-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

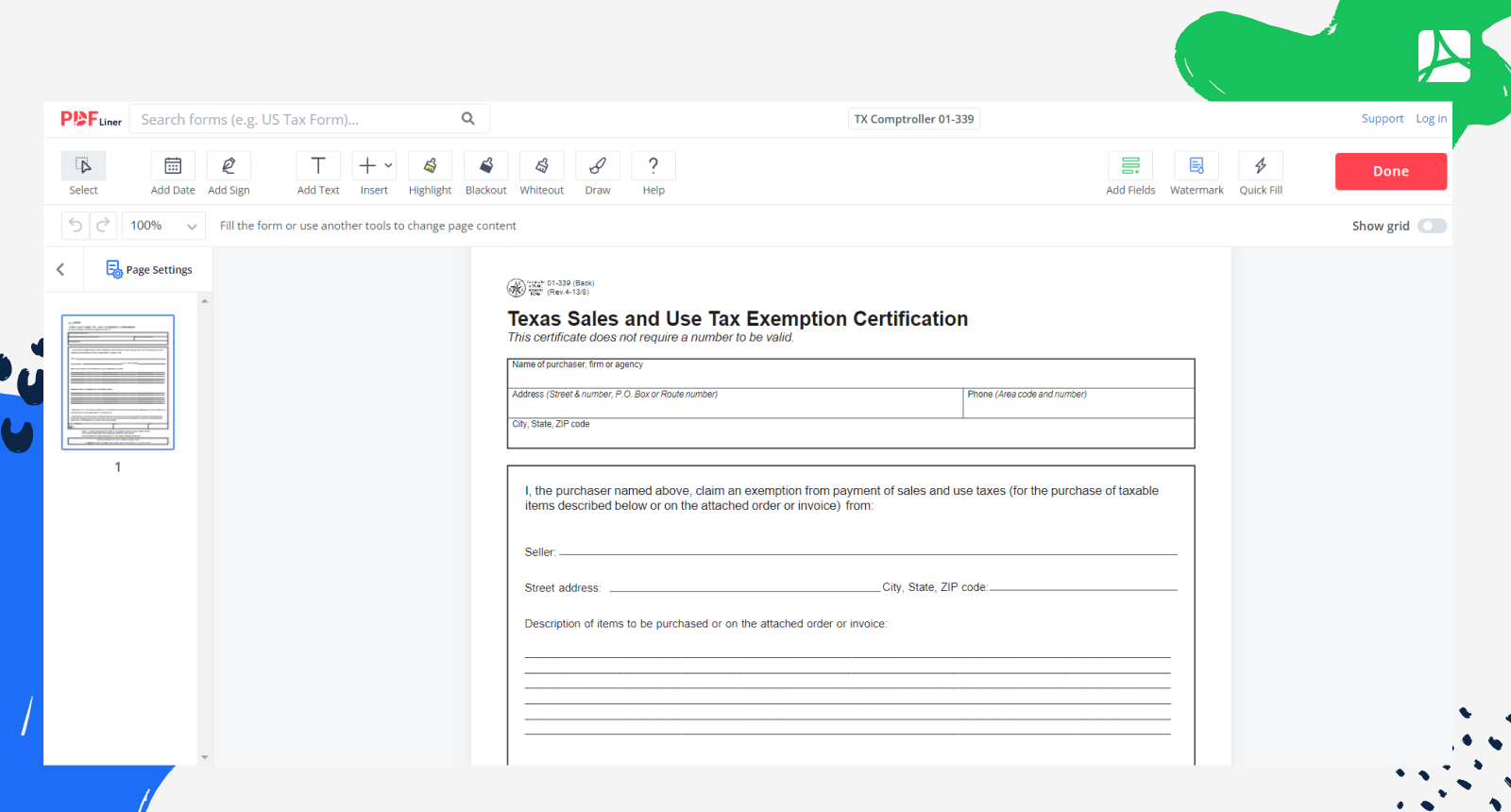

Texas Sales and Use Tax Exemption Certification

Get your Texas Sales and Use Tax Exemption Certification in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is a Texas Sales and Use Tax Exemption Certification?

The Texas form 01-339, also known as the resale or exemption certificate, is a document used by businesses and individuals to claim exemption from sales and use taxes on certain items or services in Texas. The resale certificate Texas form is issued by the Texas Comptroller of Public Accounts and can be used by buyers to purchase goods or services without paying sales tax if the seller accepts the certificate.

What should the Texas sales and use tax exemption certification form include

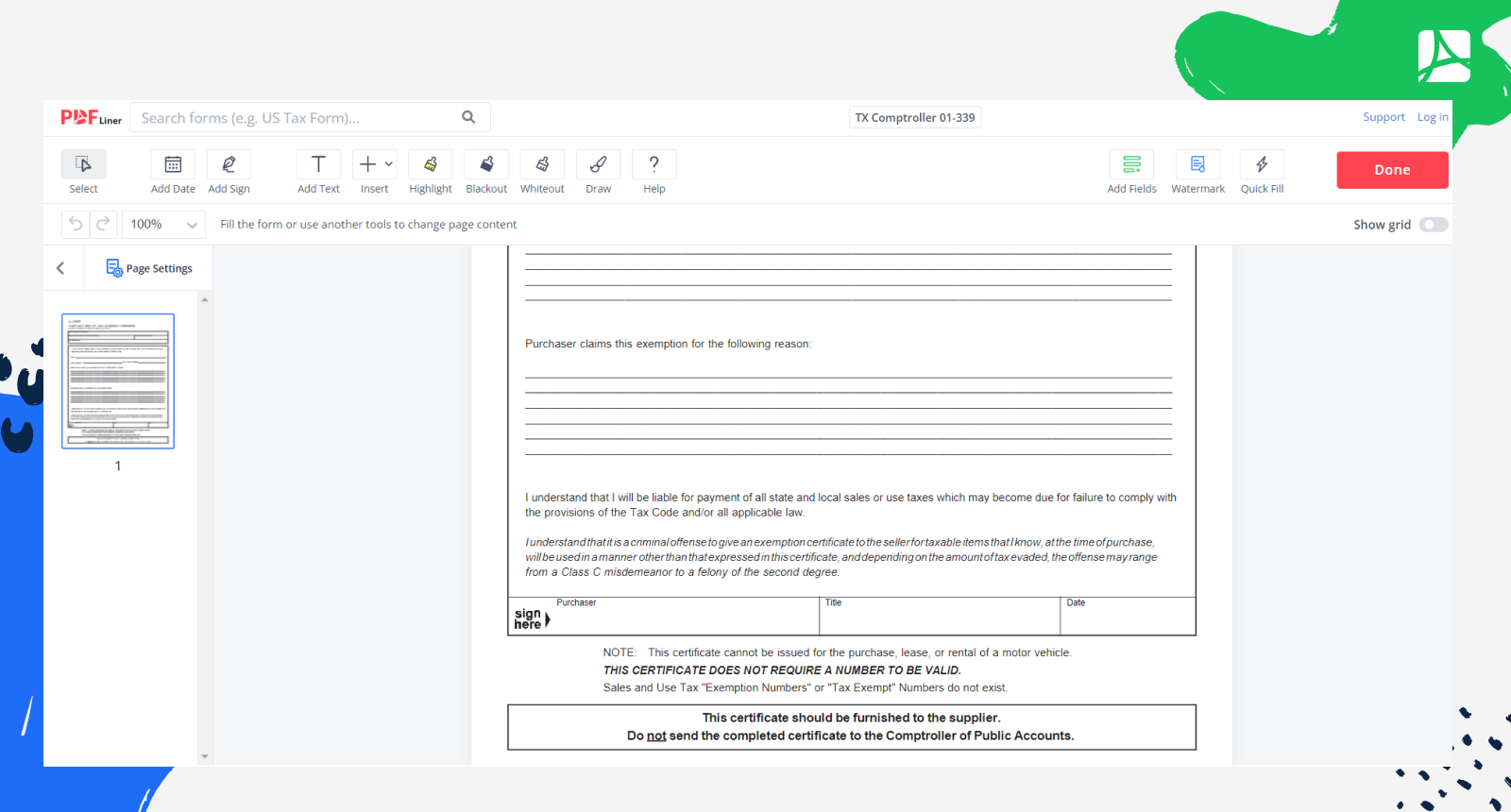

The Texas form 01 339 should include the following information:

- Your name and contact information

- Your business name and contact information (if applicable)

- Your taxpayer identification number (TIN)

- The reason for the exemption, such as resale, manufacturing, or other applicable reason

- A description of the items or services being purchased or sold

- The signature of the buyer or authorized representative

Remember to ensure that all information provided on the Texas 01-339 form is accurate and up-to-date to avoid any issues or delays in processing.

How To Fill Out the TX Comptroller 01-339 Online

Filling out the Texas resale certificate form pdf online is easy and straightforward. Follow these steps:

- Go to the PDFliner website and log in to your account.

- Find and get a copy of the Texas 01-339 fillable form.

- Enter the required information, such as your name, business name (if applicable), and contact information.

- Indicate the reason for the exemption, such as resale or manufacturing, and provide additional details as requested.

- Review the information you entered and submit the Texas resale certificate form.

Once submitted, you can download a copy of the Texas resale certificate pdf for your records. The form is valid for four years from the date of issue, after which you will need to renew it if you wish to continue claiming exemption.

When to request the TX comptroller 01-339 form

There are several situations in which you may need to request a Texas 01 339 form:

- If you are a business that purchases goods or services for resale in Texas, you may need to request the 01 339 tax form to claim exemption from sales tax on those items.

- If you are a manufacturer or processor in Texas, you may need to request the form to claim exemption from sales tax on certain items used in your production process.

- If you are a nonprofit organization in Texas, you may need to request the form to claim exemption from sales tax on certain items or services purchased for your organization's use.

- If you are an out-of-state business that makes sales in Texas, you may need to request the form 01 339 to claim exemption from Texas sales tax on those sales.

FAQ Texas Sales and Use Tax Exemption Certification

-

What qualifies for sales tax exemption in Texas?

Sales tax exemption in Texas applies to specific items such as prescription drugs, certain medical equipment, agricultural products, and manufacturing machinery, among others. Additionally, organizations with nonprofit status may also qualify for exemption.

-

How long is a Texas sales and use tax exemption certification valid?

The Texas sales and use tax exemption form remains valid as long as there is no change in the nature of the business or organization. If any changes occur, such as a change in ownership or activities that would affect the exemption eligibility, an updated form may be required.

-

What is required on a sales and use tax resale certificate in Texas?

To obtain a sales and use tax resale certificate in Texas, the following information is typically required: the purchaser's name and address, their sales tax permit number, a description of the goods being purchased for resale, and a statement declaring that the items will be resold in the ordinary course of business.

-

Are all purchases made by non-profits exempt from sales tax in Texas?

While certain non-profit organizations may be eligible for sales tax exemption in specific situations, it is not a blanket exemption for all purchases. Non-profit organizations ought to meet certain criteria and complete the necessary documentation to claim sales tax exemptions for their purchases in Texas.

Fillable online Texas Sales and Use Tax Exemption Certification