banking Statement?

Bank statement templates are common financial documents that are widely used by numerous banks and companies. Representatives of financial institutions usually fill out these documents and send them to clients' accounts further. Clients can use them in their tax reports or as proof that a specific procedure took place. Nowadays, fraudsters can send you fake bank statements to receive your personal data. This is why it is important to learn the basics about these documents, when you can use them, and their possible benefits.

These editable bank statement templates usually summarize the transactions made in a specific financial institution during a particular amount of time. Clients usually receive such templates for free from their banks. Banks can reveal to you the data related to transactions including debit, withdrawals, credit, and deposits.

Bank Statement Requirements

To recognize fillable bank statement templates from fakes, you need to learn the basic components of these documents. While the forms can differ based on their type, they still have in common some major details. Here are the components of all editable bank statement documents templates:

- Information about a financial institution. Some forms even contain the bank’s logo. The template includes the address, phone number, and the number of transactions;

- Information on the holder of a particular account. You will see the name, address, phone number, and email address on some editable bank statement templates free. However, many banks just use your name and physical address or email;

- Details on the account. A bank provides the account number or the holder’s number based on the statement it sends. If you want to fill out the form to the bank, you need to include such details as well;

- The date of the statement. No matter who sends the form, whether it is a bank or a client, there must be a date. Write down the current date when you fill out the form. If the bank sends you a statement on your debit card, check on the dates of the transaction and the date when the statement is made;

- Transactions’ details. Regardless of the document you receive or send, it must include the information on the transaction, including the actions on the account in chronological order. Specify the period of action. There may be information on the other accounts that sent money or received money from the particular ID;

- Account summary. Whenever you fill out blank bank statement templates or receive the already-made statement from your bank, there must be information on the total deposit, opening balance, or withdrawals. The closing balance can also be included based on the client’s request.

How to Use Bank Statement Templates

Once you find the right printable bank statement template, visit PDFLiner and enter the form. You can read detailed instructions written for every template in advance and make sure you have all the documents you need in front of you. Based on the document’s type, you have to provide different information there. Here are a few common instructions for you:

- Provide information about the client, including the customer’s number, name, and address.

- Provide data on the bank, including the branch and address.

- Mention the date of the statement and the deadline for the payment.

- Include information on the credit limit and the total amount of money you have there.

- Describe the procedure, including the card type, the balance you had and the balance you’ll have, payments, purchases, charges, and fees.

- Make sure you include the total amount of money.

- You can create or fill the already-made table with the transactions you’ve made, including the date when a particular transaction took place, the account, and the amount that is left on the balance.

- Put your signature and the current date under the table. If you have an official stamp, you may add it as well to make the document look more reliable. If you fill it out online, you can always add a timestamp using the PDFLiner’s editor.

How to Get a Bank Statement Template

There are several options for people who are searching for such templates:

- You can find them on the official website of your bank if it offers such services;

- You can find all the templates on PDFLiner.;

The library of this editor continues to grow, and you can find all the forms you need there. Moreover, unlike the bank’s official website which usually doesn’t offer any PDF editors, PDFLiner enables you to fill out the form online. You can even create your own electronic signature and add it to the document. The timestamp will increase the security level of the form you send to the bank.