-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

How to Fill Out Form 1040-SR Effortlessly

.png)

Dmytro Serhiiev

IRS Form 1040-SR is the version of Form 1040 for seniors – those of 65 years and older. With no content differences, it might be easier to fill out for many, for example, with weakened eyesight or other health issues. For the IRS, a simple tax return for seniors is rather new; it was introduced in 2019.

Fillable 1040-SR 6596d4d03f949ca16a0e25ca

What Is Form 1040-SR

Form 1040 (in all versions) is designed for the individual income tax return and must contain information on the income a person received during the financial year. In 2019, the IRS issued the 1040-SR form, with larger print. The difference between 1040 and 1040-SR is mostly in design: both the fonts and the spaces are larger. When it comes to the content, Form 1040-SR skips expanded income categories and income tests.

Though a bit simplified, it still requires attention and care when being filled. It might also require schedules if you have extra income sources not specified in it, or a reason to claim a tax deduction. Probably Form 1040 schedule R (Credit for the Elderly or the Disabled) will be of the most interest, but others might apply too.

Here is an instruction on how to get Form 1040-SR. Even if it’s not time to fill it out yet, you can learn more about it beforehand, to save the April rush.

1040-SR Form 6596d4d03f949ca16a0e25ca

Who Can Use the 1040-SR Form

The form is designed as an option of a tax return for seniors. So, if you are 65 or older by the end of the financial year, you can use 1040-SR instead of the regular 1040. You can also use it if you are younger, have a spouse of 65 or older, and opt for a joint tax return.

How to Fill Out Form 1040-SR

There is little difference between how to fill out Form 1040-SR and the regular 1040, and if you have no exotic income sources, there is none at all. While most of the lines are quite clear, there are some that need a deeper explanation. It’s another reason to fill out Form 1040-SR on PDFLiner as all the instructions are right here. The rest is even clearer than on the IRS site because our instructions offer more focused explanations.

If there are any schedules to file with your tax return, fill them first, as you will need to enter some data from them in your 1040-SR. They are also available on PDF Liner and are just as easy to fill and file, as well as to check with.

Fillable 1040-SR 6596d4d03f949ca16a0e25ca

Page 1

-min.png)

- Select your filing status carefully. You only need your spouse’s SSN if you file a joint return.

- Tick the boxes in the “Standard Deduction” section that describe you or your spouse.

- Specify your income sources. The amount in Line 9 must be the sum of all the amounts in the lines above, no matter tax-exempt or not.

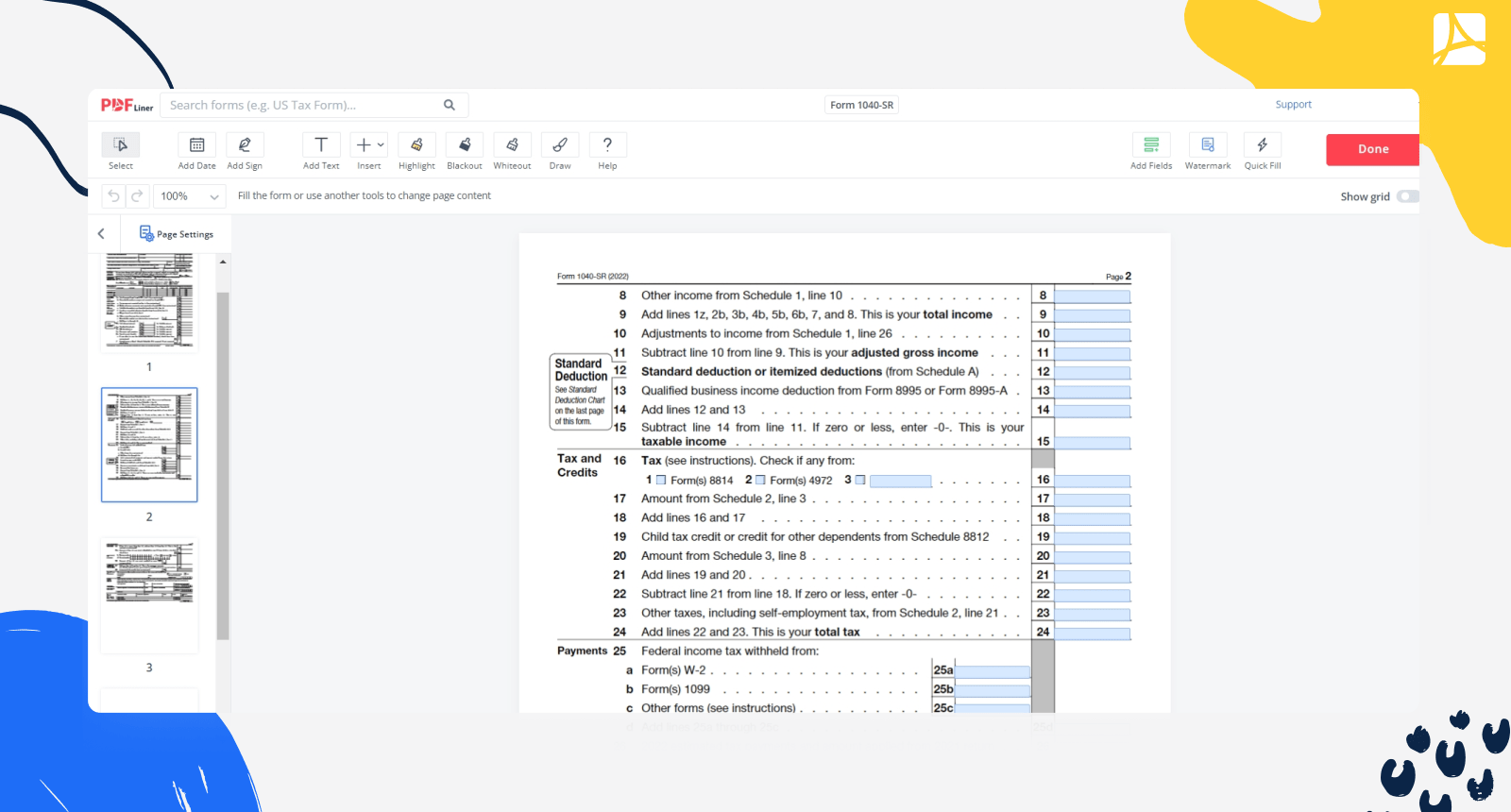

Page 2

- Your actual taxable income is the amount on Line 15. It’s Line 11 minus Line 14.

- On Line 25-a, if you work and get a salary, enter the federal tax withheld from Form W-2 when you receive it from your employer.

- On Line 25-b, if you were paid as an independent contractor, enter the federal tax withheld of all the payments from your clients along with the copies of their Form 1099.

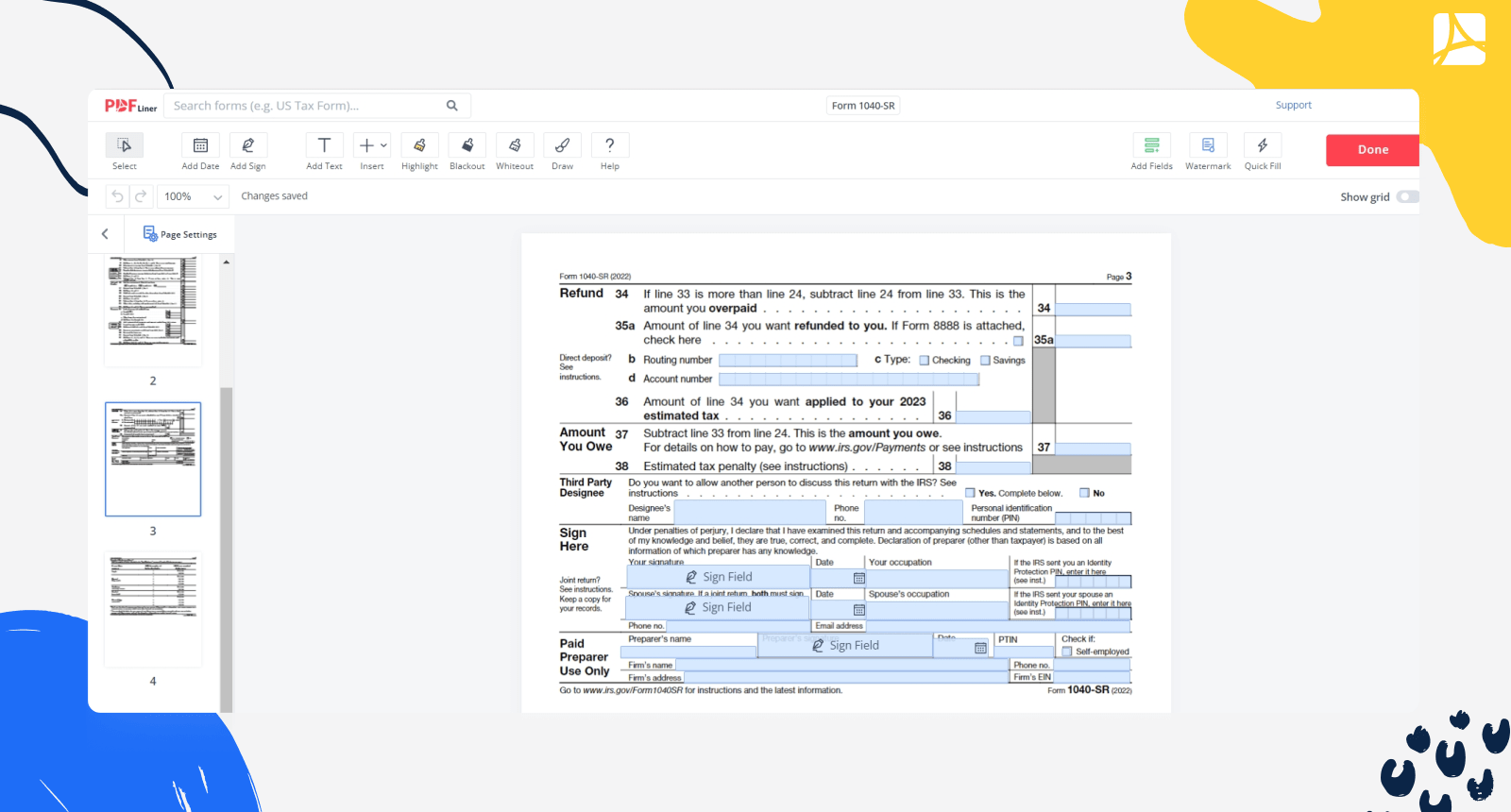

Page 3

- Check whether your total payments (Line 33) are more than your total tax (Line 24). If they are, you can have the overdue completely or partly refunded, so specify the amount on Line 35 along with your routing or account number. If they are not, the amount you have to pay is to be written in Line 37.

- In the “Sign Here” section, enter your e-signature (more on this below).

- If you were assisted in filing the return under the TCE program, you still should sign it yourself. The “Paid Preparer Use Only” is for independent preparers that offer their services outside of the TCE.

Fill Out 1040-SR 6596d4d03f949ca16a0e25ca

How to Sign Form 1040-SR

After you finish filling the form and checking all the data, you need to use your electronic signature to sign the document on Page 3. Not only is doing it on PDFLiner easier; it also automatically links your signature to your credentials, and it may look as beautiful and realistic as your natural handwritten signature (or even better). Here is more about how to sign 1040-SR, as well as any other form or document.

How to File Form 1040-SR

It’s better to do it right after the financial year is over but before the deadline, which usually comes on April 15. However, in 2021, it has been postponed until May 17. For those filing returns on paper, the mailing address depends on their state. In 2023, the IRS directly warns all the taxpayers that due to understaffing, processing paper returns might take much longer, so you better file it electronically.

For electronic filing, you can choose to download the form, fill and sign it locally, and then send it to the IRS mail. There is an official page on the IRS website with this form. But it’s easier to do it on PDFLiner, where you can file a 1040-SR to the right address in one click right after you fill and sign it.

Frequently Asked Questions

Here are the answers you might have been asking before or even after reading this guide. It’s useful to know all the specs before filling out the form.

What is Form 1040-SR used for by the IRS?

First of all, it’s easier to fill and file for elders. Secondly, the IRS staff processing 1040-SR is already prepared for what's to expect.

Do seniors get an extra tax deduction?

Yes, along with non-taxable Social Security, there is Standard Deduction for Seniors, Credit for the Elderly or Disabled, and Free IRS Tax Return Preparation. You can read more on this topic on the IRS site. This higher standard deduction is already incorporated in Form 1040-SR.

At which age is Social Security no longer taxed?

As for 2023, this age threshold is 65 years. You need to specify it in the tax return for seniors; otherwise, you wouldn’t be allowed to use 1040-SR.

Can you file 1040-SR online?

Yes, you can file a 1040-SR online on PDFLiner after filling it out and signing the form. It’s easy to do on PDFLiner because all the necessary tools are already here, and nothing will distract you from the procedure. You can also keep these Form 1040-SR instructions open in another tab to check them wherever you need.

Does Social Security count as income?

50% of it counts as taxable income if the individual who receives it has a gross income of $25,000 or more, and 85% is taxable for those grossing $34,000 or more. For couples, the threshold is $32,000 and $44,000, respectively. After the person reaches 65 or 67 (depending on the year of birth), the social security benefits are not taxed. Even if you qualify to fill out 1040-SR, you still should specify the amount.

What is the difference between Form 1040 and Form 1040-SR?

It’s all about design and fonts. Those with worsened eyesight will feel at more ease with the less fine print in 1040-SR. The blanks in 1040-SR are also easier to write in, no matter if you do it on paper or digitally.

Fill Out Tax Forms At No Time with PDFLiner

Start filing your taxes electronically today and save loads of time!