-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Texas Templates

-

Form H1200

What is Form H1200?

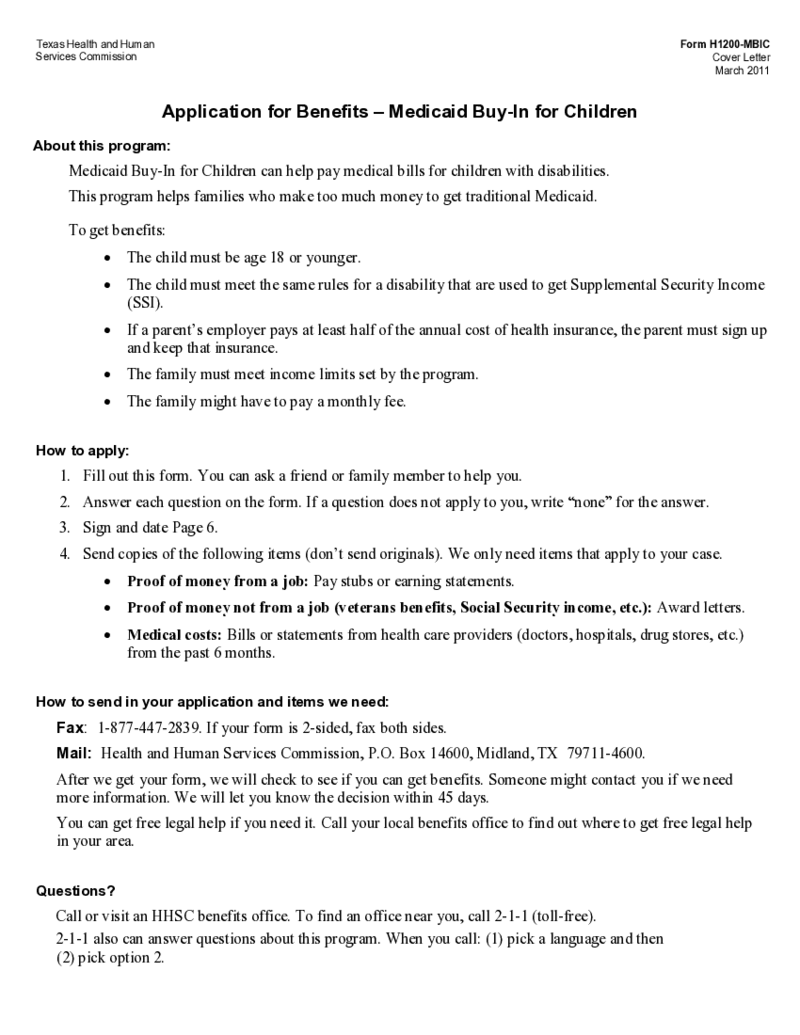

The form H1200 is also called Application for Benefits Medicaid Buy-In for Children. It was created by the Texas Health and Human Services Commission for the Medicaid program. Since Medicaid offers to pay the bills on behalf of childre

Form H1200

What is Form H1200?

The form H1200 is also called Application for Benefits Medicaid Buy-In for Children. It was created by the Texas Health and Human Services Commission for the Medicaid program. Since Medicaid offers to pay the bills on behalf of childre

-

Texas Proof of Pregnancy Form H3037

What Is Texas Proof of Pregnancy Form H3037?

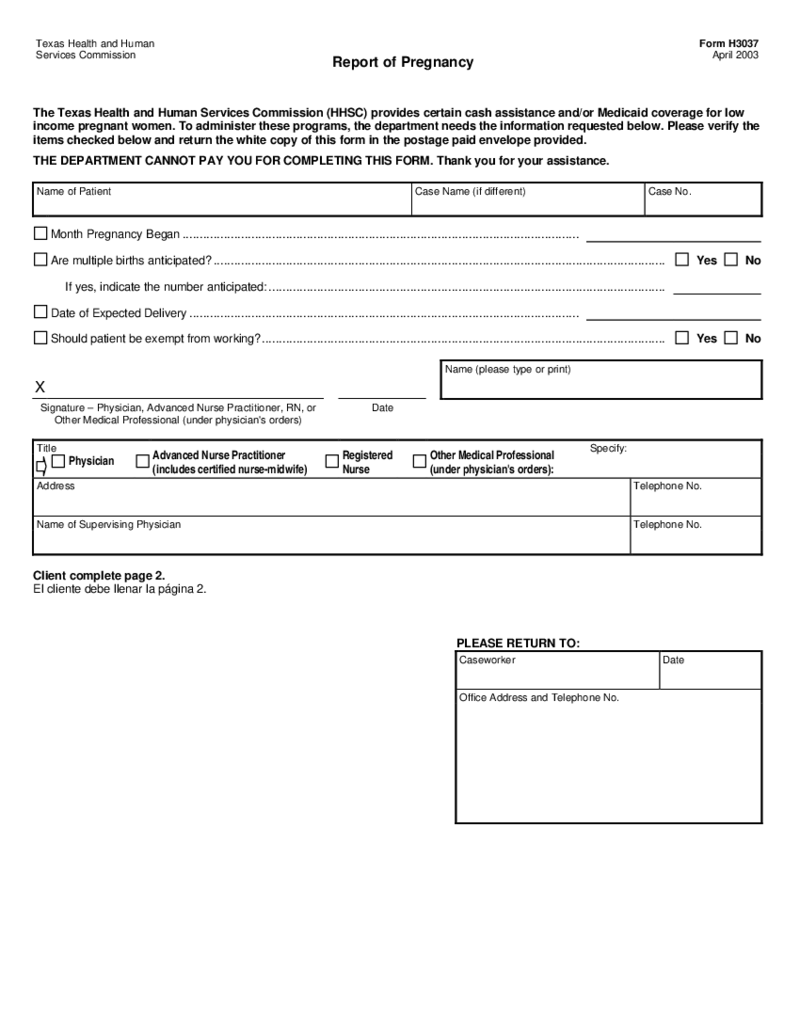

Form H3037 should be filled to report pregnancy from the sixth to the ninth month. The advisor should give an original and two copies to the individual. If the client works with a physician, an original and a c

Texas Proof of Pregnancy Form H3037

What Is Texas Proof of Pregnancy Form H3037?

Form H3037 should be filled to report pregnancy from the sixth to the ninth month. The advisor should give an original and two copies to the individual. If the client works with a physician, an original and a c

-

Texas Sales and Use Tax Exemption Certification

What Is a Texas Sales and Use Tax Exemption Certification?

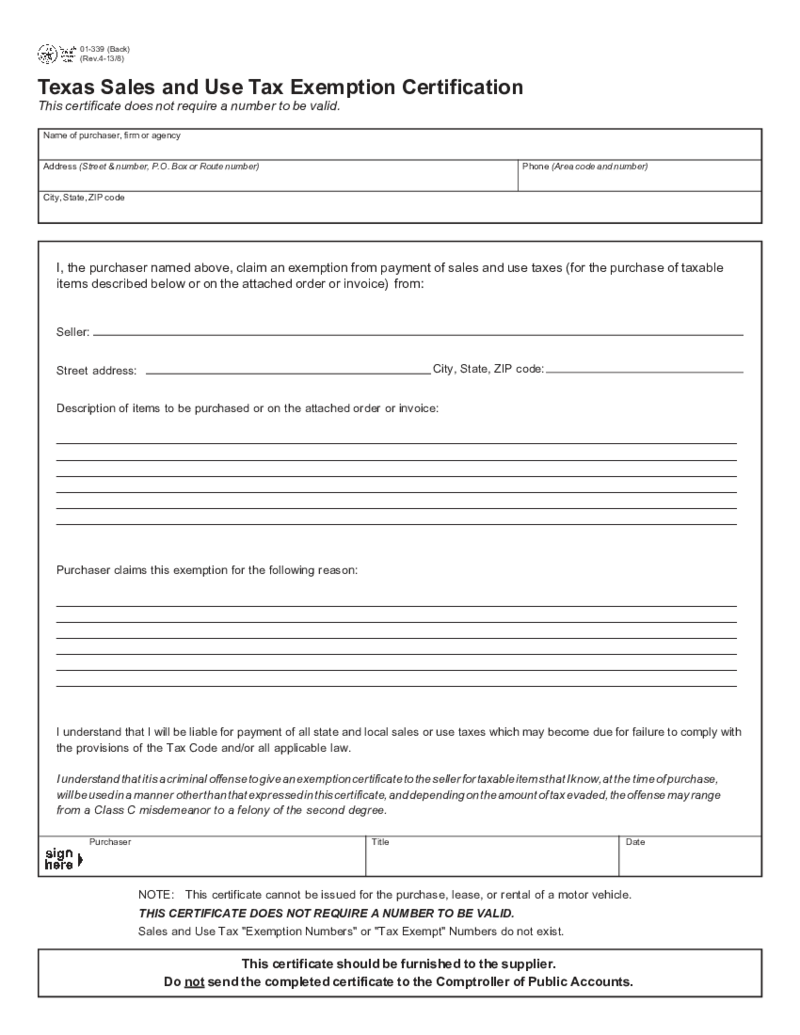

The Texas form 01-339, also known as the resale or exemption certificate, is a document used by businesses and individuals to claim exemption from sales and use taxes on certain items or services

Texas Sales and Use Tax Exemption Certification

What Is a Texas Sales and Use Tax Exemption Certification?

The Texas form 01-339, also known as the resale or exemption certificate, is a document used by businesses and individuals to claim exemption from sales and use taxes on certain items or services

-

Form H1857, Landlord Verification

Understanding and Effectively Utilizing the H1857 Form

Real estate transactions can be intricate, necessitating stringent administrative processes. One that plays a pivotal role, especially in Texas, is Form H1857. This form assures landlords that potenti

Form H1857, Landlord Verification

Understanding and Effectively Utilizing the H1857 Form

Real estate transactions can be intricate, necessitating stringent administrative processes. One that plays a pivotal role, especially in Texas, is Form H1857. This form assures landlords that potenti

-

Form 5506-NAR

What Is the 5506-NAR Form?

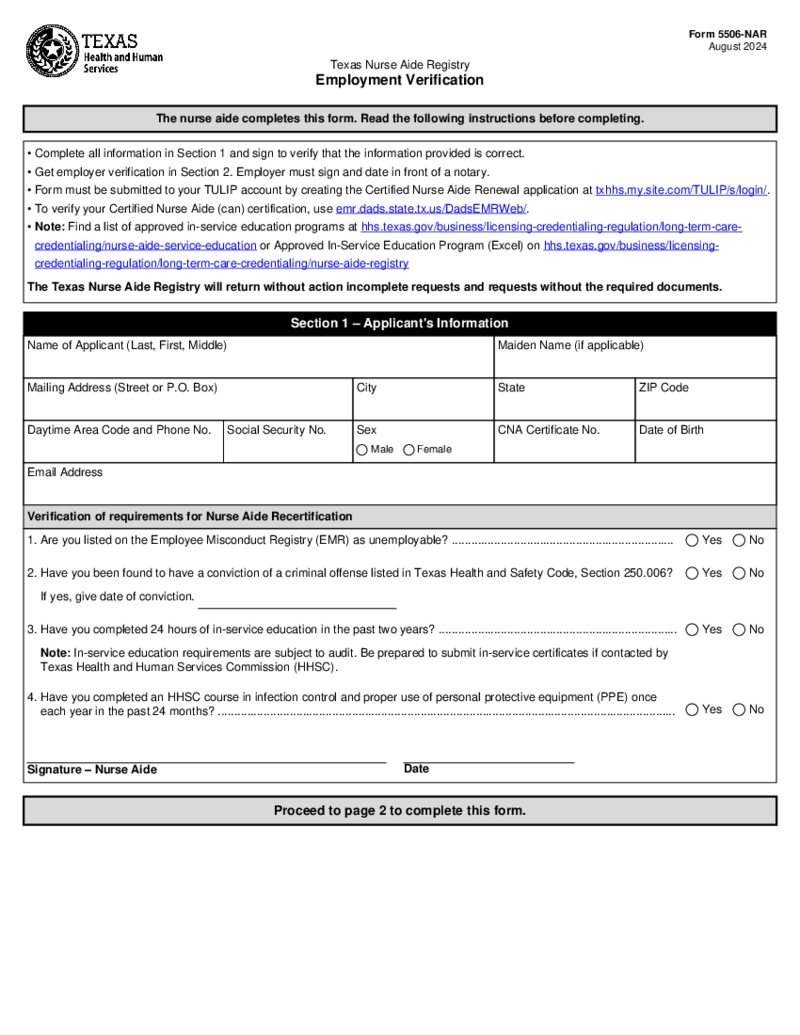

The 5506 NAR form is really important in the world of work and careers. It plays an integral role when it comes to assessing the potential of a job applicant to deliver required services. When appropriately filled out, it can pr

Form 5506-NAR

What Is the 5506-NAR Form?

The 5506 NAR form is really important in the world of work and careers. It plays an integral role when it comes to assessing the potential of a job applicant to deliver required services. When appropriately filled out, it can pr

-

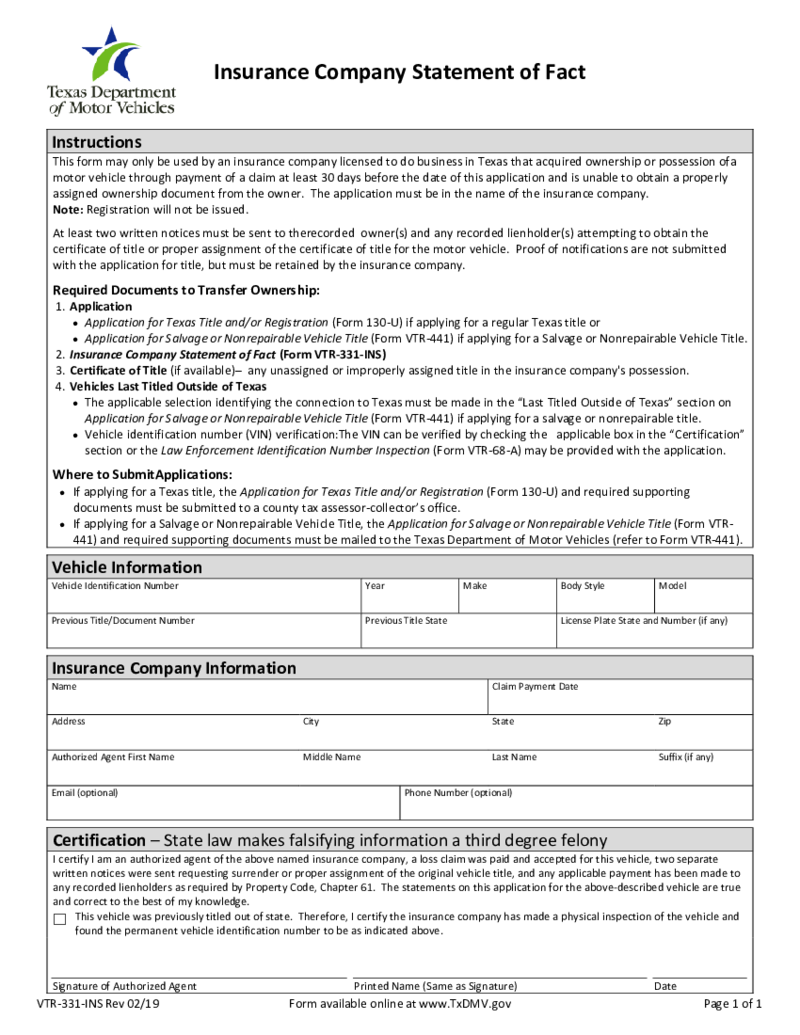

Insurance Company Statement of Fact - Form VTR-331 INS

What Is the VTR-331 INS Form?

The VTR-331 INS form is a statement of fact provided by an insurance company. It's used primarily in Texas, in accident cases involving an uninsured motorist. The insurance company is required to inform the Department of

Insurance Company Statement of Fact - Form VTR-331 INS

What Is the VTR-331 INS Form?

The VTR-331 INS form is a statement of fact provided by an insurance company. It's used primarily in Texas, in accident cases involving an uninsured motorist. The insurance company is required to inform the Department of

-

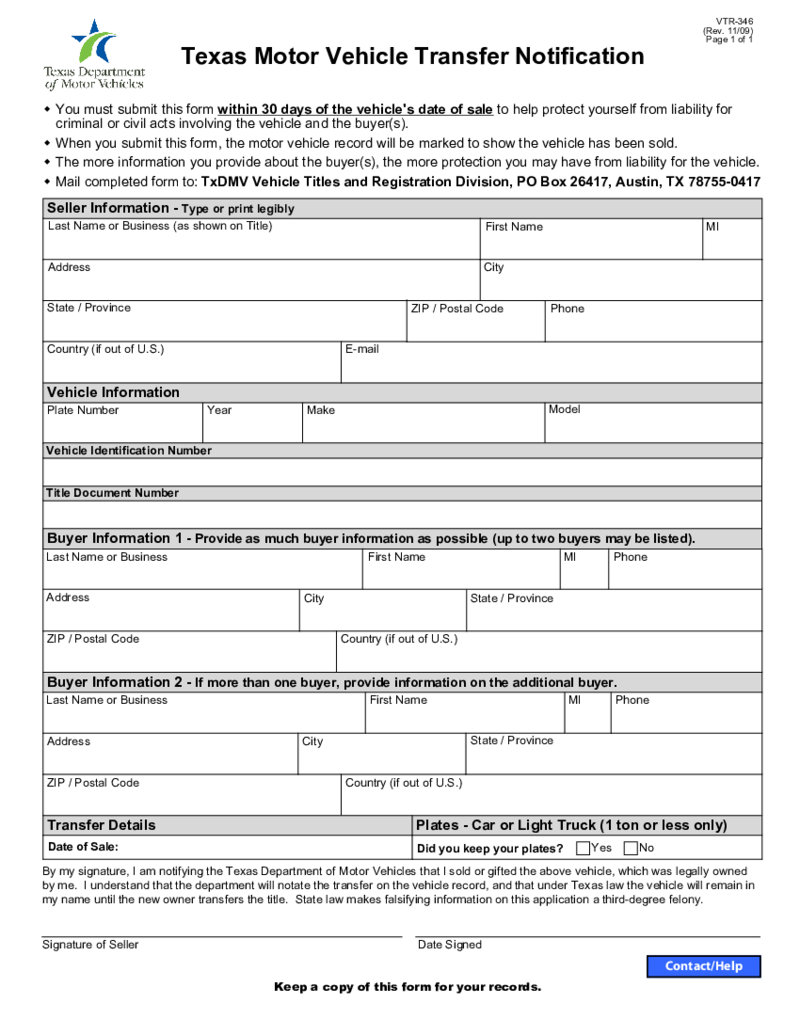

TX Form VTR-346

What Is a Texas Motor Vehicle Transfer Notification?

A TX DMV VTR 346 form Texas is a certificate of title for a motor vehicle in the state of Texas. TX form VTR 346 is an official document that proves ownership of a vehicle and is required for many vehic

TX Form VTR-346

What Is a Texas Motor Vehicle Transfer Notification?

A TX DMV VTR 346 form Texas is a certificate of title for a motor vehicle in the state of Texas. TX form VTR 346 is an official document that proves ownership of a vehicle and is required for many vehic

-

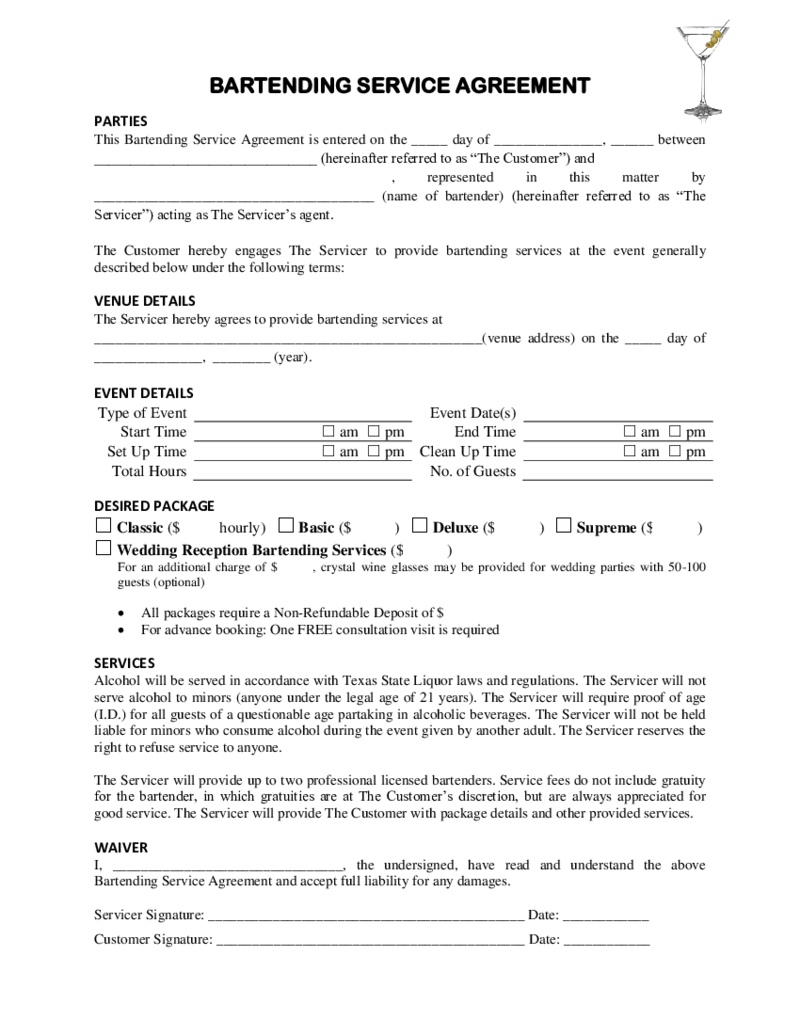

Bartending Services Contract Template

Navigating the Bartending Services Contract Template

When hosting events like bridal showers, birthday parties, corporate cocktail parties, etc., one key element typically involves hiring a professional bartending service. However, to ensure smooth operat

Bartending Services Contract Template

Navigating the Bartending Services Contract Template

When hosting events like bridal showers, birthday parties, corporate cocktail parties, etc., one key element typically involves hiring a professional bartending service. However, to ensure smooth operat

-

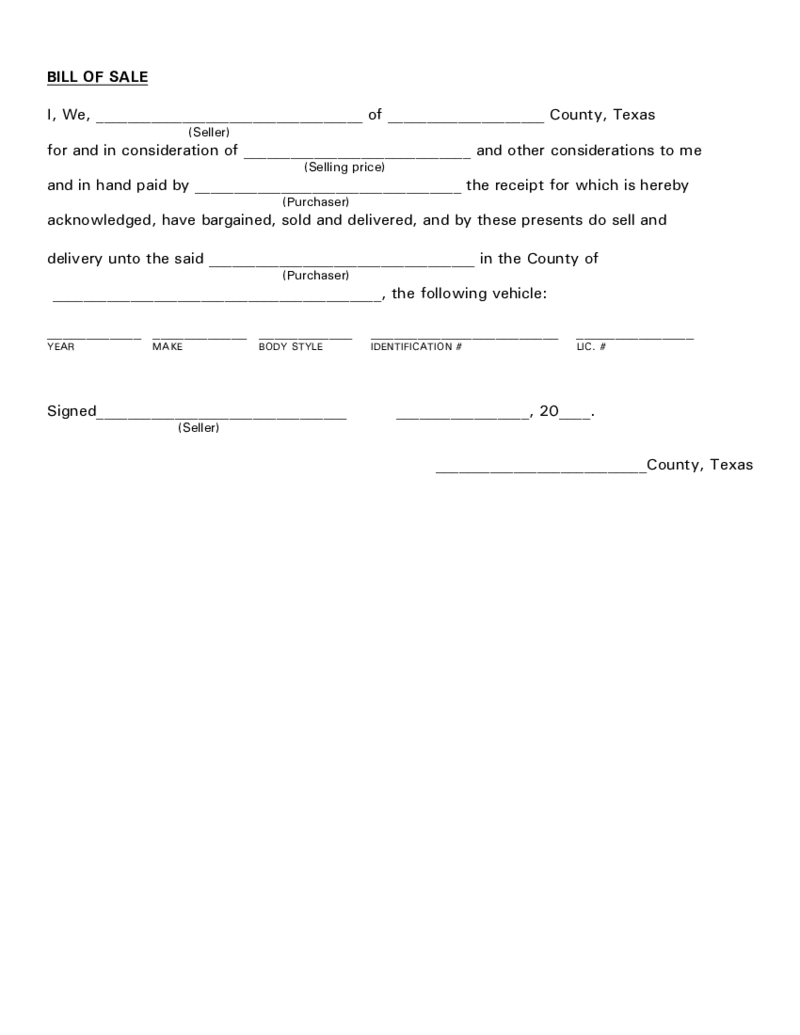

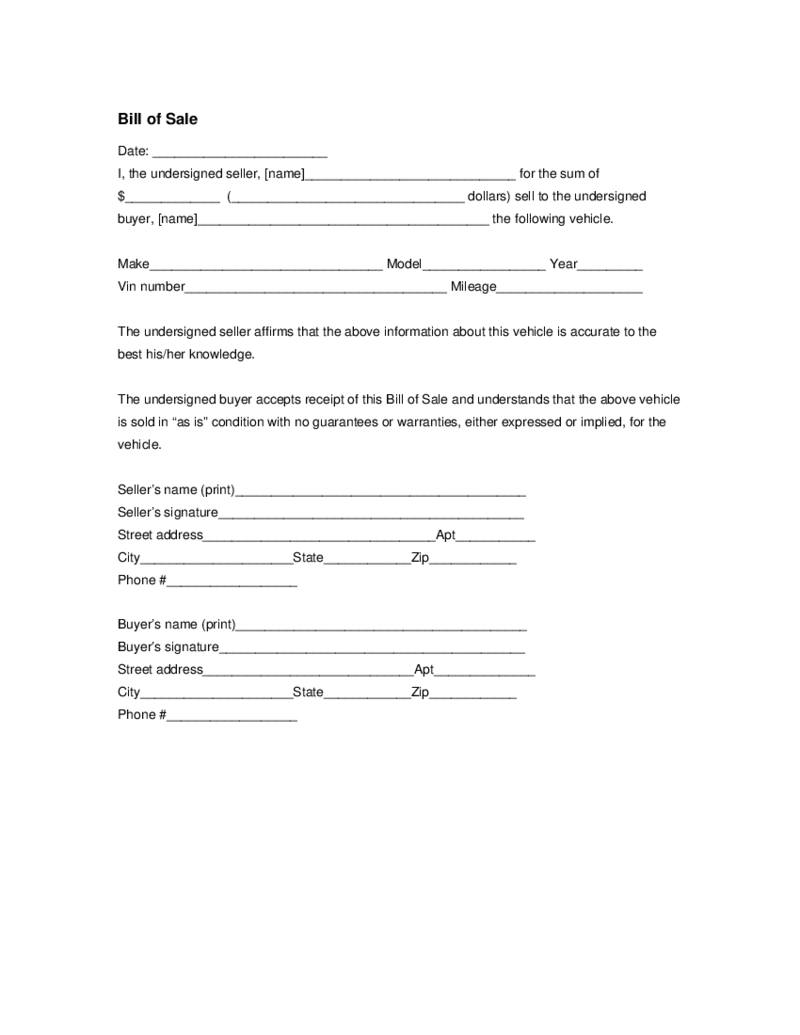

As Is Bill of Sale Texas

What is the Bill of Sale Texas?

The Texas as is bill of sale is the form that allows the sale of the vehicle from one party to another. It records the process of purchase. The as is bill of sale Texas fixates the on vehicle delivery and payment. It has to

As Is Bill of Sale Texas

What is the Bill of Sale Texas?

The Texas as is bill of sale is the form that allows the sale of the vehicle from one party to another. It records the process of purchase. The as is bill of sale Texas fixates the on vehicle delivery and payment. It has to

-

Texas Bill of Sale Form

What is a Bill of Sale Texas Template?

A Bill of Sale Texas is a document that proves the transfer of ownership of an item from one person to anot

Texas Bill of Sale Form

What is a Bill of Sale Texas Template?

A Bill of Sale Texas is a document that proves the transfer of ownership of an item from one person to anot

-

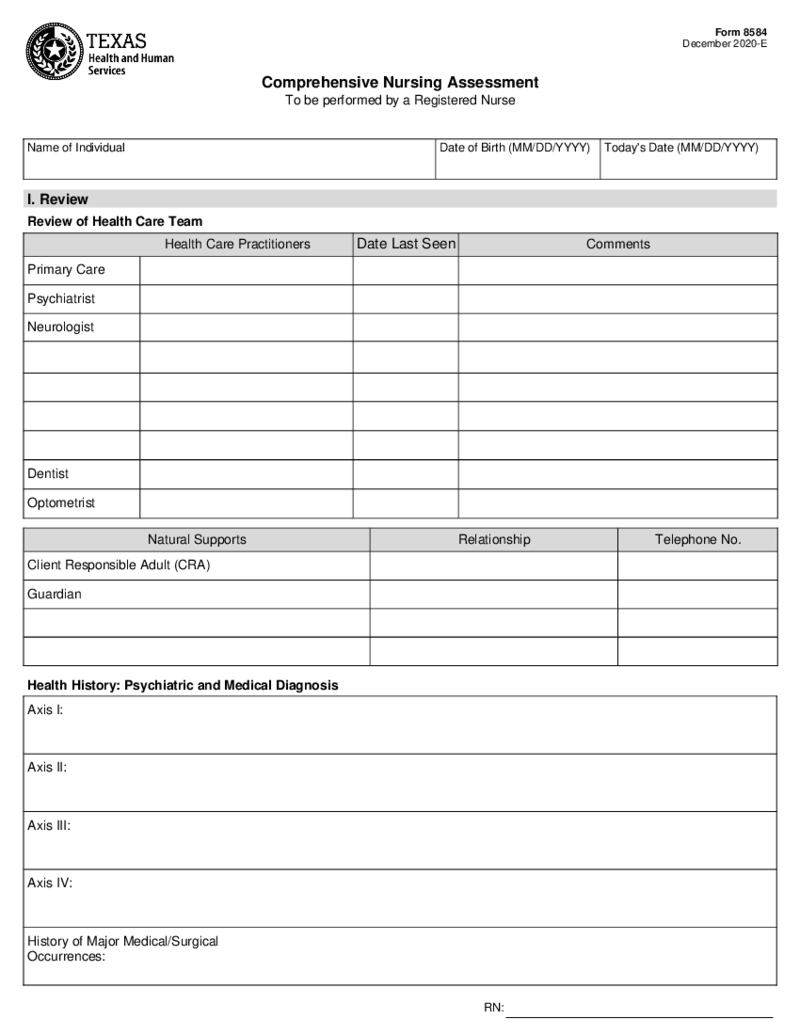

Comprehensive Nursing Assessment Form 8584

What is Comprehensive Nursing Assessment Form 8584?

Comprehensive Nursing Assessment Form 8584 is used to fill out the individual’s health history and current health condition. It should be filled out by registered nurses. This PDF form contains all

Comprehensive Nursing Assessment Form 8584

What is Comprehensive Nursing Assessment Form 8584?

Comprehensive Nursing Assessment Form 8584 is used to fill out the individual’s health history and current health condition. It should be filled out by registered nurses. This PDF form contains all

-

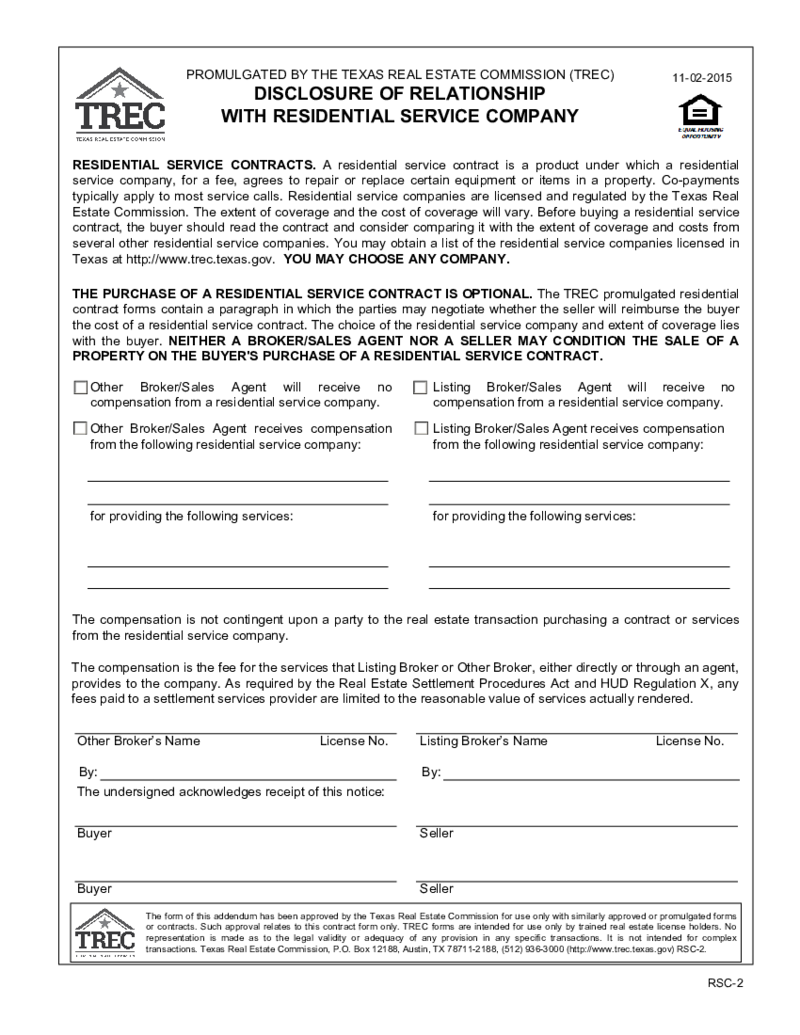

TREC Disclosure of Relationship with Residential Service Company

What Is TREC Disclosure Of Relationship With Residential Service Company

Understanding is essential for parties involved in real estate transactions, particularly within Texas. The Texas Real Estate Commission (TREC) requires this form when a real estate

TREC Disclosure of Relationship with Residential Service Company

What Is TREC Disclosure Of Relationship With Residential Service Company

Understanding is essential for parties involved in real estate transactions, particularly within Texas. The Texas Real Estate Commission (TREC) requires this form when a real estate

What Are Texas Templates?

Texas Legal Templates are official forms issued by various government agencies throughout the state of Texas for streamlining and standardizing data collection. They can be used both by professionals in public and private companies and by their clients to provide data or receive any information. Each US state has its own paperwork requirements, so when contacting organizations in Texas, you should use specific Texas legal forms. In our library, you will find more than 150 Texas free legal forms for a variety of situations that can occur in this state. Just pick the one you need and start filling it out.

What Are the Texas Templates Used For?

The state and official companies issue Texas forms to standardize workflows. They simplify and speed up the collection and processing of data. Moreover, ready-made templates ensure that users and applicants provide all the necessary information to process their requests. It helps to avoid errors and the need to re-apply. Almost every legal event has a list of accompanying forms. Some blanks can be used as stand-alone documents; others should be accompanied by copies of other papers as proof of details. Read the official manuals and our guides to learn how to use a specific template.

Types of Texas Templates

A huge variety of Texas forms are designed to be used in various situations. Here are just a few of the most popular categories:

- Standard Residential Lease Agreement. It is a document that formalizes the relationship between landlords and tenants. It prescribes the conditions for such interaction, financial aspects, and the responsibilities of each party.

- Texas Department of Transportation forms. TxDOT issues various forms, for example, to record the fact of a car crash or to apply for a new driver's license. There are general blanks for situations related to vehicles and their owners.

- Texas Healthcare forms. In this category, there are forms for contacting medical institutions in the state. For example, here you will find your Texas benefits forms and medical release forms for minors.

- Texas Real Estate Commission blanks. TREC issues applications for residential and commercial real estate situations. If you want to rent a space, complain about non-compliance with the lease terms, provide a building inspection report, and so on, you need one of these forms.

What Should Be Included in Texas Templates?

As you can see, the Texas template forms collection has files from a variety of organizations and for different occasions. Therefore, their content can vary significantly. Information needed to fill out texas DMV forms is unlikely to be required for Healthcare templates. However, many official documents share a standard structure:

- Basic information about a placeholder: Their full name, address, and contact details.

- Form details: A title and description that helps people understand what the form is for and whether they chose the right option.

- Requested information: There should be several blocks within the document to provide data and structure information. The complete list of lines and fields, as well as the required data, differs depending on the form's purpose.

- Instructions: All legal, healthcare, insurance, and other forms should have detailed guides to help fillers enter all data correctly and attach personal documents (if required).

- A submit button: E-filing is the most convenient way of submitting docs, so each form should have a button that applicants can use to submit to recipients.

Almost any Texas template form consists of these basic elements. Make sure your document has everything you need.

How to Create Texas Templates: Step-By-Step

Creating a form for your business in Texas is not difficult; you just need to know a few basic principles:

- Check out the full list of existing Texas Templates and select the option you need. Forms for different situations are presented in different categories; make sure that the one you choose is really suitable for your case.

- In the PDFLiner collection, you will definitely find what you need. Open the form with an editor or download it to your device.

- Now you can start filling it. Prepare in advance the necessary documents (for example, your ID or SSN) and enter the required information in the appropriate fields.

- After that, you need to sign the file. Your signature serves as a personal confirmation that the entered data is correct. You can sign electronically or print the document and do it manually.

- Send the completed form to the recipient. The requirements of Texas companies may vary, but in most cases, most of them accept files sent by email. Make sure you know the correct e-address, or check it on the organization's official website.

Depending on where you sent your documents, your case may be assigned a tracking number so you can track progress.