-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

SSA-21 - Supplement to Claim of Person Outside the United States

Get your SSA-21 - Supplement to Claim of Person Outside the United States in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What is the SSA 21 Form?

The SSA 21 form, as mentioned earlier, is an essential document for individuals residing outside the United States. It aids in ensuring that these individuals continue to receive their social security benefits, regardless of their location worldwide. However, managing this form can sometimes be a daunting task due to its complexities and confusing instructions.

Purpose of form SSA 21

Now, it’s crucial to understand the role of form SSA 21. Form SSA 21, or the Supplement to Claim of Person Outside the United States, primarily serves the purpose of a supplement to the original claim for Social Security benefits by a U.S citizen residing outside the United States. This form becomes essential as it helps keep the Social Security Administration (SSA) updated about your current status.

How to Fill Out SSA-21 Form

Completing the SSA-21, Supplement to Claim of Person Outside the United States, on PDFliner involves the following steps:

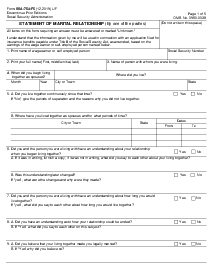

- Start by entering the full name and Social Security number of the worker on whose earnings the claim is based at the top of the form.

- Fill out the Dates Lived in the U.S. section by listing the total number of years the worker has lived in the U.S. Specify the periods from (Month-Day-Year) and to (Month-Day-Year), detailing the worker’s relationship during these periods and any countries of citizenship, including passport numbers and issuance dates.

- In the section titled "For Each Worker Listed Above," continue to list the country of birth, the periods the worker lived in that country from and to (Month-Day-Year), and the current country where living. Repeat this for each person listed in previous sections as required.

- If any person listed has been employed or self-employed outside the U.S. during the past 12 months, confirm by selecting "Yes" and provide their names along with the dates the work began. Attach Form SSA-7163 if applicable.

- Under the section for U.S. resident status for income tax purposes, enter the names of all persons listed who believe they will have U.S. resident status while living outside the U.S. Add each person’s Permanent Resident Card number and the date issued. If not lawfully admitted, select "None" and provide explanations in the Remarks section.

- Complete the income tax treaty benefits section by specifying if anyone intends to claim a reduced rate of Federal income tax withholding under an income tax treaty with the U.S. Use the Remarks section if additional space is needed for more names.

- Fill in the residence address and mailing address where the mail should be sent while abroad, noting if it is the same as the address provided in previous sections or if an alternative address is used.

- For the payment address, specify where payments should be sent while abroad, unless they are directly deposited to a bank, then skip this item.

- Answer questions about employment or self-employment expected to begin outside the U.S., and if any benefits listed under Supplementary Medical Insurance should be terminated.

- Sign and date the form in the Certification and Signatures section. If the form is signed by mark (X), ensure it is witnessed by two individuals who will provide their full addresses.

Remember to review all entries for accuracy before submitting the form to ensure all information is correctly reported according to the requirements.

Fillable online SSA-21 - Supplement to Claim of Person Outside the United States