-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

- 1099 Forms

- W-9 Forms

- Other Tax Forms

- Real Estate

- Legal

- Medical

- Bill of Sale

- Contracts

- Education

- All templates

![Picture of Legal Aid Queensland Application]() Legal Aid Queensland Application

Legal Aid Queensland Application

![Picture of Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment]() Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment

Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment

![Picture of Pennsylvania Last Will and Testament Form]() Pennsylvania Last Will and Testament Form

Pennsylvania Last Will and Testament Form

![Picture of Trustee Resignation Form]() Trustee Resignation Form

Trustee Resignation Form

![Picture of Letter of Intent to Sue]() Letter of Intent to Sue

Letter of Intent to Sue

![Picture of AU Mod(JY), Parent(s), Guardian(s) details]() AU Mod(JY), Parent(s), Guardian(s) details

AU Mod(JY), Parent(s), Guardian(s) details

![Picture of Pag IBIG Fund Special Power of Attorney for Accommodation Mortgagors]() Pag IBIG Fund Special Power of Attorney for Accommodation Mortgagors

Pag IBIG Fund Special Power of Attorney for Accommodation Mortgagors

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Other Templates

-

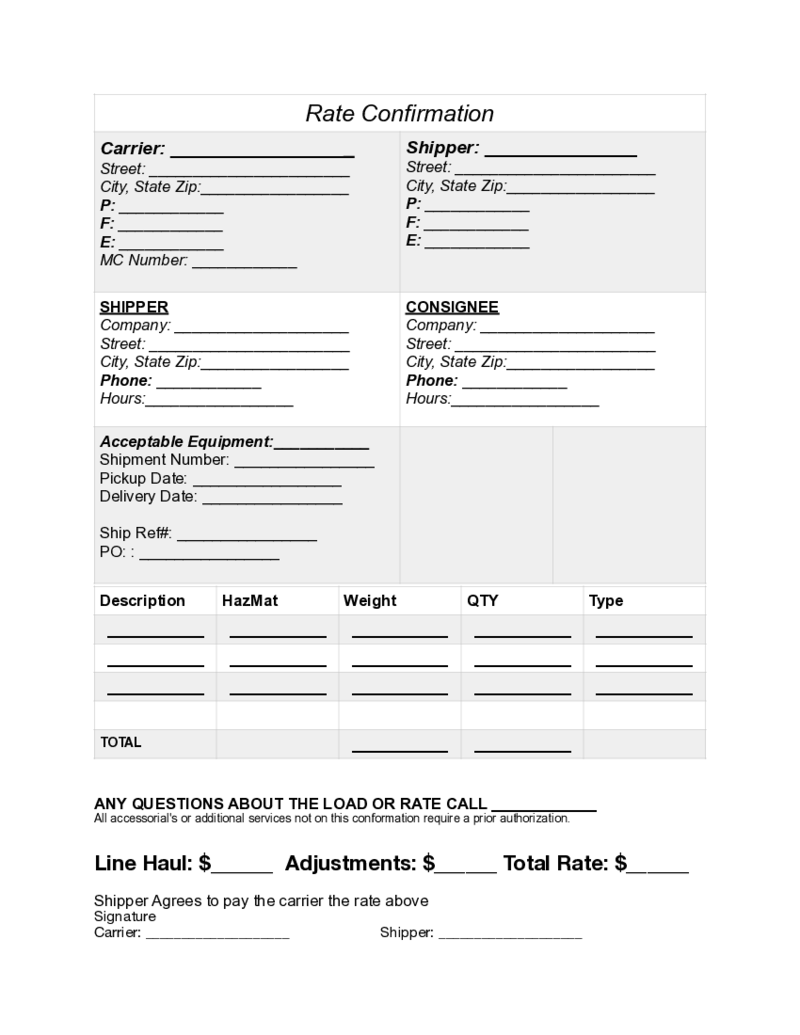

Load Rate Confirmation Template

What Is a Load Confirmation Sheet?

A rate confirmation trucking form is a document used for providing the load details for the carriers whom you have addressed. It acts as the rate and load data confirmation. It comes in the form of a one-page load

Load Rate Confirmation Template

What Is a Load Confirmation Sheet?

A rate confirmation trucking form is a document used for providing the load details for the carriers whom you have addressed. It acts as the rate and load data confirmation. It comes in the form of a one-page load

-

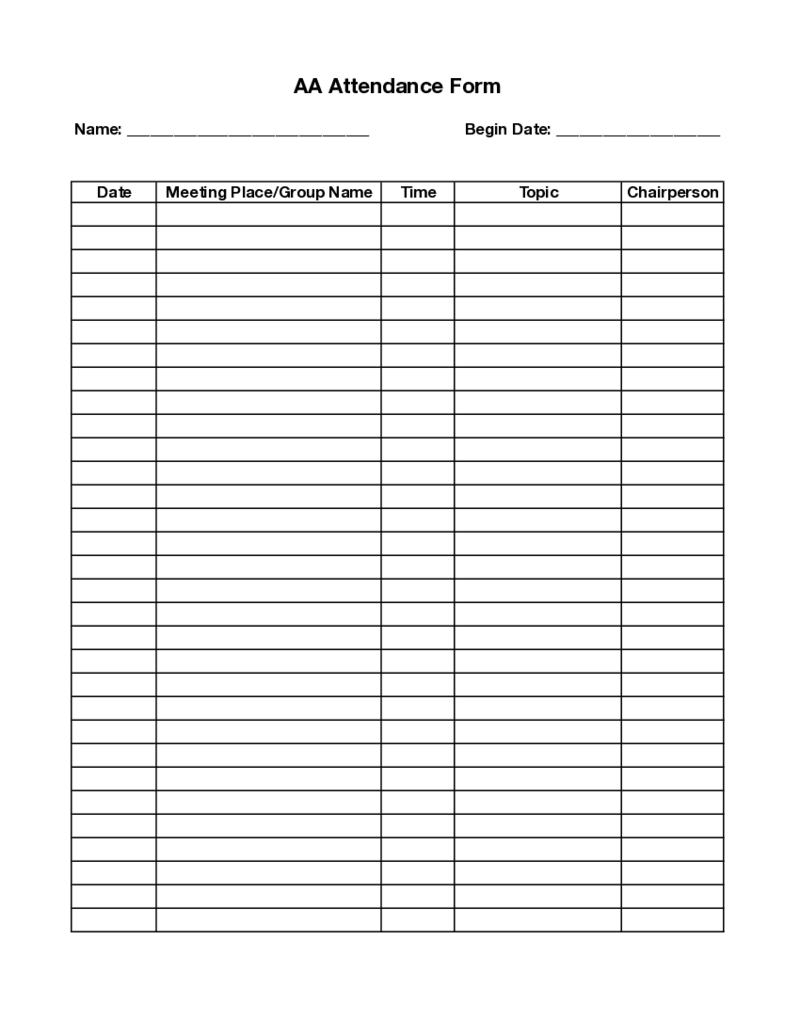

AA Attendance Form

What Is an AA Meeting Court Card Form?

An AA Court Card is a form used by individuals who have been charged with a driving under the influence (DUI) offense and are required to attend Alcoholics Anonymous (AA) meetings as part of their court-mandated sent

AA Attendance Form

What Is an AA Meeting Court Card Form?

An AA Court Card is a form used by individuals who have been charged with a driving under the influence (DUI) offense and are required to attend Alcoholics Anonymous (AA) meetings as part of their court-mandated sent

-

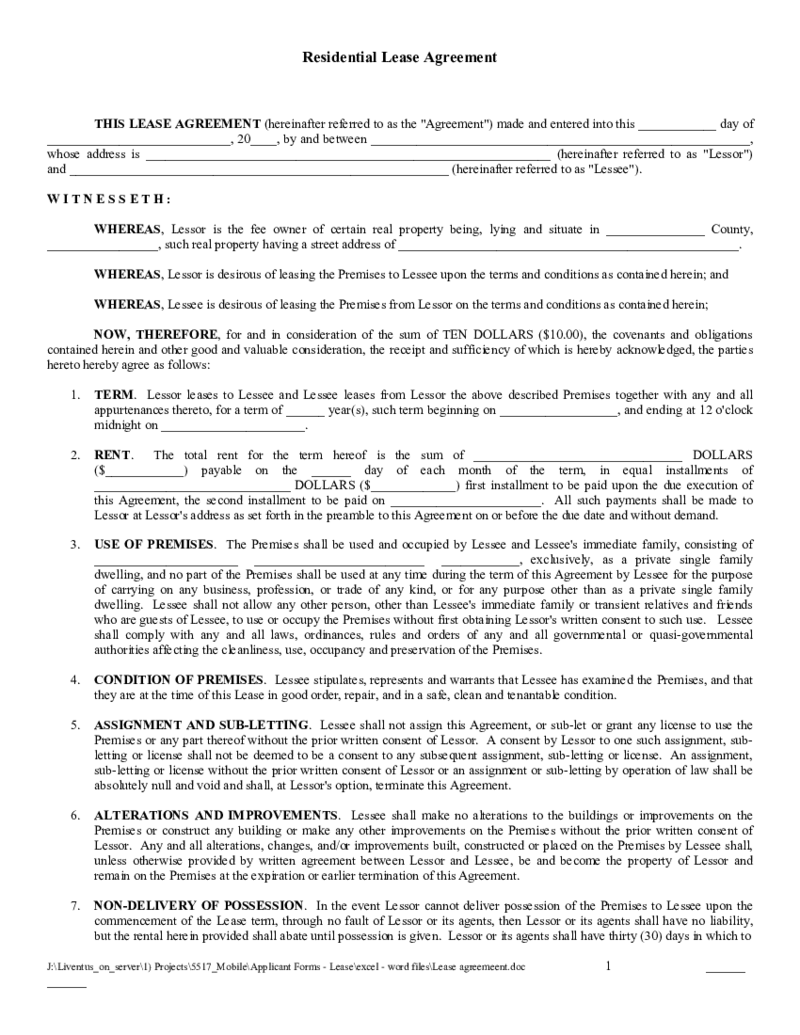

T 186 Lease Agreement Pdf

T-186 Lease Agreement

✓ Easily fill out and sign forms

✓ Download blank or editable online

T 186 Lease Agreement Pdf

T-186 Lease Agreement

✓ Easily fill out and sign forms

✓ Download blank or editable online

-

blank

What Is a Blank PDF?

Whenever you want to create a PDF file from scratch, you need a blank PDF. It is a clear canvas you can use to complete various types of tasks such as building a contract, invoice, writing an essay, etc. Nothing limits your possibilit

blank

What Is a Blank PDF?

Whenever you want to create a PDF file from scratch, you need a blank PDF. It is a clear canvas you can use to complete various types of tasks such as building a contract, invoice, writing an essay, etc. Nothing limits your possibilit

-

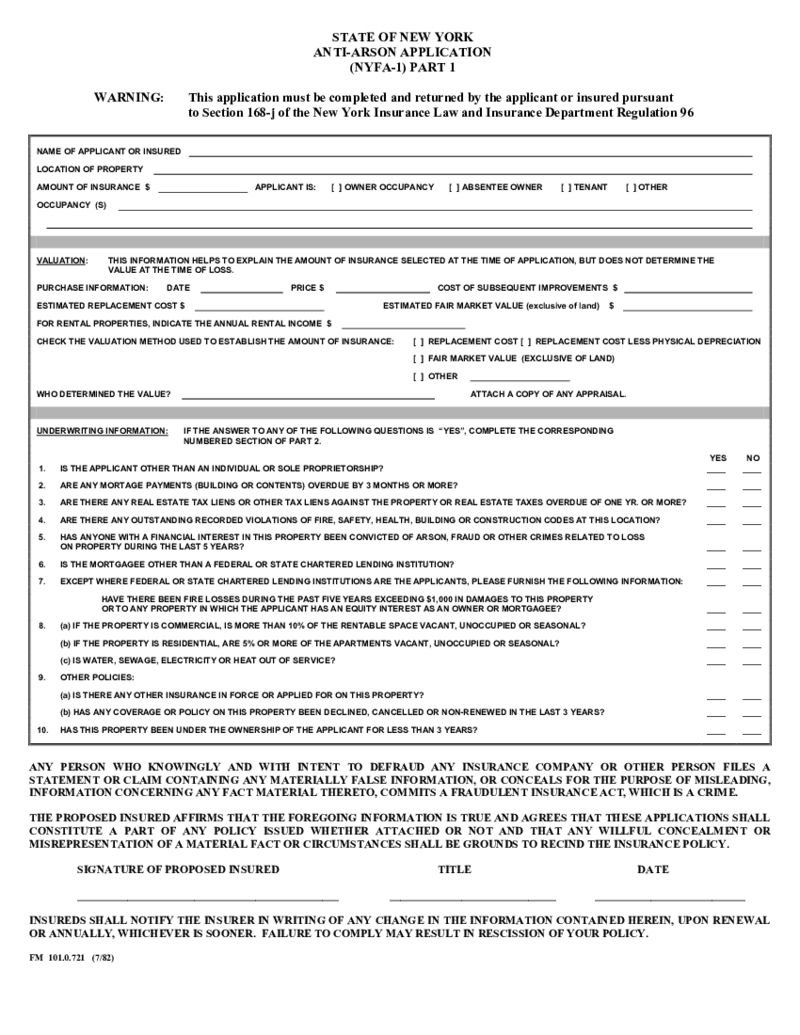

State Of New York Anti-Arson Application Part 1

Acquire a Printable State Of New York Anti-Arson Application Part 1 Online

Find the blank document in the PDFLiner documents library. First of all click "Fill this form" button, and in case you'd like to find it letter see t

State Of New York Anti-Arson Application Part 1

Acquire a Printable State Of New York Anti-Arson Application Part 1 Online

Find the blank document in the PDFLiner documents library. First of all click "Fill this form" button, and in case you'd like to find it letter see t

-

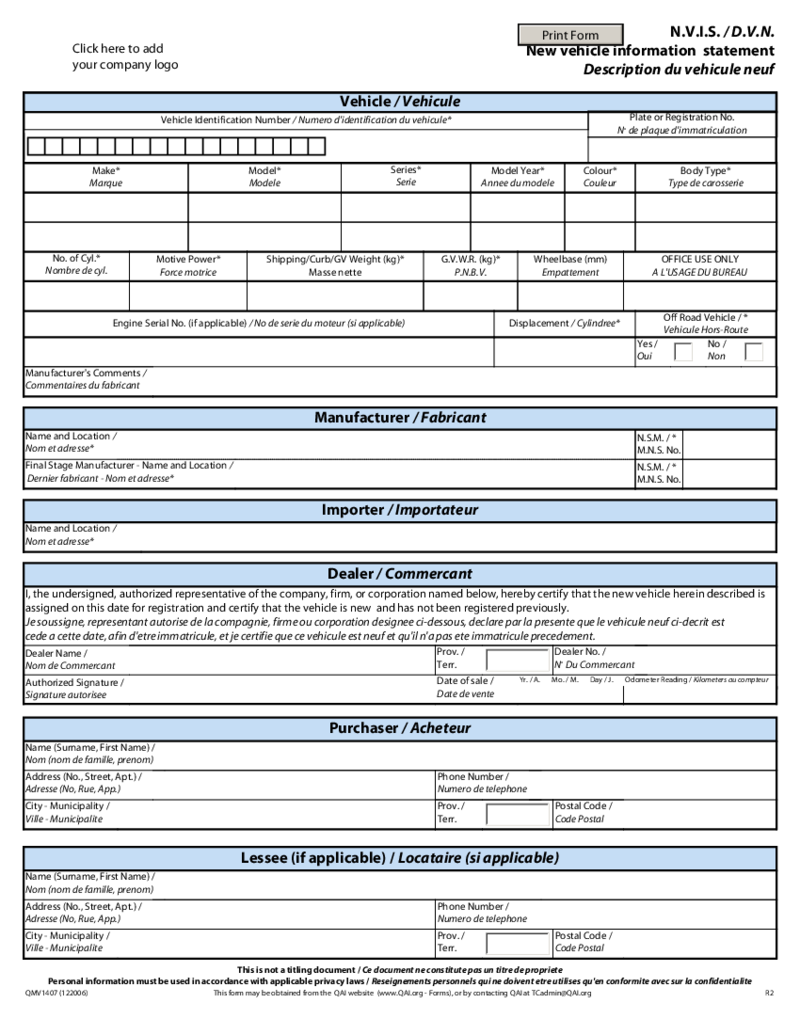

Nvis

Understanding the NVIS Form and Its Importance

The New Vehicle Information Statement (NVIS) is a document provided by vehicle manufacturers that contains important details about a new vehicle. This information is crucial for registration purposes and to e

Nvis

Understanding the NVIS Form and Its Importance

The New Vehicle Information Statement (NVIS) is a document provided by vehicle manufacturers that contains important details about a new vehicle. This information is crucial for registration purposes and to e

-

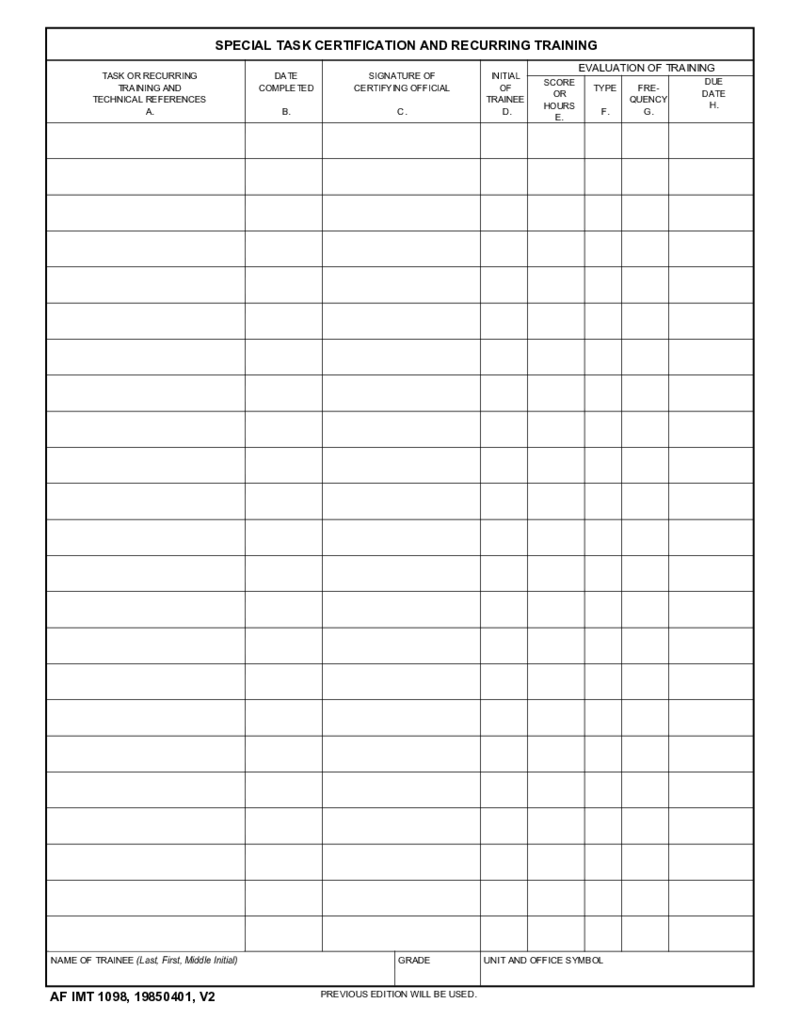

Af Form 1098

Where to Get Fillable Letter Of Surrender Of Property?

You can get the form online at here at PDFliner. Begin by clicking the "Fill this form" button or use the step-by-step instructions below to obtain the document letter:

Log

Af Form 1098

Where to Get Fillable Letter Of Surrender Of Property?

You can get the form online at here at PDFliner. Begin by clicking the "Fill this form" button or use the step-by-step instructions below to obtain the document letter:

Log

-

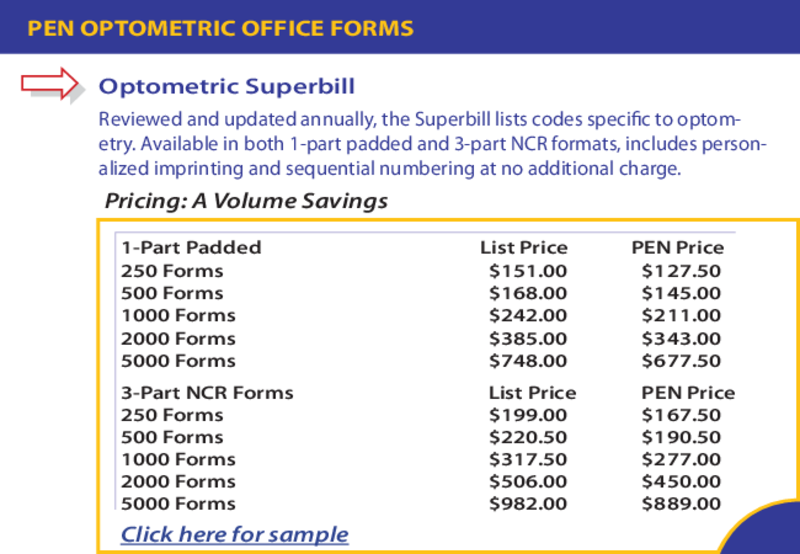

Optometry Superbill Pdf

How to Get a Fillable Optometry Superbill Pdf?

Find the blank document in the PDFLiner documents library. Start by hitting the "Fill this form" button or use the guide below to get the form letter:

Sign In to your account.

Optometry Superbill Pdf

How to Get a Fillable Optometry Superbill Pdf?

Find the blank document in the PDFLiner documents library. Start by hitting the "Fill this form" button or use the guide below to get the form letter:

Sign In to your account.

-

Employee of the Month Certificate Template

What Is Employee of the Month Template

An Employee of the Month template PDF is a pre-designed document used to recognize outstanding employees in an organization. This template typically includes sections for the employee's name, the month of recogni

Employee of the Month Certificate Template

What Is Employee of the Month Template

An Employee of the Month template PDF is a pre-designed document used to recognize outstanding employees in an organization. This template typically includes sections for the employee's name, the month of recogni

-

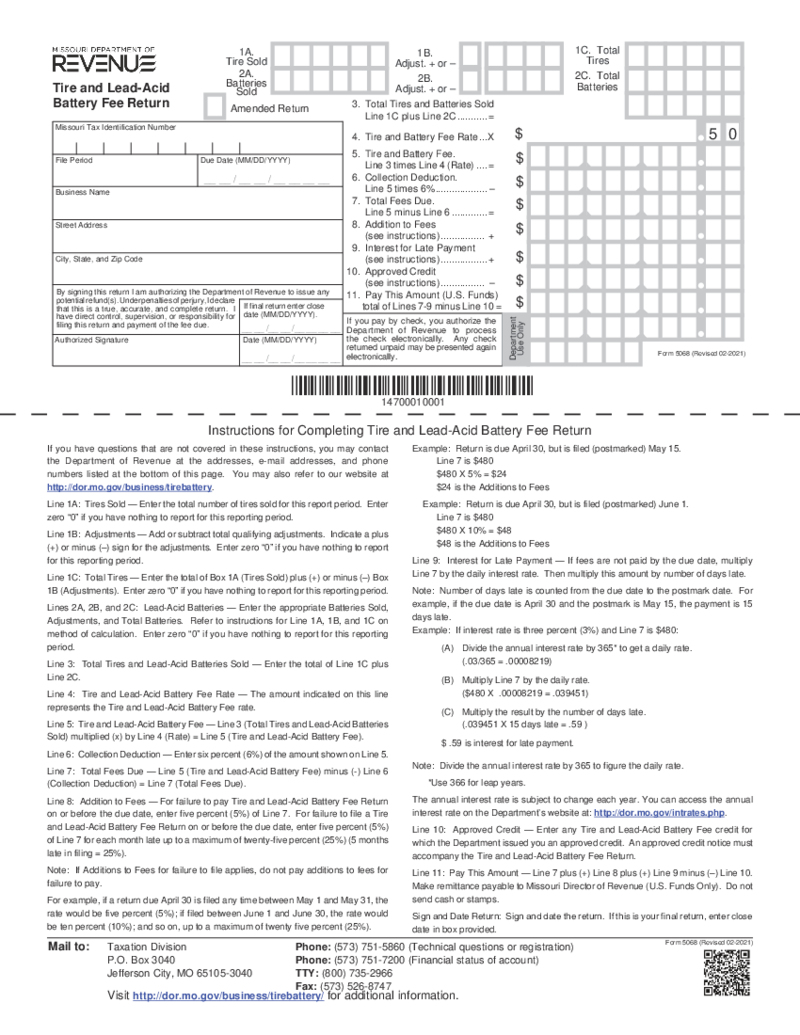

Missouri Form 53-1 (2021)

Information on Missouri's State Sales And Use Tax

Every business retailing tangible personal property or certain taxable services must pay sales tax in Missouri. As such, entities must collect, report, and remit this tax to the Missou

Missouri Form 53-1 (2021)

Information on Missouri's State Sales And Use Tax

Every business retailing tangible personal property or certain taxable services must pay sales tax in Missouri. As such, entities must collect, report, and remit this tax to the Missou

-

Blank Pleading Template

What Is a Blank Pleading Template Form?

A blank pleading form template is a legal document that outlines the facts and arguments a party presents to a court in a legal dispute. A blank pleading template form is a pre-formatted document that allows individ

Blank Pleading Template

What Is a Blank Pleading Template Form?

A blank pleading form template is a legal document that outlines the facts and arguments a party presents to a court in a legal dispute. A blank pleading template form is a pre-formatted document that allows individ

-

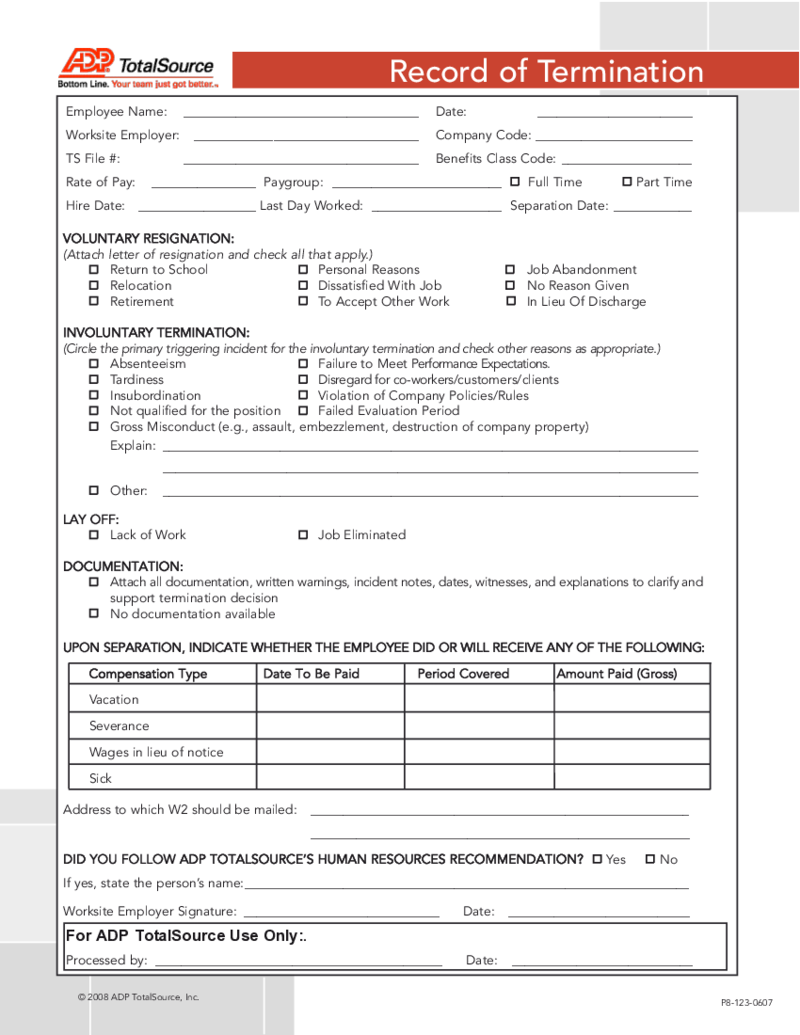

ADP Termination Form

ADP Termination Form: A Guide to Editing and Filing

The ADP Termination Form is a critical document used by businesses when terminating an employee's services. It simplifies the process of documenting the termination, ensuring all necessary informatio

ADP Termination Form

ADP Termination Form: A Guide to Editing and Filing

The ADP Termination Form is a critical document used by businesses when terminating an employee's services. It simplifies the process of documenting the termination, ensuring all necessary informatio