-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Kentucky Tax Forms

-

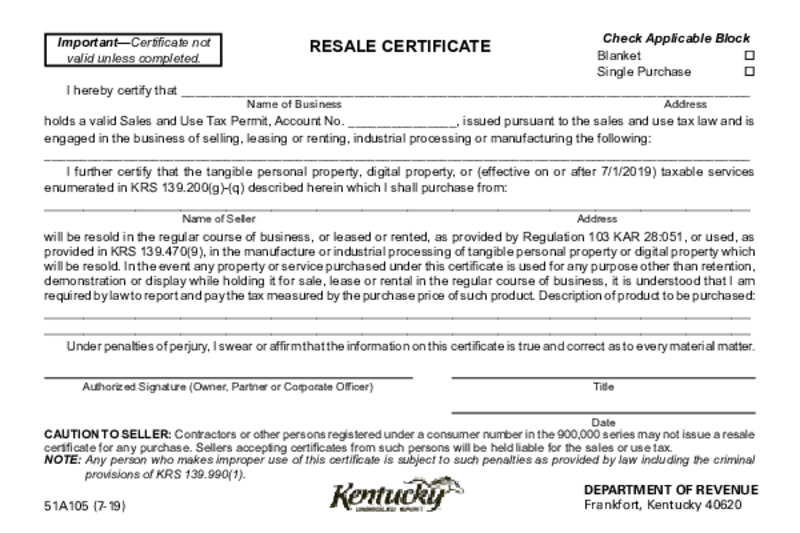

Form 51A105 - Resale Certificate (Kentucky)

What Is Form 51A105?

Form 51A105 is a legal document issued by the Kentucky Department of Revenue. It allows businesses to purchase items without paying sales tax, provided those items are to be resold in their business operations. The Resale Certificate

Form 51A105 - Resale Certificate (Kentucky)

What Is Form 51A105?

Form 51A105 is a legal document issued by the Kentucky Department of Revenue. It allows businesses to purchase items without paying sales tax, provided those items are to be resold in their business operations. The Resale Certificate

-

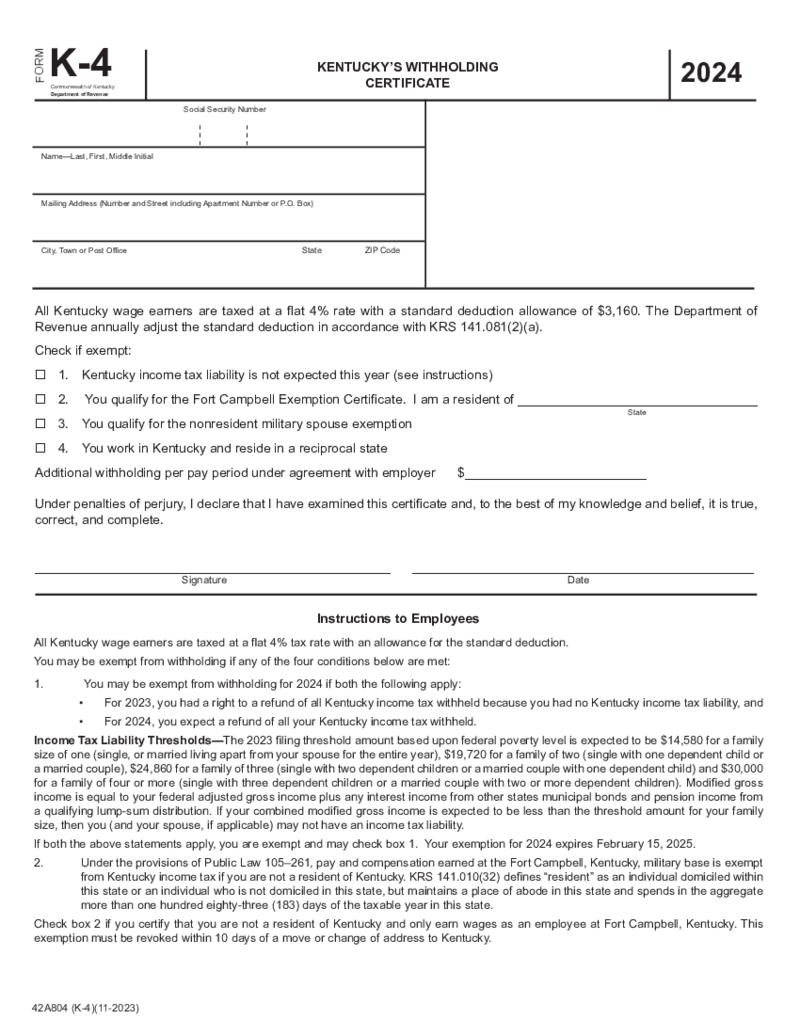

Kentucky Withholding Certificate - Form K-4

What Is the K 4 Form Kentucky?

The Kentucky K 4 withholding certificate is a state-specific document designed to help employers withhold the correct amount of Kentucky income tax from their employees' wages. This form accounts for an individual's

Kentucky Withholding Certificate - Form K-4

What Is the K 4 Form Kentucky?

The Kentucky K 4 withholding certificate is a state-specific document designed to help employers withhold the correct amount of Kentucky income tax from their employees' wages. This form accounts for an individual's

What are Kentucky Tax Forms?

Kentucky tax forms are official documents that are required by the local authorities from taxpayers who reside and work or just work in the state. It was provided by the Kentucky Department of Revenue for individuals and corporations to ease the tax records reports. These blanks are standard and have numerous similarities with the IRS blanks you need to feel for federal officials.

PDFLiner offers you a library with Kentucky state tax forms. The library is constantly growing since the new forms appear or the old ones are getting updated by the Kentucky government. You have to make sure you fill out the forms that were required from you before you send anything.

Most Popular Kentucky Tax Forms

If you are looking for specific Kentucky state tax withholding forms, you may use the search bar and quickly start filling them. However, many taxpayers don’t know which forms they need. For this situation, there is an explanation and support team on the official website of the Kentucky government. You may also check out the most popular blanks on PDFLiner and get the idea what tax payers usually complete if they live in Kentucky State. Read this list:

- Form 740. The document is known as Kentucky Individual Income Tax Return. This blank can be filled only by residents. It was provided by the Commonwealth of Kentucky Department of Revenue and must be sent there after you fill it. Make sure the document has the proper year on it before you complete it. Indicate your federal taxes, Kentucky adjusted gross income, itemized deductions, taxable income, and tax computations among other requirements. You can use this form with attachments based on your specific situation as a taxpayer.

- Form 740-X. The document is well-known as the Amended Kentucky Individual Income Tax Return. This blank is a lifesaver if you need to fix something in one of the Kentucky income tax forms. It can be anything from tax calculations to a change in the name or marital status. You need to be specific about the original data you’ve indicated in the previous form and the change you want to make. You have to write down the year of the previous form you sent.

- Schedule KW-2. It is known as Kentucky Income Tax Withheld. This is not a form but rather a schedule that indicates the total amount of withheld income tax that you’ve mentioned in the forms 740-NP-R, 740-NP, or 740. All the Kentucky tax withheld must be properly registered. This form must contain detailed information. You also have to include this form to report all withholding of taxes in Kentucky state. You don’t have to send this form with W2-G, W2, or 1099 documents.

- Form K-4. This is not just random Kentucky withholding tax forms, it is Kentucky Withholding Certificate. The form contains adjusted annual standard deductions according to the KRS rules. All the wage earners of Kentucky have the standard deduction allowance of $2 770 and are taxed with a 5 percent flat rate. You need to make sure that all the information indicated in the form matches.

- Form 740-NP-R. This is a standard Kentucky Income Tax Return but for non-residents. The document is similar to the income tax return that must be filled out by everyone who lives and works in Kentucky. Nonresidents also have to include information on their own home addresses. There are detailed instructions in the form.

Where Can I Get Kentucky Tax Forms?

Any documents from the state, whether they are Kentucky tax exempt forms or income reports can be found on the official website of the Kentucky Department of Revenue. This website contains a wide range of forms created by officials during these years. After you find the one you need, you can search for online editors to fill the document. A simpler alternative is to go to PDFLiner, find Kentucky tax return forms for your case and use the editor’s tools to complete the document there. You can later send it or save it on your device. Follow the next steps:

- Pick one of the forms you need and read the description.

- Press the button named Fill Online.

- Complete the form in the editor opened to you.

- Print it or send it online once you put in your e-signature which you also can make via PDFLiner.

FAQ:

-

Where to mail Kentucky state tax forms?

Kentucky forms must be sent to the Commonwealth of Kentucky Department of Revenue. Some forms can be sent online while others need to be transported by regular mail. You will see detailed instructions with addresses inside each specific form you open. If you don’t see the address, contact the department via the website.

-

How to send Kentucky tax forms?

If you were asked to send the form to the Kentucky Department of Revenue PO Box, you have to print the form, put the signature by hand, and go to the mail office. Use the address indicated in the form. Make sure you do it in advance since it takes longer time for regular mail to deliver to the department. If you need to send it online, you can do it via the website.