-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Form SSA-8240

Get your Form SSA-8240 in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is a Form SSA 8240?

The SSA 8240 form exists as a statement regarding an individual's wages or net earnings from self-employment. It is particularly used by people who are on Supplemental Security Income (SSI). The form helps the SSA accurately adjust the SSI payment amount based on the earner's income.

Purpose of social security form SSA 8240

The SSA 8240 form is used to provide reports of the earnings of individuals who are receiving Supplemental Security Income (SSI). It is typically filled out by a representative payee who handles the financial matters of the SSI receiver. This form particularly reports the monthly wages of the SSI beneficiary. The information is crucial as it directly affects the amount of SSI received.

How to Fill Out SSA 8240 Form

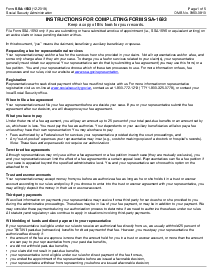

Thinking about how to fill out this SSA form can be stressful, but the process can be simplified once you are familiar with the form and its necessary documents. Also, you may follow these steps:

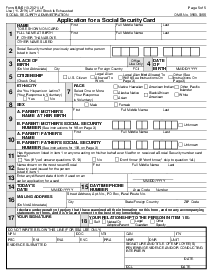

- Head over to the section titled 'Individual Whose Wage and Employment Information Will Be Obtained' and enter the full name of the individual.

- Subsequently, fill in the 'Social Security Number' for this individual, ensuring the accuracy of the number provided.

- In case the Claimant/Beneficiary is different from the individual stated above, move to the 'Claimant/Beneficiary' area and input the specific individual's full name.

- Correspondingly, fill in the 'Claimant/Beneficiary Social Security Number' box, if it's different from the one furnished earlier.

- The form then requests a 'Signature', where you should provide a legally-binding replica of the individual's signature.

- The 'Date Signed' box should be filled next. This is the date when the form is being filled.

- If the form is not being signed by the individual whose wage and employment data is included, provide the basis for the authority to sign in the designated space, either 'Parent of minor' or 'Guardian'.

- Following this, 'Print the Name of Parent/Guardian' in the provided area, which is mandatory if the form was not signed by the individual mentioned in the first section.

- In the 'Mailing Address of Individual Authorizing Disclosure' section, put down the appropriate residential or mailing address.

- The next boxes ask for the 'City, State, and ZIP Code' related to the former address.

- Proceeding to the 'Witness' section, carefully enter the 'Mailing Address for Witness 1' which asks for the complete postal address of the witness.

- Finally, the last box reads 'Witness Sign Here', requiring the elected witness to affix their signature thus authenticating the information provided within the form SSA-8240.

Why you should file the form?

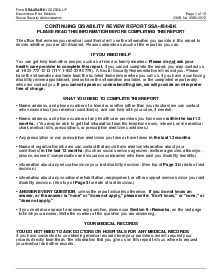

Filing the form SSA 8240 is crucial for several reasons. Firstly, it assists the SSA to accurately compute the SSI payments, ensuring you receive the right benefit. Secondly, it helps guarantee all earned incomes are accurately reported, which is vital to maintaining the integrity and authenticity of the SSA's records.

Lastly, failing to complete or provide accurate information on the Social Security SSA Form 8240 could result in adjustments to your SSI payments, potential overpayments, or even disqualifications from benefits.

Fillable online Form SSA-8240