-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

- 1099 Forms

- W-9 Forms

- Other Tax Forms

- Real Estate

- Legal

- Medical

- Bill of Sale

- Contracts

- Education

- All templates

![Picture of HIPAA Compliance Patient Consent Form]() HIPAA Compliance Patient Consent Form

HIPAA Compliance Patient Consent Form

![Picture of Legal Aid Queensland Application]() Legal Aid Queensland Application

Legal Aid Queensland Application

![Picture of Pennsylvania Last Will and Testament Form]() Pennsylvania Last Will and Testament Form

Pennsylvania Last Will and Testament Form

![Picture of AU Mod(JY), Parent(s), Guardian(s) details]() AU Mod(JY), Parent(s), Guardian(s) details

AU Mod(JY), Parent(s), Guardian(s) details

![Picture of Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment]() Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment

Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment

![Picture of Recertification for Calfresh Benefits (CF 37)]() Recertification for Calfresh Benefits (CF 37)

Recertification for Calfresh Benefits (CF 37)

![Picture of Wisconsin Last Will and Testament Form]() Wisconsin Last Will and Testament Form

Wisconsin Last Will and Testament Form

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Form 990 Schedule B (2020)

Get your Form 990 Schedule B (2020) in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

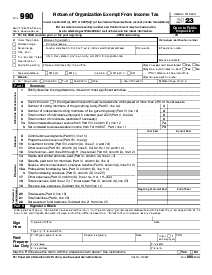

What Is Schedule B Form 990

Schedule B Form 990 is a supplemental form used by organizations when filing their Form 990, Form 990-EZ, or Form 990-PF. This particular schedule is designed to provide additional information on contributions the organization received during the year. It is primarily used to report the names and addresses of donors who contribute $5,000 or more in a single year or a certain percentage of the organization's total contributions. The requirement to include the names and addresses of contributors can vary based on the organization's total revenue and the nature of the contributions.

When to Use IRS Form 990 Schedule B

The IRS has provided specific situations in which non-profit organizations are required to use Schedule B with their Form 990 filings:

- When an organization receives a single donation of $5,000 or more from an individual, trust, or corporation within the tax year.

- Suppose the organization is a public charity receiving more than 2% of its contributions from any single donor. In that case, they must report the donor's information if the amount exceeds the 2% threshold.

- Grantmaking organizations must report all contributions from each donor exceeding $5,000 or 2% of the total grants and contributions received during the year.

- Certain exceptions and thresholds may apply based on the organization's gross receipts and the donor type.

How To Fill Out Form 990 Schedule B Instructions

Filling out the IRS Form 990 Schedule B requires careful attention to detail. Here are step-by-step guide instructions to help you complete the form:

- Step 1: Enter the organization's name and Employer Identification Number (EIN) at the top of the form.

- Step 2: Check the appropriate box for the type of form the Schedule B is being submitted with (990, 990-EZ, or 990-PF).

- Step 3: Indicate the tax year for which you are filing Schedule B.

- Step 4: Use Part I to list each person (or entity) who contributed, directly or indirectly, $5,000 or more to your organization. Include the name, address, total contributions for the year, and whether any contributions were non-cash. You need to describe the property and provide a fair market value for non-cash contributions.

- Step 5: In Part II, list any contributors that must be reported on Schedule B but weren't reported in Part I, generally because the contributions were less than $5,000.

- Step 6: Ensure that all amounts are accurate and that the sum of the contributions matches the amount reported on your Form 990.

- Step 7: Review your completed Schedule B carefully for accuracy and completeness before attaching it to your IRS Form 990 or other 990 forms.

Where To File IRS Form 990 Schedule B

The completed Schedule B Form 990 should be filed with the relevant Form 990. Generally, organizations must mail these forms to the Department of the Treasury, Internal Revenue Service Center at the address provided for their state or area. Alternatively, many organizations opt to e-file their tax documents using IRS-authorized electronic filing methods, which can be more secure and expedite processing. It's crucial to consult the IRS instructions for filing locations, as these can change, or to consult a tax professional who can assist with electronic filing options and requirements. Remember always to keep a copy of Schedule B for your organization's records.

Fillable online Form 990 Schedule B (2020)