-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

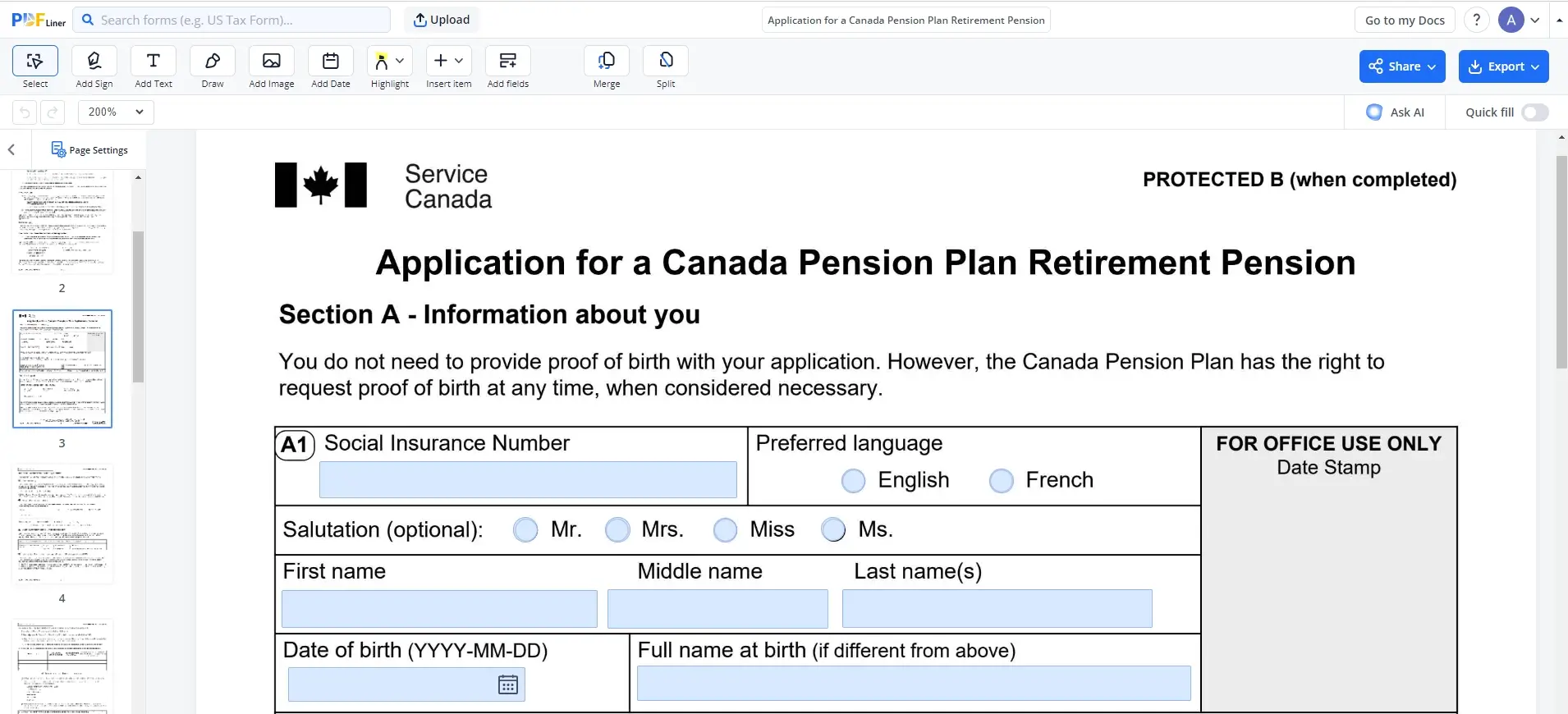

Application for a Canada Pension Plan Retirement Pension

Get your Application for a Canada Pension Plan Retirement Pension in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

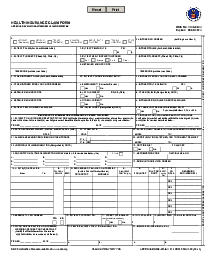

What Is ISP 1000 Form

Also known as Application for a Canada Pension Plan Retirement Pension, the ISP 1000 Form is an important document for individuals in Canada. Its fundamental purpose is to facilitate the application for the Canada Pension Plan (CPP) retirement pension. This form allows eligible individuals to claim their CPP benefits upon reaching the eligible retirement age, ensuring financial support during their retirement years. It plays a crucial role in securing retirement income for Canadian residents.

Who Should Use Canada Pension Form ISP 1000

The Canada Pension Plan Application Form ISP 1000 is used by individuals in Canada who wish to apply for the CPP retirement pension. Specifically, it should be used by:

- Canadian citizens and permanent residents;

- individuals who have reached the eligible retirement age;

- those seeking to secure financial support during their retirement years through the CPP.

How to Fill Out Application for Canada Pension Plan

To speed up the process of applying for a Canada pension, make the most of PDFLiner’s vast library of form templates. Take a browse through the selection and pick the right Canada Pension Application template. Then click on it, and it will open in the platform’s digital editor. You are now ready to fill out the 8-pager online. Here are 10 vital steps to follow if you want to successfully cope with this task:

- Start by carefully reviewing the document to understand its main elements.

- Specify your ID details, including your name, country of birth, address, and Social Insurance Number.

- Specify when you want your financial support to start.

- Provide information about your children.

- Enter your banking details.

- Indicate your current marital status, providing details if applicable.

- List your employment history, including periods of self-employment.

- Report your CPP contributions, including those made abroad.

- Disclose your earnings for the relevant years.

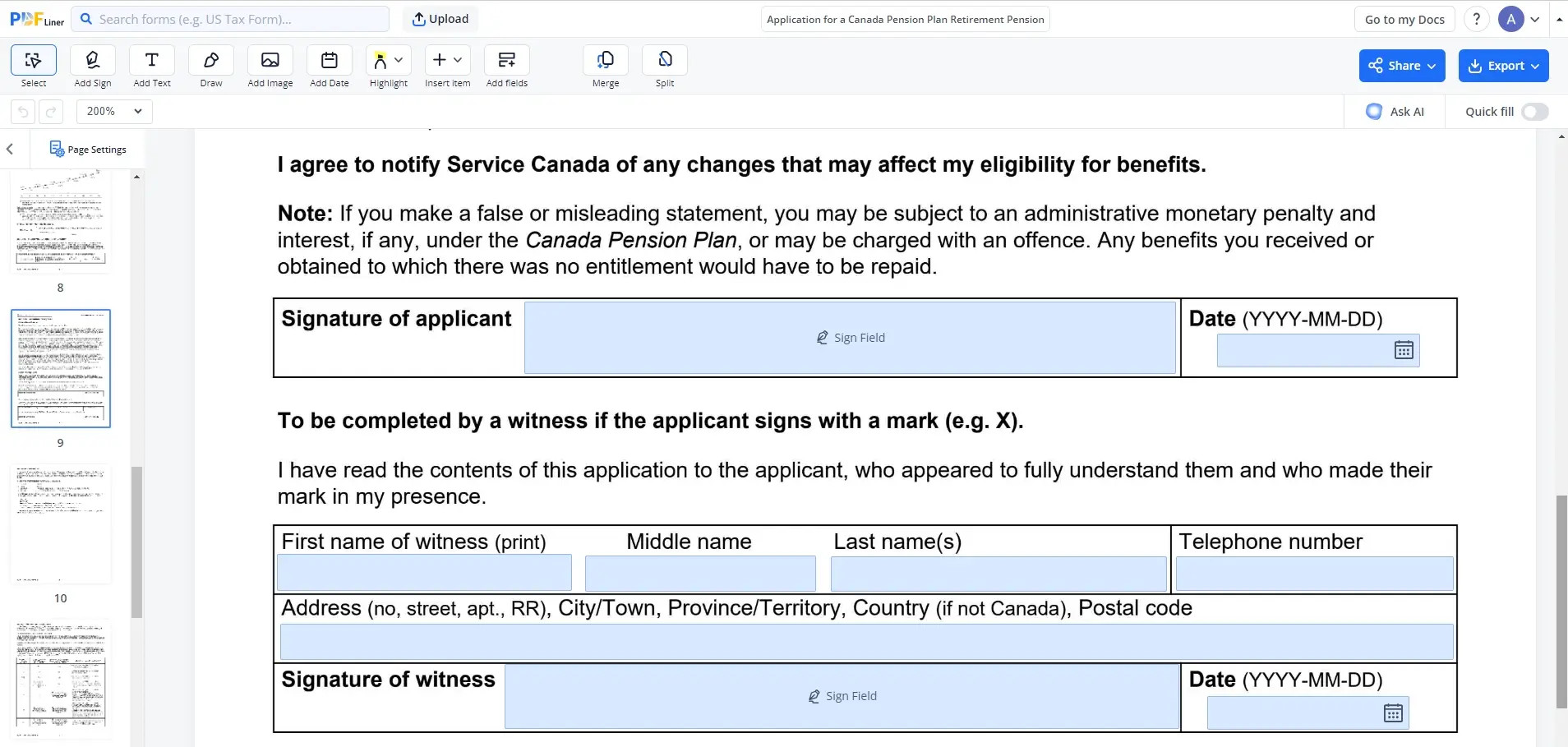

- Read and sign the declaration, certifying the accuracy of the information.

On the whole, completing Form ISP 1000 can seem pretty complex, but with these 10 structured steps, it becomes manageable. Don’t hesitate to ask for professional help if needed.

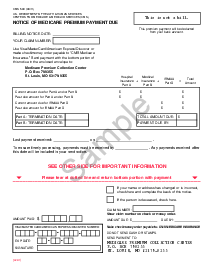

How to Apply for Pension in Canada

Applying for this kind of financial support is a straightforward process. Start by laying your hands on the required Canada old age pension application forms from Service Canada or find the right document template in the PDFLiner’s template catalog. Carefully complete the forms, ensuring their accuracy and completeness. Collect any supporting docs as requested. Finally, submit your application to Service Canada via mail or in person at a Service Canada Centre. Be prepared to provide personal and financial information to facilitate the application process.

FAQ: Canada Retirement Pension Popular Questions

-

How much can you receive from a CPP retirement pension?

The amount you can receive from CPP retirement support varies based on factors like your earnings history and the age at which you start receiving it. On average, the maximum CPP retirement support in 2023 is slightly over $1,200 per month, but individual amounts may differ.

-

Can you receive a CPP retirement pension while still working?

Yes. There is no requirement to stop working when you start receiving your CPP benefits. Your earnings may affect the amount you receive, depending on your income and age.

-

What happens if you delay your CPP retirement pension?

If you delay your CPP retirement support, you may receive higher monthly benefits when you eventually start receiving them. The increase depends on your age and how long you defer your CPP application, up to the age of 70.

Fillable online Application for a Canada Pension Plan Retirement Pension