-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Form 15112

Get your Form 15112 in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

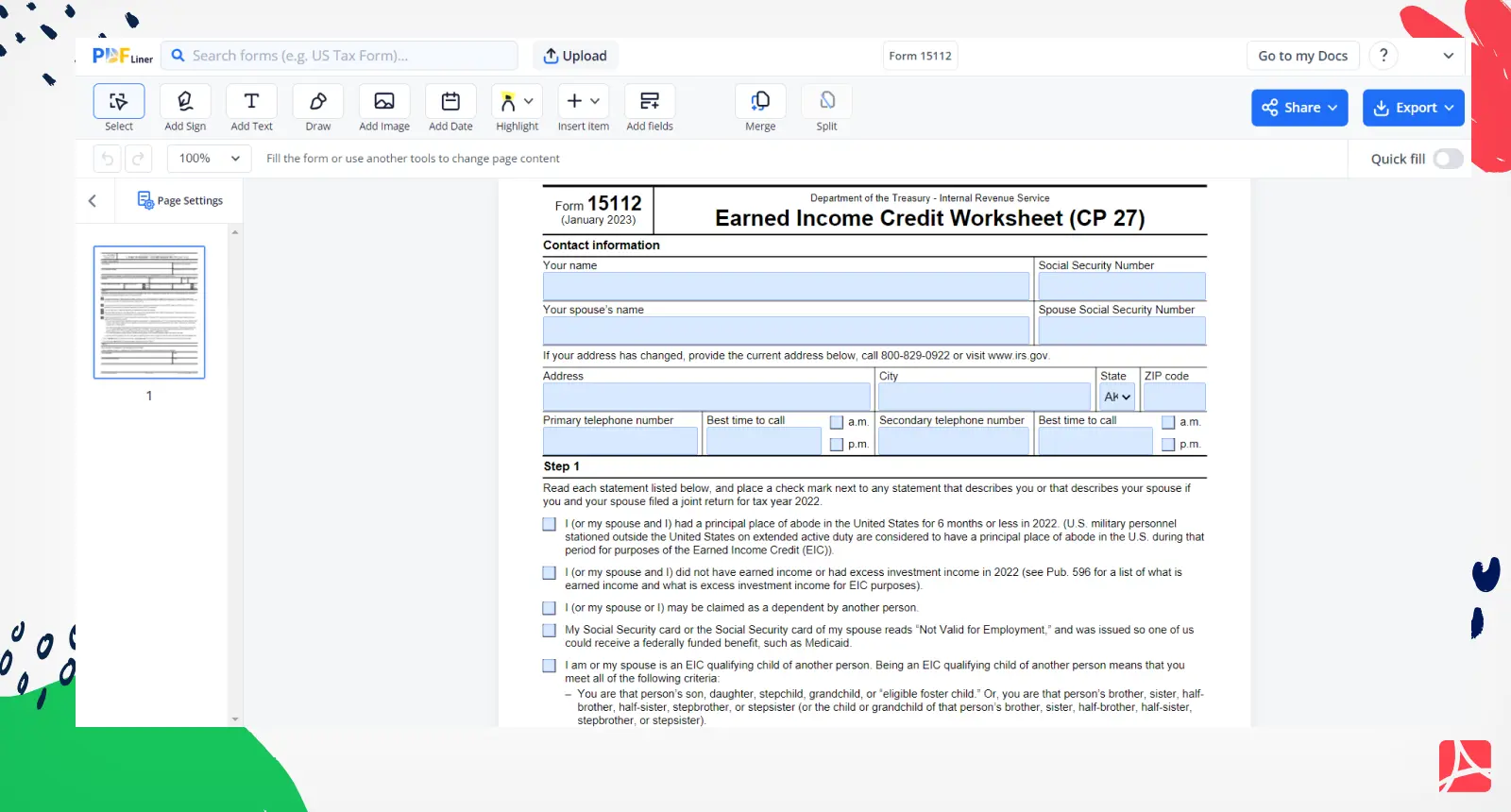

What Is IRS Form 15112 2022?

IRS form 15112 January 2022 is a document produced by the U.S. Treasury - more specifically by the Internal Revenue Service. This form came into introduction in January 2022. Just like with every other IRS form, it's essential to fill it out correctly to prevent possible issues with taxation or legal disputes.

Understanding changes in form 15112 January 2022

One of the essential factors you should consider regarding IRS form 15112 2022 is the changes made recently. The IRS often makes adjustments to these forms, based on various economic elements and factors. Being aware of these changes is a crucial step in avoiding potential legal troubles down the line.

How To Fill Out Form 15112 January 2022 PDF

You may be wondering, "how to fill out this form?" The form 15112 January 2022 PDF is designed to be straightforward and easy to understand. However, there are a few steps you should follow to ensure you fill it correctly:

- Start by providing your contact information in the designated fields. Enter your full name as it appears on your Social Security card.

- Input your Social Security Number (SSN) on the line provided. Ensure that it is correct and matches your Social Security card.

- If you’re co-filing with your spouse, fill out your spouse’s full name in the appropriate section.

- Input your spouse's Social Security Number on the designated field, ensuring it matches their Social Security card.

- In the “Address” section, type in your current home address without abbreviations. This should include your city, state, and ZIP code. If your address has changed since you last filed your return, use your current address.

- Now provide your primary telephone number. This should be the number where the IRS can reach you during your stated best time to call. Indicate whether the best time to call is a.m. or p.m.

- If you have a secondary telephone number where the IRS can also reach you, fill that out and indicate the best time to call as well.

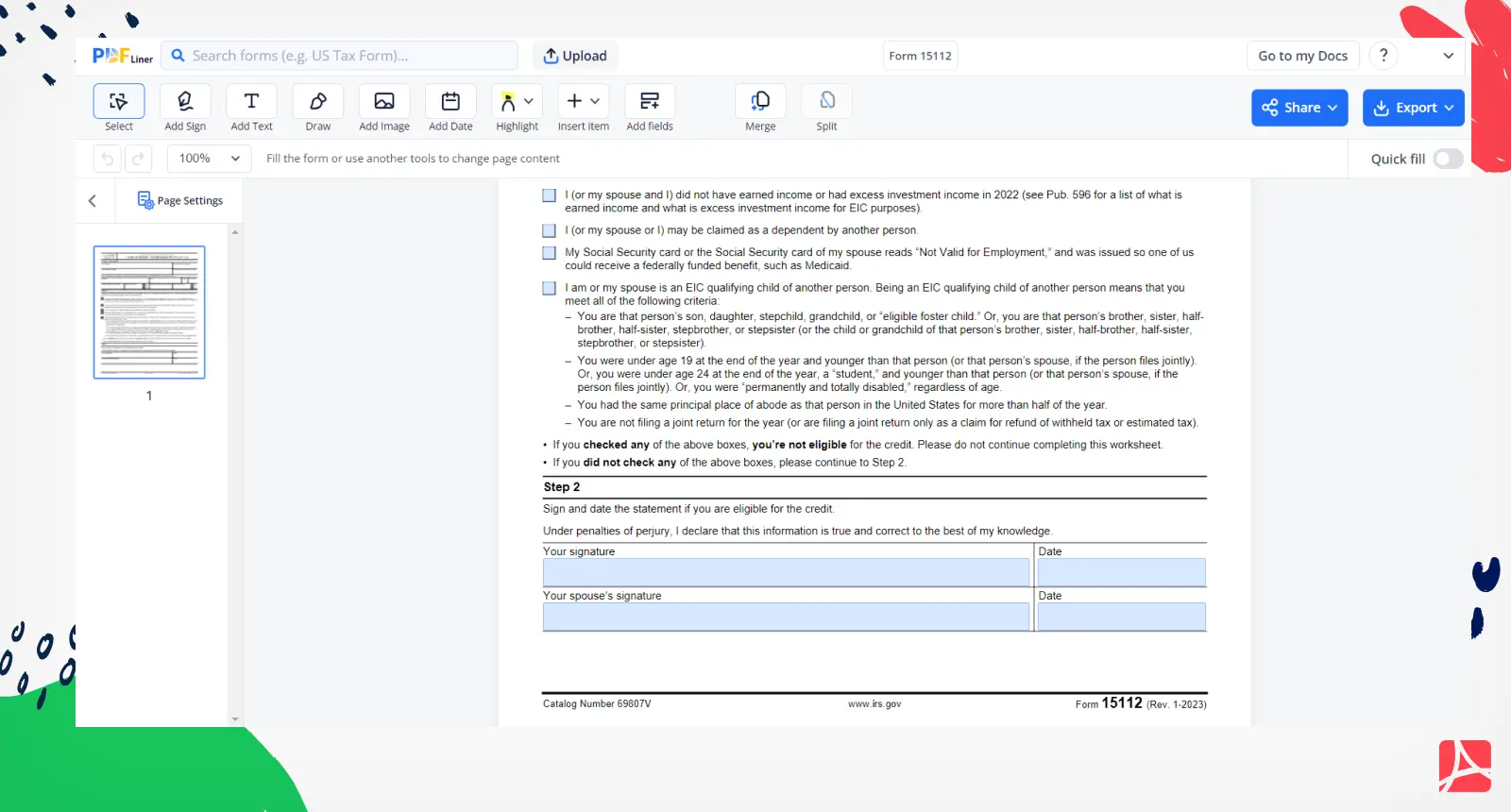

- The next section has several statements. Read each carefully, and if any apply to you or your spouse if you jointly filed, put a checkmark next to the corresponding statement in the checkbox.

- Once you have filled out all the information and checked the statements that apply to you, it's time to sign the form. Sign in the designated field labeled "Your Signature."

- Write the date using the correct American format (MM/DD/YYYY) on the line beside your signature.

- If the form is being co-filed, your spouse will also need to provide their signature and the date. Sign in the field labeled "Your Spouse's Signature."

Reasons to use form 15112 2022

You should request and use IRS form 15112 in preparation for filing your annual tax returns. It's typically needed at the start of the calendar year. In particular, you should aim to have it by the time you are preparing your tax documents, which is usually from January to April, when the tax season is in full swing.

Of course, if you need to revise or amend previous tax filings within the year, you might also need to request the form depending on your specific circumstances. Ultimately, it's essential to ensure you have an updated version of this form each tax year, such as the form 15112 January 2022 for filings in the year 2022.

Fillable online Form 15112