-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

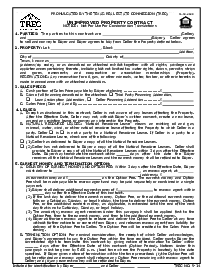

TREC Farm and Ranch Contract

Get your TREC Farm and Ranch Contract in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

Understanding the TREC Farm and Ranch Contract

If you’re looking to venture into the real estate industry, particularly in rural Texas, knowing when to use a farm and ranch contract is crucial. These contracts are mandated by the Texas Real Estate Commission (TREC) for any transactions involving farm and ranch properties.

Unimproved property contract vs farm and ranch contract

A common question that arises is the distinction between a farm and ranch contract and an unimproved property contract. Although the two contracts seem similar, their nuances are imperative to note while conducting real estate transactions in Texas.

The primary difference rests in the specific properties they cover. A Texas farm and ranch contract is employed when properties related to farming or ranching are involved. These may include barns, fences, wells, crops, or livestock. On the other hand, an unimproved property contract handles transactions involving undeveloped lands - those that have not yet seen the sorts of improvements covered by the farm and ranch contract.

How to Fill Out a Farm and Ranch Contract

The process of completing a Texas farm and ranch real estate contract can be simplified into several steps.

- Begin with the 'Parties' section of the form. Provide the names of the Seller and the Buyer.

- Move on to the 'Property' section. Input the 'land address' in the designated field. Under 'Improvement', 'Accessories', and 'Crops', check the boxes that apply to the conditions of the property.

- In the 'Exclusions and Reservations' section mention any part of the property, like fixtures and improvements, that are not included in the sale.

- ‘Sales Price’ needs to be specified in the next section. This price is agreed upon by both parties and is fixed.

- Check the appropriate boxes under 'Leases' to acknowledge if there are any existing leases on the property.

- Fill out 'Earnest Money' and 'Termination Option'. The amount of earnest money to be paid should be filled and the number of days for the termination option should be specified.

- Under 'Title Policy and Survey', denote who will pay the costs related to the Title Policy and Survey.

- In the 'Property Condition' section, specify any repairs or treatments that are needed for the property.

- Fill out ‘Brokers and sales agents’ as per the property and contract dealing.

- Specify details under the 'Closing' section, such as the closing date, locale, prorations, and expenses.

- Move to the 'Possession' section and specify when the Buyer will take control of the property.

- In the 'Special Provisions' area, outline any unique terms or issues pertaining to the transaction.

- Specify the distribution of settlement and other expenses in 'Settlement and Other Expenses'.

- Fill out the ‘Casualty Loss’, ‘Default’ and ‘Attorney’s Fees’ sections based on the agreed terms between parties.

- ‘Escrow’ details need to be provided in the next section.

- Fill out the 'Federal Tax Requirements' section based on your status. Provide information necessary regarding FIRPTA.

- Fill in the 'Notice' section with the contact details of both Buyer & Seller.

- In the 'Agreement of Parties', check the applicable boxes.

- Specify the details of any consulted attorneys in the 'Consult an Attorney Before Signing' section.

- At last, record the date of final acceptance and buyer's and seller's signatures and names.

When to use farm and ranch contract in Texas?

Nowadays, there are several instances when you'd want to use a farm and ranch contract in Texas. Understanding these scenarios is important to gauge if this type of contract is suitable for you:

- When Purchasing or Selling a Farm or Ranch: This contract is specifically designed for transactions involving farms and ranches. This means whenever you're buying or selling these types of properties, it would be appropriate to use this form.

- Involvement of Residence or Farm Structures: If the farm or ranch property sale involves a residential house or farming buildings such as barns, fences, or other outbuildings, this contract would be apt.

- Transactions Including Miscellaneous Assets: If the sale includes other miscellaneous assets such as equipment, standing crops, or livestock, you should draft a contract.

- Concerning Mineral and Water Rights: When a property transaction also includes transfer or reservation of water or mineral rights, a contract is required.

- Property with Surface Leases and Easements: If the property you're dealing with has surface leases or easements, use the document as it contains specific provisions for these elements.

Fillable online TREC Farm and Ranch Contract