-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

What Is 1099-K Form - Guide for Everyone

.png)

Dmytro Serhiiev

Last Update: Jan 2, 2024

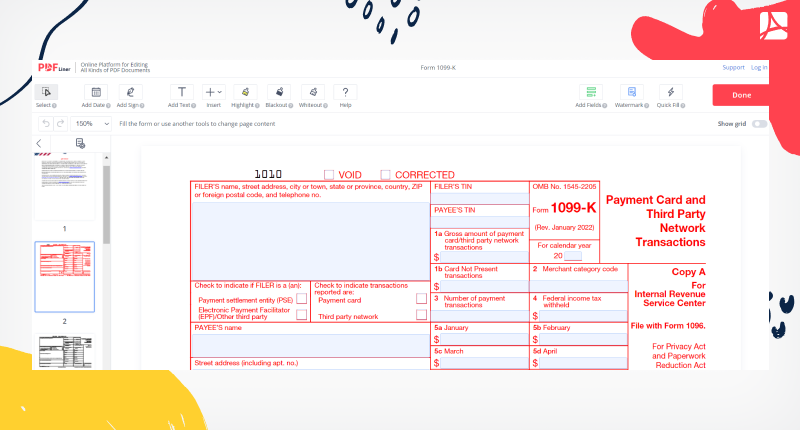

What is a 1099-K form and how to file this document to the IRS? Let’s find out all the details. The form is received by any owner of a small business that accepts debit or credit card payments. It is filled out for eBay sellers and owners of ridesharing businesses. The IRS requires this form to track all the transactions related to your business.

Fillable 1099-K 61b0d849cd679625c255dc62

Key Takeaways

- This form is used by the IRS to track transactions conducted via credit cards and third-party payment networks, helping determine taxes owed by businesses.

- Businesses processing over $600 annually through credit or debit cards should expect a 1099-K from their payment processors by January 31.

- The form includes vital data like the filer’s and payee’s information, account details, transaction amounts, and tax withholdings.

- Multiple copies of the form are needed for different entities (IRS, state tax departments, and payees), with tools like PDFLiner simplifying the process by automatically generating required copies.

What Is Form 1099-K?

Many small business owners are wondering “what is the purpose of a 1099-K?” Also known as Payment Card and Third Party Network Transaction Form, it is provided by the credit card companies and third-party payment processors who re-send the money from the customers to your store. This information is used by the IRS to find out the taxes you have to pay. A copy of the form is sent to a business owner as well. While you don’t necessarily need to learn how to fill a 1099-K tax form, you might find this information useful for your business.

Printable 1099-K 61b0d849cd679625c255dc62

What Is a 1099-K Used For?

If you don’t know the purpose of this form, you might have just started your business. This document is sent to a small business owner annually, as well as to the IRS. It includes the data on all transactions you’ve received for the products you sell. Later, the information must be attached to your tax return. You have to process $600 or over in total to receive the form. The numbers are counted from the stored-value, debit, and credit cards.

In case you did not receive the form, you still need to report the numbers. Make it in the official tax return form. The numbers must be accurate. If you did not receive the form by the due date, but your situation matches the one described by the official norms, you have to contact the IRS.

The form is available in the open-access around the Internet. You can find it on the IRS official website. To check out the form there, use the search bar and follow the IRS recommendations.

The simplest way to get to the form is to click on a blue button here, on PDFLiner. You don’t have to search for it through the website, since the link to the form is already located on this page. Open it, examine the fields, and try to complete it to see which information you have to provide. You can always upload the form in the PDFLiner storage after you receive it. Don’t delete it, since you need to attach this document to your annual tax report.

When Is Form 1099-K Issued?

You can expect to receive the IRS Form 1099-K from the third parties or banks by January 31. For 2022, it had to be issued to a business owner if the bank or service processed over $600. Before that, there had to be payments of $20 000 and over. The service had to process over 200 payments made by individuals.

This year, the number of payments is not important. There aren’t any hosting fees, processing fees for credit cards, or costs of advertising. You don’t have to include the payment for the Internet access and your home office.

Instructions for 1099-K Form

The 1099-K instructions are not complicated since the form is not that big. There are several copies you have to send to specific parties. Make sure you have all the information compiled before you start filling it. If you are an owner of a small business, you don’t need to follow these 1099-K requirements and can expect the already filled form by January 31. Here is the basic information you have to provide in the form:

- data on the filer, including their name, address, and phone;

- put a tick in the box with the right statement about the filer;

- information about the payee, including the name, address, name of the PSE, and phone number;

- individual number of account, based on the IRS instructions;

- TINs of the filer and payee (you can get that by requesting a W9 form from them);

- the gross amount of payment card and transactions that are not present in the card;

- category code of merchant, number of transactions, and withheld federal tax;

- amount of payment for January, February, March, April, May, June, July, August, September, October, November, and December;

- a state and its number;

- income tax withheld by the state.

Copy A is for the IRS, and Copy 1 is for the State Tax Department. Copy B is for the payee. There is Copy 2 filed with the income tax return. Copy C is for the filer. The easiest way to create and send copies is by using the PDFLiner online editor because you would only need to fill out the Copy A and the information will be automatically copied to all other copies.

Form 1099-K 61b0d849cd679625c255dc62

FAQ

Here are the most frequently asked questions about Form 1099-K. Read them to clarify all the details about filing this document.

How to file Form 1099-K?

Once you receive Form 1099-K from the entity, you have to attach it to the gross receipts of the taxpayer’s income from the business. Receipts are usually reported in Schedule C of the tax report. You may send it to the IRS either by regular mail or electronically. Read more.

How to get a 1099-K form?

You will receive the form by January 31 from the third parties that work with your transactions. If you did not receive it, you can contact them. Another option is to address the IRS.

Fill Out Tax Forms At No Time with PDFLiner

Start filing your taxes electronically today and save loads of time!

Fillable 1099-K 61b0d849cd679625c255dc62