-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Insurance Templates

-

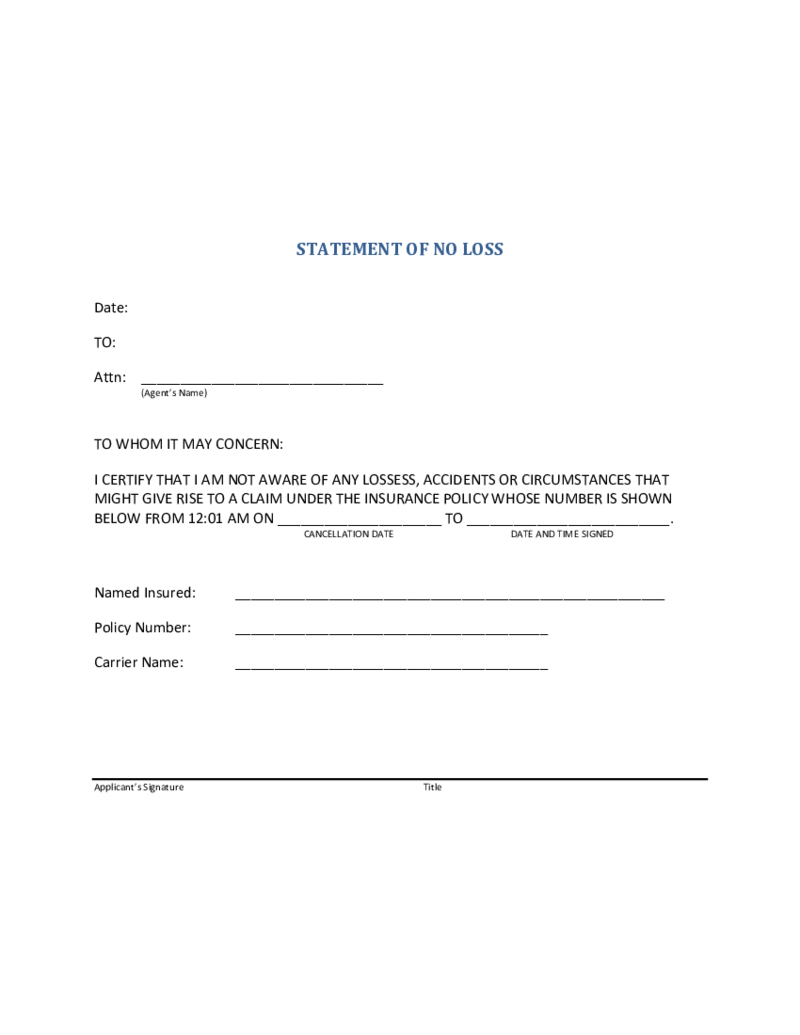

Statement of No Loss

What is a Statement of No Loss?

A Statement of No Loss Form is a simple one-page letter that ensures that you haven’t faced any losses that can result in claims. This signed document is used in the insurance field, and you need to provide it t

Statement of No Loss

What is a Statement of No Loss?

A Statement of No Loss Form is a simple one-page letter that ensures that you haven’t faced any losses that can result in claims. This signed document is used in the insurance field, and you need to provide it t

-

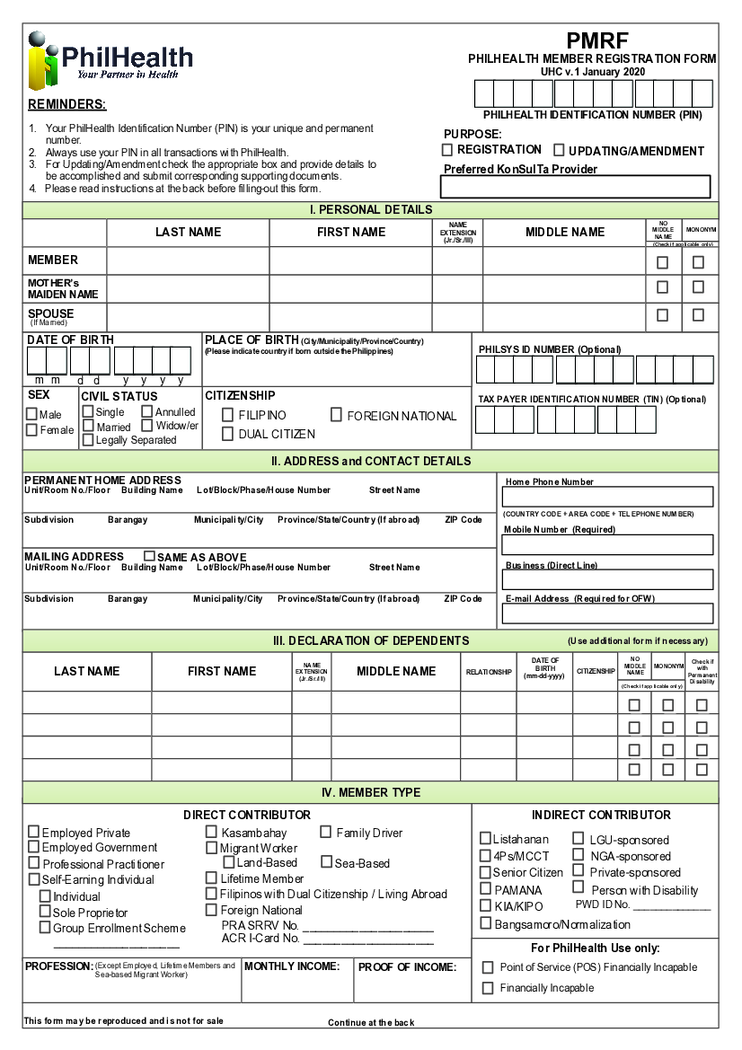

PMRF Form

What is a PMRF Form

The PMRF Form of PhilHealth is a two-page application that Filipino citizens can use to become a member of the local insurance program. You need to obtain a PhilHealth Identification Number before filling it out. You do not need other

PMRF Form

What is a PMRF Form

The PMRF Form of PhilHealth is a two-page application that Filipino citizens can use to become a member of the local insurance program. You need to obtain a PhilHealth Identification Number before filling it out. You do not need other

-

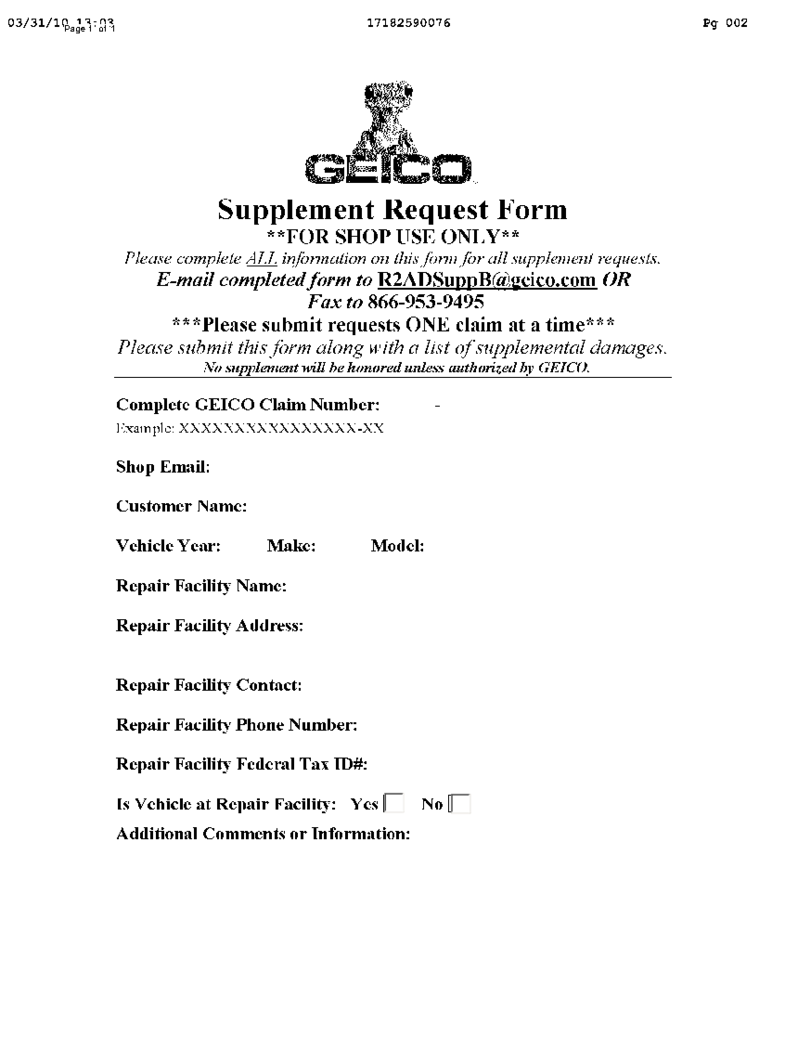

Geico Supplement Request

What is the Geico Supplement Request Form?

The Geico supplement request form is a specific form provided by Geico, one of the largest auto insurance companies in the United States. Geico policyholders use this form to request additional repairs or compens

Geico Supplement Request

What is the Geico Supplement Request Form?

The Geico supplement request form is a specific form provided by Geico, one of the largest auto insurance companies in the United States. Geico policyholders use this form to request additional repairs or compens

-

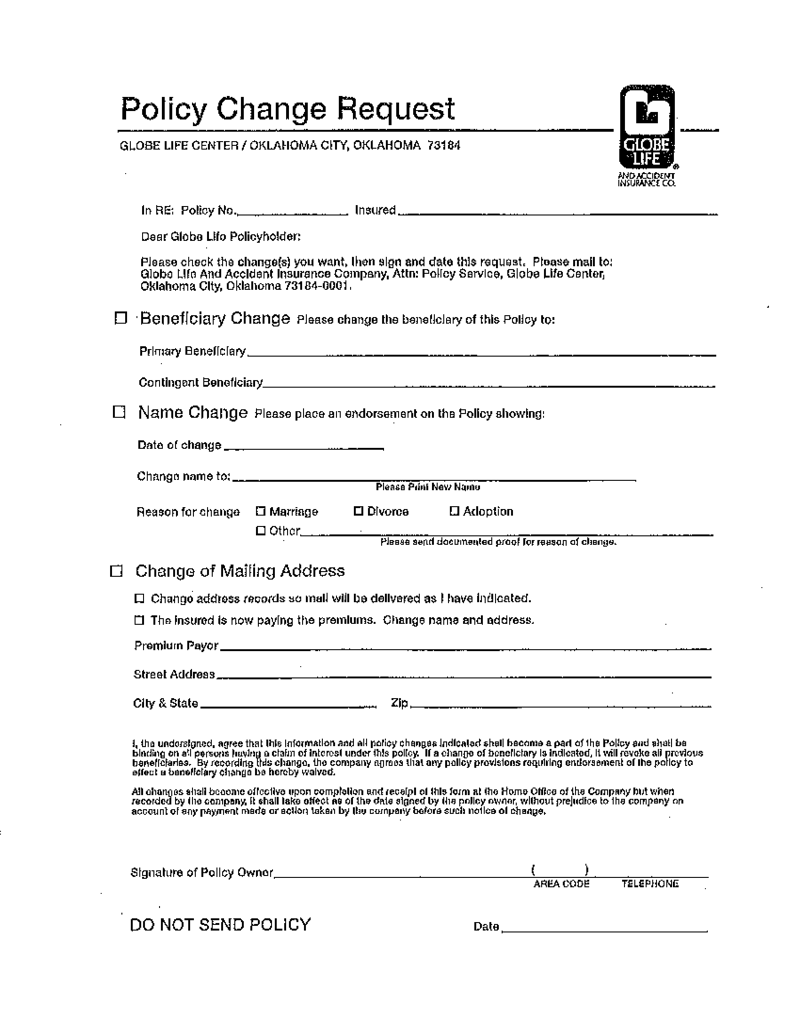

Globe Life Beneficiary Change Form

What is the Globe Life Beneficiary Change Form?

The globe life beneficiary change form is a document that allows policyholders to modify the beneficiaries listed on their life insurance policy. This form is typically required when individuals want to add,

Globe Life Beneficiary Change Form

What is the Globe Life Beneficiary Change Form?

The globe life beneficiary change form is a document that allows policyholders to modify the beneficiaries listed on their life insurance policy. This form is typically required when individuals want to add,

-

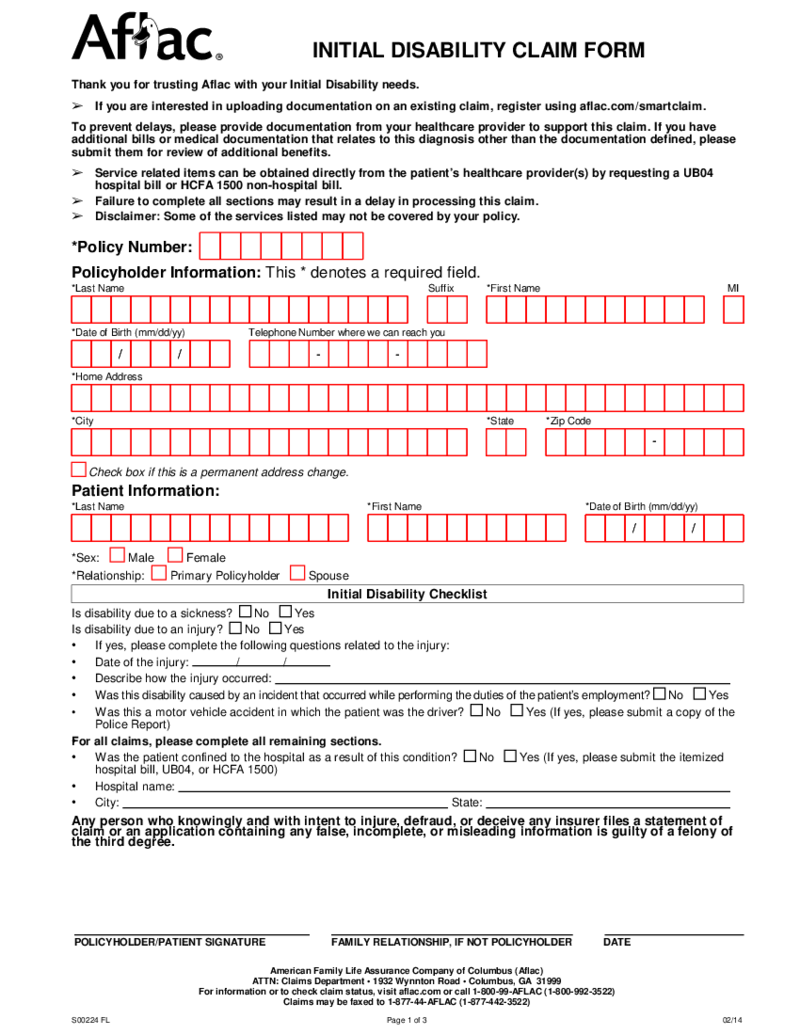

Aflac Initial Disability Claim Form

What Is an Aflac Initial Disability Claim Form?

It is a simple three-page form that AFLAC policyholders can fill out to request the benefits they are entitled to from the company. Typically, the form is provided by AFLAC itself in response to a request fr

Aflac Initial Disability Claim Form

What Is an Aflac Initial Disability Claim Form?

It is a simple three-page form that AFLAC policyholders can fill out to request the benefits they are entitled to from the company. Typically, the form is provided by AFLAC itself in response to a request fr

-

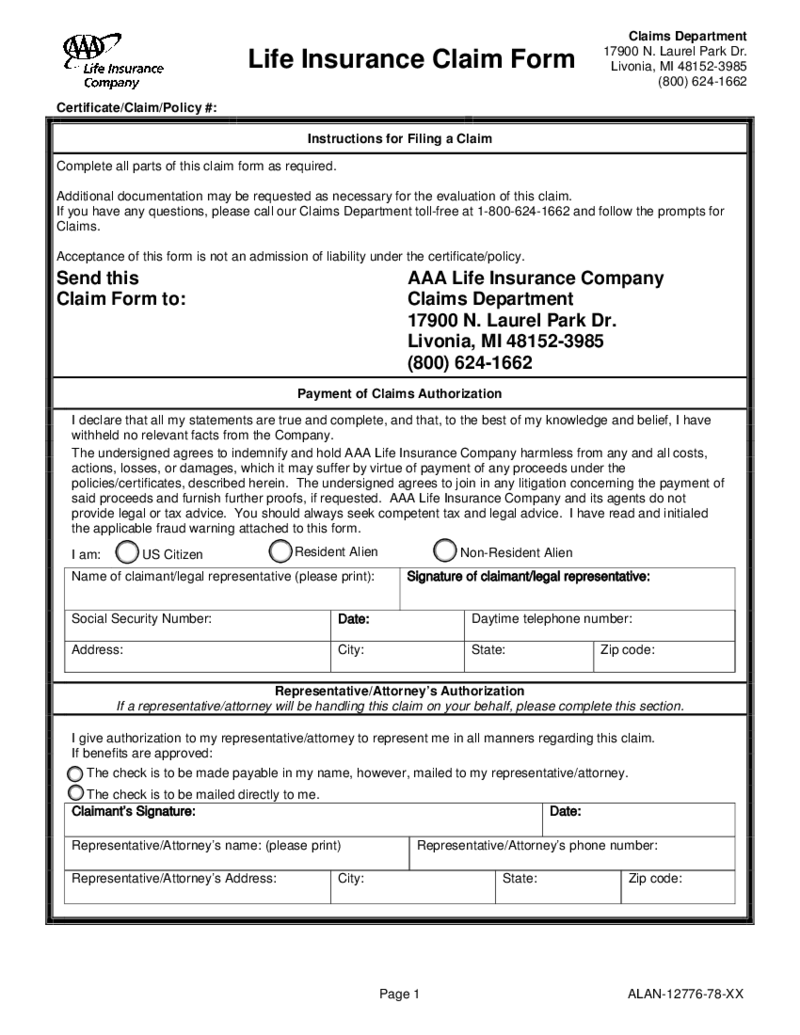

AAA Insurance Claim

What is the AAA Insurance Claim Form?

The AAA life insurance death claim form is a document that AAA (American Automobile Association) provides to policyholders who need to file an insurance claim. This form serves as a standardized template that policyho

AAA Insurance Claim

What is the AAA Insurance Claim Form?

The AAA life insurance death claim form is a document that AAA (American Automobile Association) provides to policyholders who need to file an insurance claim. This form serves as a standardized template that policyho

-

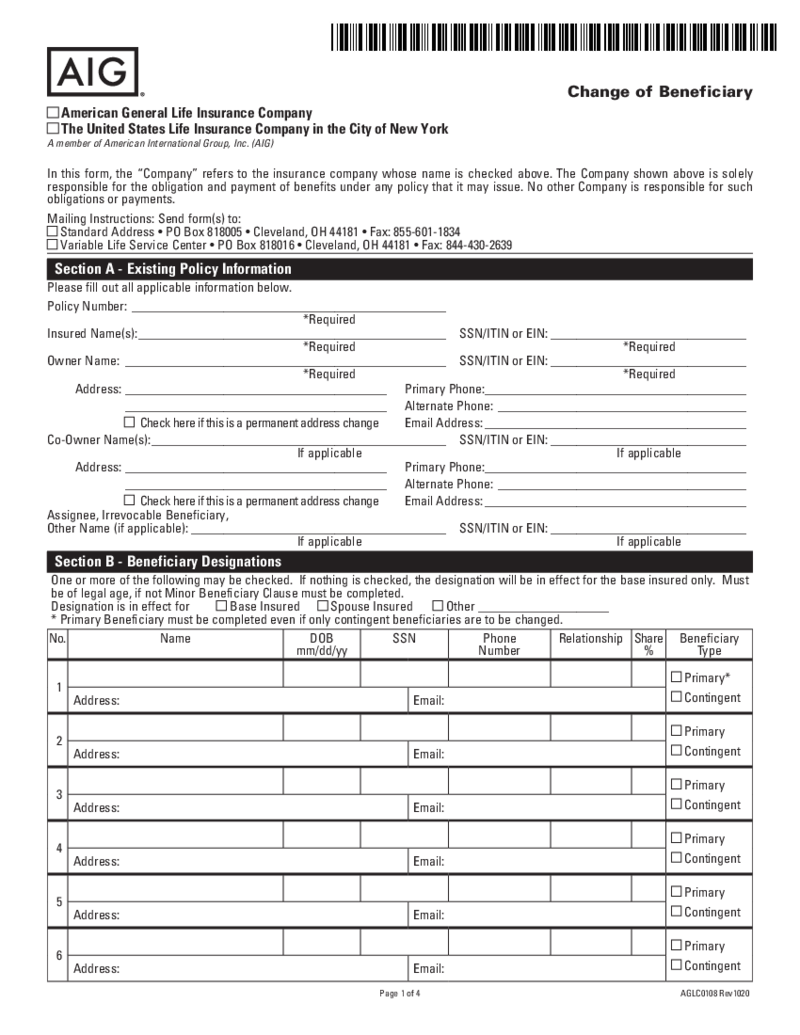

AIG Change of Beneficiary Form

What Is the AIG Life Insurance Change of Beneficiary Form?

The AIG change of beneficiary is a document utilized by AIG life insurance policyholders to make changes or updates to the beneficiaries of their policy. The choice of beneficiary can hugely impac

AIG Change of Beneficiary Form

What Is the AIG Life Insurance Change of Beneficiary Form?

The AIG change of beneficiary is a document utilized by AIG life insurance policyholders to make changes or updates to the beneficiaries of their policy. The choice of beneficiary can hugely impac

-

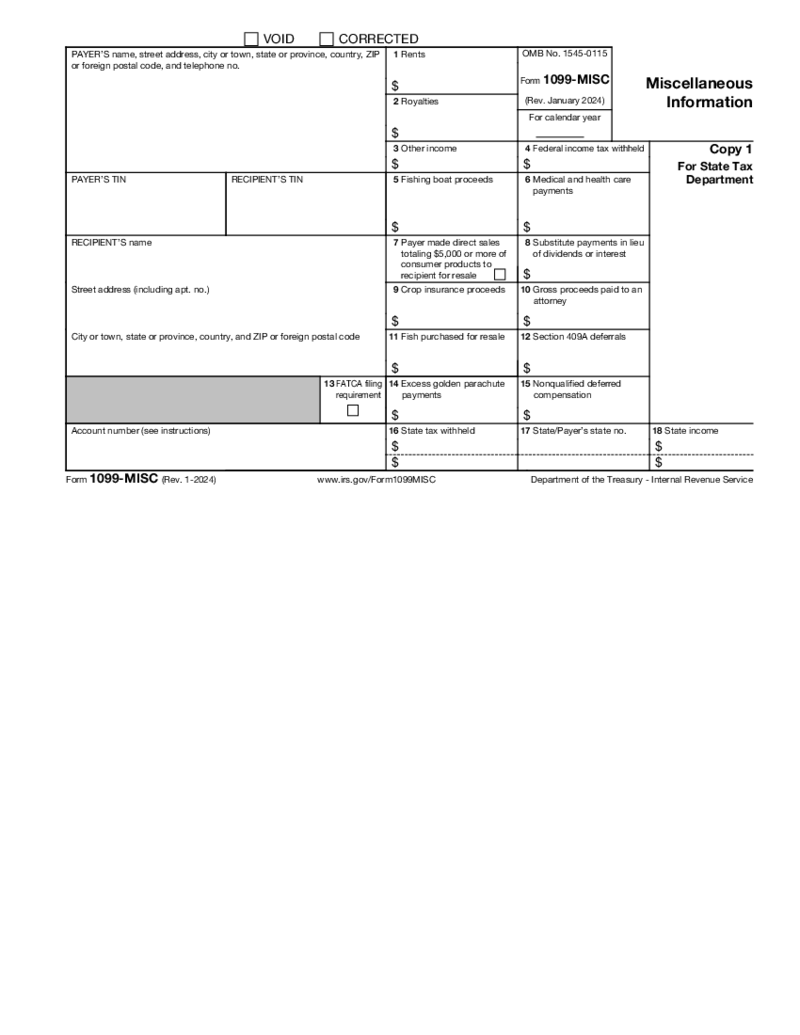

Form 1099-MISC (2024)

What Is the 1099-MISC Form?

All 1099 form series provide the IRS with all the necessary information about the taxpayer. Specifically, the 1099-MISC form is used to provide information about miscellaneous income.

Before 2020 the document wa

Form 1099-MISC (2024)

What Is the 1099-MISC Form?

All 1099 form series provide the IRS with all the necessary information about the taxpayer. Specifically, the 1099-MISC form is used to provide information about miscellaneous income.

Before 2020 the document wa

-

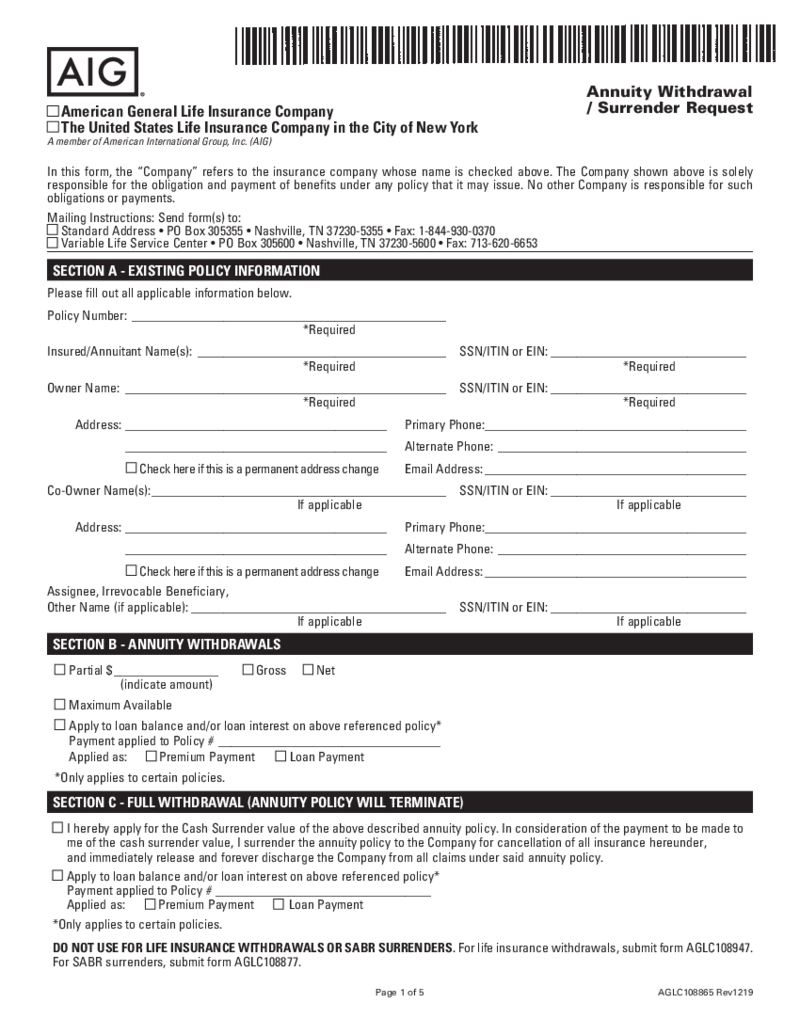

AIG Annuity Withdrawal Form

What is the AIG Annuity Withdrawal Form?

The AIG Annuity Withdrawal Form is a document that allows you to withdraw money from your annuity account with AIG. An annuity is a financial product that provides you with regular payments over a specified period

AIG Annuity Withdrawal Form

What is the AIG Annuity Withdrawal Form?

The AIG Annuity Withdrawal Form is a document that allows you to withdraw money from your annuity account with AIG. An annuity is a financial product that provides you with regular payments over a specified period

-

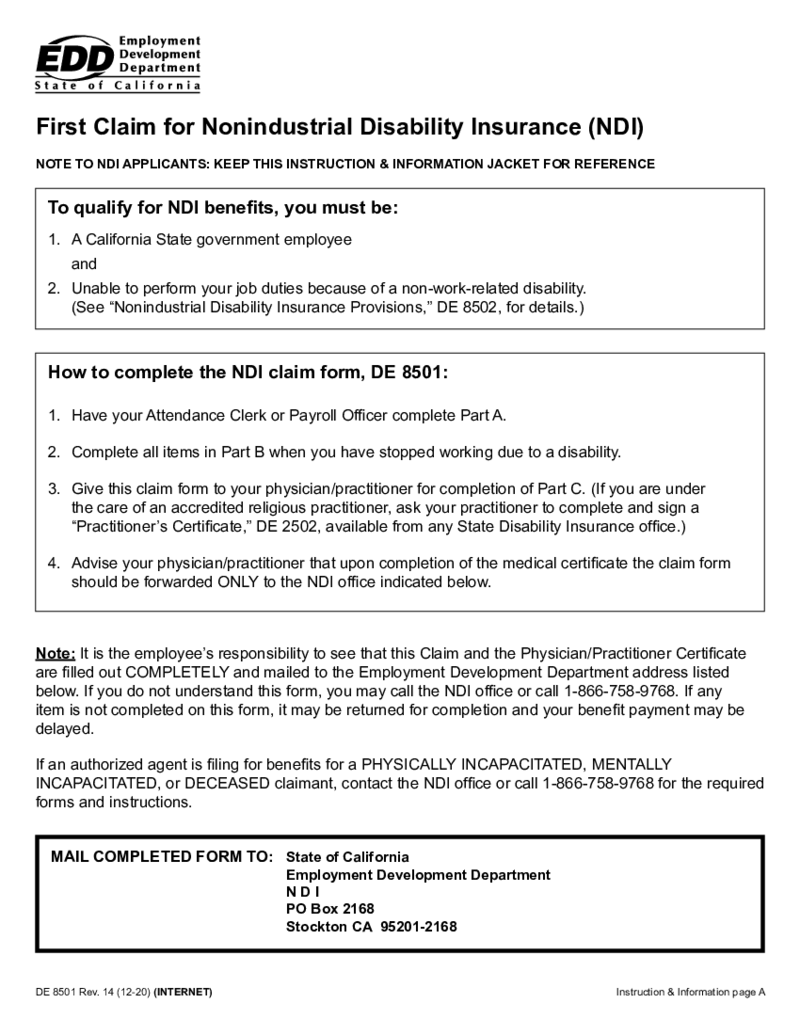

DE 8501 - First Claim for Nonindustrial Disability Insurance (NDI)

What Is a California State Disability Form PDF?

It is a three-page document used to claim benefits when an employee is unable to work due to illness, injury, or other medical conditions unrelated to their work. It is sometimes also called the Non-Industri

DE 8501 - First Claim for Nonindustrial Disability Insurance (NDI)

What Is a California State Disability Form PDF?

It is a three-page document used to claim benefits when an employee is unable to work due to illness, injury, or other medical conditions unrelated to their work. It is sometimes also called the Non-Industri

-

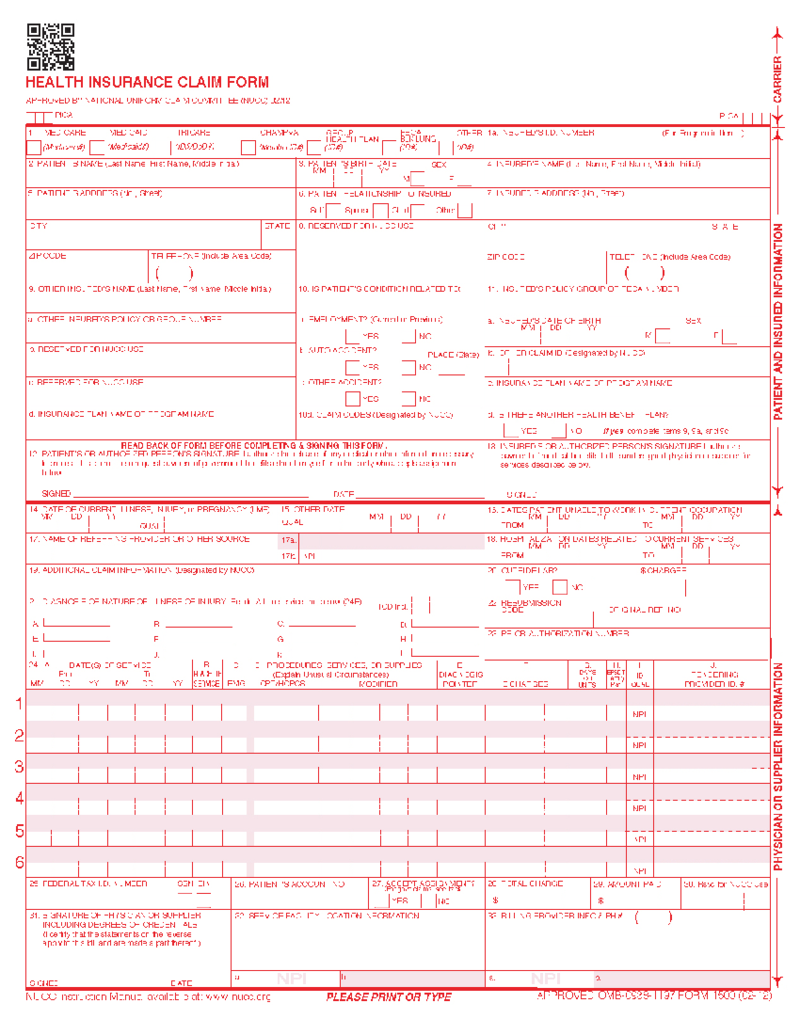

Form CMS-1500 (02-12)

What is a CMS 1500 Claim Form (2012)

The CMS-1500 Claim Form is a detailed health insurance blank used by various non-institutional providers to bill Medicare, Medicaid, Tricare, and other government carriers. Copies of other papers, such as test results

Form CMS-1500 (02-12)

What is a CMS 1500 Claim Form (2012)

The CMS-1500 Claim Form is a detailed health insurance blank used by various non-institutional providers to bill Medicare, Medicaid, Tricare, and other government carriers. Copies of other papers, such as test results

-

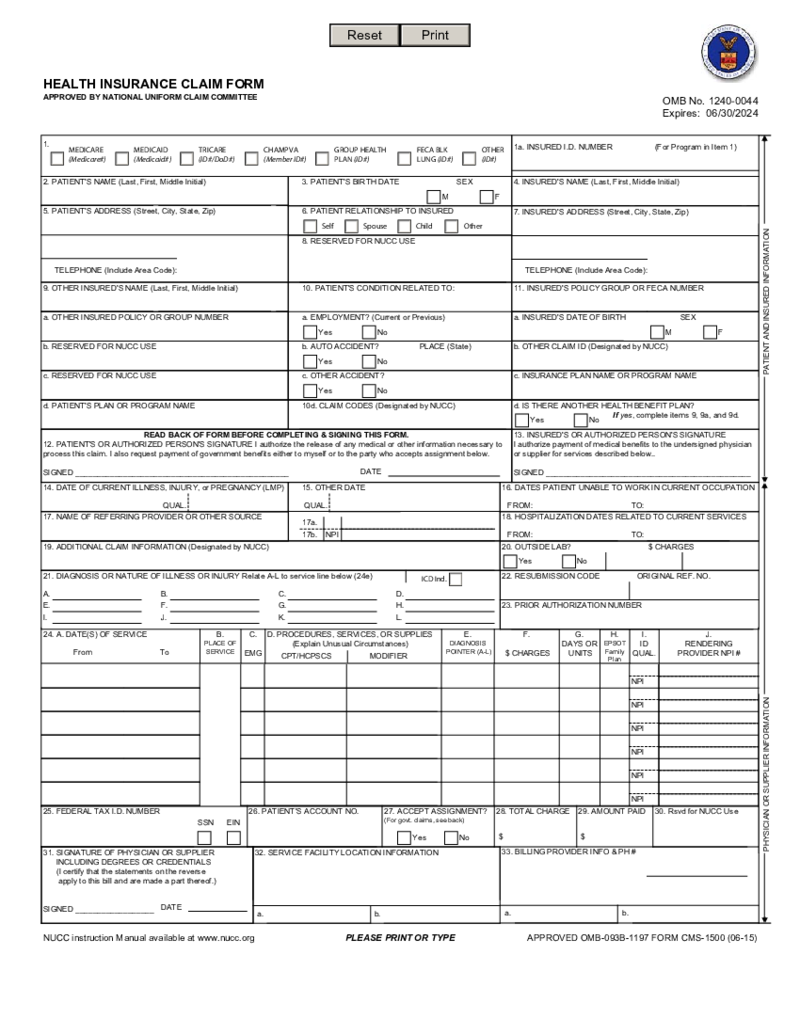

CMS 1500 Health Insurance Claim Form

What is CMS 1500 Claim?

CMS 1500 is a Claim form for Health Insurance. It was originally used to claim billing by either suppliers or a physician. The form is developed by CMS or Centers for Medicare and Medicaid. After some time, insurance carriers began

CMS 1500 Health Insurance Claim Form

What is CMS 1500 Claim?

CMS 1500 is a Claim form for Health Insurance. It was originally used to claim billing by either suppliers or a physician. The form is developed by CMS or Centers for Medicare and Medicaid. After some time, insurance carriers began

What Are Insurance Templates?

A template for insurance is a standardized form used by insurance companies and agents for a variety of tasks, such as life and property insurance for clients. A typical insurance document contains information about the insured person, insured events, damages, validity periods, and much more. Having a convenient and professional insurance card template guarantees a faster process of working with insured people and processing personal information. Unified forms also allow customers to compare insurance policy options quickly and choose the most appropriate coverage.

What Are the Insurance Forms Used For?

Insurance agents use many different documents in their work. Insurance templates are designed to make their tasks easier and speed up the data processing process. Since almost anything you own can be insured, insurers need to have an extensive collection of insurance templates that they might need in various situations. The PDFLiner library contains more than 220 forms for different occasions. There are also standard blanks from AIG, Blue Cross, Aflac, and other major insurance companies in the world. Our templates are easily customizable, so you can make any changes to make the final document fully meet your needs.

Types of Insurance Templates

You will find different types of insurance templates freely available on the Internet and on our website. Some are highly specialized documents used for specific cases, while others are more general and suitable for several tasks at the same time. Here are just a few of the main types of insurance templates you can find on PDFLiner:

- car insurance;

- homeowner's insurance;

- health insurance;

- business insurance;

- travel insurance.

You can easily view the contents of templates for insurance by simply opening them with our editor. Make sure the form contains the necessary fields, and start filling it out. Adjust any of our files to make them fully meet your needs.

What Should Be Included in Insurance Templates?

Since the property and life insurance template is a form of a legally binding agreement, it should contain the following information:

Agreements

The parties, in this case, insurance companies and their clients, should agree in writing to the conditions and requirements described in the document.

Declarations

This section usually includes information about the company's policy, the start and end date of the contract, and so on.

Conditions

This part describes the situations in which the insurance policy comes into force. The agencies undertake to inform customers about changes in the contract, and clients, in turn, undertake to adhere to the agreed schedule for making insurance premiums.

Exclusions

Exclusions mean any situation that is not covered by the policy. For example, self-mutilation is not a life insurance event.

Riders

The main insurance policy can include additional services such as protecting valuable items or life insurance in case of high-risk activities.

How to Make Insurance Website Templates: Step by Step

The PDFLiner collection includes hundreds of insurance templates free of charge that you can use as they are or customize to your liking. Here's how to work with the insurance template in our editor:

Step 1: Understand which form is best for the current situation. These can be blanks of large companies or standard templates for life and property insurance.

Step 2: Find the desired template in the PDFLiner library. Read the description and review the content to see if it's what you need.

Step 3: Enter the requested information in the appropriate fields. Indicate the insured person's contacts, the insurance cost, and so on.

Step 4: Make sure there are no errors in the document. It is essential because incorrect information can have serious financial consequences.

Step 5: Don't forget to sign the insurance template for it to take effect and have legal weight.

Step 6: Hand over the completed document to the recipient. You can do it by handing over the printed policy in person or by emailing.

Are Insurance Templates Legally Binding?

An insurance contract is a document that legally binds participants with certain obligations. The company undertakes to compensate the loss of the insured person. The client, in turn, must comply with the described conditions and regularly make insurance premiums so that the contract remains valid.

The templates themselves are not contracts but only serve as a basis for creating an agreement between two parties. Only a document signed by all participants can be considered legally binding during the period specified in the text. If one of the parties violates the described conditions, it will incur appropriate penalties and fines.