-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

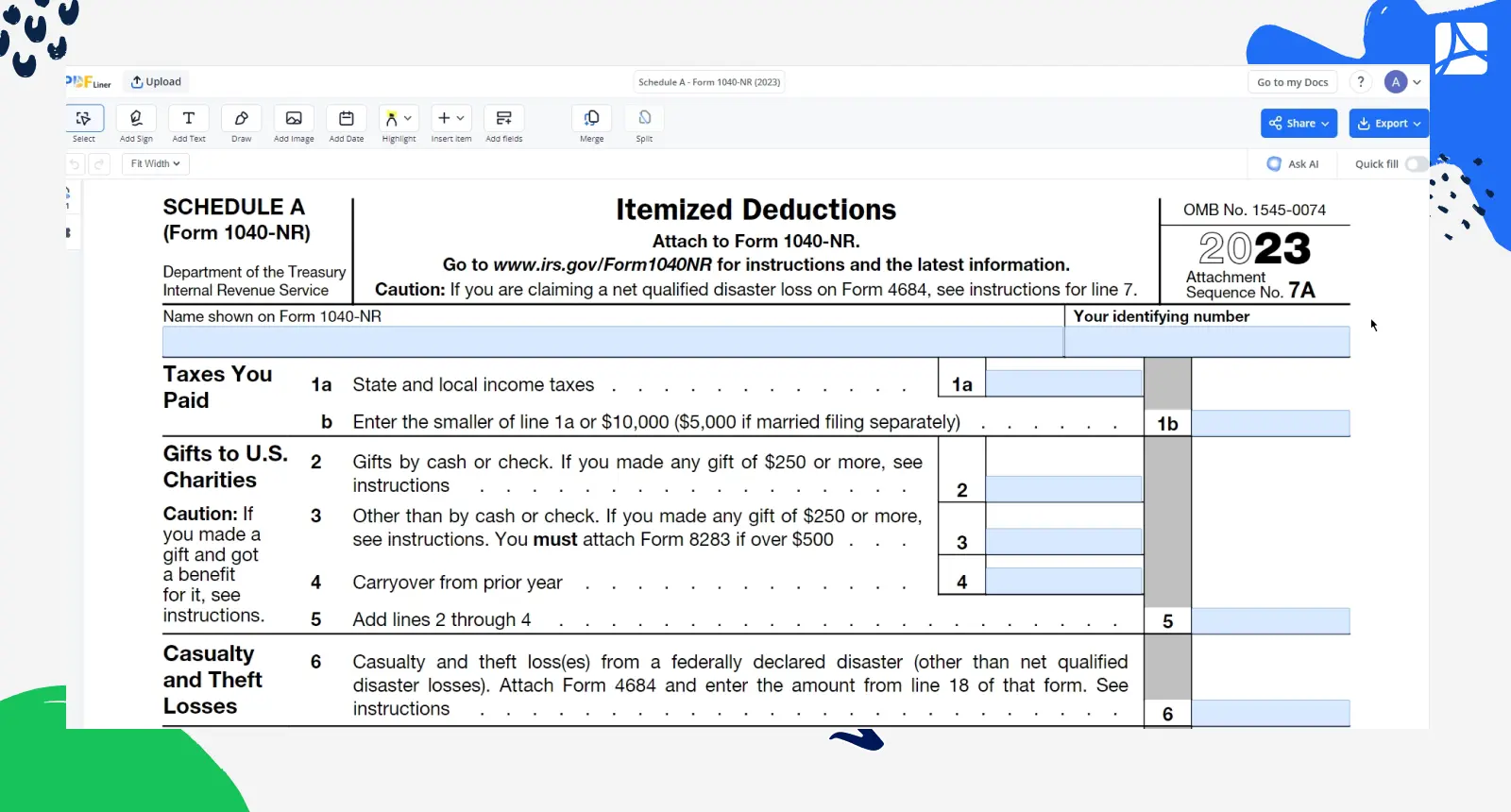

Schedule A - Form 1040-NR (2023)

Get your Schedule A - Form 1040-NR (2023) in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

Why It's Important to Know Schedule A - Form 1040-NR

As a nonresident, if you've had U.S.-sourced income, you may need to familiarize yourself with Schedule A Form 1040 NR. It is the tax form used to itemize deductions, which can potentially lower your taxable income and lead to a more favorable tax situation. Deductions could range from medical and dental expenses to gifts to charity and casualty losses.

Eligibility criteria for filing form 1040-NR Schedule A

Before proceeding with the filing process, it's important to determine whether you need to file Schedule A alongside Form 1040-NR. This primarily applies to individuals considered nonresident aliens for U.S. tax purposes who are reporting income such as wages, dividends, or rental income from U.S. sources and who plan to itemize their deductions instead of taking a standard deduction.

How to Fill Out the Form 1040 NR Schedule A

Completing tax forms accurately is essential to avoid any potential issues or delays with your tax return. Here's a broad step-by-step guidance to assist you:

- Ensure you have all necessary documentation, such as receipts for charitable gifts and records related to state and local taxes paid.

- Fill in your personal details at the top of the form, including your full name and identification number (such as Social Security Number or Individual Tax Identification Number).

- Next, enter the total amount of state and local income taxes paid during the tax year.

- Enter the smaller of the following two amounts:

- Line 1a (total state and local income taxes paid)

- $10,000 ($5,000 if married filing separately)

- Report gifts by cash or check of $250 or more. Follow the instructions regarding required forms and recordkeeping.

- Report other non-cash gifts of $250 or more. You will need to attach Form 8283 if the value exceeds $500.

- If applicable, report any carryover from previous years' deductions.

- Only include casualty and theft losses from a federally declared disaster (excluding net qualified disaster losses), attaching Form 4684 with the amount from line 18 of that form.

- List any additional itemized deductions according to the instructions.

- Sum up the values entered in lines 1b–7 and write down the result.

- Enter the summed total on Form 1040-NR, line 12.

Remember to check the official IRS instructions for Form 1040-NR for further clarifications and updates.

Maximizing your deductions with form 1040-NR Schedule A

By understanding how to itemize deductions properly, you can maximize the potential tax benefits. Be mindful of deductions that are particularly applicable to nonresident aliens and do not overlook any deductions for which you may be eligible, such as state and local income taxes paid or un-reimbursed business expenses related to U.S. income.

Form Versions

2021

Fillable Schedule A - Form 1040-NR for 2021

2022

Fillable Schedule A - Form 1040-NR for 2022

Fillable online Schedule A - Form 1040-NR (2023)