-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Michigan DHS Self-employment Form

Get your Michigan DHS Self-employment Form in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

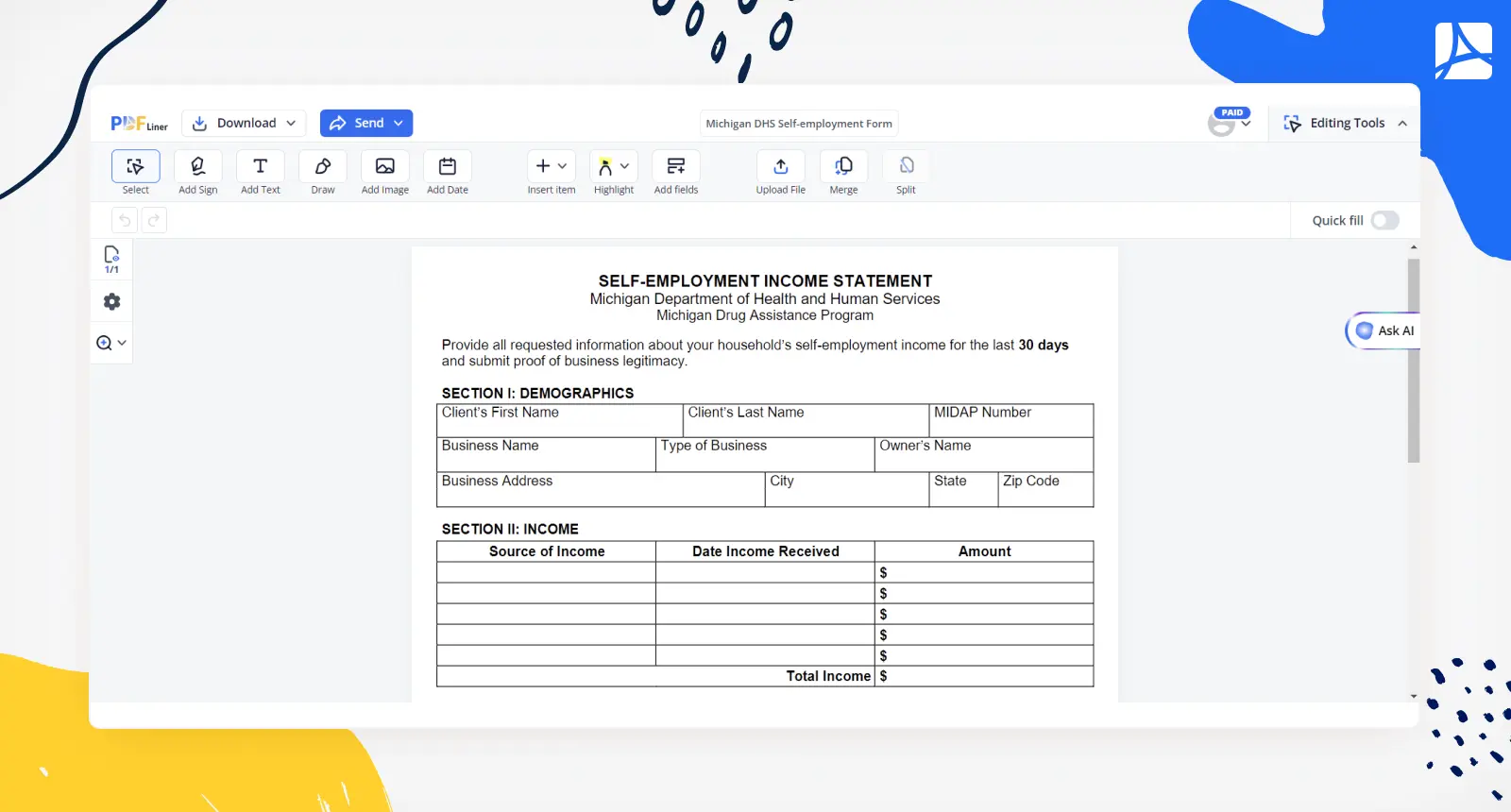

How to Fill Out the Michigan Self-Employment Form

If you're a self-employed individual in Michigan, you might need to fill out the form, formally known as the MDHHS-5762 Self-Employment Income Statement. This form is for reporting your income to the Michigan Department of Health and Human Services (MDHHS) for programs like the Michigan Drug Assistance Program (MIDAP).

In this expert-level guide, we'll walk you through the process of completing this form, ensuring that you understand each section and can provide the required information accurately.

Section I: Demographics

The first section of the form is straightforward but essential. Here, you provide your personal and business details.

- Client’s First Name and Last Name: Enter your full legal name as it appears on official documents.

- MIDAP Number: This is your unique identification number for the Michigan Drug Assistance Program. If you don’t have one, you may need to contact your case manager or the program’s helpline.

- Business Name and Type of Business: Specify the name of your business and the type of services or products you offer. For instance, you might write "Jane's Freelance Writing" and "Content Creation Services."

- Owner’s Name: If you are the sole proprietor, this will be your name. If your business has multiple owners, list the primary owner’s name.

- Business Address: Provide the complete address of your business, including city, state, and zip code.

Section II: Income

This section is the core of the form where you detail your income over the last 30 days.

- Source of Income: Describe each source of income. This could include payments from clients, sales of products, or other business-related income.

- Date Income Received: Enter the dates on which you received the income. Be as precise as possible, as this ensures accuracy in your reporting.

- Amount: List the amount received for each source of income.

After listing all income sources:

Total Income: Calculate and enter the total amount of income received in the last 30 days. This is a simple sum of all the amounts listed above.

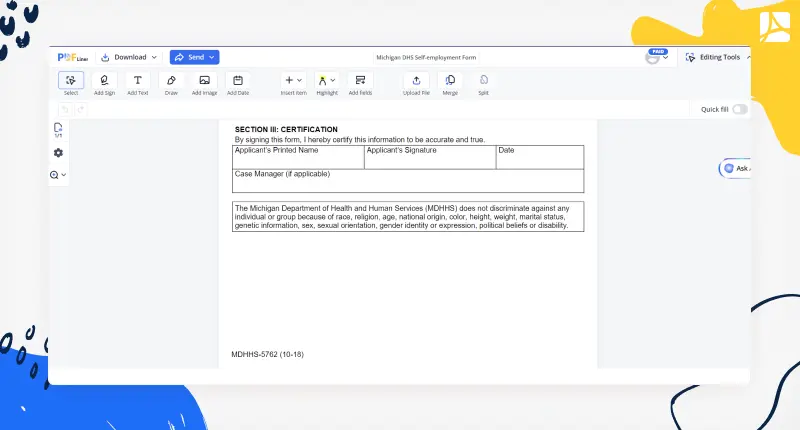

Section III: Certification

This final section is about certifying the accuracy of the information you've provided.

- Applicant’s Printed Name: Print your full name clearly.

- Applicant’s Signature: Sign the form to confirm that the information you have provided is accurate and true.

- Date: Enter the date you are signing the form.

If you have a case manager, they will need to fill in their information as well.

Tips for Completing Michigan Self-employment Statement

- Accuracy is Key: Ensure that all the information you provide is accurate. Double-check dates and amounts before submitting.

- Documentation: Attach any required proof of your business's legitimacy, such as business licenses or recent tax returns, as specified by MDHHS.

- Keep Records: Maintain copies of this form and any documentation you submit for your records. This can be helpful in case any questions arise about your submission.

- Seek Assistance: If you are unsure about any part of the form, do not hesitate to reach out to a case manager or a representative from MDHHS. They can provide guidance and ensure you complete the form correctly.

Conclusion

Filling out the DHHS self-employment form can initially seem daunting, but by breaking it down into manageable sections, the process becomes much more straightforward. Remember to provide accurate information, keep thorough records, and seek help when needed. With this guide, you're well-equipped to navigate the form with confidence, ensuring that your self-employment income is reported correctly and efficiently.

For further details, always refer to the official guidelines provided by the Michigan Department of Health and Human Services. Happy filing!

Fillable online Michigan DHS Self-employment Form