-

Templates

Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesInsuranceInsurance templates make it easier for agents to manage policies and claims.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Other tax forms - page 17

-

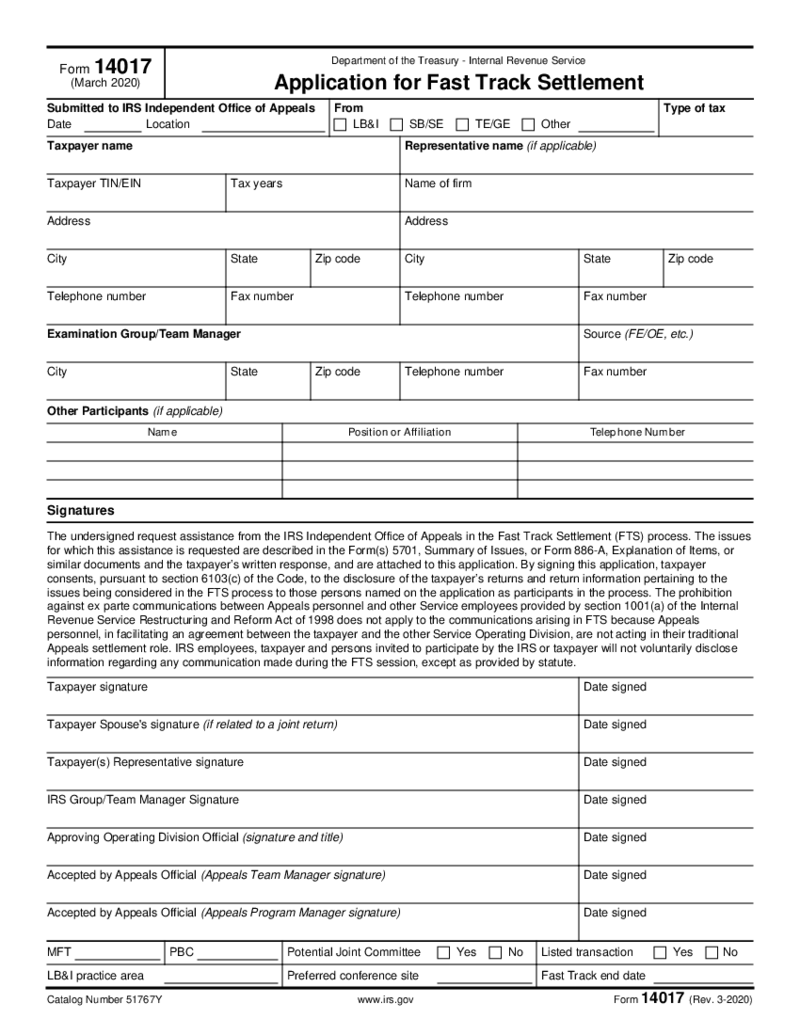

Form 14017

1. What is the 14017 form?

The fillable 14017 form is used for the Fast Track Settlement process. It must be filed to the IRS in the form of a request. The form is known as an application for the FTS process. After you download 14017, you can ask for the

Form 14017

1. What is the 14017 form?

The fillable 14017 form is used for the Fast Track Settlement process. It must be filed to the IRS in the form of a request. The form is known as an application for the FTS process. After you download 14017, you can ask for the

-

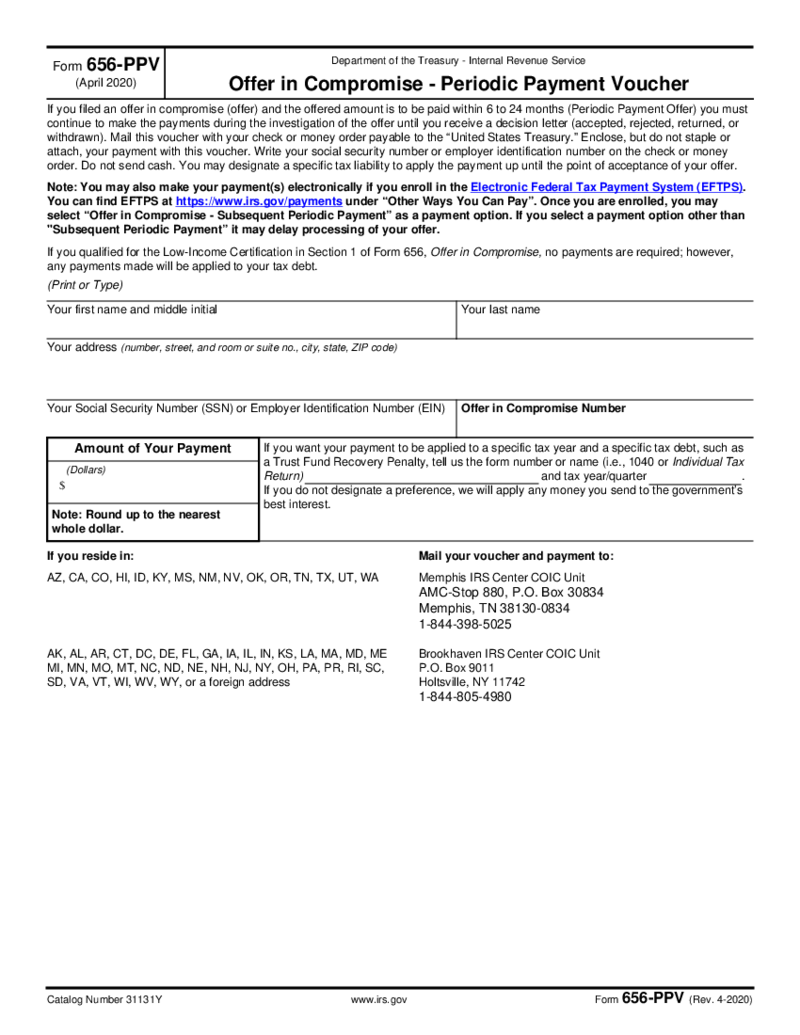

Form 656-PPV

What Is IRS Form 656-PPV

Navigating the complexities of tax resolution can be daunting, and IRS Form 656-PPV serves as a crucial tool for taxpayers seeking to address their tax liabilities. This form is specifically used for making an off

Form 656-PPV

What Is IRS Form 656-PPV

Navigating the complexities of tax resolution can be daunting, and IRS Form 656-PPV serves as a crucial tool for taxpayers seeking to address their tax liabilities. This form is specifically used for making an off

-

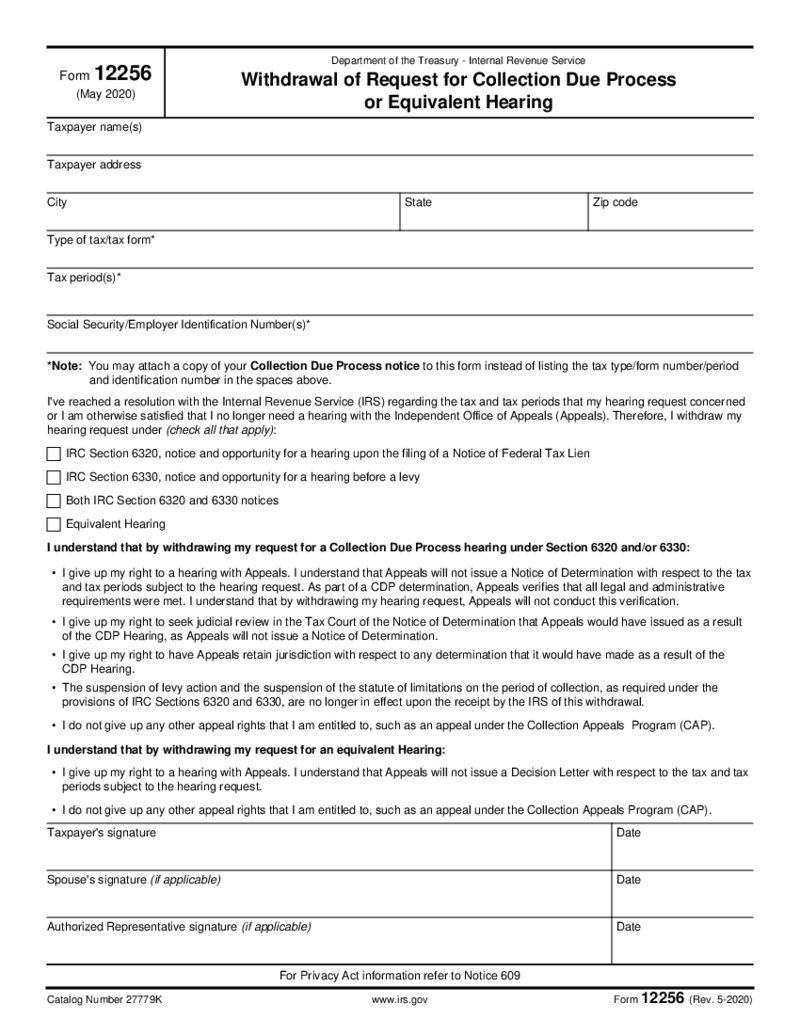

Form 12256

What Is Form 12256

IRS Form 12256 is a document taxpayers utilize to request the withdrawal of a filed Notice of Federal Tax Lien. The form acts as a formal petition to the Internal Revenue Service, indicating the taxpayer's desire fo

Form 12256

What Is Form 12256

IRS Form 12256 is a document taxpayers utilize to request the withdrawal of a filed Notice of Federal Tax Lien. The form acts as a formal petition to the Internal Revenue Service, indicating the taxpayer's desire fo

-

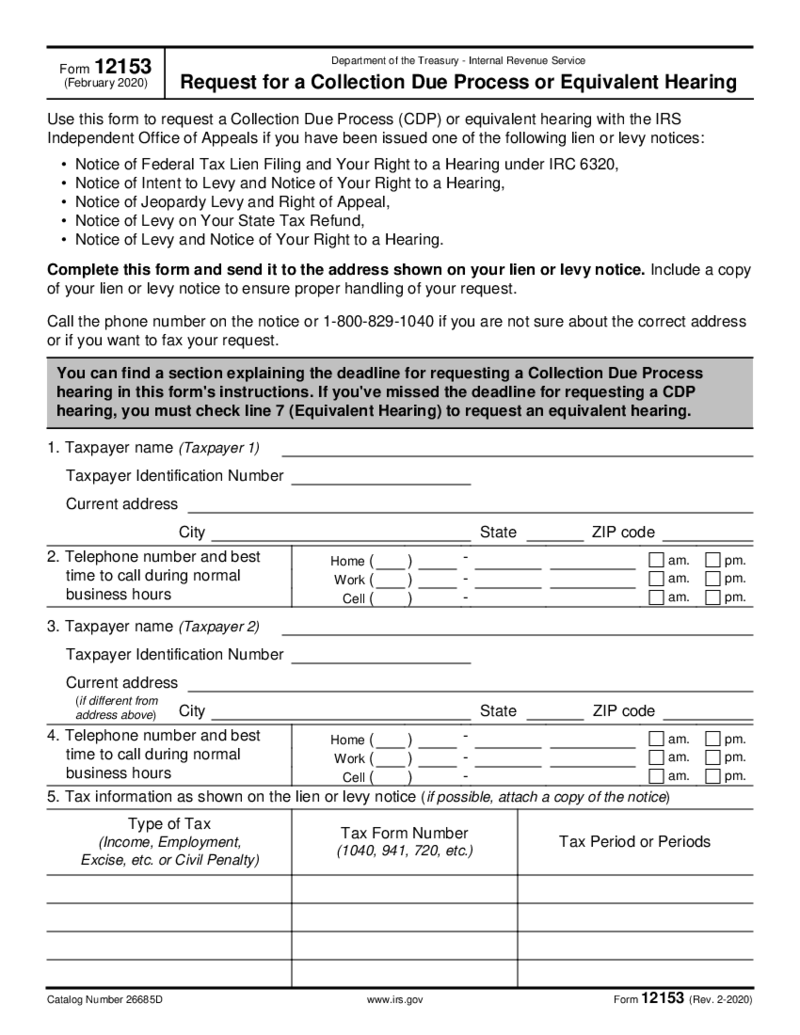

Form 12153

1. What is a 12153 Form?

The fillable Form 12153 (Request for a Collection Due Process or Equivalent Hearing) is a federal tax form designed by the IRS (Internal Revenue Service) and issued by the IRS Office of Appeals to let you request a CDP (Collection

Form 12153

1. What is a 12153 Form?

The fillable Form 12153 (Request for a Collection Due Process or Equivalent Hearing) is a federal tax form designed by the IRS (Internal Revenue Service) and issued by the IRS Office of Appeals to let you request a CDP (Collection

-

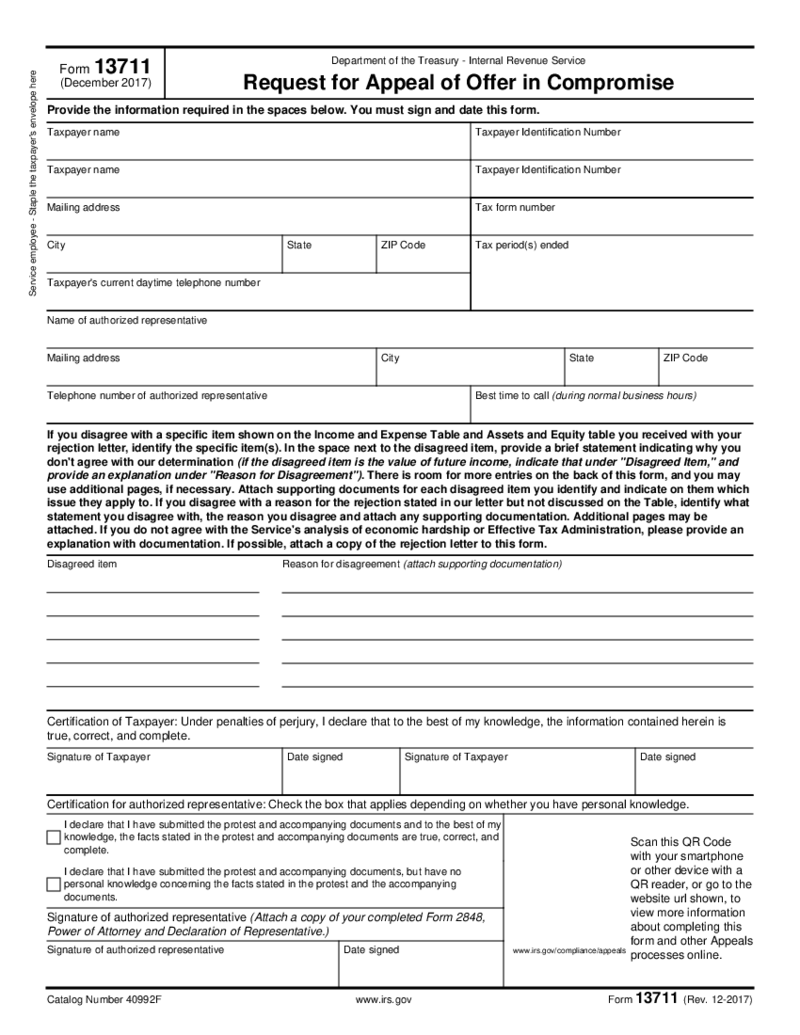

Form 13711

1. What is a 13711 Form for?

Form 13711 (Request for Appeal of Offer in Compromise) is an official federal tax form by the US Internal Revenue Service that is used for requesting an appeal when you receive an offer rejection letter from the local IR

Form 13711

1. What is a 13711 Form for?

Form 13711 (Request for Appeal of Offer in Compromise) is an official federal tax form by the US Internal Revenue Service that is used for requesting an appeal when you receive an offer rejection letter from the local IR

-

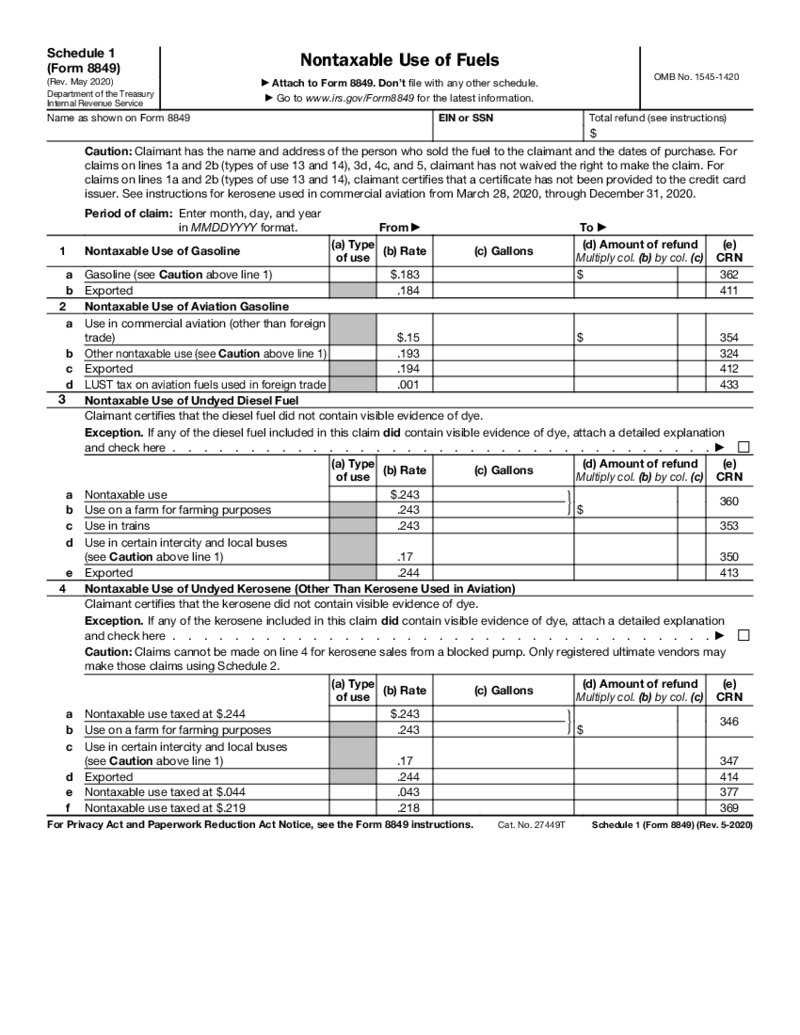

Form 8849 (Schedule 1)

What is Form 8849 Schedule 1?

Form 8849 can be used to get a refund of excise taxes, and its Schedule 1 is dedicated to certain fuels used in a nontaxable way. The list includes gasoline, kerosene, undyed diesel fuel and a variety of alternative fuels.&nb

Form 8849 (Schedule 1)

What is Form 8849 Schedule 1?

Form 8849 can be used to get a refund of excise taxes, and its Schedule 1 is dedicated to certain fuels used in a nontaxable way. The list includes gasoline, kerosene, undyed diesel fuel and a variety of alternative fuels.&nb

-

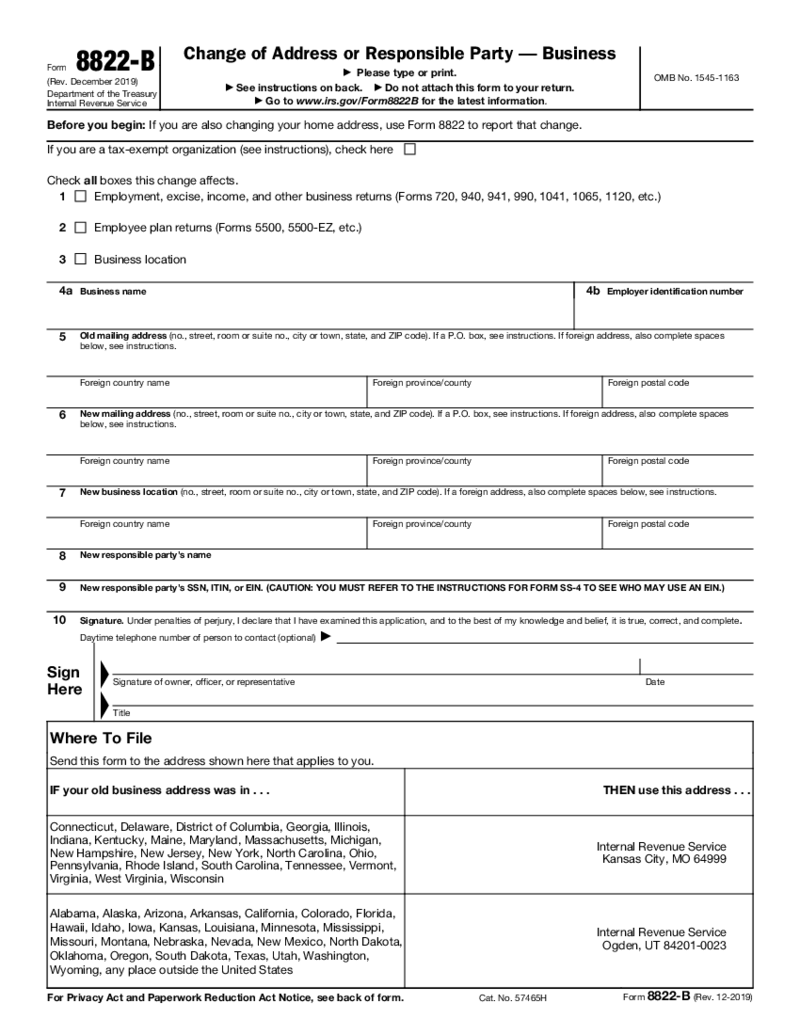

Form 8822-B

What Is a Form 8822-B?

Form 8822-B is a form you need to file when your business has changed its mailing address or responsible party when you change your actual location. By filing Form 8882-B you make sure your new address is registered and your data is

Form 8822-B

What Is a Form 8822-B?

Form 8822-B is a form you need to file when your business has changed its mailing address or responsible party when you change your actual location. By filing Form 8882-B you make sure your new address is registered and your data is

-

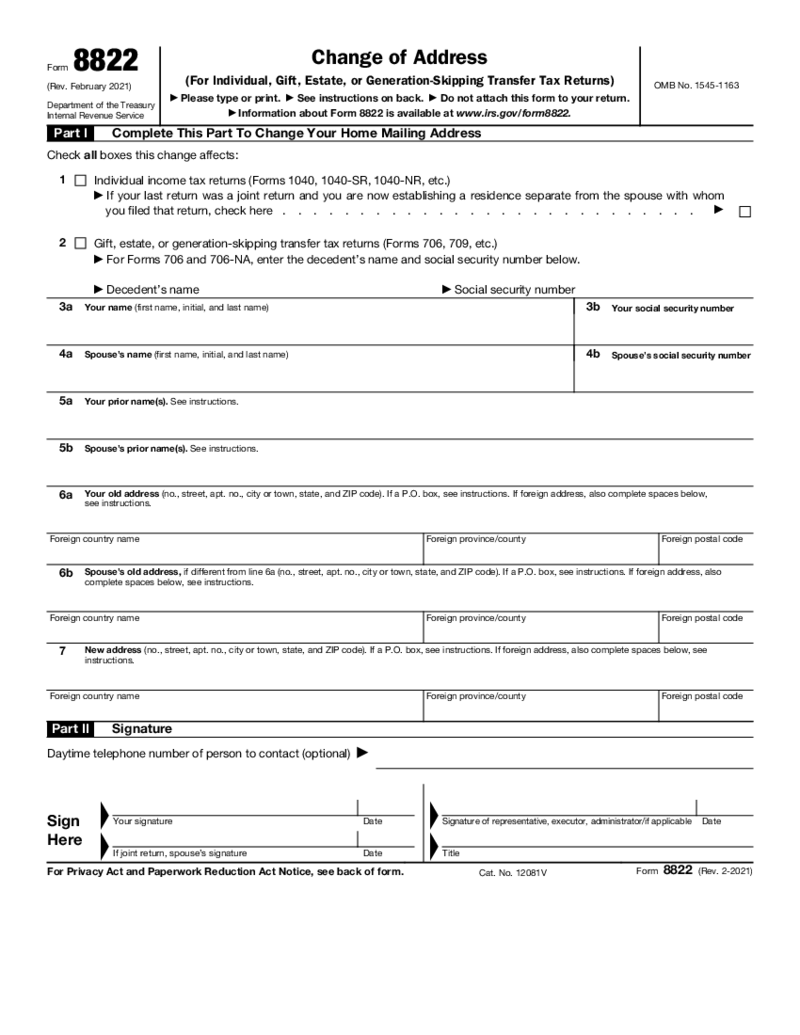

Form 8822 - Change of Address

What Is IRS Form 8822?

Also called Change of Address (For Individual, Gift, Estate, or Generation-Skipping Transfer Tax Returns), Form 8822 is a document for updating your address with the IRS. It's used when you move or have new cont

Form 8822 - Change of Address

What Is IRS Form 8822?

Also called Change of Address (For Individual, Gift, Estate, or Generation-Skipping Transfer Tax Returns), Form 8822 is a document for updating your address with the IRS. It's used when you move or have new cont

-

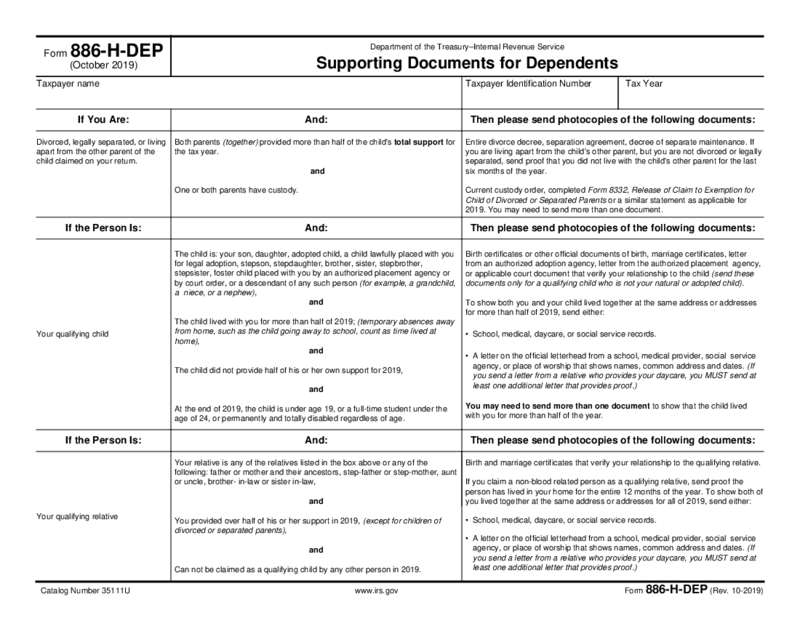

Form 886-H-DEP

What is Form 886 H DEP?

Download 886-H-DEP form as a supporting document for the dependent. You get this document free of charge and have to provide it to the IRS if you are a parent of the child stated in your return or a relative o

Form 886-H-DEP

What is Form 886 H DEP?

Download 886-H-DEP form as a supporting document for the dependent. You get this document free of charge and have to provide it to the IRS if you are a parent of the child stated in your return or a relative o

-

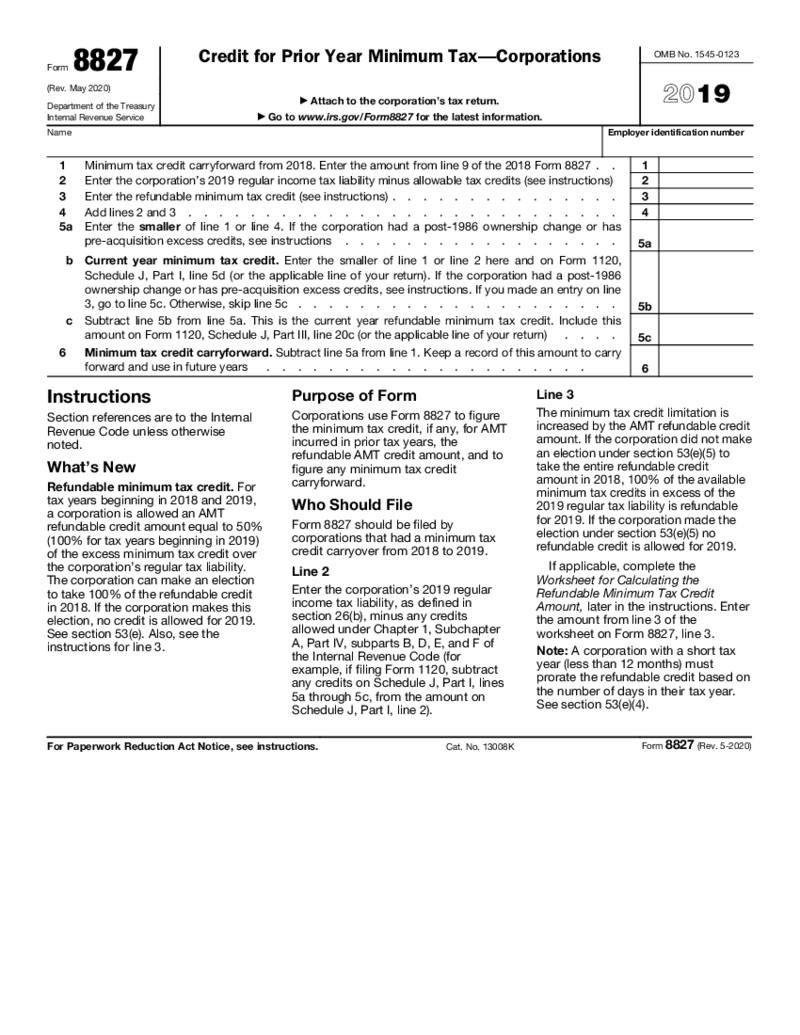

Form 8827

What Is Tax Form 8827

IRS Form 8827, officially titled "Credit for Prior Year Minimum Tax—Corporations," is used by corporations to calculate and claim a credit for the alternative minimum tax (AMT) paid in prior tax years

Form 8827

What Is Tax Form 8827

IRS Form 8827, officially titled "Credit for Prior Year Minimum Tax—Corporations," is used by corporations to calculate and claim a credit for the alternative minimum tax (AMT) paid in prior tax years

-

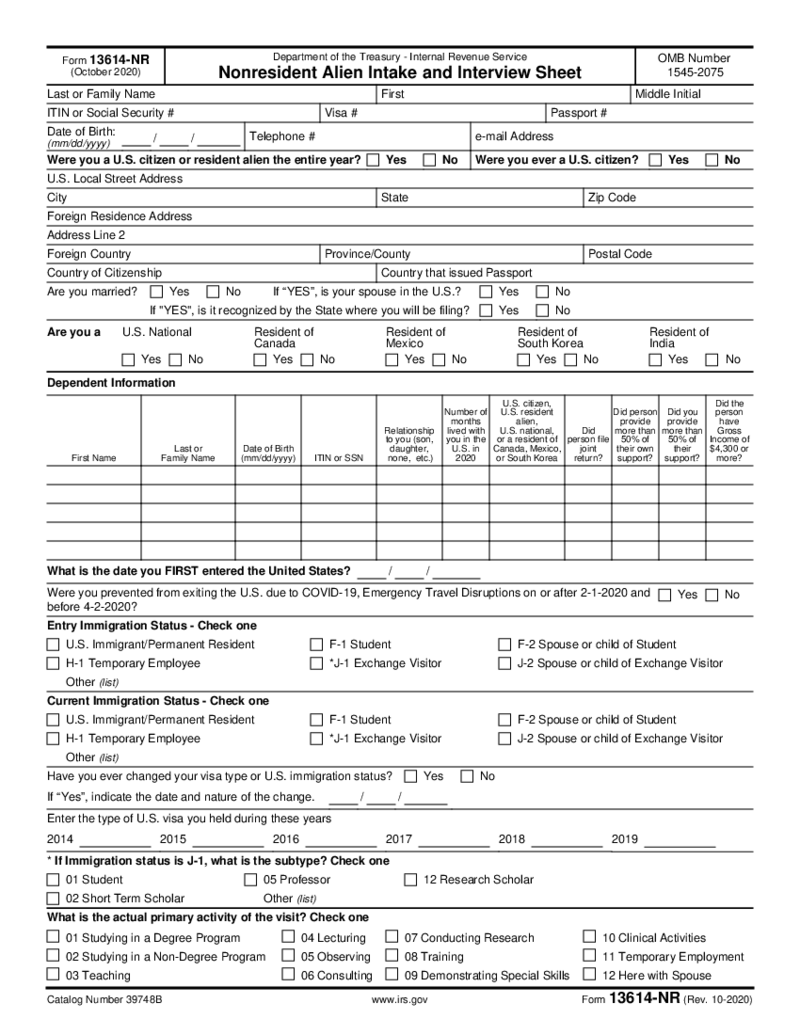

Form 13614-NR

What is form 13614-NR

Form 13614-NR is a Nonresident Alien Intake and Interview sheet blank. It is provided by the Internal Revenue Service (IRS). This document is necessary for tax returns, but only under the specific conditions that apply to nonresident

Form 13614-NR

What is form 13614-NR

Form 13614-NR is a Nonresident Alien Intake and Interview sheet blank. It is provided by the Internal Revenue Service (IRS). This document is necessary for tax returns, but only under the specific conditions that apply to nonresident

-

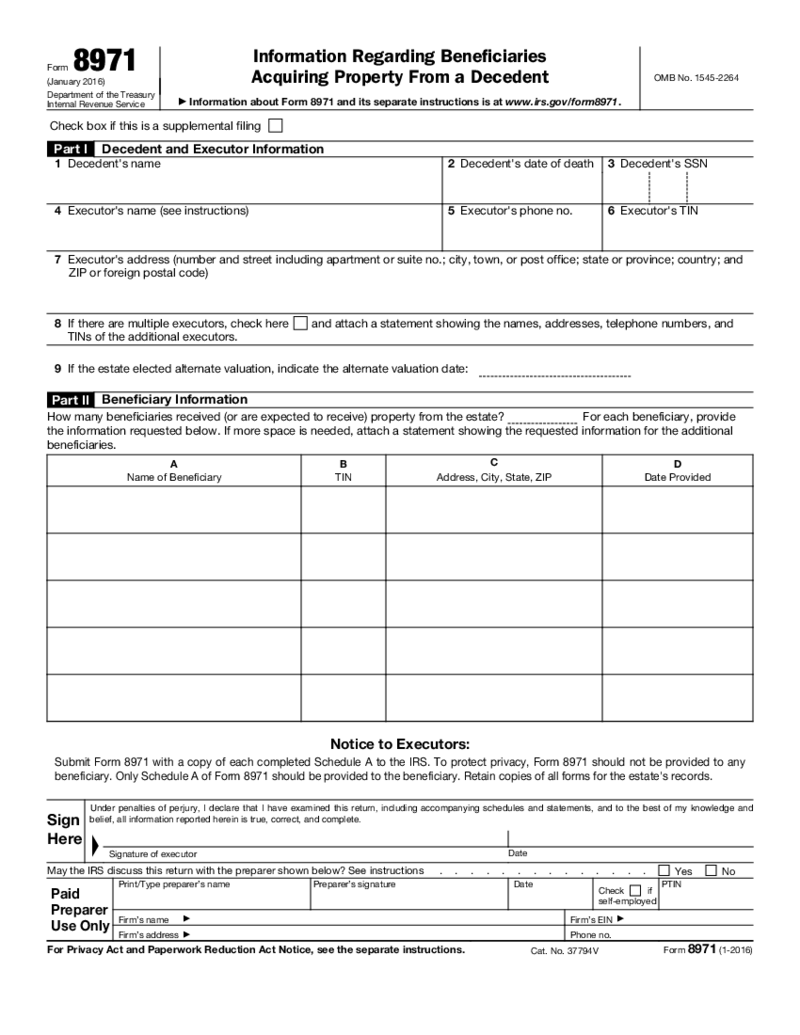

Form 8971

What is 8971 Form?

The fillable 8971 form is sent to the IRS by executors, who have to report the final tax value of the distributed estate. The form is known as the information on the beneficiaries acquiring the property from the decedent. It goes with t

Form 8971

What is 8971 Form?

The fillable 8971 form is sent to the IRS by executors, who have to report the final tax value of the distributed estate. The form is known as the information on the beneficiaries acquiring the property from the decedent. It goes with t

FAQ

-

What tax forms do I need?

That depends on a wide variety of factors, such as the state you live in, the specificity of your work, the format of your operation, and the like. You can consult a tax expert if you have questions on these nuances.

-

What are allowances on tax forms?

A withholding allowance is an exemption reducing the amount of income tax withheld from an employee’s wages. Upon determining your employees’ withholding allowances, you can easily pinpoint their federal income taxes.

-

When will unemployment send out tax forms?

You’re probably trying to ask us when your state unemployment office will mail you Form 1099-G (the total amount of taxable unemployment payment). The due date in this respect is January 31.

-

Where can I pick up tax forms?

You can head to your local IRS office or a post office, or library that offers tax forms. But why all the fuss if you can download the needed tax templates from our digital library. Give PDFLiner a go and you’ll forget about the alternative (and rather subpar) methods.