-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

- 1099 Forms

- W-9 Forms

- Other Tax Forms

- Real Estate

- Legal

- Medical

- Bill of Sale

- Contracts

- Education

- All templates

HIPAA Compliance Patient Consent Form

HIPAA Compliance Patient Consent Form

Legal Aid Queensland Application

Legal Aid Queensland Application

Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment

Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment

Florida Last Will and Testament Form

Florida Last Will and Testament Form

Recertification for Calfresh Benefits (CF 37)

Recertification for Calfresh Benefits (CF 37)

Pennsylvania Last Will and Testament Form

Pennsylvania Last Will and Testament Form

AU Mod(JY), Parent(s), Guardian(s) details

AU Mod(JY), Parent(s), Guardian(s) details

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

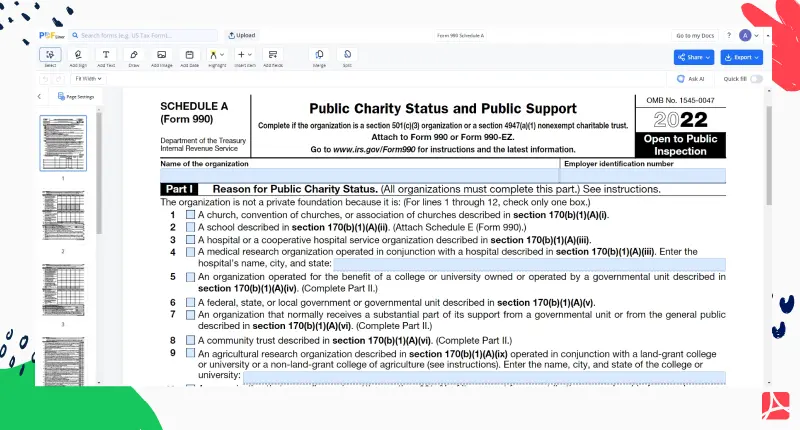

Form 990 Schedule A

Get your Form 990 Schedule A in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is Form 990 Schedule A

Also known as Public Charity Status and Public Support, 990 Form Schedule A is an important IRS document used by tax-exempt organizations to provide detailed information about their public charity status and the sources of their public support. This schedule helps the IRS assess the organization's eligibility for tax-exempt status and ensures transparency regarding their financial activities, allowing donors and the public to evaluate their operations and contributions.

Who Should Use Schedule A Form 990

The document is typically utilized by the following entities:

- tax-exempt organizations: nonprofits, charities, and other entities recognized as tax-exempt under the IRS regulations;

- organizations seeking transparency: those wanting to provide detailed information about their public charity status and sources of public support;

- donors and the public: individuals and entities interested in evaluating the financial activities and contributions of tax-exempt organizations;

- regulatory authorities: the IRS and state agencies that use this form to assess eligibility for tax-exempt status.

How to Fill Out IRS Forms 990 Schedule A

Want the process of completing Schedule A 990 Form to be as problem-free as possible and save your time along the way? Here's a 9-step guide to help you master every stage of the procedure:

- Begin by finding the template of the form in question in the PDFLiner's extensive database of pre-formatted files.

- Download the template or edit it online, depending on your preference. Our online editor allows you to complete the form without leaving your home or office.

- Read the form’s content carefully. They will help you understand its requirements.

- Fill in your organization's information accurately, including its name, EIN, and address.

- In Part I, specify reasons for Public Charity status.

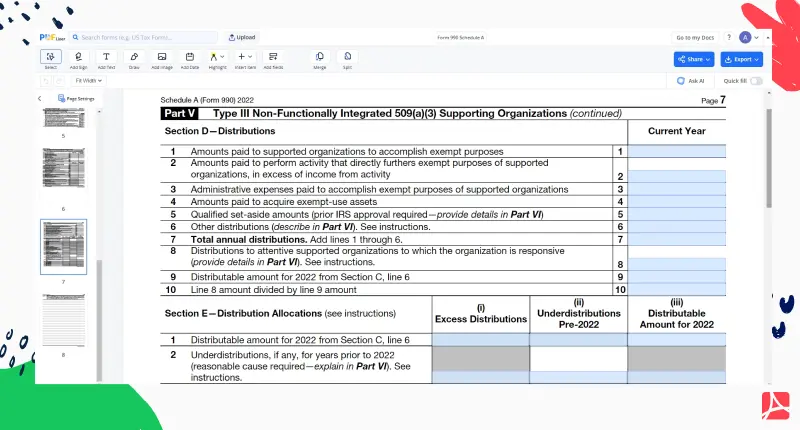

- In Part II, III, IV, and V, complete the financial sections of the file, detailing your organization's revenue, public support, and other financial data.

- Attach any required schedules and additional documentation as specified in the instructions.

- Carefully review all entries for accuracy and completeness. Make sure to include all necessary attachments.

- Save a digital copy for your records and print a hard copy if required.

By utilizing the PDFLiner's usability-powered platform and its repository of templates, you can streamline the process of filling out Form 990 Schedule A and ensure its compliance with the current tax regulations.

How to File Schedule A Form 990

When it's time to submit the document, ensure that every section is filled out accurately and comprehensively. Don't forget to include all the necessary supporting documents, and don't skimp on the details. After the file is diligently prepared, affix your authorized signature. Finally, send it off to the IRS at the address specified in the instructions. Remember, keeping things thorough and precise ensures a smooth navigating the sea of your administrative affairs.

Fillable online Form 990 Schedule A