-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

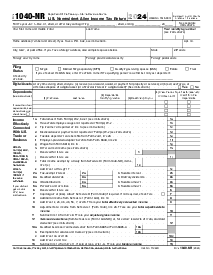

Form 1040-V (2021)

Get your Form 1040-V (2021) in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is Form 1040 V 2021

Form 1040-V is an IRS payment voucher used by taxpayers to submit payment of their outstanding tax balance. You send a statement with a check or money order for any balance due on the "Amount you owe" line of your Form 1040, 1040-SR, or 1040-NR. This form provides the IRS with the necessary information to correctly associate the payment with the taxpayer's account. Although it may seem like a simple slip of paper, it ensures that your payment is processed promptly and accurately, minimizing the potential for errors in your account standings.

When to Use IRS Form 1040 V 2021

There are specific scenarios where taxpayers should utilize the IRS Form 1040-V when making their tax payments:

- Those with a balance due on their tax return (Form 1040 or its variants) are not paying electronically.

- Individuals who opted to mail their payment after completing their return electronically didn't schedule an electronic payment.

- Taxpayers must make additional payments toward their balance due after submitting their tax return. Utilizing this voucher during these situations is essential to maintain orderly records with the IRS and properly apply your funds.

How To Fill Out Form 1040 V For 2021

Filling out Form 1040-V is straightforward but must be done correctly to avoid processing issues. Follow this step-by-step guide to complete your voucher:

- Write your social security number or your taxpayer identification number on the form. If you are filing a joint return, enter the SSN shown first on your return.

- Provide your complete legal name, along with your spouse's name if filing jointly, exactly as it appears on your tax return.

- Enter your mailing address, including the city, state, and ZIP code.

- Specify the amount you are paying with this voucher.

- When sending a check or money order with Form 1040-V, make it payable to the "United States Treasury." Include your SSN, tax year, and form number on the payment to ensure proper posting to your account.

Where To File Form 1040 V 2021

The mailing address for Form 1040-V can vary depending on your state and whether you are including a payment. To find the correct address:

- Determine if you are including payment. Different addresses are used for payments versus submissions without payments.

- Use the provided IRS envelope if you received one with your tax bill. Otherwise, use a standard envelope and ensure the proper postage is included.

Ensure your Form 1040-V and accompanying payment are mailed by the tax deadline (usually April 15th for the tax year). If the deadline falls on a weekend or a holiday, the due date may be extended to the next business day. Remember that interest and penalties may apply if you are paying after the deadline.

Form Versions

2022

Fillable Form 1040-V for 2022 tax year

Fillable online Form 1040-V (2021)