-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

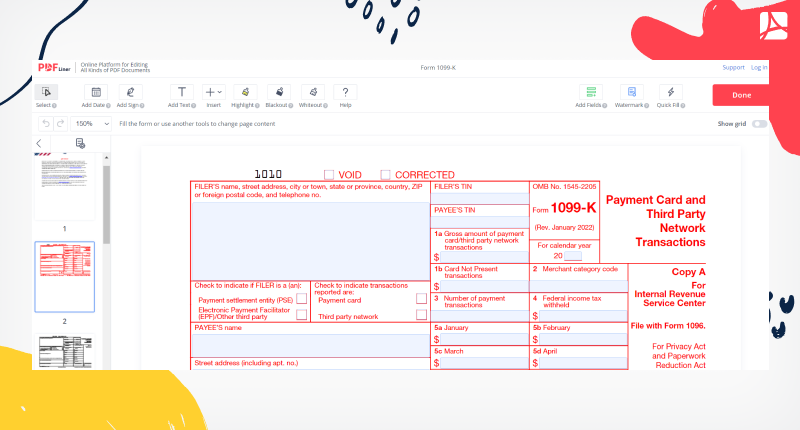

Detailed Guide on How to File 1099-K Form

.png)

Dmytro Serhiiev

Searching for how to file a 1099-K form? If you are not a bank employee or an accountant who keeps all transactions in the documents, you don’t have to complete the form on your own. All you need to do is to wait for it. After receiving the form, you have to send it to the IRS.

Fillable 1099-K 61b0d849cd679625c255dc62

What Is Form 1099-K?

Although you are not the one who has to fill out this form, don’t underestimate its importance. If you are a small business owner, you need to learn what is Form 1099-K before you start selling anything online. Basically, the form was created by the IRS to receive the information on digital payments you receive in your store.

The IRS Form 1099-K is sent to you and the IRS by third parties through whom your customers pay you for the products or services. You need to sell goods of at least $600 and over in total to receive this form. It does not matter which products you sell, it can even be a ridesharing business. In case you’d like to know more we have a complete guide on 1099-K Form.

Printable 1099-K 61b0d849cd679625c255dc62

How to File a 1099-K Form?

Filing a 1099-K Form is a necessary action for everyone who trades online, uses debit or credit cards, or third-party systems to receive payments. The copy of the form goes to the IRS as well, so you can’t provide different information in your tax report.

Once you receive the form, you have to attach it to Schedule C of your tax report. Make sure you provide accurate numbers. If the form has wrong numbers, contact the IRS in advance and describe your situation. You may also contact the bank beforehand, try to find out the reason for the mistake, and ask them to resend the form to the IRS.

The best possible way to send the form is online. PDFLiner allows you to fill out the tax return and the 1099-K. You may send it electronically to the IRS right after you finish editing the document by saving the forms and attaching them to your e-file. PDFLiner offers you the feature to make changes in documents. If you find any mistakes or unfilled sections, just go back there. You may also provide an electronic signature with one click.

Form 1099-K Deadline and Important Dates

You have to understand how to report a 1099-K form and when to do this. You will receive the form by January 31. If this day happens on a weekend or holiday, the date will be postponed to the next working day.

The IRS has to receive this form before March 31, so the IRS paper filing must be made up to February 28. Follow these dates if you don’t want to receive a fee for the delay. This is why it is crucial to find where to file a 1099-K form. The IRS offers you to fill it online, and you can always use standard regular mail.

FAQ

Read the most popular questions about filing Form 1099-K. Check the answers below to understand the details you might have missed.

Who has to file Form 1099-K?

You have to be a Payment Settlement Entity to file the form, revealing payment transactions that were made during the year. The sum must be $600 or more. You can attach the form to your tax report.

Which form goes with 1099-K?

Usually, you need to report your taxes using a 1040 form. Attach Form 1099-K to Schedule C there. You need to transfer the numbers from Form 1099-K to Schedule C.

How to add Form 1099-K to your taxes?

Follow the instructions above. You have to provide the information on your profit in Form 1040. A 1099-K version contains the data you have to add to Form 1040 Schedule C.

Fill Out Tax Forms At No Time with PDFLiner

Start filing your taxes electronically today and save loads of time!

Form 1099-K 61b0d849cd679625c255dc6