-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

What Is a 1099-S Form and How to File It

.png)

Dmytro Serhiiev

If you wonder “what is a 1099-S form?”, you should know that the form is popular among real estate agents and people who have to conduct real estate deals by themselves. It is an important document you have to provide in your real estate transactions. You have to learn how to file a 1099-S form to report a full amount of capital gains on a yearly tax return as a seller.

1099-S Fillable Form 61b0d42323f74a452d0dc672

What Is a 1099-S Form?

The IRS Form 1099-S was created to report the sale of the real estate or exchange procedure. It offers to make sure that sellers are reporting all their capital gains during the tax return period. The IRS requires detailed data to make sure that the seller of the real estate is paying the right amount of taxes.

You have to learn how to report 1099-S on the tax return even if you just close the transaction on the real estate. It must be filed by the person responsible for the closing of the transaction. This person has to send one copy to the IRS, and if you are not the transferor, you have to receive one copy as well.

If you are not sure whether you have to report an exchange or sale, you need to read the IRS instructions for Schedule D, Form 1040. If the real estate is not your main living place, provide information in Form 6252, 4797, or Schedule D of the most appropriate form.

In brief, if a person buys $200,000 real estate property, and sells it for $250,000, the capital gains income is $50,000. Each year this taxable income must be reported to the IRS.

In brief, if a person buys $200,000 real estate property, and sells it for $250,000, the capital gains income is $50,000. Each year this taxable income must be reported to the IRS.

Printable 1099-S Form 61b0d42323f74a452d0dc672

How to File a 1099-S Form

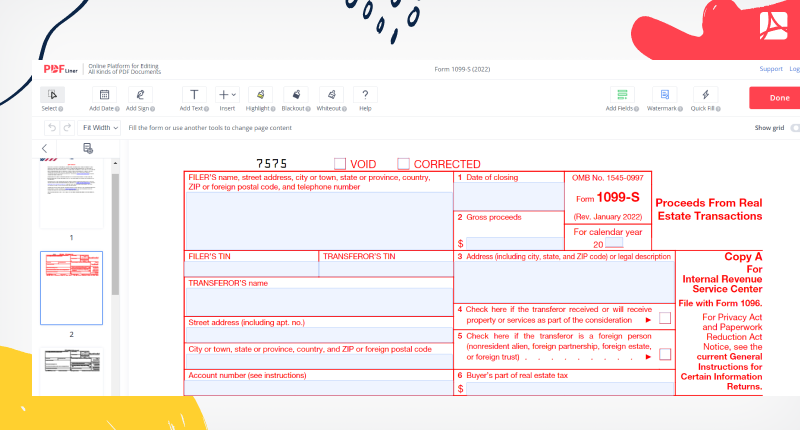

Read these detailed 1099-S instructions before you begin to complete the form. While the form contains 5 pages, most of them are copies and instructions from the IRS. You have to make sure you read these recommendations before you file anything. Copy A in red color is for IRS Center. You can’t cut or separate forms there. Provide the following information to fill out your 1099-S:

- Data on the filer, including their address, and name;

- Date of closing in the 1st box and gross proceeds in the 2nd;

- Include the filer’s and transferor’s TINs;

- Information about the transferor, including the name, street address, and city. You have to write down the ZIP code too;

- Account number;

- Provide information on the property address in box 3;

- Out the tick in appropriate boxes in the 4th and 5th sections;

- Name the buyer’s part of the tax for real estate.

FAQ

Read the most frequently asked questions about the form. This information might be helpful for you.

Do S corps get 1099?

No, corporations do not receive these forms. It does not matter whether they are C or S corporations, they do not require 1099 forms.

Do you have to pay taxes on a 1099-S form?

Yes, you have to do it. The form provides a report on the income from real estate deals. You can find this document on the PDFLiner website. It is sent to the IRS to prove the accuracy of taxes.

Who must file Form 1099-S?

The form must be filed by the transferor. If you are the one who closes the real estate deal, you need to send this form. Another question is who do you send 1099-S to. You send the 1st copy to the IRS, the 2nd to the transferor, and the 3rd to the filer.

Fill Out Tax Forms At No Time with PDFLiner

Start filing your taxes electronically today and save loads of time!

Fillable 1099-S 61b0d42323f74a452d0dc672