-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

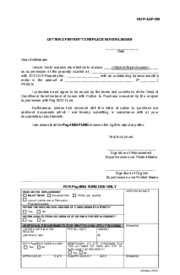

Pag IBIG Fund Home Financing Documents Claim Stub

Get your Pag IBIG Fund Home Financing Documents Claim Stub in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

Comprehensive Guide to Pag IBIG Fund Home Financing Documents

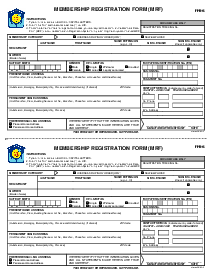

Pag IBIG Fund Home is an advantageous program provided by the Home Development Mutual Fund (HDMF) in the Philippines. Aimed at Filipino workers, this system allows them to save for potential housing investments regularly. By being a member of the Pag IBIG Fund, you receive permanent and long-term housing loans with affordable interest rates.

Understanding the Pag IBIG Home Fund Form

A primary document you need in the process is the Pag IBIG Home Fund Form. This necessary paperwork is to be filled completely and accurately to avoid any complications in your applications. The form contains vital sections such as members' personal information, employment records, details of chosen housing unit, and loan payment scheme. To avoid the hassle of physical submission, many users prefer availing of the online service provided by the PDFliner website.

How to Fill Out Pag IBIG Fund Home Financing Documents Claim Stub

Here's a detailed guide on how to fill out this Pag-IBIG fund home financing document on the PDFLiner website:

- Start by entering your last name, first name, and middle name in the designated fields at the top of the form. If you have a name extension like Jr. or II, include it in the appropriate section.

- Record your Housing Account Number in the corresponding field to ensure your application is linked to the correct account.

- Fill out the Issued by section with the signature over the printed name of the issuer and the date to certify the accuracy of the provided information.

- Depending on your status as the claimant, check the appropriate box to indicate if you are the registered owner, a representative, an heir or heirs of a deceased registered owner, an assignee/successor-in-interest, or the principal borrower. This will determine which set of documents you need to submit.

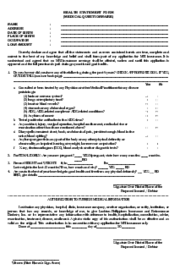

- For registered owners:

- If you are a female who was single at the time of the housing application but are now married, include a marriage contract.

- Ensure you have two valid IDs with your signature and photo.

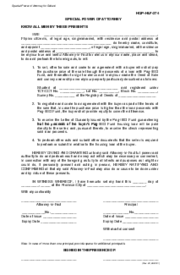

- For representatives:

- Provide a Special Power of Attorney (SPA) executed by the registered owner.

- Include two valid IDs for both the registered owner and the representative.

- For heirs of a deceased registered owner:

- Attach photocopies of the PSA Certified True Copy of the Borrower's Death Certificate and Birth Certificate/s of the heir/s.

- If applicable, include a notarized affidavit of guardianship, proof of surviving heir/s, and a SPA executed by the heir/s.

- Submit the deed of partition, last will, or final decision on intestate/estate proceedings if available.

- For assignees/successors-in-interest:

- Comply with all applicable items from A to F mentioned for other categories.

- Attach a deed of sale/assignment executed by the deceased registered owner in favor of the claimant and a SPA executed by the surviving spouse and other heir/s.

- For principal borrowers:

- Provide two valid IDs with signature and photo.

- If applicable, include a marriage contract for a female registered owner who was single at the time of housing application but is now married.

- Ensure that you bring all required documents, along with this claim stub, to the designated location mentioned in the form for the claiming of titles and other home financing documents.

Remember, in all instances where photocopies are submitted, the original documents must be presented for authentication.

Also, note that Pag-IBIG Fund may request additional documents or proofs to establish the true identity of the rightful claimant and to eliminate any doubt regarding the claims.

Best Practices for Dealing with Pag IBIG Fund Home

Understanding and handling the nuances of the Pag IBIG Fund Home cannot be overstressed. It's essential to properly fill out the forms and keep a record of all necessary documents. Managing your Pag IBIG Fund Home Financing Documents Claim Stub is one of the data points that should be handled with most precision. Here's where digital document management platforms like PDFliner come into play. They help in keeping your documents stored, organized, and ready for submission or retrieval at all times.

Fillable online Pag IBIG Fund Home Financing Documents Claim Stub