-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

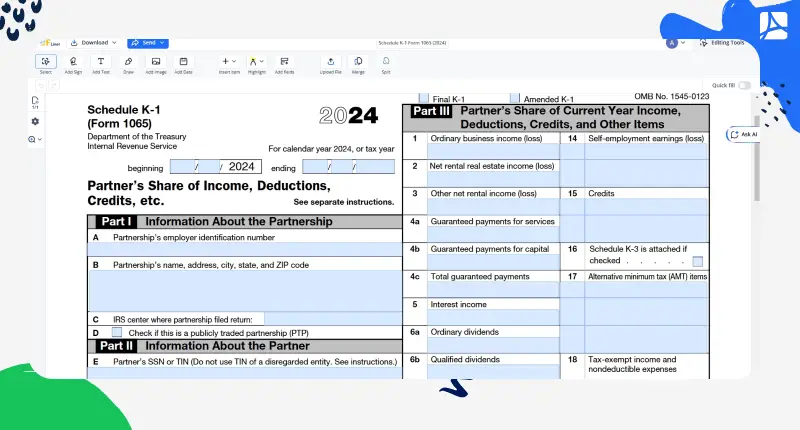

Schedule K-1 Form 1065 (2024)

Get your Schedule K-1 Form 1065 (2024) in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is IRS Schedule K-1 (Form 1065) 2024

Schedule K-1 Tax Form 1065 is an IRS tax form issued annually for the purpose of documenting the revenue, profits, losses, and credits of each partner within a business entity, as well as other IRS-focused financial details about business partnerships. This document should be prepared by each partner within a business entity.

What you need Schedule K-1 (form 1065) for

Schedule K-1 is submitted as part of your Partnership Tax Return, Form 1065, which documents your business entity’s total net revenue. The thing is, in the US, partnerships are treated as the so-called ‘pass-through’ entities. Therefore, tax liability is shifted from the entity to the persons (partners) whose common operation is concentrated on it. And that’s where the Schedule K-1 form comes into play.

You have to file the Schedule K-1 (Form 1065) if you’re:

- Part of a general partnership;

- Partner within a limited partnership;

- Operate in a limited liability partnership;

- Partner within a Limited Liability Company that has chosen to pay their income taxes as a business entity.

Luckily, the IRS Schedule K-1 Form 1065 is a single-page document. Bear in mind that you can leave certain parts in your Schedule K-1 Form 1065 blank. It depends on your business specifics. Overall, if filling out the document is challenging, it is advised that you check out the guidelines from the IRS or consult with your bookkeeper to save time.

Organizations that work with Schedule K-1 form 1065

- IRS

IRS Schedule K-1 form 1065 resources

- Download blank Schedule K-1 Form 1065

- IRS Instructions for Schedule K-1

- How to get a Schedule K-1

- How to fill out Schedule K-1

Step 1: To open the fillable form, click the blue button above.

Step 2: Write the details about the partnership: CEO’s id number, entity’s business name, full address, as well as your business’s IRS filing address, and whether your business is traded on a stock exchange or a publicly-traded company.

Step 3: Specify information about the partner: partner’s id number, full name, address, as well as the type of partnership and the type of entity.

Step 4: Enter partner’s revenue share, as well as credits, losses, and deductions over the current financial period.

Step 5: Click the "Export" button to download or print the document.

Form Versions

2019

Fillable Schedule K-1 Form 1065 (2019) year

2020

Fillable Schedule K-1 Form 1065 (2020) year

2022

Fillable Schedule K-1 Form 1065 (2022) year

2023

Fillable Schedule K-1 Form 1065 (2023) year

FAQ: Schedule K-1 Form 1065 Popular Questions

-

How to read a Schedule K-1 form 1065?

To read a Schedule K-1 (Form 1065), start by identifying your share of the partnership’s income, deductions, credits, and other financial information in the different sections. Each box corresponds to a specific tax category, and the instructions provided by the IRS can help interpret them properly.

-

How to report Schedule K-1 form 1065?

Report the information from Schedule K-1 on your personal tax return, typically on Form 1040. Income, losses, and deductions should be placed in the appropriate sections based on the type of income (e.g., capital gains, dividends, rental income).

-

How to get your IRS Schedule K-1 (Form 1065)?

Your Schedule K-1 is provided by the partnership, usually by March 15th. If you haven't received it, contact the partnership managing the business, as they are responsible for preparing and distributing the form.

-

What do I do with a Schedule K-1 (Form 1065)?

Use Schedule K-1 to report your share of the partnership's income, losses, and credits on your individual tax return. Ensure all figures are accurately transferred to the appropriate tax forms before filing with the IRS.

-

How to file Schedule K-1 form 1065?

If you are a partnership, you must complete and file Schedule K-1 as part of Form 1065 and distribute copies to all partners. Each partner then uses the form to report their share of the partnership’s financial activity on their personal tax returns.

Fillable online Schedule K-1 Form 1065 (2024)