-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

Filling out Form 4506-C: The Basics

.png)

Dmytro Serhiiev

If you want to know more about form 4506-C, we’ve got you covered. In this article, we’ll let you in on the basics of what IRS form 4506 is and how to fill it out. Keep reading for further details and be ready to approach your tax preparation the smartest way possible.

Blank Form 4506-C 6391f2c02a21f3cea30542bf

What Is Form 4506-C

-min.png)

The IRS tax form 4506-C is a document utilized by authorized third parties for retrieving a taxpayer’s return data for the purpose of income verification. The 4506 tax form differs from 4506-C in the way it is granted to the applicant. The former represents retrieved tax return data in the form of an exact photocopy, while the latter is provided in the form of transcripts. You can learn how to get form 4506-C in one of our previous blog posts. Read on to find out how to complete form 4506-C.

Form 4506-C 6391f2c02a21f3cea30542bf

How to Fill Out Form 4506-C

You can find the 4506-C template via our extensive catalog, or head to the official IRS website to get the form if that’s more convenient to you. Form 4506-C is a two-page doc that consists of the actual fillable form (page one) and the instructions for it (page two). Need form 4506 instructions? Head to the corresponding post on our website.

Form 4506-C should be completed accurately and correctly, just like any other tax form. Make sure you only sign the form when you fill out all the fields it comes with. In case you feel that the process is way too challenging for you, don’t hesitate to turn to a professional bookkeeper to lend you a helping hand.

Find a detailed line-by-line guide on how to fill out form 4506-C below:

Line 1a. Type the name of the taxpayer on the tax return.

Line 1b. Indicate the SSN of the taxpayer.

Line 2a. Type the name of the spouse based on the latest tax return.

Line 2b. Type the SSN of the spouse.

Line 3. Insert the current name (in case it differs from Line 1a) and address.

Line 4. Indicate the address based on the latest tax return (in case it differs from the information on Line 3).

Line 5a. Enter the IVES participant’s name and contact details.

Line 5b. Specify customer file number (read the instructions for more details).

Line 6. Indicate the tax return form utilized by the taxpayer within the latest year requested.

Line 6a-c. Check one of the three boxes to specify the transcript type you need.

Line 7. Check the box if you need form W-2, 1099 series, 1098 series, or 5498 series transcript.

Line 8. Indicate the year or period needed in the format mm/dd/yyyy.

Now, bear in mind that the box above the signature (and slightly to the left) must be checked in order for the form to be accepted by the Internal Revenue Service.

Don’t forget to specify the signer’s name below their signature and indicate the full date of the signature. The IRS won’t accept the form if the date exceeds 120 calendar days from the signature date to the date when the form is processed by the IRS.

Here are some useful tips on how to fill out form 4506-C correctly:

- print clearly or type;

- fill out the form using black ink only (or just fill it out online);

- avoid crossing out or using correction fluid: in case of errors, just fill out a new form (or just use PDFLiner to complete the form online, i.e. error-less-ly).

If you’re looking for the most convenient way to fill out form 4506-C, then you should definitely do it online via PDFLiner. With our straightforward service and its multiple handy features, you’ll go paperless (as well as errorless), streamline your document workflow, while saving lots of money and effort along the way.

Last but not least, don’t forget that filling out the 4506 form online is also a very wise, time-saving choice.

How to Sign Form 4506-C

Did you know that e-signatures come with multiple advantages like enhanced security, eco-friendliness, the possibility to sign documents on the go wherever you are, and much more? On an additional plus side, digital signatures are legally recognized in every state and U.S. territory where federal law applies.

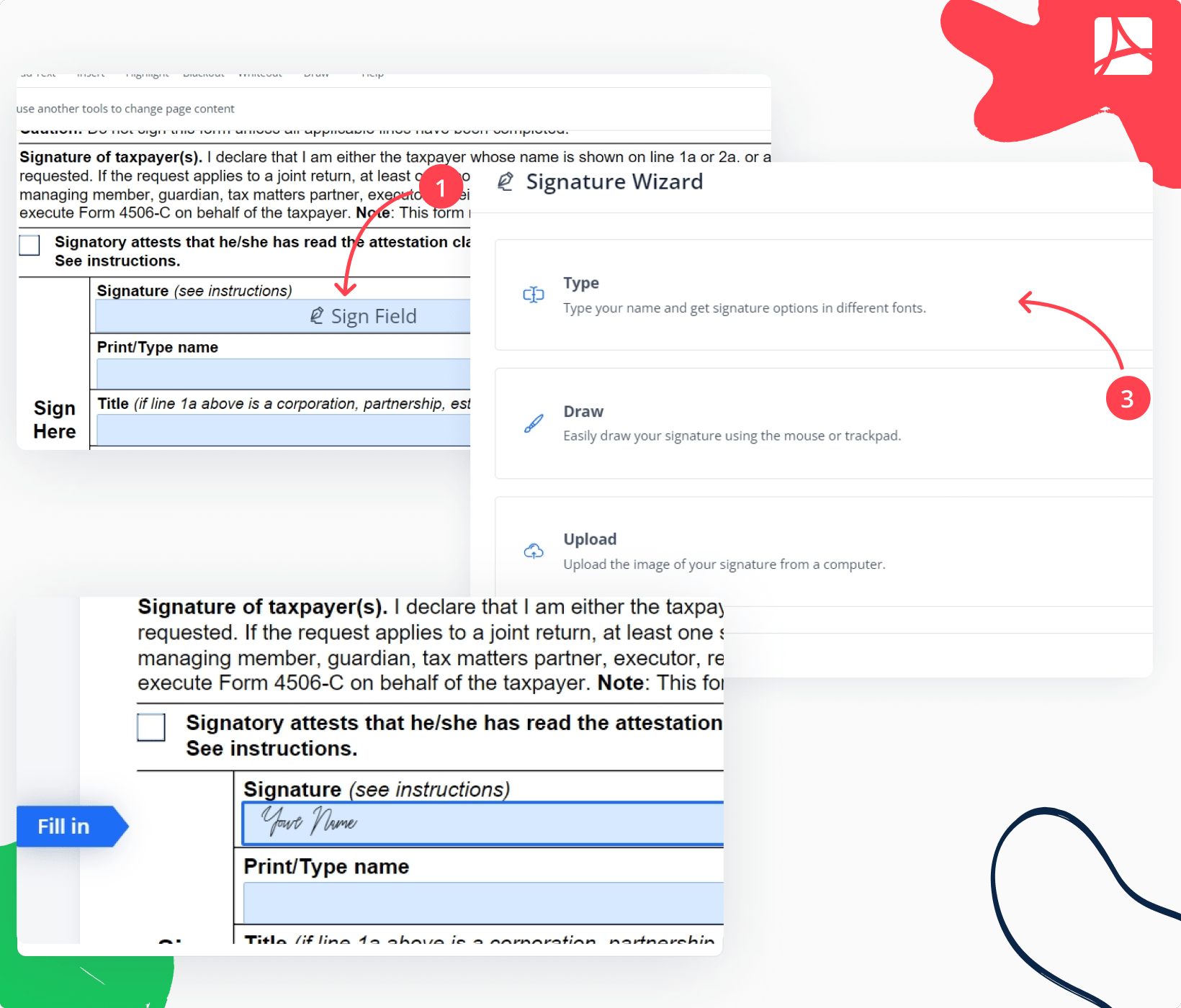

Here’s a quick step-by-step guide on e-signing your 4506-C via PDFLiner:

1. Hit ‘Sign Field’ at the end of the first page.

2. Tap ‘Add New Signature’ when the Signature Wizard launches.

3. Select how you want your signature generated out of these three options: Type, Draw or Upload. That’s about it!

If you have some questions left, explore a detailed guide on how to sign Form 4506-C on our site.

How to File Form 4506-C

Form 4506-C (which is also commonly referred to as IVES Request for Transcript of Tax Return, by the way) is completed by the Income Verification Express Service (IVES) participants (most frequently mortgage lenders whose goal is to verify a borrower’s income during the loan application process).

Once the form is filled out and thoroughly checked, the IVES participant faxes it with the approved IVES cover sheet to their assigned Service Center. Make sure you avoid sending the form directly to the IRS address. Bear in mind that the IRS must receive the 4506-C form within 120 days of the signature date.

Fill out 4506-C Form 6391f2c02a21f3cea30542bf

FAQ

What is the difference between 4506-C and 4506-T?

IRS form 4506-C replaced form 4506-T, so, basically, they represent one and the same notion. Starting from May 2021, the IRS only accepts form 4506-C when tax data retrieval is necessary.

Where to mail form 4506-C?

Upon completing the form, the IVES participant sends it with the approved IVES cover sheet to their allocated Service Center. Do not send the form directly to the IRS address.

When to fill in 4506-C?

If you want the form to be successfully accepted, fill it out and sign it with the following important factor in mind: the IRS must receive the file within 120 days of the signature date.

File Taxes Online at No Time With PDFLiner

Start filing your taxes electronically today and save loads of time!

Fill Out 4506-C Form 6391f2c02a21f3cea30542bf