-

Templates

Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesInsuranceInsurance templates make it easier for agents to manage policies and claims.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Other tax forms - page 12

-

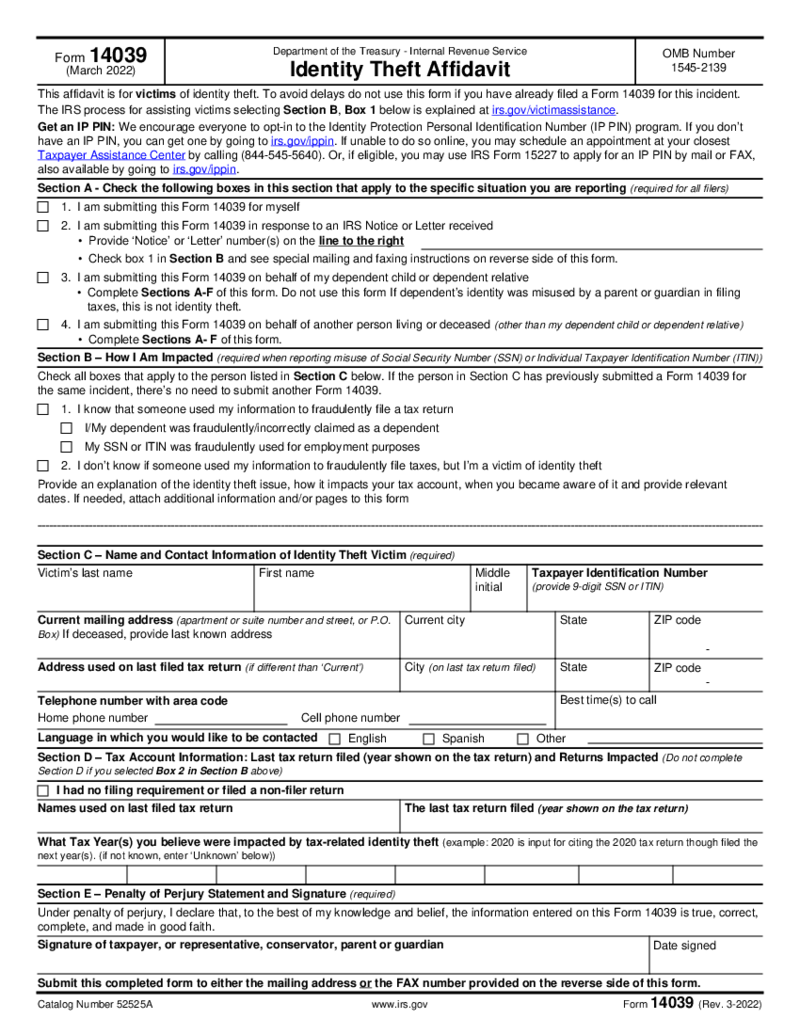

IRS Form 14039

What is 14039 IRS Form?

The IRS Form 14039 online is a simple two-page document that every US taxpayer, regardless of citizenship, can use in the event of identity theft or suspected identity theft. Also, you’ll need to attach a completed tax return

IRS Form 14039

What is 14039 IRS Form?

The IRS Form 14039 online is a simple two-page document that every US taxpayer, regardless of citizenship, can use in the event of identity theft or suspected identity theft. Also, you’ll need to attach a completed tax return

-

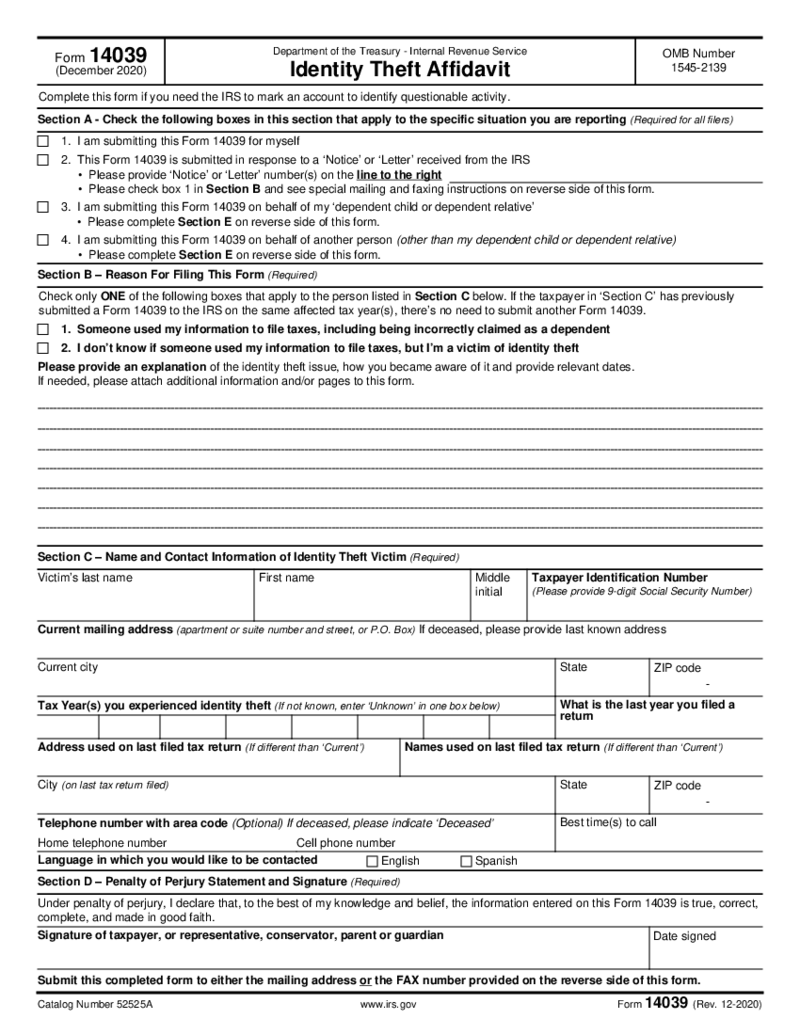

Form 14039, Identity Theft Affidavit (2020)

What Is A 14039 Form

Form 14039, also known as the Identity Theft Affidavit, is a document provided by the Internal Revenue Service (IRS) for taxpayers to report instances of identity theft that have affected their

Form 14039, Identity Theft Affidavit (2020)

What Is A 14039 Form

Form 14039, also known as the Identity Theft Affidavit, is a document provided by the Internal Revenue Service (IRS) for taxpayers to report instances of identity theft that have affected their

-

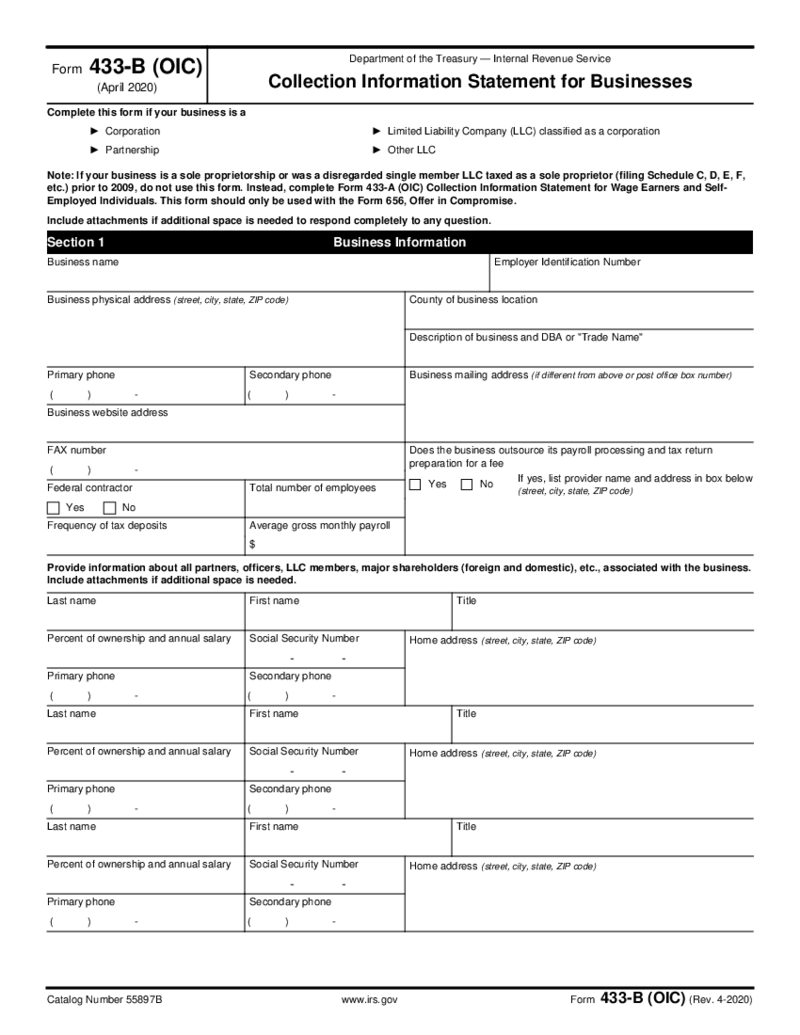

Form 433-B (OIC), Collection Information Statement for Businesses (2020)

What Is A Form 433 B OIC

The IRS Form 433-B (OIC) is a vital document for businesses in debt to the Internal Revenue Service. It is a Collection Information Statement for Businesses seeking to establish an offer in compromise (OIC). An OIC allows business

Form 433-B (OIC), Collection Information Statement for Businesses (2020)

What Is A Form 433 B OIC

The IRS Form 433-B (OIC) is a vital document for businesses in debt to the Internal Revenue Service. It is a Collection Information Statement for Businesses seeking to establish an offer in compromise (OIC). An OIC allows business

-

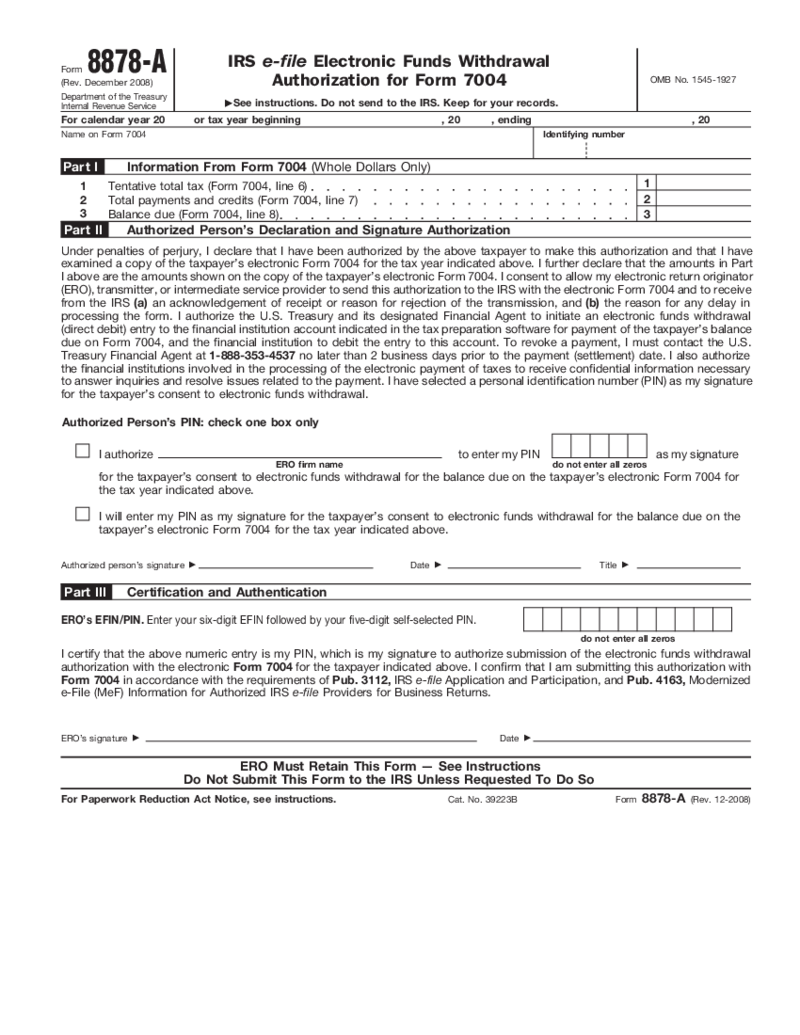

Form 656 (2020)

What Is a Form 656 IRS

Form 656, known as the Offer in Compromise (OIC), represents a program devised by the IRS for taxpayers who cannot fulfill their tax obligations in full. This form allows individuals and businesses

Form 656 (2020)

What Is a Form 656 IRS

Form 656, known as the Offer in Compromise (OIC), represents a program devised by the IRS for taxpayers who cannot fulfill their tax obligations in full. This form allows individuals and businesses

-

Form 656

What Is 656 Form?

Form 656 is the form used for applying for tax compromise, to actually pay less than you owe. This form is meant for you to report your circumstances and the reasons you apply for an offer in compromise (OIC).

You can fill

Form 656

What Is 656 Form?

Form 656 is the form used for applying for tax compromise, to actually pay less than you owe. This form is meant for you to report your circumstances and the reasons you apply for an offer in compromise (OIC).

You can fill

-

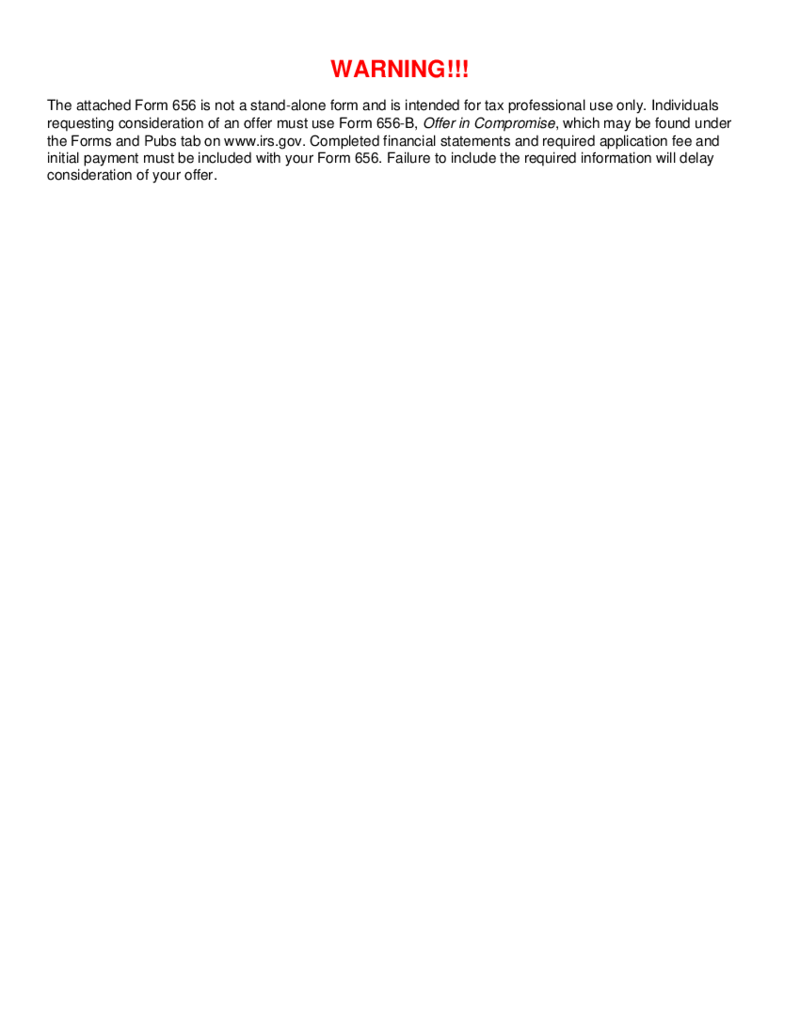

IRS IP PIN Application - Form 15227

What Is IRS Form 15227?

Also referred to as IRS IP PIN application, it’s a form that allows you to apply for an Identity Protection Personal Identification Number. Wondering what this number is all about? It’s a 6-digit number that shiel

IRS IP PIN Application - Form 15227

What Is IRS Form 15227?

Also referred to as IRS IP PIN application, it’s a form that allows you to apply for an Identity Protection Personal Identification Number. Wondering what this number is all about? It’s a 6-digit number that shiel

-

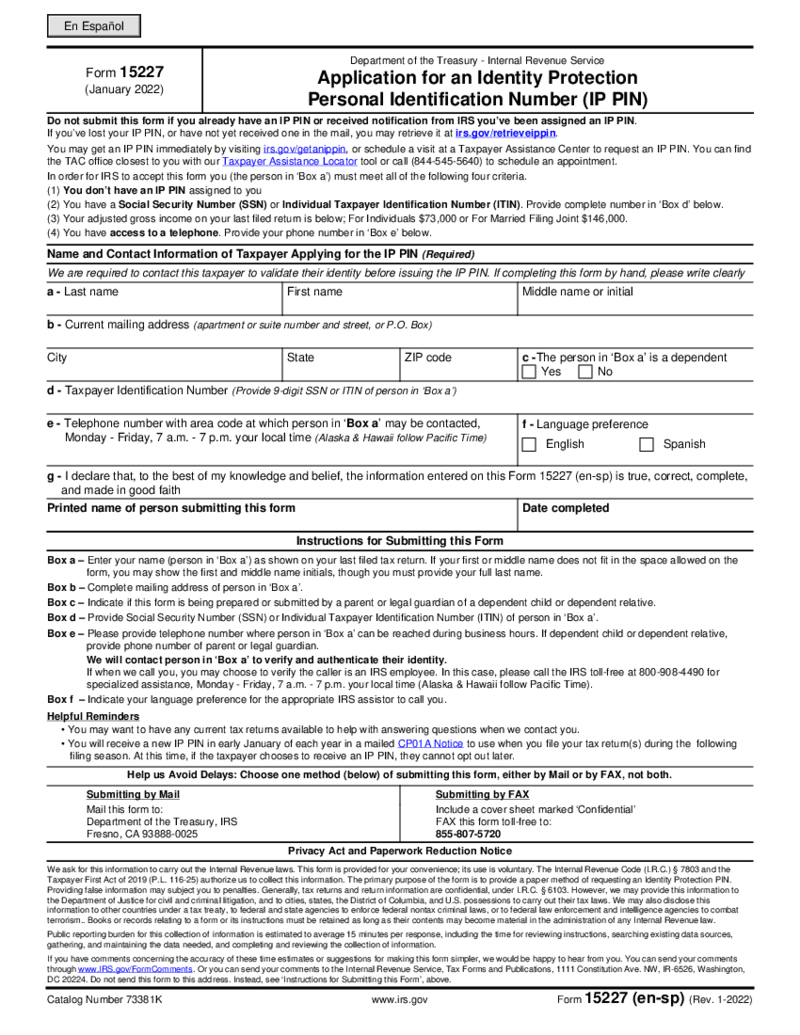

Form 2688

What Is Form 2688

Form 2688, also known as the Application for Additional Extension of Time To File U.S. Individual Income Tax Return, is a request form sent to the IRS. This document serves as a tool fo

Form 2688

What Is Form 2688

Form 2688, also known as the Application for Additional Extension of Time To File U.S. Individual Income Tax Return, is a request form sent to the IRS. This document serves as a tool fo

-

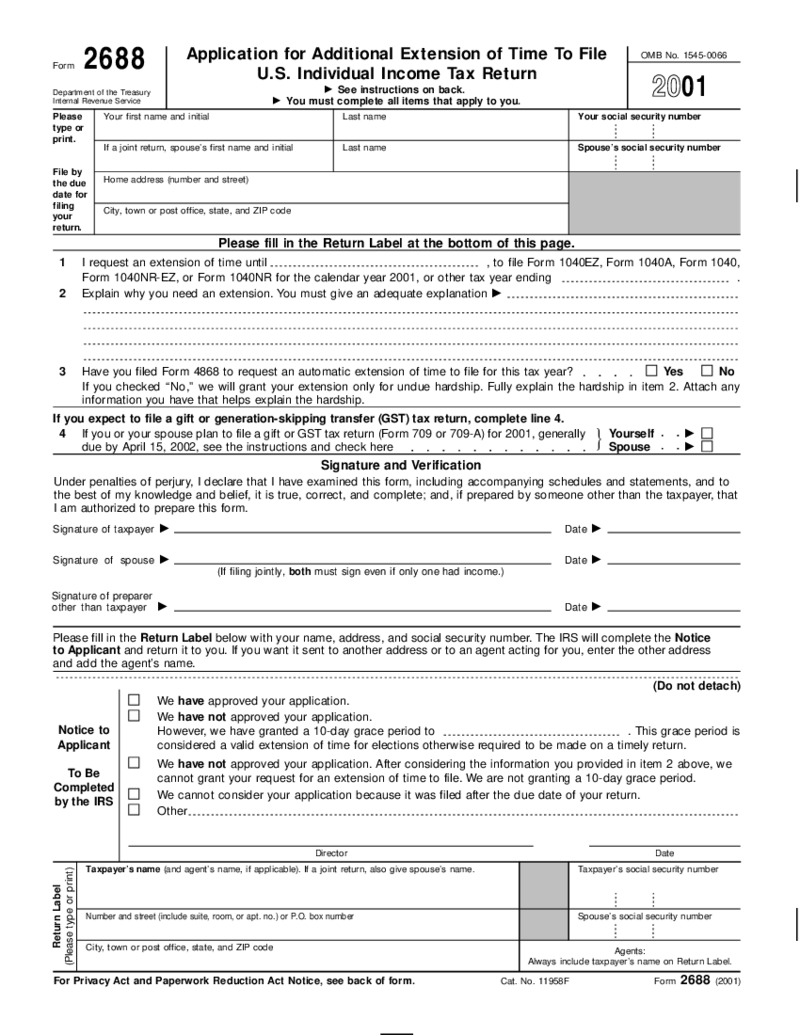

Form 8878-A

What Is Form 8878 A

Understanding the nuances of IRS documentation is crucial, especially regarding authorizations for electronic filing. Form 8878 A, officially known as the IRS e-file Signature Authorization for

Form 8878-A

What Is Form 8878 A

Understanding the nuances of IRS documentation is crucial, especially regarding authorizations for electronic filing. Form 8878 A, officially known as the IRS e-file Signature Authorization for

-

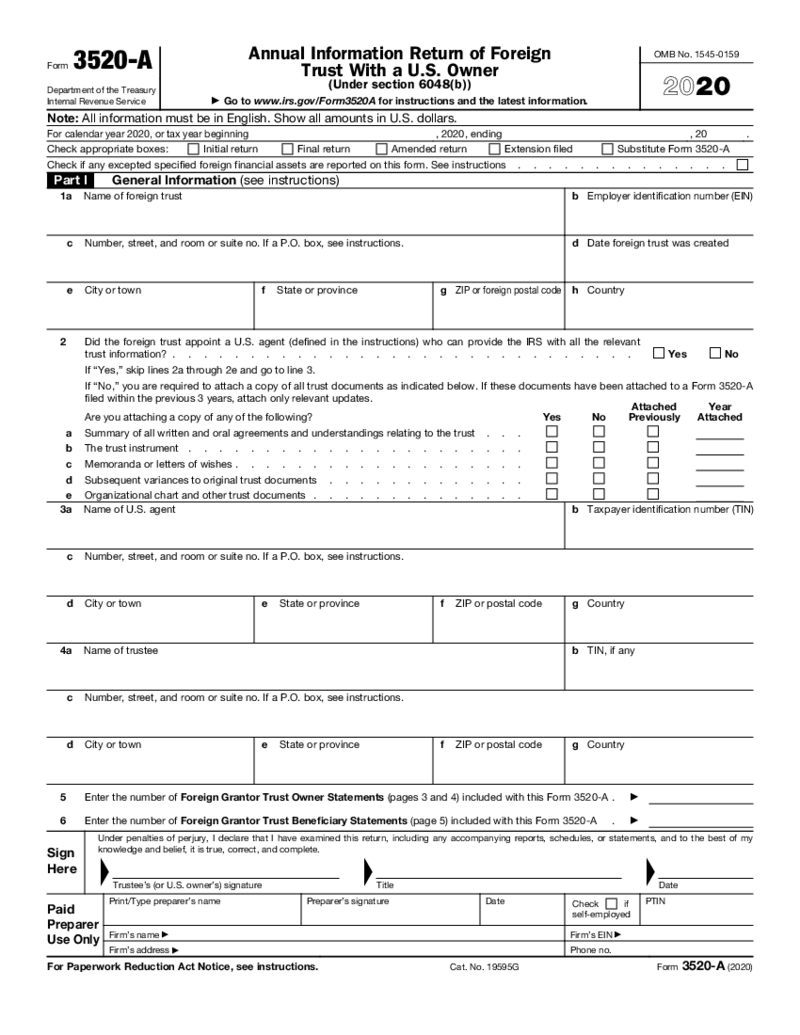

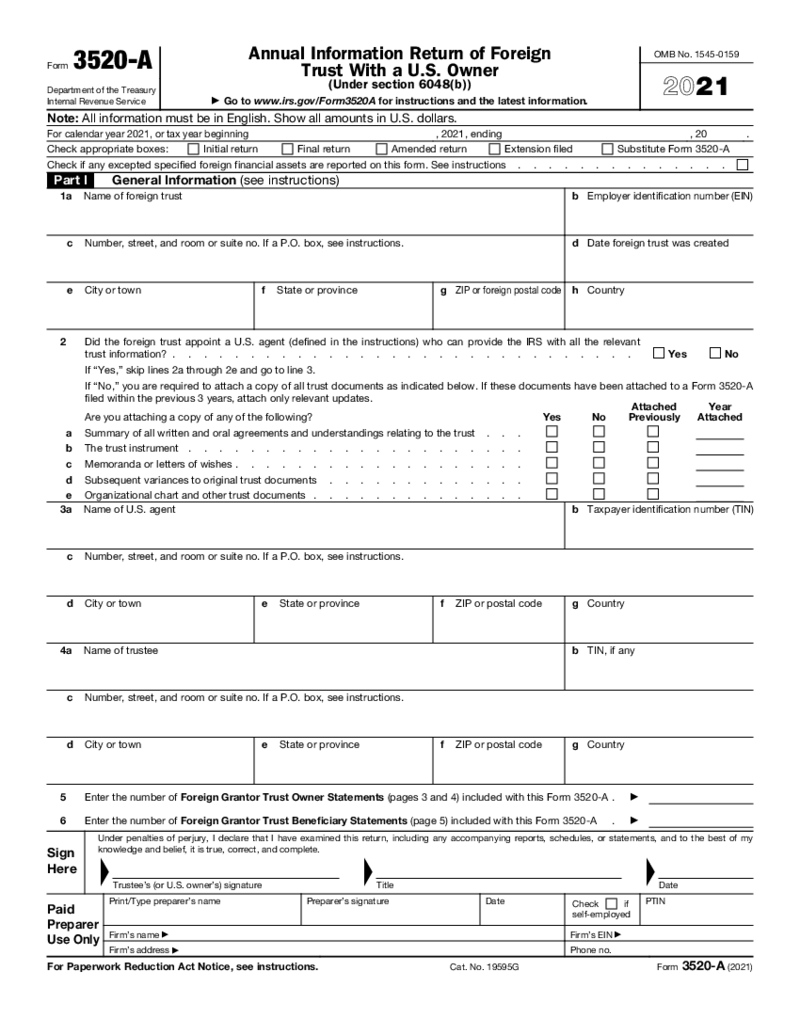

Form 3520-A (2020)

What Is Form 3520 A 2020

Form 3520 A, also known as the Annual Information Return of Foreign Trust With a U.S. Owner, is a vital document for individuals involved with foreign trusts. The form allows the United States Internal Revenue Service (

Form 3520-A (2020)

What Is Form 3520 A 2020

Form 3520 A, also known as the Annual Information Return of Foreign Trust With a U.S. Owner, is a vital document for individuals involved with foreign trusts. The form allows the United States Internal Revenue Service (

-

Form 3520-A

What Is Form 3520-A?

The 3520 A form is also called the Annual Information Return of Foreign Trust With a U.S. Owner. The form meets section 6048(b) IR Code. No matter whether the foreign trust is located, the document must still be filled in English, and

Form 3520-A

What Is Form 3520-A?

The 3520 A form is also called the Annual Information Return of Foreign Trust With a U.S. Owner. The form meets section 6048(b) IR Code. No matter whether the foreign trust is located, the document must still be filled in English, and

-

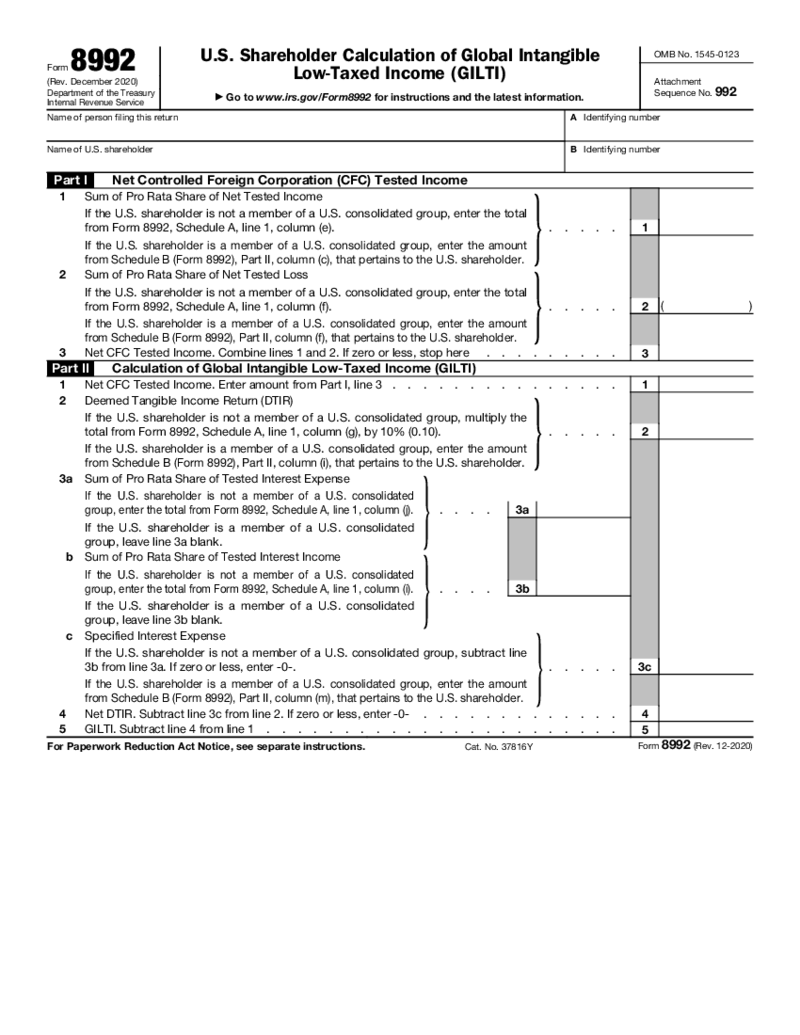

Form 8992 (2020)

What Is IRS Form 8992

IRS Form 8992 is used by the U.S. shareholders of any controlled foreign corporations (CFCs) to calculate their Global Intangible Low-Taxed Income (GILTI) inclusion for the tax year. Understanding and complying with the requirements

Form 8992 (2020)

What Is IRS Form 8992

IRS Form 8992 is used by the U.S. shareholders of any controlled foreign corporations (CFCs) to calculate their Global Intangible Low-Taxed Income (GILTI) inclusion for the tax year. Understanding and complying with the requirements

-

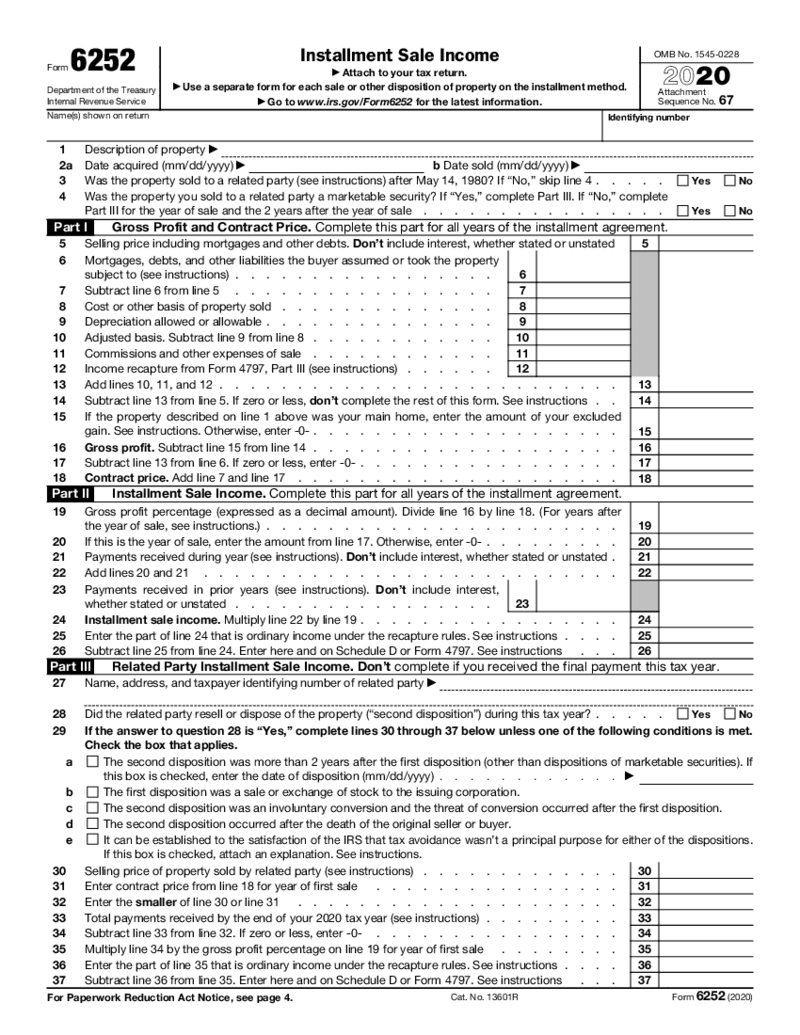

Form 6252 (2020)

What Is IRS Form 6252 For 2020

IRS Form 6252 for 2020 is a tax document individuals and businesses use to report income from an installment sale. An installment sale is a transaction where payments are received over time, spanning more than one tax year.

Form 6252 (2020)

What Is IRS Form 6252 For 2020

IRS Form 6252 for 2020 is a tax document individuals and businesses use to report income from an installment sale. An installment sale is a transaction where payments are received over time, spanning more than one tax year.

FAQ

-

What tax forms do I need?

That depends on a wide variety of factors, such as the state you live in, the specificity of your work, the format of your operation, and the like. You can consult a tax expert if you have questions on these nuances.

-

What are allowances on tax forms?

A withholding allowance is an exemption reducing the amount of income tax withheld from an employee’s wages. Upon determining your employees’ withholding allowances, you can easily pinpoint their federal income taxes.

-

When will unemployment send out tax forms?

You’re probably trying to ask us when your state unemployment office will mail you Form 1099-G (the total amount of taxable unemployment payment). The due date in this respect is January 31.

-

Where can I pick up tax forms?

You can head to your local IRS office or a post office, or library that offers tax forms. But why all the fuss if you can download the needed tax templates from our digital library. Give PDFLiner a go and you’ll forget about the alternative (and rather subpar) methods.