-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

- 1099 Forms

- W-9 Forms

- Other Tax Forms

- Real Estate

- Legal

- Medical

- Bill of Sale

- Contracts

- Education

- All templates

HIPAA Compliance Patient Consent Form

HIPAA Compliance Patient Consent Form

Legal Aid Queensland Application

Legal Aid Queensland Application

Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment

Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment

Florida Last Will and Testament Form

Florida Last Will and Testament Form

Recertification for Calfresh Benefits (CF 37)

Recertification for Calfresh Benefits (CF 37)

Pennsylvania Last Will and Testament Form

Pennsylvania Last Will and Testament Form

AU Mod(JY), Parent(s), Guardian(s) details

AU Mod(JY), Parent(s), Guardian(s) details

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

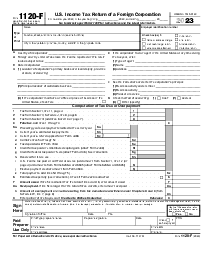

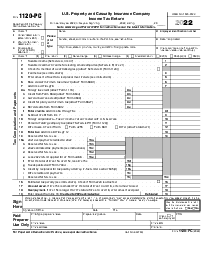

Form 1120-PC (2020)

Get your Form 1120-PC (2020) in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is a Form 1120-PC

Taxation for insurance companies offering property and casualty insurance policies is complex. Enter Form 1120-PC, a beacon for these organizations navigating the fiscal seas. This specialized document is pivotal, enabling property and casualty insurance companies to accurately compute and report their income taxes to the Internal Revenue Service (IRS). Form 1120-PC ensures a comprehensive fiscal overview essential for these entities to comply with federal tax obligations by segregating the nuances of insurance income, losses, and reserves.

When to Use IRS Form 1120 PC

IRS Form 1120 PC finds its application in specific situations, tailor-made for property and casualty insurance companies. The list below highlights the circumstances warranting its use:

- For companies deriving income from premiums on insurance policies securing against risks.

- When entities must explain their investment income, losses, and the state of reserves.

- To itemize deductible expenses unique to insurance entities and claim relevant tax credits.

- Ensuring adherence to the tax reporting requirements set forth by the IRS for the niche sector of property and casualty insurers.

How To Fill Out Form 1120 PC Instructions

The procedure for completing Federal Tax Form 1120-PC is meticulous, demanding attention to detail. Below is a stepwise guide:

Identification Information: Enter the company’s name, address, Employer Identification Number (EIN), and the applicable tax year.

Income and Deductions: Detail the premiums earned, losses incurred, dividends to policyholders, and underwriting expenses. This section requires a thorough understanding of the insurance business.

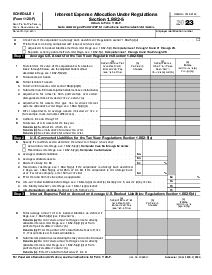

Tax Computation: Apply the appropriate tax rates to calculate the income tax liability. Also, incorporate any foreign tax credits, if applicable.

Schedule Analysis: The form entails various schedules for elucidating investment income, dividend details, and loss reserves. Fill these with precision, referencing the company’s financial records.

Sign and Date: An officer of the company must sign the form, affirming the accuracy of the information provided.

Attachments: Ensure all relevant schedules and additional forms are attached, as the IRS requires for comprehensive reporting.

When to File Federal Tax Form 1120-PC

Timeliness in filing Federal Tax Form 1120-PC is crucial for adherence to IRS mandates. The filing deadline typically aligns with the fifteenth day of the fourth month following the close of the company's tax year. For companies observing a December 31 year-end, April 15 becomes the pivotal date. Should this date fall on a weekend or public holiday, the deadline extends to the subsequent business day. Furthermore, provision exists for extensions, allowing companies additional time to compile and report intricate financial data accurately.

Property and casualty insurance companies ensuring compliance with their tax obligations find a structured ally in Form 1120-PC. The adherence to deadlines, meticulous completion of the form, and understanding the scenarios demanding its use are pillars supporting the robust financial framework of these specialized entities.

Fillable online Form 1120-PC (2020)