-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

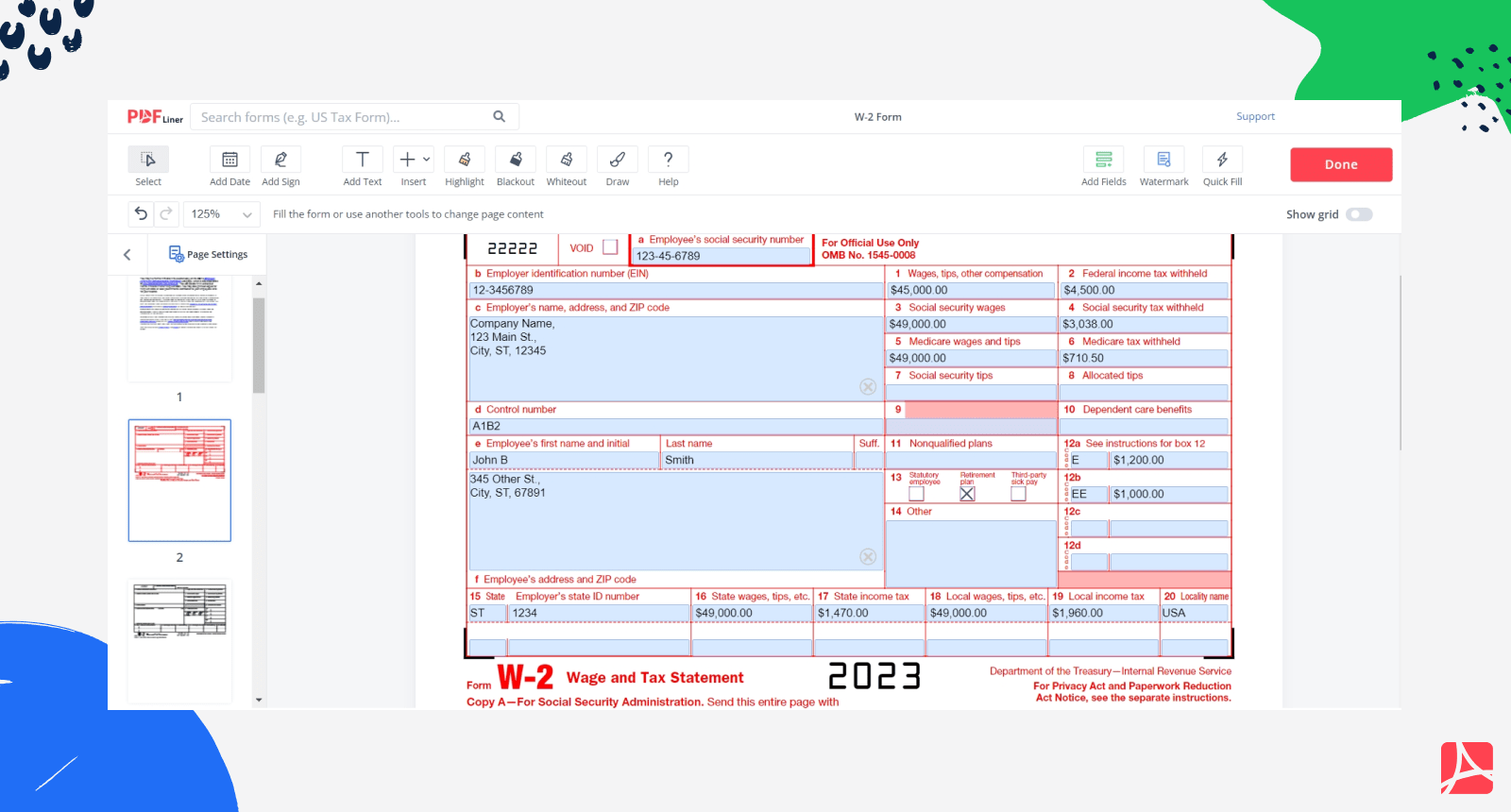

How to Fill Out a W-2 Form in 2022 and 2023: Complete Instructions

.png)

Dmytro Serhiiev

Still wondering ‘How to Fill Out Form W-2'? Being officially employed comes with a lot of bureaucracy, which is as perplexing as necessary. For each yearly tax return, an employer, and employee must handle several forms, like W-2, 1099, 1040, etc., to reflect on their income. Let’s take a thorough look at W-2 and what to do with it to file your taxes correctly.

.jpeg)

What Is a W-2 Form and Where to Get It?

Also referred to as the Wage and Tax Statement, Form W-2 is issued by the IRS to monitor and collect data about your income and taxes. Yearly, an employer is to send the document to each full-time employee to juxtapose the employee’s income information with their records. Moreover, it shows the number of taxes, which were subtracted from the previous year’s income to submit this information to the Social Security Administration.

.png)

While the purpose and procedures of W-2 are clear, the whole sending-and-receiving process is complicated. The document is obtained by an employer to be sent to an employee. After that, the employee sends it to the employer, who submits it to the SSA. Finally, the form goes back to the IRS.

Upon collecting all the necessary information, you need to get the form. Normally, the employer will send you one by Jan 31 so that you can complete the document in the following two months. But how to get W-2 from the IRS if your employer hasn’t provided it for you? Access the IRS’s official website and download it, after that you can fill it out by yourself with data provided by your employer. In case you need to find 2022 W-2 click the bellow button and open it using PDFLiner editor.

How to Fill Out a W-2 Form?

Form W-2 is simple, it has several copies, but in PDFLiner once you filled out the first copy the rest of the form will be completed automatically. So let's take a look at the process line by line:

Line a: First of all, enter an employee SSN, so IRS can identify the tax payer correctly.

Lines b, c, d: These lines should include information about employer. Enter EIN, Employer's name and address with ZIP code. Also, add the company control number, which is an article in which this W-2 form is registered in the employer’s accounting records.

Lines e and f: Here you should add the employee's personal information. Write the name and home address with ZIP code.

.png)

Line 1: Sum up all the taxable wages, tips and other compensations that were paid to the employee during the year. Enter the total amount in this line.

Line 2: Write here a total amount of the federal tax withheld, and don't forget about the 20% of tax withheld on excess parachute payments.

Line 3: Present the entire amount of wages earned before taxes were removed, excluding social security and allocated tips. In later years, the amount should be changed if there is any gain or loss due to the expiry of the possibility of forfeiture.

Line 4: Find the total sum of employee social security taxes withheld in 2022, including those taken out of tip wages (in 2023 they should not be more than $9,932.40 ($160,200 × 6.2%). Do not report any taxes you paid yourself; only include the deductions taken directly from an employee's wages and tips.

Line 5: Income taxed for social security (lines 3 and 7) is the same earnings that are taxable for Medicare, but this one has no limits. Enter the entire amount of salary and tips in line 5. Make sure to include any tips the employee declared, even if you weren't able to collect the Medicare tax on that money.

Line 6: Provide the total amount of Medicare tax withheld from employee earnings in the current 2023 year, excluding the individual's share.

Line 7: Regardless of a lack of sufficient funds, you must still report the tips your employee reported to you. The combined total for lines 3 and 7 should be no greater than $160,200, which is the ceiling for the 2023 Social Security wage base.

Line 8: If you own or run a big restaurant or bar, you should make sure to display the tips earned by the worker.

Line 10: Provide a total of the benefits associated with the dependent care assistance program (section 129) that were given to your employee.

Line 11: Use this line to find out if any of the sum listed in line 1 or lines 3 and 5 was acquired in a prior year. The SSA utilizes this information to make sure the social security earnings test has been accurately administered and the correct amount of benefits has been dispensed.

Lines 12: Enter the relevant codes in the section dedicated to the items mentioned below and a next to them write a total amount. Pay attention that the codes have no connection with boxes 12a through 12d of Form W-2. When only one code (for example, C) needs to be filed, you can place the code in 12a and the associated amount on the W-2 Form. Do note enter more than 4 items in this section. Use the following codes:

- Code A — Uncollected social security or RRTA tax on tips.

- Code B — Uncollected Medicare tax on tips.

- Code C — Taxable cost of group-term life insurance over $50,000.

- Code D — Elective deferrals under a section 401(k) cash or deferred arrangement (plan).

- Code E — Elective deferrals under a section 403(b) salary reduction agreement.

- Code F — Elective deferrals under a section 408(k)(6) salary reduction SEP.

- Code G — Elective deferrals and employer contributions (including nonelective deferrals) to any governmental or nongovernmental section 457(b) deferred compensation plan.

- Code H — Elective deferrals under section 501(c)(18)(D) tax-exempt organization plan.

- Code J — Nontaxable sick pay.

- Code K — 20% excise tax on excess golden parachute payments (not applicable to Forms W-2AS, W-2CM, W-2GU, or W-2VI).

- Code L — Substantiated employee business expense reimbursements.

- Code M — Uncollected social security or RRTA tax on taxable cost of group-term life insurance over $50,000 (for former employees).

- Code N — Uncollected Medicare tax on taxable cost of group-term life insurance over $50,000 (for former employees).

- Code P — Excludable moving expense reimbursements paid directly to a member of the U.S. Armed Forces.

- Code Q — Nontaxable combat pay.

- Code R — Employer contributions to an Archer MSA.

- Code S — Employee salary reduction contributions under a section 408(p) SIMPLE plan. S

- Code T — Adoption benefits.

- Code V — Income from the exercise of nonstatutory stock option(s).

- Code W — Employer contributions to a health savings account (HSA).

- Code Y — Deferrals under a section 409A nonqualified deferred compensation plan.

- Code Z — Income under a nonqualified deferred compensation plan that fails to satisfy section 409A.

- Code AA — Designated Roth contributions under a section 401(k) plan.

- Code BB — Designated Roth contributions under a section 403(b) plan.

- Code DD — Cost of employer-sponsored health coverage.

- Code EE — Designated Roth contributions under a governmental section 457(b) plan.

- Code FF — Permitted benefits under a qualified small employer health reimbursement arrangement.

- Code GG — Income from qualified equity grants under section 83(i).

- Code HH — Aggregate deferrals under section 83(i) elections as of the close of the calendar year.

Line 13: Use a checkbox that applies to the employee:

- Statutory employee: Check this box for people who are classified as statutory employees, meaning their earnings are taxable for social security and Medicare taxes, but there is no need to withhold federal income tax from paychecks. However, do not check this box for individuals who are categorized as a common-law employee.

- Retirement plan: Check this box if the worker was involved in the retirement plan in any capacity during the year.

- Third-party sick pay: Check the box below only if you are a third party who will be reporting sick pay payments with a Form W-2 for an insured employee, or if you are an employer filing payments made by a third party. Please refer to Section 6 of Publication 15-A for more information.

Line 14: If you included the full amount of the vehicle's lease in the employee's income, it should either be reported in this box or on a separate statement presented to your employee. Additionally, you can use this box for any other information that you want to convey to your employee.

Lines 15-20: You have to indicate income taxes both for your state and local income. It’s very important to file both accordingly since your tax return depends on them.

Fill out a W-2 Form 6596e0950573f9514908ee3a

How to Read a W-2?

Although many people wonder how to file for taxes without W-2, it’s practically impossible if you are a registered worker. The form itself consists of essential information for your taxation and binds you to your current employer. However, don’t be overwhelmed since the form itself is not as complex as, for instance, Form 1040.

With the document consisting of copies A, B, and 1, the former is used strictly for displaying what the original form includes. It’s done to prevent people from confusing similar forms or misstepping while filing. Meanwhile, Copy B is meant for filling out by an employee and can be handled online if you know how to access W-2 online.

Finally, Copy 1 is an optional form with the same requirements and information. It’s used as a counterpart for submitting it to other authorized bodies or simply sending it to the employer for keeping.

The first thing you need is the employer’s business information to facilitate identification. Their SSN, EIN, and address, as well as the name and control number, are provided by the employer or even filed by themselves. Next comes your tax information. If you know how to get a W-2 from an old job, then completing and calculating your overall income and withheld taxes should be easier. At the end of the form, there are fields for state and local income and taxes to add.

How to File W-2?

After completing the form and checking it for errors, you have to submit it to the IRS and send a copy to the employer. The IRS uses this information to determine your entitlement to certain benefits and calculate your overall tax obligation. If the office finds that you have overpaid your standard income tax obligations, you will be notified. Consequently, you may file for a refund with your next tax return if you are aware of how to get a previous year’s W-2 form.

The due time for handling the form is strict. The employer is to send a copy to fill out by Jan 31 of the current year. While you complete the form for your past year’s income and taxes, you have exactly 2 months to finish and submit it. With Apr 15 as the deadline, the IRS has to receive it timely to proceed with your tax return.

In case you fail to do so, there will be penalties. If your delay is minor, and the form is submitted in the following month, the penalty amounts to $50. Otherwise, the total penalty can exceed $500,000 yearly.

Printable W-2 Form 6596e0950573f9514908ee3a

FAQ

Do you have any other questions related to how to get an old W-2 form or its completion? Take a look here!

How to get a copy of a W-2?

A copy of the form is normally sent to you by the employer if your annual earnings are over $600. If not, you can download it from the IRS’s official website (see how to get your W-2 online).

Who has to file W-2?

The form is filed by an employee to show their official income and income taxes. While the form is mostly completed by a worker, some information is to be provided by the employer, like the employer’s SSN, EIN, legal name, address, etc.

How to get W-2 from a previous employer?

The process of how to get a copy of W-2 fast by accessing your previous employment is rather easy. Simply contact your prior employer’s HR department and request the form.

How to get a lost W-2 from previous years?

In case of a loss or misstepping, W-2 can always be accessed through the IRS itself. By writing an official statement about your inability to obtain a copy from your previous employment place, you can be provided with one from the IRS’s archive.

How to find AGI on W-2?

There is no AGI on your W-2 simply because you calculate your Adjusted Gross Income by using the W-2 amounts as a component. You AGI is normally located on your 1040.

How to generate W-2 forms?

To simplify filing Form W-2, you can always use digital generators that know how to get W-2 online and fill it out automatically. All you need to do is provide the platform with the requested information. The generator will analyze your data, make amends, and send the complete form to the IRS.

How to get Walmart W-2?

By Jan 31, Walmart publishes a copy of the W-2 form to be filed by the store’s employees. It will be sent to your official employee’s account automatically, or you can download it yourself if you are aware of how to find W-2 online. Either way, the form is completely the same for both cases.

File Taxes Online at No Time with PDFLiner

Start filing your taxes electronically today and save loads of time!

Fillable W-2 Form 6596e0950573f9514908ee3a