-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Education Templates

-

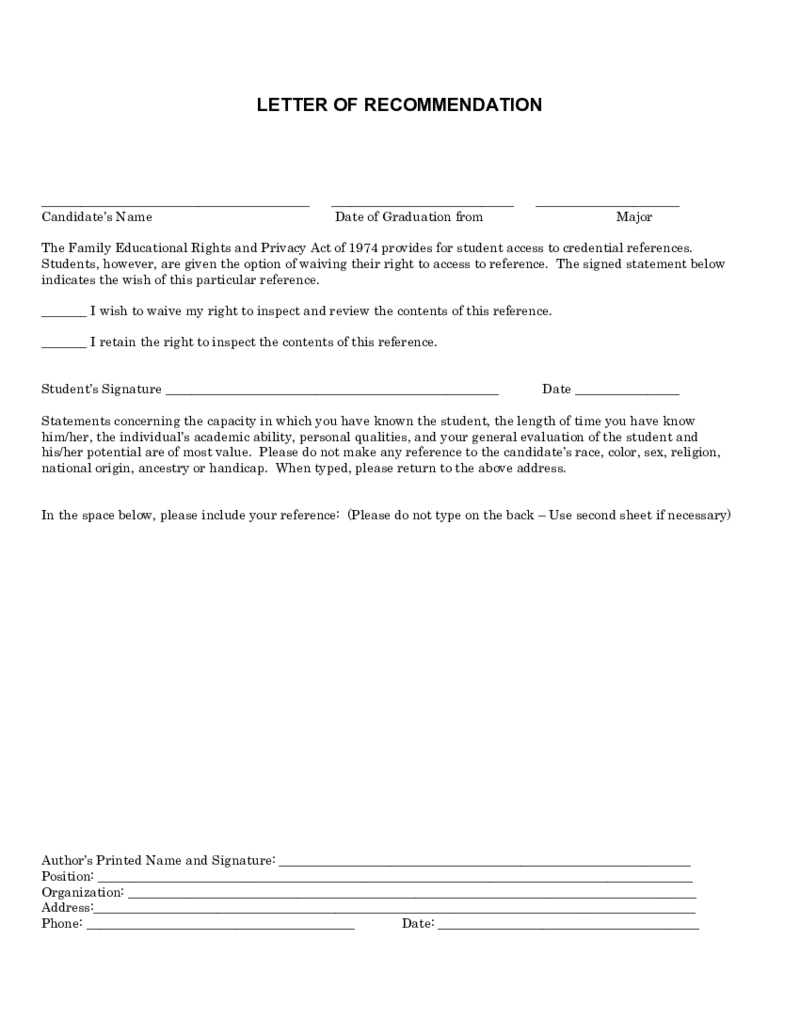

Letter Of Recommendations Template

What Is Letter of Recommendations?

The letter of recommendations template is the standard form that contains aspects of the working process inside the company. It has to be written and handed in by the authority who works with the person mentioned in the

Letter Of Recommendations Template

What Is Letter of Recommendations?

The letter of recommendations template is the standard form that contains aspects of the working process inside the company. It has to be written and handed in by the authority who works with the person mentioned in the

-

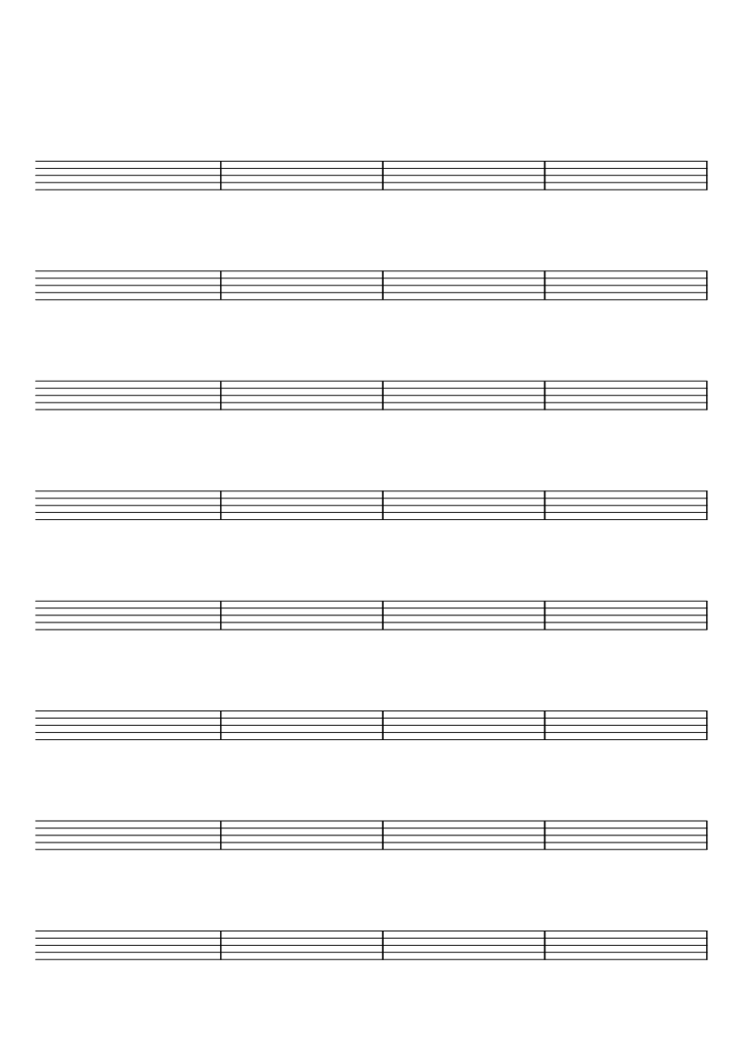

Blank Music Sheet with 8 Staves and 32 Bars

Welcome music lovers! Whether you're a skilled composer, budding music student or a dedicated music teacher, we are here to simplify your musical notation journey with our editable blank music sheet. Let's dive into the realm of musical composition and notati

Blank Music Sheet with 8 Staves and 32 Bars

Welcome music lovers! Whether you're a skilled composer, budding music student or a dedicated music teacher, we are here to simplify your musical notation journey with our editable blank music sheet. Let's dive into the realm of musical composition and notati

-

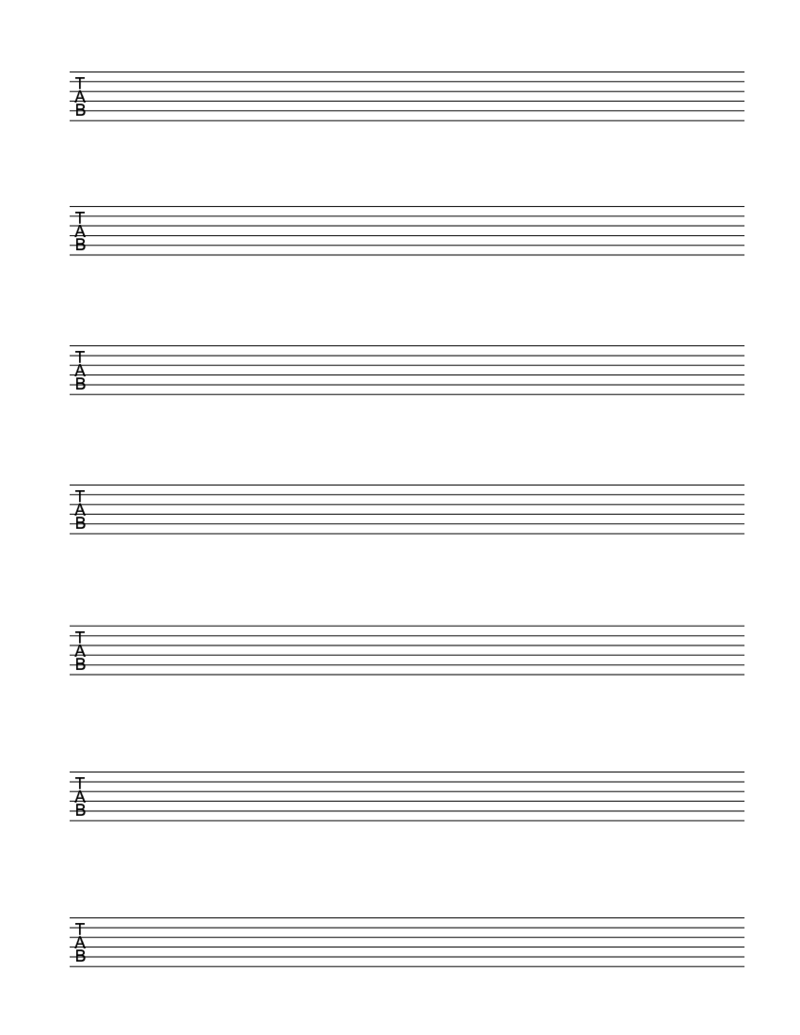

Blank Sheet Music for Guitar - TAB Sheet

What Is a Music Sheet for Guitar

It’s a document that features musical notation adjusted specifically for the guitar. The document forms a visual representation of music. If you learn how to read it, you’ll know which strings to pluck, the fin

Blank Sheet Music for Guitar - TAB Sheet

What Is a Music Sheet for Guitar

It’s a document that features musical notation adjusted specifically for the guitar. The document forms a visual representation of music. If you learn how to read it, you’ll know which strings to pluck, the fin

-

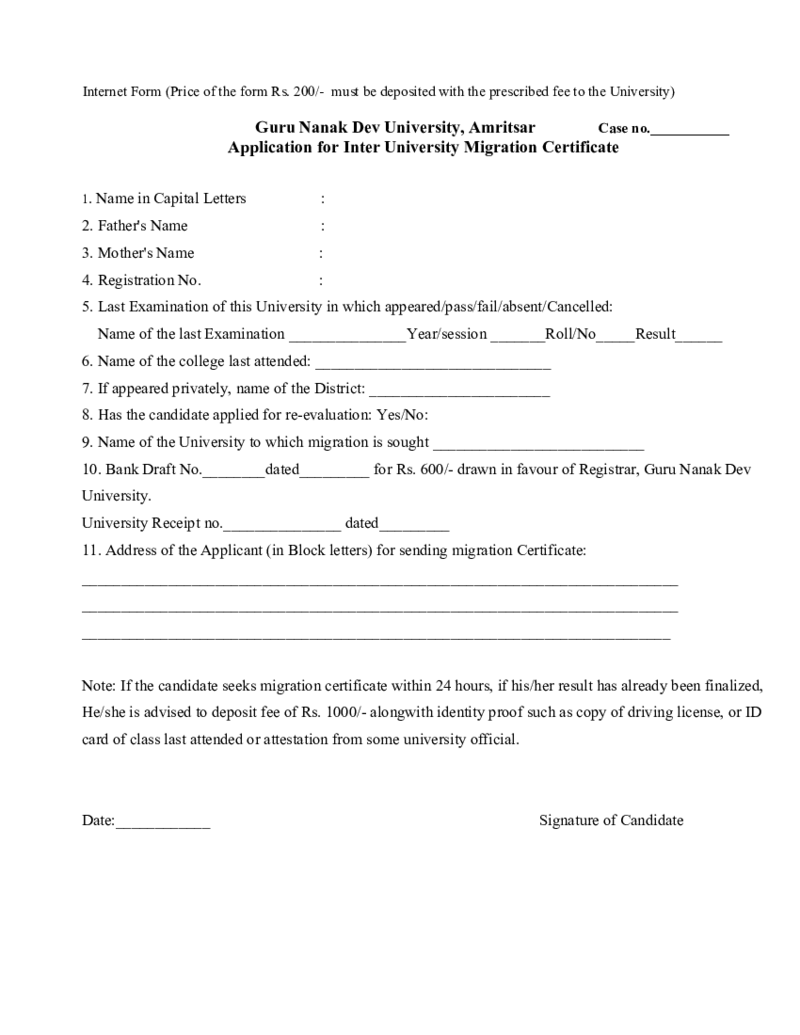

GNDU Migration Certificate

What Is a GNDU Migration Certificate Form?

It is a three-page document that every Guru Nanak Dev University student can use to request the migration certificate needed to continue their studies. This file is filled not only by students but also by princip

GNDU Migration Certificate

What Is a GNDU Migration Certificate Form?

It is a three-page document that every Guru Nanak Dev University student can use to request the migration certificate needed to continue their studies. This file is filled not only by students but also by princip

-

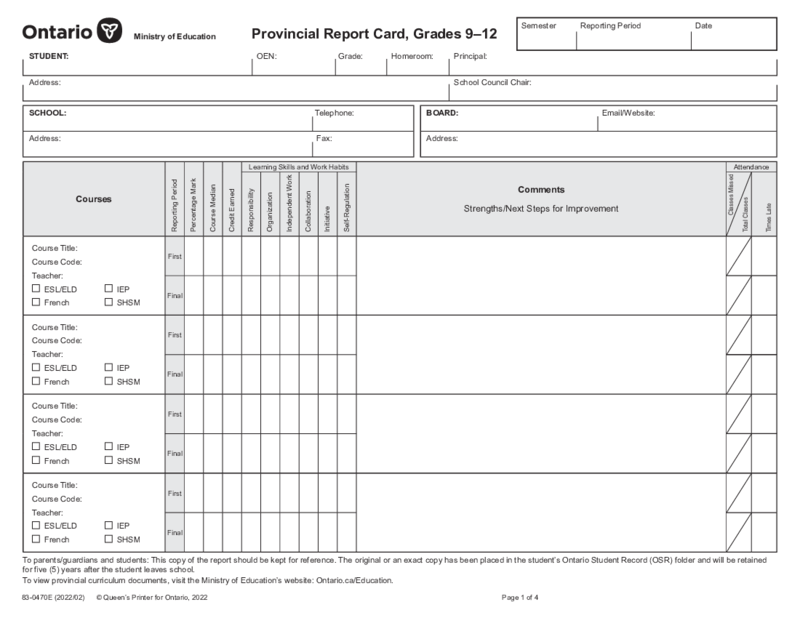

Canada Ontario 84-0470E

What Is an Ontario Provincial Report Card?

The Ontario provincial report card is a standardized form used to depict students' performance in their schoolwork. It contains sections for each subject a student enrolls in, including English, Math, Science

Canada Ontario 84-0470E

What Is an Ontario Provincial Report Card?

The Ontario provincial report card is a standardized form used to depict students' performance in their schoolwork. It contains sections for each subject a student enrolls in, including English, Math, Science

-

Equipment Release Form

What Is an Equipment Release form?

The fillable Equipment Release form is an agreement between two parties about the liability over the equipment. After one party downloads the Equipment Release form, it is filled with the details of the proper exchange.

Equipment Release Form

What Is an Equipment Release form?

The fillable Equipment Release form is an agreement between two parties about the liability over the equipment. After one party downloads the Equipment Release form, it is filled with the details of the proper exchange.

-

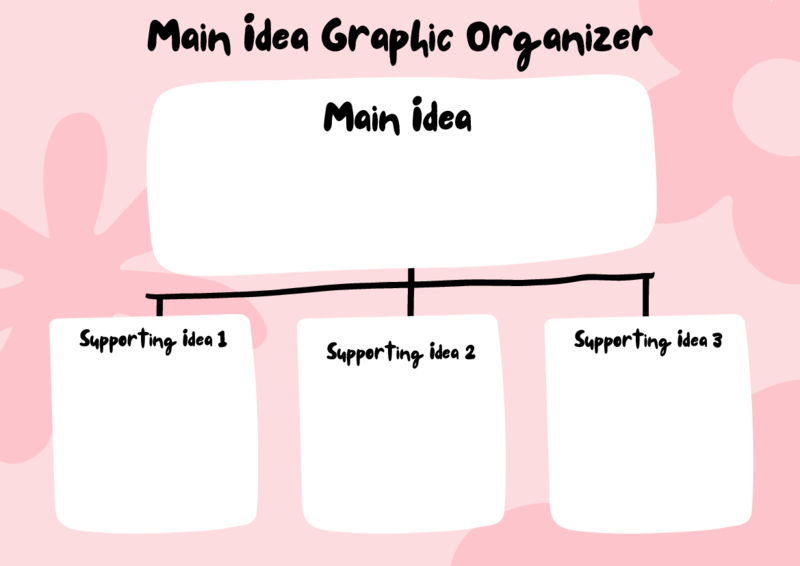

Graphic Organizer Template

What Are Graphic Organizer Templates

They are predesigned files that help organize and visualize complex information and ideas. A graphic organizer template has a specific structure with various shapes, lines, and labels. This peculiar structure helps use

Graphic Organizer Template

What Are Graphic Organizer Templates

They are predesigned files that help organize and visualize complex information and ideas. A graphic organizer template has a specific structure with various shapes, lines, and labels. This peculiar structure helps use

-

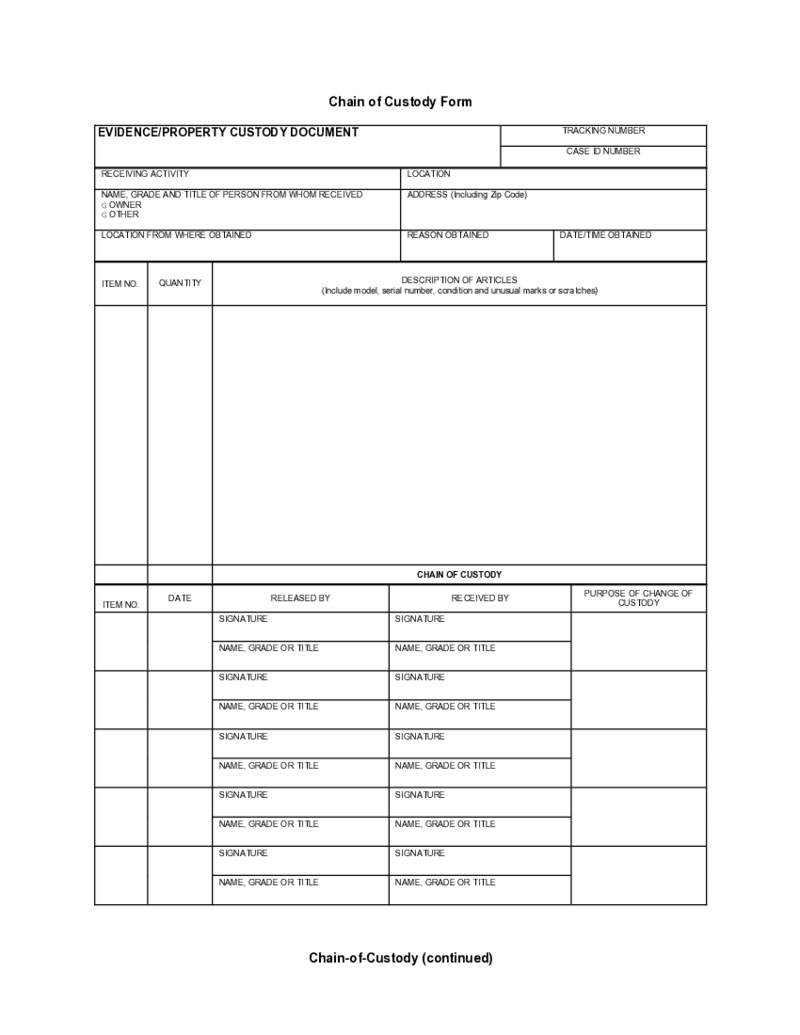

Chain of Custody Form

What Is the Chain of Custody Form?

The Chain of Custody Form is used for the confirmation that a specimen was handled in the right way during the drug testing. There are federally mandated chain of custody and control procedures that every treatment cente

Chain of Custody Form

What Is the Chain of Custody Form?

The Chain of Custody Form is used for the confirmation that a specimen was handled in the right way during the drug testing. There are federally mandated chain of custody and control procedures that every treatment cente

-

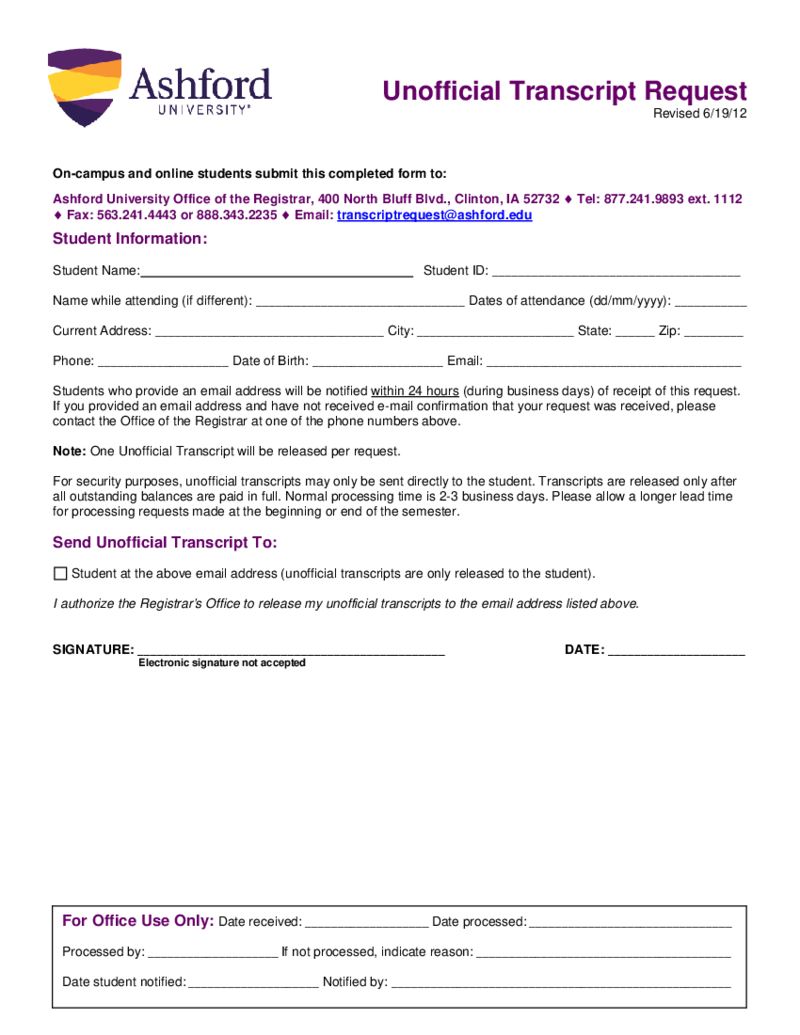

Ashford University Unofficial Transcript Request

What Is an Ashford University Unofficial Transcript Request Form?

An unofficial transcript is a document that shows a student's academic performance and progress in their degree program. Ashford university unofficial transcript request form is used by

Ashford University Unofficial Transcript Request

What Is an Ashford University Unofficial Transcript Request Form?

An unofficial transcript is a document that shows a student's academic performance and progress in their degree program. Ashford university unofficial transcript request form is used by

-

Blank Sheet Music 10 Staves With Treble Clef

Music is a beautiful language of emotion, and one of the key components of this language is the music notation. Among the common symbols in music notation, the treble clef is one of the most vital. This article presents a comprehensive guide on the usage of blank mus

Blank Sheet Music 10 Staves With Treble Clef

Music is a beautiful language of emotion, and one of the key components of this language is the music notation. Among the common symbols in music notation, the treble clef is one of the most vital. This article presents a comprehensive guide on the usage of blank mus

-

Logarithmic Graph Paper

What Is a Logarithmic Graphing Paper?

Logarithmic graph paper, or semi-log graph paper, is a specialized type of graph paper used for appl

Logarithmic Graph Paper

What Is a Logarithmic Graphing Paper?

Logarithmic graph paper, or semi-log graph paper, is a specialized type of graph paper used for appl

-

Biography Book Report Template

What Is a Biography Book Report?

A biography book report template is a structured format designed for effectively reviewing a biography. It includes sections where the student can write about the person's life, achievements, and significant character

Biography Book Report Template

What Is a Biography Book Report?

A biography book report template is a structured format designed for effectively reviewing a biography. It includes sections where the student can write about the person's life, achievements, and significant character

What Are Educational Templates Used For?

You can find and use many different types of educational templates on PDFliner. These templates can be used for various purposes, such as tracking students' progress, creating lesson plans, or managing class schedules. One of our website's most popular uses of templates on education is to track student progress. To use it, you need to use a template to create a grade report for each student.

What Are Educational Templates?

Educational templates are a set of document layouts that you can use to plan and organize lessons. You can use such templates to create different lesson plans, including for individual classes, groups, or even an entire school year. The layouts can be adapted to any of your needs as an educator. It is also worth mentioning that such templates are a valuable resource for those who want to ensure that their lessons are well-organized and effective.

Types of Educational Templates

Today, there are a number of educational templates that you can use to create a customized learning experience for your students. These templates are ubiquitous for creating lesson plans, activities, and even grading that meet the needs of your students. Using these templates, you can create an effective, practical, and engaging learning environment for your students.

- Education Lesson Plan Template

You can use this template to create a detailed lesson plan or workshop. You can use this template to define the lesson's purpose, the activities used, and the materials needed. This template is very useful for educators who are planning a new lesson or unit.

- Activity Template

This template is handy for you if you are looking for new, innovative, and engaging ways to engage your students.

- Blank Music Sheets

For many educators, this is one of the most popular types of educational templates is the blank music sheet, perhaps it will interest you as well. This type of template allows you to create your own music sheets that you can use for different purposes in your lesson. For example, you can use a blank sheet of music to write a song tune or create a lead sheet for a band.

- Learning Agreement Practicum

This learning agreement is a formal document detailing the practicum's expectations and goals. This document must be completed by student, academic department, and internship supervisor. This agreement is designed to protect all parties involved and ensure that the internship meets the student's needs.

- Student Emergency Information

The Student Emergency Information Template is designed to help institutions keep track of important contact information for each student. This template is typically used to collect information such as a student's name, parent/guardian contact information, medical information, allergies, or special needs. Also, you can customize such a template to meet the needs of your particular school.

What Should Include in Educational Templates?

When creating an educational template, you need to include certain elements to provide the most complete and effective learning experience for students. Here are some key components to add to all educational templates:

- The first component is learning objective. At the top of each template, you should list the learning objective. It points out to the teacher what students should be able to do after completing the lesson or activity.

- The second component is a list of materials needed. This will help you gather all the materials you need before starting the lesson.

- The third component is step-by-step instructions. When putting them together, you should remember that the instructions ought to be clear and easy to follow. They also must be focused on the learning goal.

- The fourth component is assessment. You can present it in the form of a quiz, test, or project. It is important to include assessment so that you can assess how much the student has understood the current class.

How to Create Educational Templates: Step by Step

For you, creating an educational template can be a simple or complicated process, depending on your individual needs. You may use online tools, such as PDFliner, to make the process a little easier. Here are the basic steps for creating an educational template:

- Visit the PDFliner website and create an account.

- Click the create new document button or choose one of the existing ones like the Matric Certificate Template.

- Choose colors. Colors play an important role in your template's overall look and feel. Always be sure to choose colors that complement each other and that you think will be pleasing to the eye.

- Add content. This is the most important step in creating your template. You need to add content that is relevant to your audience and easy for listeners to understand.

- Save template. When you are happy with your template, don't forget to save it in a format you can use in the future. Also, remember about right title and save location so you can find and use it at the time you need it.