-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

DE 4 Form

Get your DE 4 Form in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is California Form DE 4?

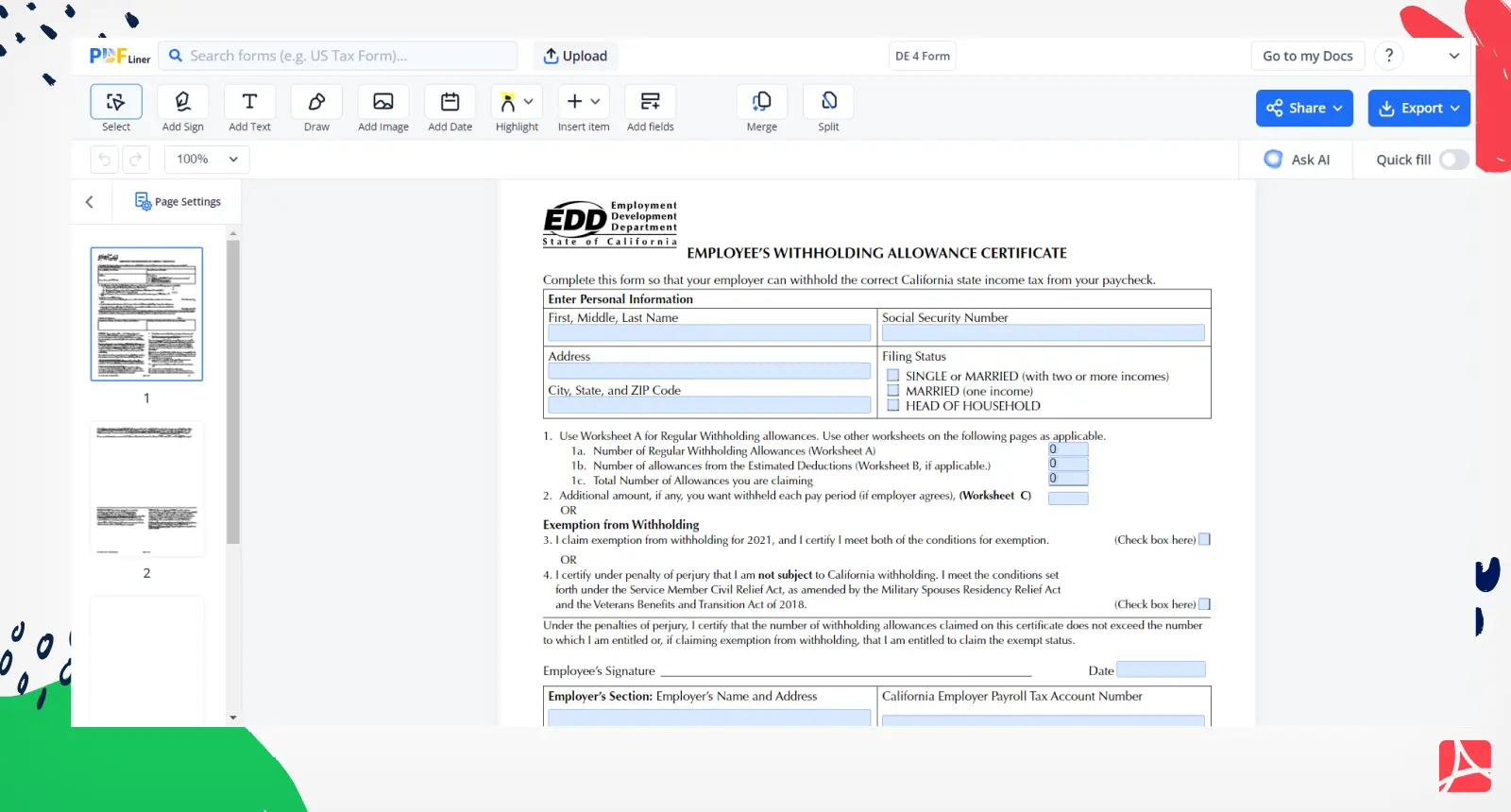

Also referred to as Employee’s Withholding Allowance Certificate, it’s a form utilized for withholding tax from your new employee’s wages. Each employee should file the DE 4 form, along with a federal form W-4, so make sure it’s your priority. You can find a pre-made template of the California form DE-4 here in the extensive PDFLiner blank form library, along with other niche-oriented templates and customization tools to cater to your most specific needs.

What do I need the California DE 4 form for?

Here’s what you need this form for:

- calculating the amount of taxes to be withheld from your salary by your employer;

- accurately reflecting your state tax withholding obligation.

Along with the tax form DE 4, PDFLiner features a breadth of other pre-designed form templates catering to a multitude of niches: healthcare, finance, taxes, immigration, and many more. Whether you’re on the prowl for this particular template or need any other form, your chances of finding it here on PDFLiner get a mighty boost.

How to Fill Out the DE 4 Form

The document features four pages. The second, third, and fourth pages are nonfillable and are for informational purposes only. The first one should be carefully filled out with maximum attention to detail and precision.

The remaining informational pages should be relied upon in case any questions arise as you progress through the form completion. Don’t forget that in case you find completing the form challenging, you can always seek professional advice or assistance.

Now that your "What is a DE 4 form?" question has been answered, you’re free to complete it so that your employer can withhold the correct California state income tax from your paycheck. Follow these steps to succeed:

- Indicate your full name.

- Type your social security number.

- Specify the details about the allowances you’re claiming.

- Add your signature.

- Add current date.

In the Employer’s section of the form, there should be your employer’s name and address, along with the California employer payroll tax account number. Consider completing this form digitally, for it’s the fastest and most error-proof way of managing your documentation. With PDFLiner, you can also add a legally binding digital signature to the document and save heaps of your valuable time along the way. Our e-signatures are legitimate, completely secure, and addable in a flash.

Organizations that work with the form

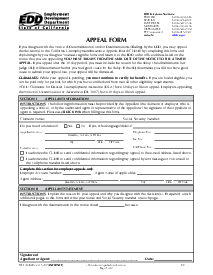

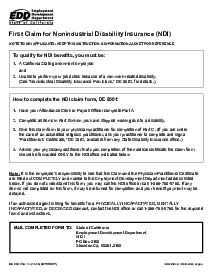

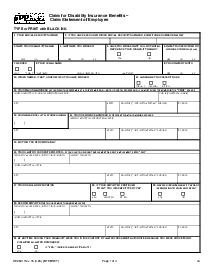

- EDD (Employment Development Department in California).

Fillable online DE 4 Form