-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

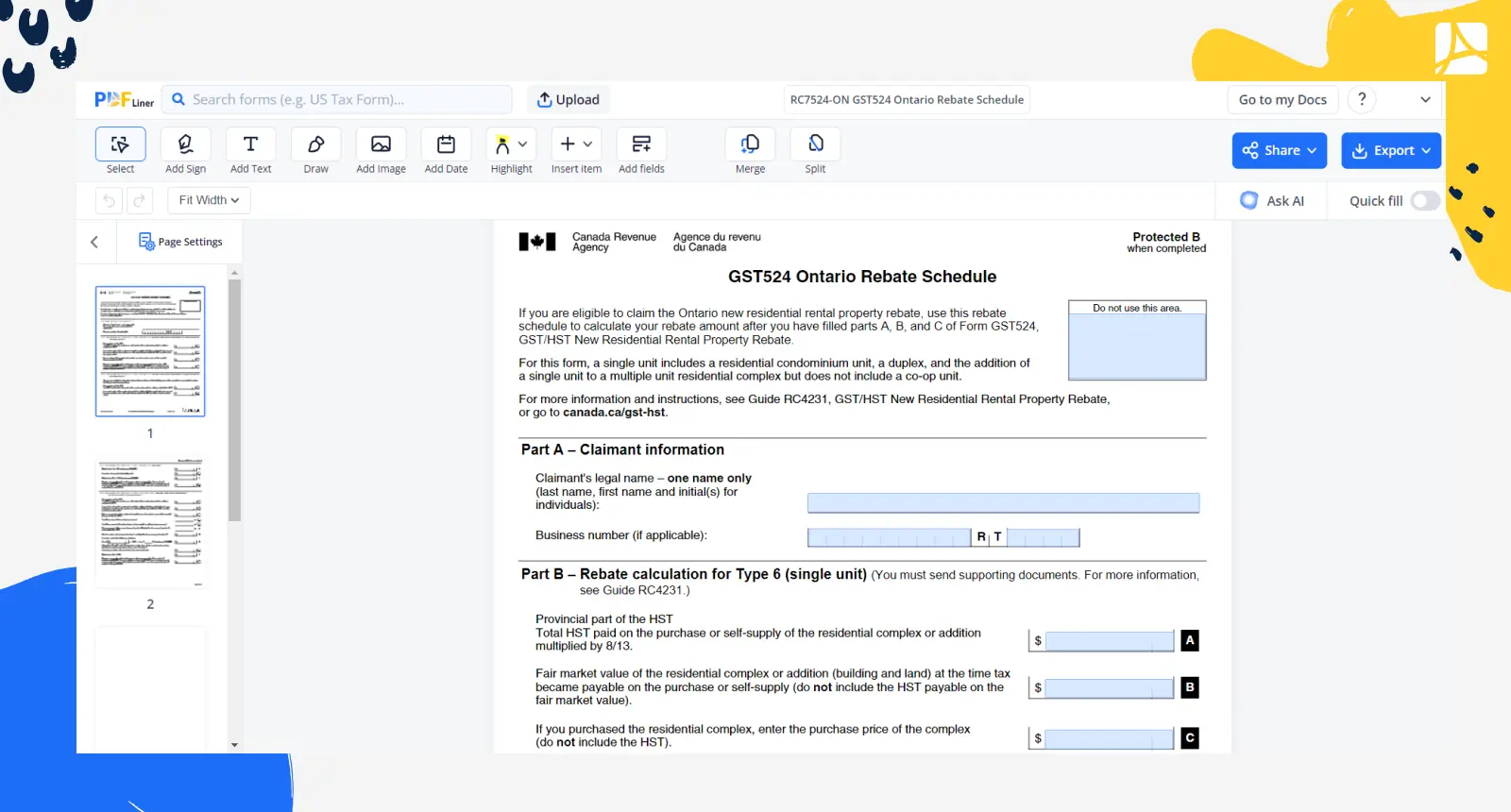

RC7524-ON GST524 Ontario Rebate Schedule

Get your RC7524-ON GST524 Ontario Rebate Schedule in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is Ontario Rebate Schedule?

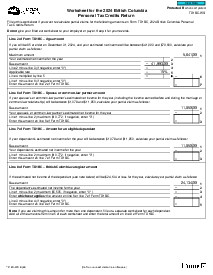

GST524 Ontario Rebate Schedule form is a refund of a portion of the provincial sales tax that is paid on the purchase or construction of a newly built home. The rebate for new homes is available to first-time home buyers as well as to those who have owned a home in the past.

Also known as GST524, it’s a schedule utilized for calculating your refund amount paid on the purchase or construction of the newly built Ontario new residential rental property. The fillable and printable template of form GST524 can be found here in the lengthy PDFLiner template catalog. You’re welcome to launch it and fill it out straight from the comfort of your home, without even leaving our website. Convenience is what we aim for.

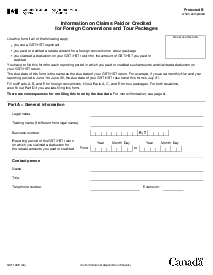

What Ontario rebate schedule is used for

The document is used for:

- claiming the Ontario new home refund;

- calculating your refund amount;

- saving money on your new home purchase.

You’re eligible for the rebate (refund) if you’re a resident (individual, not an entity) of Ontario who’s planning to buy a new HST-eligible home. New homes, newly constructed homes, and energy-efficient home upgrades are among the most frequent eligible purchases.

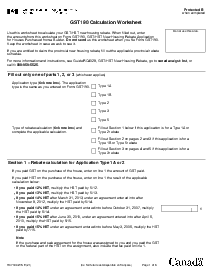

How to Fill Out the Form

The document consists of 5 pages. The first four pages are fillable. The last page contains filing instructions. Below, you will find a quick step-by-step guide on how to fill out the form.

- Log in to PDFLiner.

- Find the pre-made form of the Provincial Rebate Schedule via our search facility.

- Launch the file.

- Start completing it.

- In Part A, indicate claimant information: full name and business number, if applicable.

- In Part B, sort out the rebate calculation for Type 6 (single unit).

- In Part C, focus on rebate calculation for Type 7 (single unit).

- In Part D, concentrate on rebate calculation for Type 8 (unit in a co-op).

- Refer to Part E for rebate calculation for Type 6 and Type 7 (units in a multiple residential complex).

- Manage Part F for rebate calculation for Type 9A and Type 9B.

If you’re looking for the speediest and most error-free way to manage your documentation, going digital is your best bet. Filling out your forms online saves heaps of your valuable time, as well as allows you to focus on your direct field of work. PDFLiner is your best choice when it comes to digital file management. With our tools, you’ll enjoy editing your docs, incorporating e-signatures into them, as well as infusing them with your branding in the most time-saving way possible.

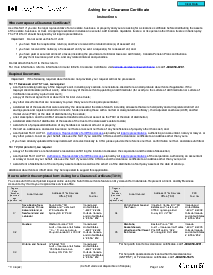

How to submit the Ontario rebate schedule

Upon completing the form, you’re going to need to file it to the authorities. You’re welcome to do it online or via regular mail. They will process the rebate and respond with a check. Don’t forget to proofread the form before submitting it, especially the part with your address. Because it’s the address they’ll use for their response.

Naturally, sending the document online is more beneficial, for it saves you from such incidents as lost or damaged files. Opt for PDFLiner if you want to streamline your administrative affairs and generally take them to the next level.

Organizations that work with form GST524

- the Canada Revenue Agency (CRA);

- the Ontario Ministry of Finance.

Fillable online RC7524-ON GST524 Ontario Rebate Schedule