-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

RBC Bank Statement Template

Get your RBC Bank Statement Template in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

Comprehensive Guide to RBC Bank Statement Template

Bank documents like the bank statement are crucial for both personal and business financial management. For Royal Bank of Canada (RBC) customers, accessibility to these documents can make banking processes faster and more straightforward.

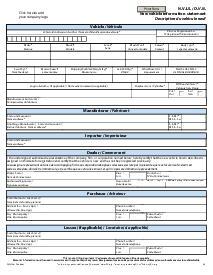

Understanding the RBC Bank Statement

Before diving into the use of the PDFliner platform, it's essential to understand the RBC bank statement. As a crucial financial document, it provides a comprehensive record of all transactions made on your account within a specified period. From deposits, withdrawals, check clearance, direct debits, transfers to interest earned, everything will be detailed in your RBC bank statement.

Benefits of the RBC Bank Statement Template on PDFliner:

Using the RBC Bank Statement Template on PDFliner comes with various benefits. First, users can find it significantly quicker to locate the particular template they require. Thus, saving you time and energy.

Additionally, filling out the bank statement through this platform can be done in a matter of moments. There's more on the site with a built-in AI that can answer your questions on the forms or help summarize them. Lastly, the multipurpose functionality that allows you to save, share, sign, or print the statement instantly makes financial management very convenient.

How to Fill Out Bank Statement RBC

Here's a detailed guide on how to fill out the RBC bank statement PDF template:

- Start with the 'Personal Information' section. Enter your first name, middle name, and surname in the respective fields.

- Include your social insurance number and date of birth in the format specified (Month, Day, Year).

- Next, provide your complete home address including apartment or P.O. box number, street and number, city or town, province, and postal code.

- Fill in your home telephone number, business telephone number, and your marital status. Specify the number of dependents you have.

- Under 'Principal bank or financial institution', write the name and address of your main banking institution. Include your savings and chequing account numbers.

- In the 'Employment Information' area, input your gross income details such as annual salary or wages, commissions, bonuses, dividends, interest, and rental income.

- If applicable, add any other sources of income, itemizing each source.

- For 'Spouse's Gross Income', enter relevant details if applicable, including salary, wages, and any other income, clearly listing different income sources.

- List your yearly expenses such as mortgage or rent payments, real estate taxes, income taxes, insurance premiums, and payments towards credit cards, alimony, or child support.

- Sum these up to calculate your total annual expenses.

- Move to 'Assets and Liabilities'. List all your assets such as cash in Royal Bank and other institutions, life insurance cash surrender value, retirement accounts, marketable securities, real estate, and other significant assets, ensuring each item is clearly described.

- Under 'Liabilities', note all your obligations like mortgages on real estate, credit card debts, and other debts, providing specifics for each category including total amounts and balances owed.

- Calculate your net worth by subtracting total liabilities from total assets and enter this figure in the provided space.

- In the 'Sundry Obligations' section, disclose any contingent obligations not listed elsewhere such as guarantees or endorsements, specifying the liability amount, to whom it is owed, and the nature of the obligations.

- Answer the questions in the 'General Information' section regarding past financial conduct such as asset repossession, involvement in claims or lawsuits, bankruptcy, and unpaid taxes. Provide details where necessary.

- Next, complete the schedules (A through F) attached to the form that require detailed listings of securities, real estate, insurance, retirement accounts, business interests, and bank loans, ensuring all fields are accurately filled out based on the instructions for each schedule.

- Finally, sign and date the form in the designated area at the bottom of the page to declare that all provided information is true and correct to the best of your knowledge.

- Confirm that the information will be used by the bank to assess your creditworthiness and that any loan obtained will be used for business purposes.

Fillable online RBC Bank Statement Template