-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

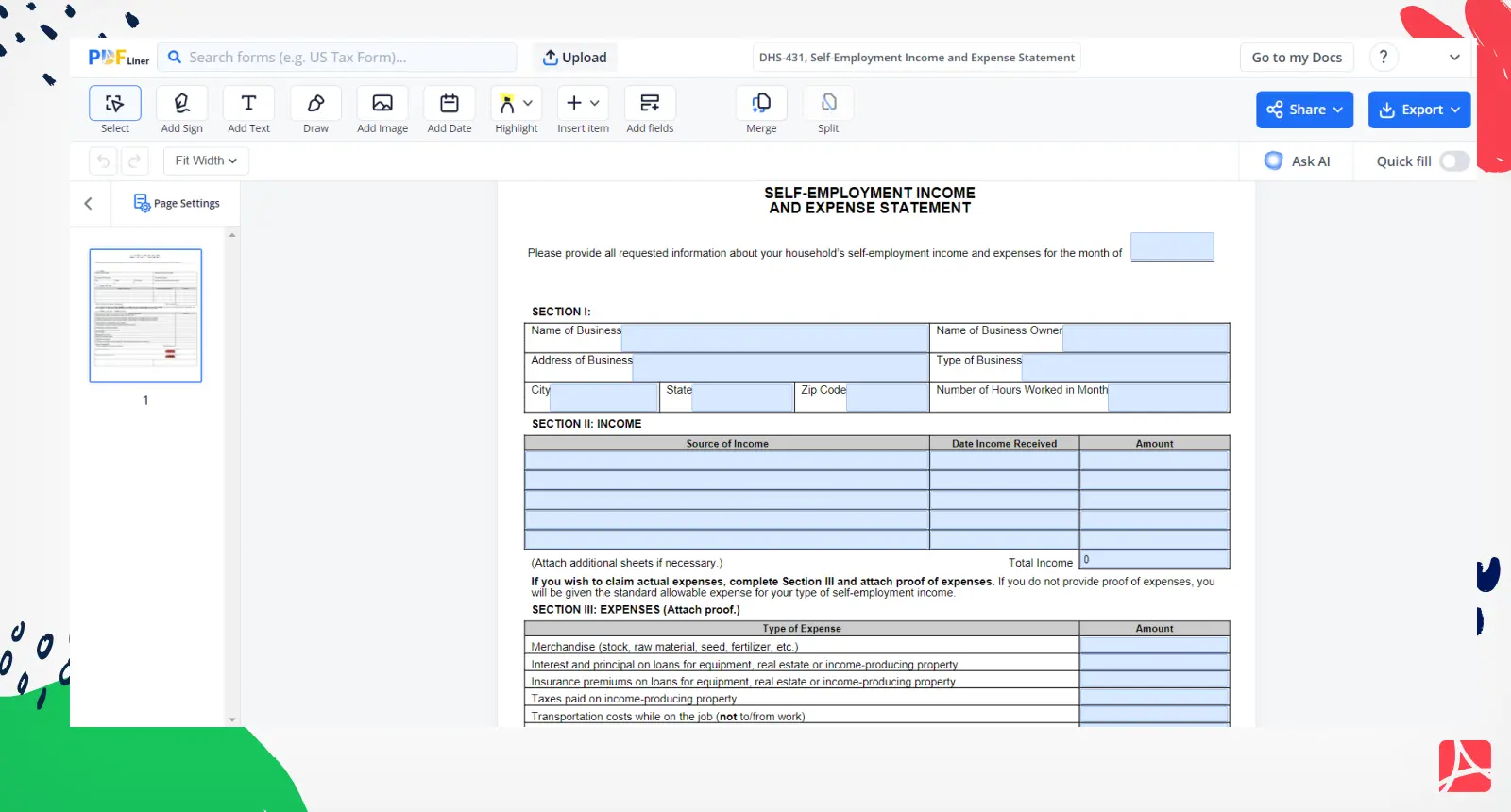

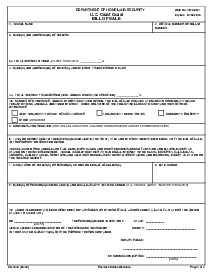

DHS-431, Self-Employment Income and Expense Statement

Get your DHS-431, Self-Employment Income and Expense Statement in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is DHS-431 Self-Employment Statement Form

The DHS-431 Self-Employment Income and Expense Statement is Michigan's official form for reporting self-employment earnings to qualify for essential state benefits including SNAP (food assistance), TANF (cash assistance), Medicaid, and childcare programs. This comprehensive Michigan DHS 431 form guide covers everything from AI-powered PDF filling solutions to step-by-step completion instructions, ensuring you maximize your eligibility for assistance programs while saving hours of paperwork time.

What is DHS 431 self-employment statement used for

The DHS Self Employment form assesses an individual's self-employment income and expenses for determining eligibility for various DHS programs and services. Its main purposes include:

- reporting self-employment income: individuals provide details about their earnings from self-employment activities;

- documenting business expenses: the form captures various expenses incurred while running the self-employment business;

- evaluating eligibility: DHS uses the information to assess an individual's financial situation and determine their qualification for assistance or benefits.

With all that said, the form provides a structured format to report self-employment earnings and expenses, reducing errors. Also, the form template available via PDFLiner simplifies the reporting procedure, saving your precious time and effort.

How to Fill Out DHS-431

Section 1: Business Information

- Business Name: Enter your DBA or sole proprietorship name

- Business Type: Select from dropdown (service, retail, manufacturing, etc.)

- Start Date: Month/year you began self-employment

- Tax ID: Your EIN or SSN if sole proprietor

- Business Address: Physical location or home address if home-based

Section 2: Monthly Income Reporting

Calculate and report your gross monthly income from:

- Client payments and invoices

- Cash transactions (must be documented)

- Online sales and digital services

- Seasonal or irregular income (averaged over 12 months)

- Bartering income (fair market value)

💡 Pro Tip: Use bank statements and payment processor reports (PayPal, Stripe, Square) for accurate income documentation.

Section 3: Allowable Business Expenses

Michigan DHS allows 50% standard deduction OR actual expenses including:

- Advertising and marketing costs

- Business insurance premiums

- Equipment and supplies

- Home office expenses (proportional)

- Internet and phone bills (business portion)

- Mileage and vehicle expenses

- Professional licenses and fees

- Rent for business space

Section 4: Net Income Calculation

Net Income = Gross Income - (Business Expenses OR 50% Standard Deduction)

Common Mistakes to Avoid

Top 10 DHS-431 Filing Errors

- Mixing personal and business expenses - Only report legitimate business costs

- Forgetting cash income - All income must be reported, even cash

- Using outdated tax information - Use current year figures

- Missing supporting documents - Attach all required receipts

- Incorrect averaging - Seasonal income requires 12-month averaging

- Double-claiming expenses - Choose standard OR actual deduction, not both

- Unsigned forms - Electronic signatures are now accepted

- Late submission - File within 10 days of application

- Incomplete sections - Every field requires an answer

- Math errors - Use AI tools to verify calculations

DHS-431 vs DHS-432 Forms

| Feature | DHS-431 | DHS-432 |

|---|---|---|

| Purpose | Self-employment income statement | Self-employment worksheet |

| Frequency | Monthly reporting | Initial application |

| Programs | All DHS benefits | Specific programs only |

| Detail Level | Comprehensive | Summary |

| Processing Time | 10-15 business days | 5-7 business days |

How to report self-employment income

When reporting self-employed income using the DHS-431 form, consider the following sum-it-all-up useful tips from our experts. First, maintain accurate records of all your income and business expenses to ensure accurate reporting.

Second, in the Income and Expense statement PDF, report all sources of self-employment income and provide comprehensive details of business expenses. Third, include necessary receipts and invoices to substantiate reported income and expenses. Finally, if you’re unsure about specific entries or deductions, consult a reliable tax professional for guidance.

Frequently Asked Questions

-

How often must I submit DHS-431?

Initially with your application, then whenever income changes by more than $100 monthly, and at each redetermination period (typically every 6-12 months).

-

What happens if I make an error?

Submit a corrected form immediately with a cover letter explaining the error. Using AI fill tools reduces errors by 75%.

Fillable online DHS-431, Self-Employment Income and Expense Statement